What’s The Difference Between a 529 Savings Plan and Prepaid Tuition Plan?

As 5/29 day approaches, our Mission Wealth advisors are delighted to share awareness about the value of planning for higher education and some misconceptions around 529 plans and prepaid tuitions. Read the article below to learn the difference between a 529 savings plan and a prepaid tuition plan.

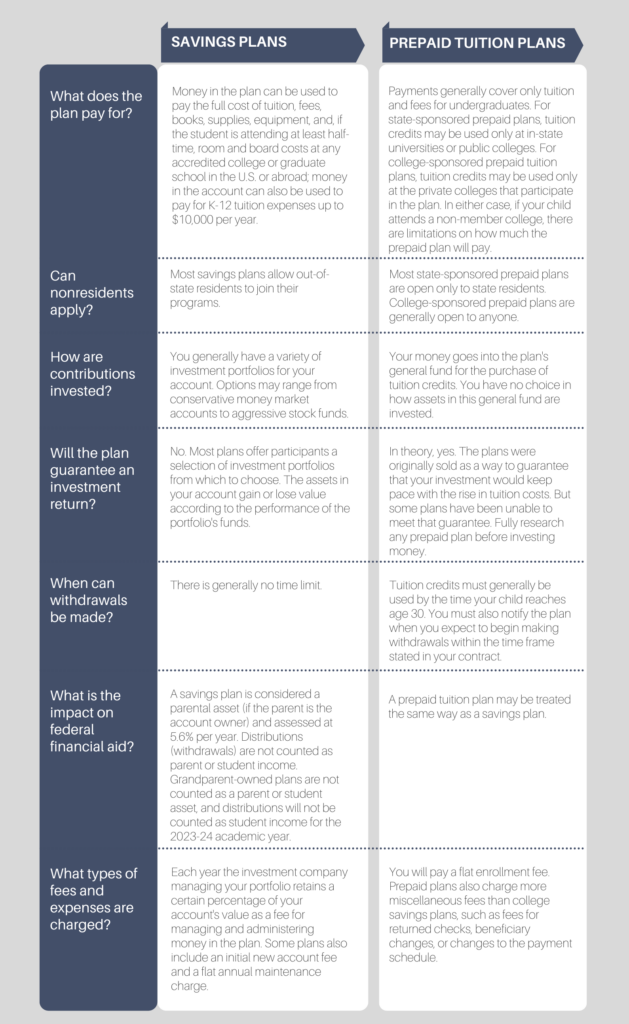

529 savings plans are more popular than 529 prepaid tuition plans because they are broader in scope and more flexible. Most every state offers at least one 529 savings plan, but only a handful of states offer a prepaid tuition plan. Generally, you can join any state's savings plan, but you can only join your own state's prepaid tuition plan. The type of plan you choose will depend primarily on the type of college you think the beneficiary might attend.

What is a Prepaid Tuition Plan?

What is a 529 Savings Plan?

By contrast, a savings plan doesn't restrict the beneficiary's choice of college. Funds in a savings plan account can be used for the full cost (tuition, fees, books, and, if the student attends at least half-time, room and board) at any college or graduate school in the country or abroad that is accredited by the U.S. Department of Education. This provides maximum flexibility on choice of college. But there is no guaranteed minimum rate of return. When you contribute to a 529 savings plan, your money goes into one or more of the plan's investment portfolios, and you either gain or lose money depending on how your investment options perform.

By contrast, a savings plan doesn't restrict the beneficiary's choice of college. Funds in a savings plan account can be used for the full cost (tuition, fees, books, and, if the student attends at least half-time, room and board) at any college or graduate school in the country or abroad that is accredited by the U.S. Department of Education. This provides maximum flexibility on choice of college. But there is no guaranteed minimum rate of return. When you contribute to a 529 savings plan, your money goes into one or more of the plan's investment portfolios, and you either gain or lose money depending on how your investment options perform.

If you're a fairly conservative investor and believe that your child will choose from among a number of public colleges located in your home state, then a prepaid tuition plan may be the appropriate choice (assuming your state offers one). But if you don't want to restrict your child's college options or you believe that you can earn a better rate of return than what is promised by a prepaid tuition plan, then a savings plan that offers a range of investment options may be the right choice.

How Will My 529 Plan Be Treated for Financial Aid Purposes?

The financial aid treatment varies depending on whether the account is owned by a parent or by a grandparent.

Parents as account owner: Under federal financial aid rules, the value of a 529 plan is listed as a parent asset on the government's aid form, the FAFSA, if the parent is the account owner. A 529 plan that is owned by a student or funded with UTMA/UGMA assets is also reported as a parent asset on the FAFSA if the student is a dependent student. Under the federal aid formula, a parent's assets are assessed (counted) at a rate of 5.6% (this means that 5.6% of a parent's assets are deemed available to put toward college expenses each year). Later, any money withdrawn from the 529 account is not counted again as student income— a positive situation.

Grandparents as account owners: The rules are different for grandparent-owned 529 accounts. If a grandparent (or other relative) is the account owner of a 529 plan, then it is not listed as a parent asset or student asset on the FAFSA. So, it doesn't count as an asset at all. However, withdrawals from a grandparent-owned 529 account are counted as student income on the FAFSA the following year. Under federal aid rules, student income is counted at 50%, which means that a student's financial aid eligibility could drop by 50% in the year following a 529 plan withdrawal.

For example, let's say you make a $40,000 withdrawal from your 529 account in Year 1 for your grandchild's college expenses. In Year 2, the FAFSA will count that $40,000 as student income and assess it at 50%, with the result that your grandchild's aid eligibility would be reduced by $20,000 (50% of $40,000). To prevent this situation, one option is to wait until your grandchild has submitted his or her last FAFSA before withdrawing money from the account.

Colleges set their own rules when deciding how to award their own financial aid, and most generally follow the federal treatment of 529 plans. However, colleges may differ in their treatment of plan withdrawals. A Mission Wealth Client Advisor can discuss your specific college planning goals and consider the investment objectives and risks with you.

Important Upcoming 2022 FAFSA Changes to Consider

Qualified withdrawals from grandparent owned 529 plans (and other non-parent owned), cash gifts from grandparents to the student, or gifts made directly to the school will no longer be reported as income to the student on the FAFSA form. Questions pertaining to the above will be removed from the new simplified FAFSA form for 10/1/2022, which will apply for the 2023-24 academic year. Since the FAFSA form looks back two years at income sources, restrictions regarding grandparent owned 529 plans and gifts will no longer be a concern in year 2021 and beyond.

Savings Plans vs. Prepaid Tuition Plans

How Mission Wealth Can Help

You May Also Be Interested In These Other Articles:

Estate Planning for Your High School Graduate

Guide to Financial Aid for Parents and Students

Note: Before investing in a 529 plan, please consider the investment objectives, risks, charges, and expenses carefully. The official disclosure statements and applicable prospectuses, which contain this and other information about the investment options, underlying investments, and investment company, can be obtained by contacting your financial professional. You should read these materials carefully before investing. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. Investment earnings accumulate on a tax-deferred basis, and withdrawals are tax-free as long as they are used for qualified education expenses. For withdrawals not used for qualified education expenses, earnings may be subject to taxation as ordinary income and possibly a 10% federal income tax penalty. The tax implications of a 529 plan should be discussed with your legal and/or tax professionals because they can vary significantly from state to state. Also be aware that most states offer their own 529 plans, which may provide advantages and benefits exclusively for their residents and taxpayers. These other state benefits may include financial aid, scholarship funds, and protection from creditors.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00452195 05/22