Understand the advantages of international portfolio allocation, and uncover ways to reduce overall risk from volatility. Watch the video and learn why you should diversify globally.

Investing will always involve risk, but different investments offer different levels of uncertainty and volatility in relation to their potential returns. For example, you may feel confident that you’ve made a low-risk investment choice based on the fact that historically, equity markets/stocks have outperformed bonds. The reality is that predicting forward-looking investment performance makes assumptions drawn from historical performance. This means you can never guarantee success in any single investment in any given year.

Investing will always involve risk, but different investments offer different levels of uncertainty and volatility in relation to their potential returns. For example, you may feel confident that you’ve made a low-risk investment choice based on the fact that historically, equity markets/stocks have outperformed bonds. The reality is that predicting forward-looking investment performance makes assumptions drawn from historical performance. This means you can never guarantee success in any single investment in any given year.

Considering that nearly 50% of the global stock market opportunities exist outside of the U.S, global diversification works to reduce this overall risk.

This makes rebalancing and considering asset allocation important factors in investment management (watch The Importance of Asset Allocation). Whether you're a business owner, retiree, professional or an independent woman, it’s important to know the differences between emerging markets, developed markets, and your home country. By investing in the global markets and aligning your life goals with your investment decisions, you could open a world of opportunities (view the msci emerging markets index here).

This makes rebalancing and considering asset allocation important factors in investment management (watch The Importance of Asset Allocation). Whether you're a business owner, retiree, professional or an independent woman, it’s important to know the differences between emerging markets, developed markets, and your home country. By investing in the global markets and aligning your life goals with your investment decisions, you could open a world of opportunities (view the msci emerging markets index here).

What is Global diversification, and why is it important when investing?

diversification, and why is it important when investing?

Global diversification refers to a portfolio allocation to equities across the globe, including allocations to international and emerging market stocks, in addition to the U.S. stock market.

Why do we believe global diversification is important?

As nearly 50% of global stock market opportunities exist outside of the U.S, we believe it’s important to have dedicated allocations to both international and emerging market stocks across our model portfolios.

Longer term economic growth rates are also expected to be higher in many countries outside of the U.S., particularly for emerging market countries. Such outsized growth rates may in turn benefit stock market returns in those same countries. We believe having dedicated allocations to higher growth economies may thus provide for increased longer-term expected portfolio return potential.

Investing in emerging and international markets isn’t a guarantee.

Maintaining a globally diversified stock allocation may also provide diversification benefits within a well-constructed portfolio. U.S., international and emerging market stocks don’t always move in tandem. In many instances U.S. stocks may be up while international or emerging markets move down. Conversely, U.S. stocks may experience weakness while international and or emerging markets outperform. The best and worst performing investments in a specific year, country, or sector will change with the environment, making it impossible to time the market.

Exposure to international or emerging markets is not inherently good as your portfolio allocations and risk tolerance should be determined by your unique needs and life goals. What global investing does offer is an opportunity to further distribute the risks within your portfolio, adding a new layer of diversification outside of what’s available domestically.

Can global diversification offset negative domestic stock market returns?

A prime example of the benefits of global diversification is the time period commonly referred to as the “lost decade” for U.S. stocks. From January 2000 through December 2009, the S&P 500 lost nearly 1% on an annual return basis. Had you had all your stock investments in the U.S. you would have lost nearly 1% annually over that 10 year period.

Had you maintained dedicated allocations to international and emerging markets in a globally diversified portfolio, both international and emerging market stocks would have helped offset the negative U.S. stock market return.

Why?

In contrast to the U.S. market, international stocks were positive over the same decade returning an annualized 3.5% return. Correspondingly, emerging markets were soundly positive returning +10.7% annually over the same period. This divergence in returns across asset classes may also offer enhanced rebalancing opportunities, and may add to the overall long-term return potential of an investment portfolio. Watch our video on The Benefits of Rebalancing.

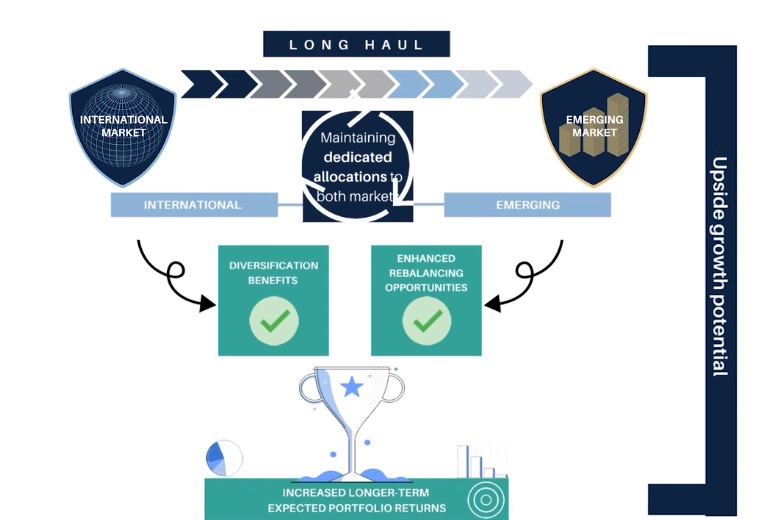

Over the long-haul, we believe maintaining dedicated allocations to international and emerging markets may help provide diversification benefits and enhanced rebalancing opportunities. This may concurrently offer upside growth potential, and may ultimately provide for increased longer-term expected portfolio returns.

How Mission Wealth Can Help

At Mission Wealth, we build custom portfolios for our clients based on a deep understanding of their goals and objectives as derived by our financial planning process. Asset allocation and global diversification are employed in an attempt to maximize risk-adjusted returns. Learn more about our investment management services, or contact our experienced team for more information.

00387521 04/21