Whether you’re a business owner, building a retirement plan, an independent woman, or a professional, it’s never a bad idea to understand the “why” behind investment decisions. Shifting your investment approach is a powerful way towards managing uncertainty, towards positively leveraging your absolute returns.

Whether you’re a business owner, building a retirement plan, an independent woman, or a professional, it’s never a bad idea to understand the “why” behind investment decisions. Shifting your investment approach is a powerful way towards managing uncertainty, towards positively leveraging your absolute returns.

Watch the video now, or keep reading for the top takeaways.

What is a multi-strategy approach to investing?

What is a multi-strategy approach to investing?

When considering various investment options – be it mutual funds, exchange traded funds, or other types of investments – most investment strategies fall into one of two buckets: passive or active.

What's the difference between a passive and active investment strategy?

A passive strategy typically employs a low-cost approach to investing, usually following an index or enhanced index methodology. On the other hand, an active approach to investing aims to utilize manager skill to outperform within certain areas of the market. Active funds tend to have higher expense ratios than passive funds to compensate for the additional layer of manager input and oversight. Importantly, we believe there is room within a portfolio for both active and passive funds. And we believe using both passive and active approaches where it makes sense may ultimately enhance the long-term returns of a broadly diversified portfolio.

What does a passive investment strategy look like?

Within highly efficient markets, we employ passive strategies in the form of low-cost index solutions. U.S. large cap stocks are a good example of a highly efficient market.

Why do you choose to invest in low-cost, index based strategies within the U.S. large cap?

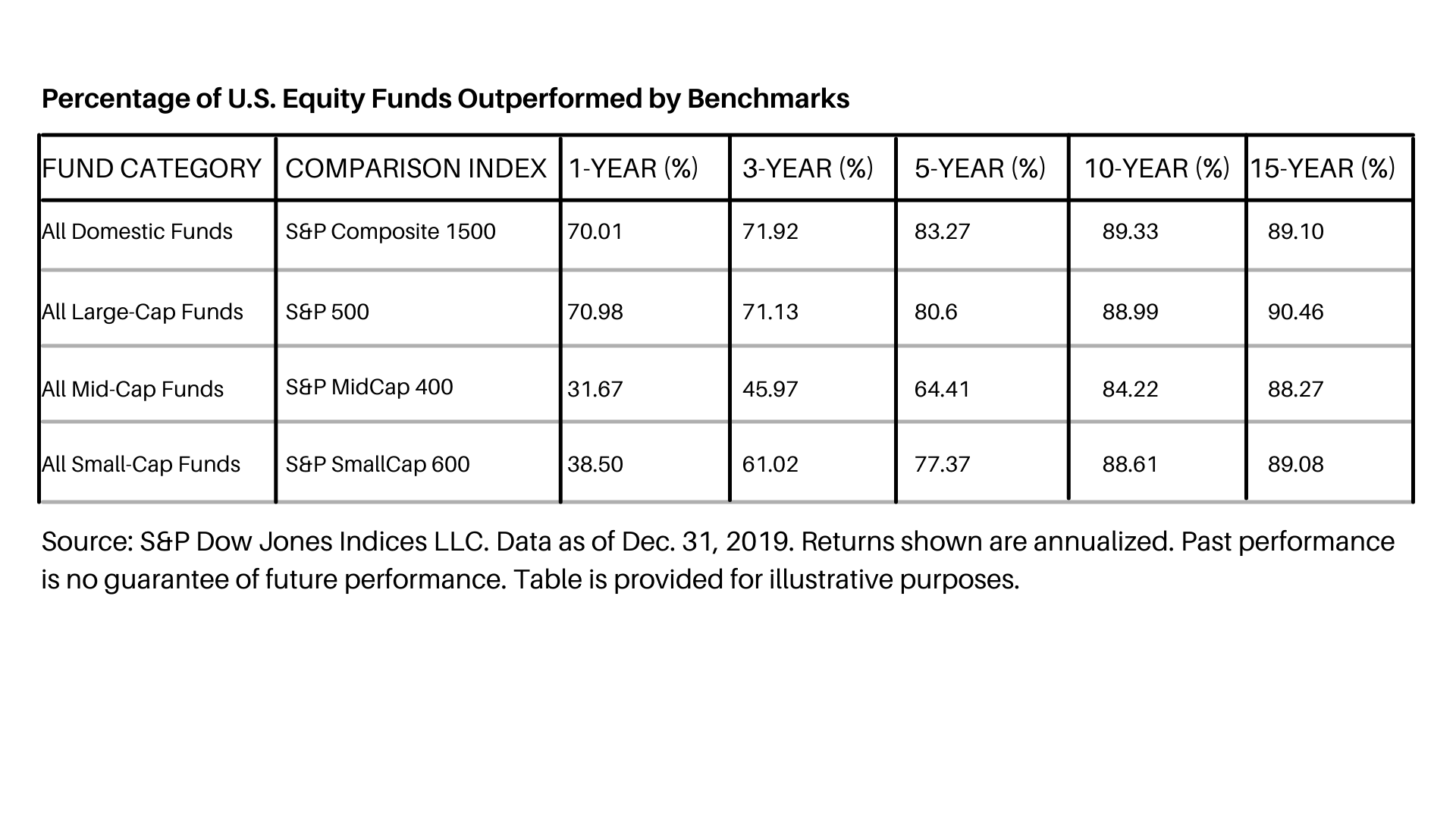

Empirical evidence shows that on average, active managers do not add any value within this asset class. In fact, over extended periods of time, active managers, on average, have a very poor record. As this chart illustrates, between 80% and 90% of all actively managed funds underperform a passive benchmark – in this case the S&P 500 over five, ten and 15 year periods. You can see similar results hold true for mid-cap and small cap U.S. stocks.

Taking this data, at best you have a 20% chance of picking an active manager who will outperform in the forthcoming period. Oh and by the way, there is no correlation between past performance and future results. This is generally considered somewhat of a warning, saying that no one should assume an investment will continue to perform well in future purely because it's done well in the past. Correspondingly, don't discount an investment just because it's done poorly in the short-term as it could improve.

In fact many of the best performers in one time period may end up being amongst the worst in subsequent time periods. For this reason we believe an index-based approach to investing within U.S. large cap and other similarly highly efficient markets has a better chance of outperforming actively managed strategies.

So where do actively managed funds make sense within a portfolio?

We believe less efficient asset classes – such as high yield bonds, emerging markets debt or direct credit – are best suited to an actively managed fund approach.

Think about the efficiency of an asset class this way; if you asked any of your friends whether they have ever bought a stock, almost all of them would reply yes. However, if you asked that same friend if they have ever bought a high yield bond or an emerging market bond, the reply would be much different. Simply put, high yield bonds, emerging markets debt and direct credit are all examples of much less liquid – and therefore –more inefficient asset classes where employing high quality active managers may add value. As an example, our preferred high yield bond manager has consistently outperformed more than 80% of peer group funds over extended periods.

We believe utilizing a multi-strategy approach to investing, incorporating both active and passive strategies and being thoughtful about which asset classes are best suited for each type of approach, may ultimately enhance long-term expected returns within our clients broadly diversified portfolios.

How Mission Wealth Can Help

At Mission Wealth we work closely with you to identify your goals and build your roadmap, while helping you to consider your future options and optimize your financial security. To learn more, click here or reach out to our experienced team.

00397832 03/21