What is a Donor-Advised Fund?

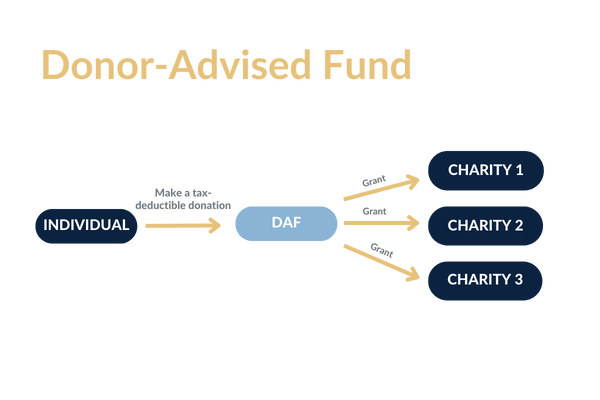

A donor-advised fund, or DAF, is a charitable giving vehicle, generally a separately identified fund or account, administered by a third party (a 501(c)(3) organization, your charity) that allows you to make an irrevocable contribution to that fund and be eligible for an immediate tax deduction.

Once your contribution is liquidated to the fund, the charity legally controls the fund, but you (the donor) retain advisory privileges with respect to the distribution of funds and the investment of assets in the account. Additionally, the initial contribution used to establish a DAF can be minimal compared to other giving vehicles.

So, why are donor-advised funds gaining such popularity and who benefits the most?

4 Reasons Donor-Advised Funds Are Beneficial

- First, the donation to the fund is immediate and is a great tool to use in a tax year when you have significantly higher income, and you want a tax deduction offset. This higher income can be from securities-related capital gains, the sale of a highly appreciated business or real estate, or if your employment income is higher than normal due to a bonus or the exercise of stock options. Note that there are limitations to the tax deduction based on your Adjusted Gross Income, and it is best to first consult your financial advisor or tax preparer.

Another strategy is to “bunch” or combine two or three years of charitable contributions in order to exceed the higher standard deduction in a given year. Although you will not likely make contributions to the DAF each year using this strategy, you can still support your favorite charities in “off” years as you have an unlimited period of time to grant out funds.

- Secondly, for tax preparation purposes, it streamlines your recordkeeping and consolidates tax receipts all in one centralized, online location. The donation receipt from the DAF manager is the only document you need to provide to your tax preparer. You can make multiple grants to charities from the DAF, but those do not need to be tracked since the actual contribution of cash, securities, or other appreciated assets to the DAF is your sole tax deduction.

- Another benefit is the tax-advantaged ability to donate non-cash, highly appreciated assets without paying capital gains. This can be as simple as an appreciated stock or mutual fund, or the donation can be more complex, like privately held company stock, cryptocurrency, or valuables such as art.

As an example, say you own a stock that you previously purchased at $25/share. Today, it is worth $75/share. If you sold the share, you would potentially pay up to 20% in capital gains tax on the $50/share gain, therefore reducing the net amount that you give to a charity. Instead, if you donate the share to your DAF, you receive the full $75 as a tax deduction and when the charity sells the share, it pays no taxes and retains $75 as a cash donation.

- Lastly, DAFs have risen in popularity due to the lower costs and simplicity compared to forming a foundation which can require a substantial initial contribution, legal costs, and annual tax filings. A DAF can be opened with a minimal contribution and grants can be as low as $50 each. In addition, a DAF can be in the name of a family and multiple family members can be involved in the grant decisions or even be named as legacy owners once the initial DAF owners have passed away.

Overall, donor-advised funds offer abundant tax advantages, control over the account, and the ability to create a lasting legacy with your family. If you do not have a donor-advised fund and are interested in learning more, please contact your Mission Wealth Client Advisor for their assistance.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Recent Insights Articles

What Is the One Big Beautiful Bill Act? Key Tax Law Changes Every Family Should Know

Is Private Equity the Missing Piece in Your Investment Strategy?

Market Update for 6/18/25

Maximize Your Impact. Inspire Future Generations.

We help our clients create their charitable mission, develop their areas of focus, and utilize our Strategy Team to make recommendations on tax and estate-efficient strategies. We also introduce clients to potential nonprofit partners in their field of interest and implement the plan to achieve their mission. Talk with a Mission Wealth charitable planning advisor about incorporating charitable giving into your financial plan.

Please visit our website at missionwealth.com or call us at (805) 882-2360 to speak with a wealth management professional.

00502690 03/23