Market Update

We continue to monitor the fallout and repercussions from the Silicon Valley Bank (SVB) situation closely. Our dedicated team has years of experience navigating many similarly volatile market environments, and our portfolios have performed well during the current period of increased stress. Like any market event, this too shall eventually pass.

For perspective, the market is still positive on the year, with the S&P 500 up over +2% and the broad bond market (as measured by the Bloomberg Aggregate Bond Index) up over +3%. Despite the recent increase in volatility, the market as a whole has held up relatively well, with weakness largely isolated to the banking sector.

Now a week removed from SVB’s failure and the appointment of the Federal Deposit Insurance Corporation (FDIC) as receiver, uncertainty is still elevated. Following SVB’s collapse, trouble soon spread to regional banks. At the very heart of the issue is deposit holder confidence. Heightened scrutiny has been placed on banks with higher percentages of deposits falling above the FDIC guarantee threshold of $250,000; deposits falling below the $250,000 limit are considered “stickier” and less likely to leave. First Republic (ticker FRC) was highlighted as having a smaller percentage of deposits under the $250,000 limit and has come under particular pressure, leading to a consortium of 11 major banks providing $30 billion of uninsured deposits to the firm. This helped buoy markets on Thursday, with bank stocks broadly appreciating after the announcement, though FRC experienced renewed selling on Friday.

Elsewhere, Credit Suisse (CS) came under pricing pressure after it found “material weaknesses” in its reporting and control processes and its largest shareholder, the Saudi National Bank, said it could not provide additional financial support. This development certainly didn’t help the narrative surrounding the banking industry, though sentiment improved after CS was able to access up to 50 billion Swiss francs via a credit line with the Swiss National Bank, and also offered to repurchase debt.

Steps Aimed at Supporting Deposit Holder Confidence

While SVB is not considered a systemically important bank and the issues that led to its downfall were unique, it has nonetheless shaken confidence in the financial industry. Regulators aimed to address this issue head on with the steps they took this past weekend. Last Sunday’s joint announcement by the Federal Reserve, FDIC and Treasury was directly aimed at improving deposit holder confidence, particularly those deposits held at smaller regional banks. To this end, two announcements were made.

First, all deposits held at SVB and Signature Bank were guaranteed, not just those under the $250,000 FDIC limit (deposit holders at both banks have had full access and have been free to withdraw funds all week). In announcing this, regulators have implicitly provided protection for all deposits at any bank in the country; it would be inconsistent to provide a full guarantee only to SVB and Signature Bank’s deposit holders but not provide that same guarantee on deposits held at other banks.

Second, the Fed announced it would provide near unlimited liquidity to the banking sector by way of a new Bank Term Funding Program (BTFP). The program enables banks to borrow money directly from the Fed for up to one year by pledging assets held on their balance sheets (high quality securities like Treasuries and Agency securities). It’s likely this program could be extended if need be.

During the 2008 banking crisis, though late to the game, Congress granted much more power to the FDIC, Fed and Treasury in bail out legislation to backstop banks. We are seeing those powers in action today, which in hindsight, if available back in 2008 may have curtailed the unwinding of the system with quicker action to isolate the problems before they spread.

We are optimistic these steps – in addition to this week’s developments – will ultimately shore up confidence in the financial sector. Essentially, regulators are saying all deposits are safe, ensuring all liquidity is there if needed, with the goal of preventing additional bank runs like the one that happened at SVB.

Economic Implications

It is still uncertain to what extent this will have economic ramifications. If confidence is restored and the situation resolves itself relatively quickly, the impact is likely to be mild; the longer uncertainties remain, the larger the economic impact. Steps taken by regulators and the industry are aimed at shoring up confidence, and the fact that market weakness has largely been isolated to the banking sector is an indication the market believes this may not be a prolonged issue. While the situation is still fluid, tighter financial conditions are likely to weigh on economic growth. Banks broadly are in a wait-and-see approach. Regional banks are likely to scale back lending operations, particularly for commercial and industrial loans. Some of that activity may be picked up by the large major banks (given they have experienced increased capital flows), but a lot of it will also fall to the private lending channel. Regional banks may also be forced to offload high quality assets, providing opportunities for competitors and the private space.

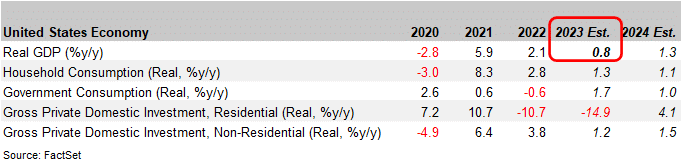

With all that being said, consensus economic estimates anticipate positive GDP growth for the full year of +0.8%, and despite some recent headlines about recessionary probabilities rising, economists who have updated growth forecasts since last Friday have an average estimate of +1.0% GDP growth for the full year (per FactSet data).

Fed Faced with Tricky Decision

The current uncertainty puts the Fed in a tricky situation. Do they raise rates at next week’s FOMC meeting, or do they pause? As of writing, the market is currently assigning approximately a 70% probability that the Fed raises rates another 0.25%, though as recently as mid-week the probability they raise vs. pause was essentially a coin flip, at near 50/50. If the Fed decides to pause, Chair Powell is likely to be careful in communicating they are leaving the door open for further rate hikes, especially if the current issues transpire to cause limited economic impact. Under such an outcome, inflation is unlikely to be close to their target of 2% by year end. Indeed, consensus currently estimates inflation to end the year at 4.0%. If the Fed raises rates 0.25%, it would be an indication they don’t believe current issues will lead to a significant economic impact, and not significant enough to bring about a material decline in inflation.

To be sure, expectations for Fed rate hikes have reduced. Just two weeks ago, discussions were swirling around the possibility of a 0.50% rate hike at next week’s meeting and the market was pricing in 1.0% or more of total hikes. A 0.50% increase next week is all but off the table. Even if they raise rates 0.25%, the extent of additional rate increases has likely been reduced. Given the Fed’s clearly communicated laser focus on inflation, we believe we would have to see a significant deterioration in economic fundamentals for inflation to move lower and for the Fed to even consider cutting rates, which is not our base case given the information at hand.

We continue to monitor developments closely. We believe our portfolios are well positioned to navigate the current environment and ultimately achieve the long-term financial goals of our clients.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00503143 03/23