Charitable Planning and Philanthropy

At Mission Wealth, maximize opportunities to give, utilize tax-advantaged strategies, and honor your charitable intent.

On-Demand Year-End Charitable Giving Webinar

Our virtual discussion on year-end planning, estate strategies, and the transformative impact of philanthropy is now on demand. Explore how you can leave a meaningful legacy for your family and contribute to the greater good. Director of Philanthropic Strategy, Amanda Thomas and Director of Estate Strategy, Andrew Kulha share valuable insights to help you navigate the complexities of financial planning and family charitable discussions, all while making a positive difference in the world.Maximize Your Impact. Inspire Future Generations.

We help our clients create their charitable Mission Statement, develop their areas of focus, and utilize our Strategy Team to make recommendations on tax and estate-efficient strategies. We also introduce clients to potential nonprofit partners in their field of interest and help implement their strategies to achieve their mission.

Incorporating Charitable Giving Into Your Financial Plan

Many of our clients want to incorporate charitable giving and philanthropy into their financial plan but need guidance. Through our continued planning process, we determine the most efficient way for clients to facilitate their giving. This may include distributions from retirement plans, using donor advised funds for the transfer of appreciated stock, or more sophisticated solutions such as charitable gift annuities or charitable remainder trusts.Gifting to Family and Friends

We all want to help our loved ones but one should consider the financial and emotional implications before gifting money to your children, other family members, and friends. You should first run a long-term cash flow projection to determine if you have financial capacity to gift during your lifetime. Our Wealth Management Review process will help quantify the excess cash and assets that may be available for family gifting.

The benefits of gifting are numerous. First, gifting removes certain assets from your estate, thus potentially saving your family members taxes upon your death. Second, you will get to watch as the benefits of your gift take root in your child's or grandchild's life. As with all forms of generosity, you will get a great deal of satisfaction from gifting. Imagine watching a grandchild graduate from college knowing you have helped provide tuition or a daughter buy her first house with funds you have given.

Intra-Family Loans can be difficult and there are limitations on annual gifting. One should consult their Mission Wealth Client Advisor to understand the options and the most tax-effective strategies to consider.

Depending on your vision and goals, you have many choices available to you. At Mission Wealth, we can help you think through this process, offering suggestions and tools.

Creating a Charitable Foundation

Though you might not realize it, there are thousands of charitable foundations across the United States geared towards helping a wide range of individuals. Top foundations include the Ford Foundation, The Rockefeller Foundation, Andrew W. Mellon Foundation, and the Pew Charitable Trusts. Leading the list in philanthropy is the Bill and Melinda Gates Foundation which is by far the largest foundation in the world. Its mission: "To create a world where every person has the opportunity to live a healthy, productive life"

You may share the desire to improve the lives of others in some way. You do not have to be a billionaire or a major corporation to get involved with philanthropy. Many Americans are starting to donate their own money to these beneficial organizations as well as creating their own. A private foundation is a charitable organization typically established by an individual or family with a substantial initial gift. Private foundations are overseen by a board of directors or trustees responsible for receiving charitable contributions, managing and investing charitable assets and making grants to other charitable organizations.

Running a foundation is not only a financial investment, but also a time commitment. Tasks might include securing additional funds, employing a staff, hiring an investment manager, publicizing your foundation, reviewing applicants for aid, and handling tax and legal issues. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit.

If you and your family are interested in creating a charitable giving vehicle that is efficient, simple and impactful, you might want to consider alternatives like a donor-advised fund (more below).

Types of Charitable Giving Tools

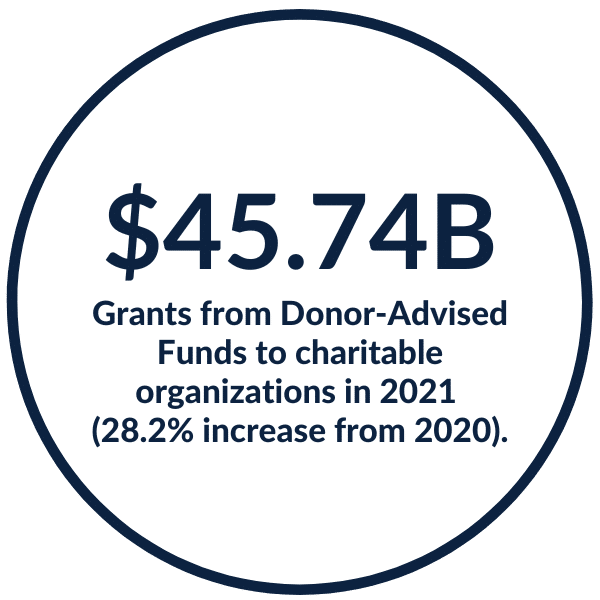

- Donor-Advised Fund (DAF) - A Donor-Advised Fund is a simple, tax-efficient way to support multiple charities. Generally, the DAF is a separately identified fund or account that is maintained and operated by a 501(c)(3) organization, or a charity like Fidelity Charitable. The charity then legally controls the fund, but the donor retains advisory privileges with respect to the distribution of funds and the investment of assets in the account. The initial contribution used to establish a DAF can be minimal compared to other giving vehicles. You can potentially grow your donations tax-free by recommending how the funds should be invested until a grant is made. You can also support charitable causes anonymously, if you wish.

- Charitable Remainder Trust (CRT) - Charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw predictable annual income for life or for a specific time period. There are different types of CRTs, including either Charitable Remainder Annuity Trust (CRAT), or a Charitable Remainder Unitrust (CRUT). A CRAT pays a set dollar amount of income each year, while a CRUT pays a percentage based on the annual balance of the Trust. There are also different types of CRUTS which allow you to control the timing of income.

- Charitable Gift Annuities (CGA) - A Charitable Gift Annuity is an agreement under which a 501(c)(3) organization, in return for an irrevocable transfer of cash or other property, agrees to pay the annuitant(s) lifetime income. There can only be 2 annuitants, and payments can be made to them jointly or successively. Unlike with a CRT, part of the gift may be used immediately by the charity, with the remainder of the gift invested in an account to provide for the annuitant’s income stream.

There are more charitable giving tools and strategies besides those listed above. Compare the different ways to give on Fidelity Charitable's website.

If you want to make donations part of your legacy planning, those wishes should be outlined in your will and trust, and discussed with the person you choose to execute your estate. You might even want to discuss your charitable plans with your whole family. Getting your loved ones involved can help ensure your legacy continues to do good in perpetuity.

Deciding Where To Give and What Interests to Fund?

Funding causes or events that matter to us strengthens our connectedness to other people, and makes us feel like we’re making a difference in our communities. Those good feelings can last a lot longer than the quick hit of happiness we get after a big impulse buy. But funding a cause or event also has its own set of potential pitfalls that need to be navigated if you want good works to be a part of your financial planning.

Many people with a strong charitable impulse jump in with both feet, and find themselves in over their heads very quickly. Whatever the size of your intended generosity, you need to start by consulting your monthly budget and figuring out exactly how much money you can afford to give. Set a reasonable limit. It’s great that you want to help other people. But if you end up committing more than you can really afford, who is going to help you?

Supporting an organization either financially or with your time and expertise is an investment. As with any investment, you want to be sure that the organizations you support are trustworthy and effective. To determine if an nonprofit is well positioned to address the problems it is trying to solve, you should first start with online research using one of these screening tools:

We can help clients evaluate how much they can afford to give as well as to understand their choices with a lens that would be the most "tax-friendly".

Develop & Review Your Estate Plan

"My life is too busy to tackle estate planning."

"I don't have to plan for my family, I have life insurance."

"I'm simply focused on paying my bills now. Worry about the future? I'll do it later."

"I don't want to think about death, I've just barely started living!"

Whether from denial, hesitancy, or sheer lack of time, thousands of Americans put off developing an estate plan. According to a 2022 caring.com survey, 67% of Americans have no estate plan, with the highest percentage saying the reason they don’t have one is that they just haven’t gotten around to it. This leaves many families unprotected and unable to direct the financial outcome of a loved one's death.

It is vitally important to begin developing an estate plan today. Your state of residence has a default set of rules for what will happen to your assets if you don’t have a plan in place, and if a goal of yours is to help your family or provide for certain charitable wishes, then you must have a clear plan that details these wishes.

Once you have written a Will or Trust and planned your estate, don't think that it is set in stone. As your life changes and your financial situation evolves, your plan should grow with you. At Mission Wealth, your advisor will walk you through an estate plan review at least every other year. Doing so will keep your legal documents up to date and ensure that your wishes will be upheld.

Our Director of Estate Strategy and team will review your current estate plan and help you understand how it is currently laid out and identify if any updates may be in order. We review this every other year to ensure that the designated parties are still appropriate and able to serve, and to determine if further updates to your plans are warranted.

How Can Mission Wealth Help You?

Contact us to get a FREE, no-obligation consultation!

Giving Back: How One Partner is Making a Difference at HORSEPOWER Therapeutic Learning Center

July 26, 2024

From Financial Chaos to Philanthropic Clarity: The Legacy of Sue and Paul Slater

April 18, 2024

The Transformative Power of Women Investors in Philanthropy and Impact Investments

March 13, 20241The 2022 Edition of The Donor-Advised Fund Report