Market Perspectives Q2 2021

By Kieran Osborne, MBus, CFA®

By Kieran Osborne, MBus, CFA®

Partner, Chief Investment Officer

Welcome to Mission Wealth’s market perspectives for the second quarter of 2021. I’m Kieran Osborne, Partner and Chief Investment Officer at Mission Wealth and I’m excited to be presenting our outlook on the economy and financial markets.

This presentation will cover three broad themes: an update on markets, our views on the economy and our outlook moving forward.

Key Themes

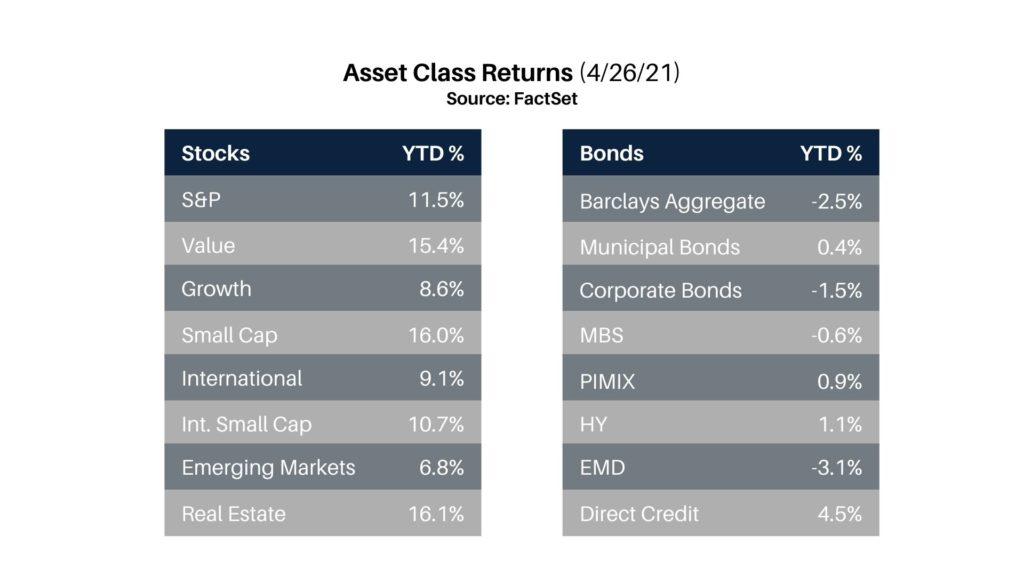

Despite some volatility tied to inflation concerns, stocks have experienced a strong start to the year, and continuing the strength experienced in the back half of 2020. There has been some disparity in performance however, with Value stocks outperformed Growth stocks as those companies set to benefit the most from re-opening broadly outperformed, while those stocks that outperformed in 2020 – principally tech-oriented businesses that benefited from the advantages afforded by the socially distanced economy – largely underperformed. Despite recent relative strength, we believe the economic backdrop may continue to be supportive of Value stocks vs. Growth stocks.

Inflation concerns have pushed bond yields higher, with the benchmark U.S. 10-year Treasury currently trading around 1.6%, up from 0.9% at the beginning of the year. As a result, longer duration fixed income most susceptible to interest rate changes has particularly struggled.

While measures of risk appetite are elevated, we believe the macroeconomic backdrop remains supportive.

Speaking of the economy, we expect this year’s growth to be the strongest in decades, underpinned by massive accommodative policies and positive vaccine progress. The strength of the recovery continues to be closely tied to COVID developments, and we believe the current pace of vaccine roll-out will allow economic growth to accelerate through the back half of 2021 and into 2022. Many economic data points are already trending very positively and we believe there is already strong economic momentum. As a result, economic projections continue to be revised higher.

While we do anticipate an increase in inflation this year, we believe structural issues are likely to contain inflation over the medium term. Specifically, structural issues containing commodity prices, labor market slack and the recent substantial investment in technology across many sectors may help contain inflation over the medium term.

Recent and forthcoming fiscal stimulus packages have increased debt levels to historic levels, though the U.S. is in a relatively strong position to service that debt given the low interest rate environment. With that being said, fiscal adjustments will ultimately be required and the Biden Administration is proposing tax increases to fund further stimulus. We anticipate the issue of taxes to be in flux for some time.

So with this backdrop, what is our outlook moving forward?

Firstly, we believe the macro backdrop remains supportive of the stock market. While potential tax increases may cause some uncertainty, earnings are expected to increase dramatically and monetary policy may help underpin stock market strength. Turning to the bond market, longer maturity core fixed income may be challenged in a low, but rising interest rate environment, while select areas of the bond market may perform relatively well. To this end, we have maintained dedicated allocations to actively managed bond funds and fixed income asset classes we consider may perform relatively well in a rising interest rate environment.

Mission Wealth Actions

To this point, I think it’s useful to review some of the other actions we’ve been taking at Mission Wealth:

- Firstly, we maintained our disciplined approach to portfolio rebalancing.

- Through the latter half of last year were focused on reducing overweight exposures to Growth stocks in favor of Value stocks as well as reducing large cap positioning in favor of small caps based on relative performance.

- We continue to favor dedicated allocations to global equities. Despite recent strength, we believe ongoing accommodative policies and the macro environment remain supportive. Any near-term volatility may offer a rebalancing opportunity.

- We positioned our core fixed income allocations with less duration risk – or interest rate sensitivity – than the broad bond market and have actively avoided areas of the bond market most susceptible to interest rate changes, such as long duration Treasuries.

- We believe unique opportunities currently exist in certain areas of the bond market which may offer relative return upside for our bond funds.

- We continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Stocks Continue to Rally

Despite a recent pick-up in volatility tied to inflationary concerns, stocks experienced a strong start to the year.

While optimism regarding the economic growth outlook combined with positive vaccine progress helped to underpin stock market strength, a pro-cyclical rotation drove some disparity in performance across various industries and sectors. As a result, Value stocks broadly outperformed Growth stocks as companies set to benefit the most from re-opening outperformed, while many tech-oriented businesses that did particularly well in 2020 have underperformed recently.

Importantly, through the latter half of last year we were focused on reducing overweight exposures to Growth stocks in favor of Value stocks based on relative strength at the time.

Core Bonds Challenged

As a function of the improved economic outlook and massive expansionary policies, inflation concerns increased, driving bond yields higher which weighed on the broad bond market, as measured by the Bloomberg Barclays Aggregate Index.

Leading into 2021, we had anticipated a rising interest rate environment and had positioned our core fixed income allocations accordingly, with less duration risk (interest rate sensitivity) than the broad bond market and actively avoiding areas of the bond market most susceptible to interest rate changes, such as long-duration Treasuries in the 10 year – 30 year maturity range. We have also maintained dedicated allocations to actively managed bond funds and fixed income asset classes we consider may perform relatively well in a rising interest rate environment.

Leading into 2021, we had anticipated a rising interest rate environment and had positioned our core fixed income allocations accordingly, with less duration risk (interest rate sensitivity) than the broad bond market and actively avoiding areas of the bond market most susceptible to interest rate changes, such as long-duration Treasuries in the 10 year – 30 year maturity range. We have also maintained dedicated allocations to actively managed bond funds and fixed income asset classes we consider may perform relatively well in a rising interest rate environment.

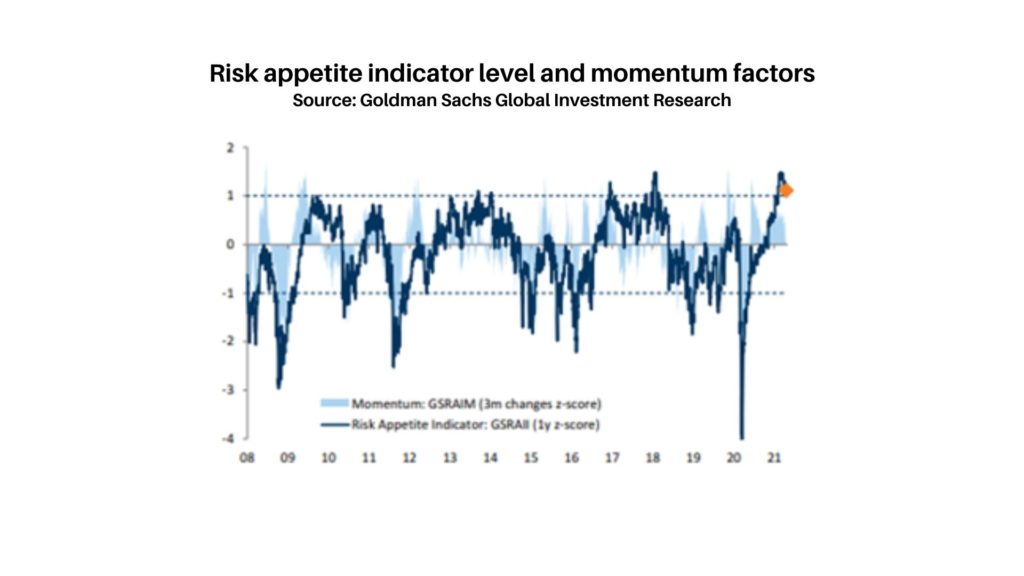

As this chart shows, measures of risk appetite remain elevated, though off highs. It’s important to note that risk appetite can stay elevated if supported by a positive macro backdrop, which we believe is currently in place. Interestingly, Risk Appetite has been driven more from bond price movements recently and less from stocks.

As this chart shows, measures of risk appetite remain elevated, though off highs. It’s important to note that risk appetite can stay elevated if supported by a positive macro backdrop, which we believe is currently in place. Interestingly, Risk Appetite has been driven more from bond price movements recently and less from stocks.

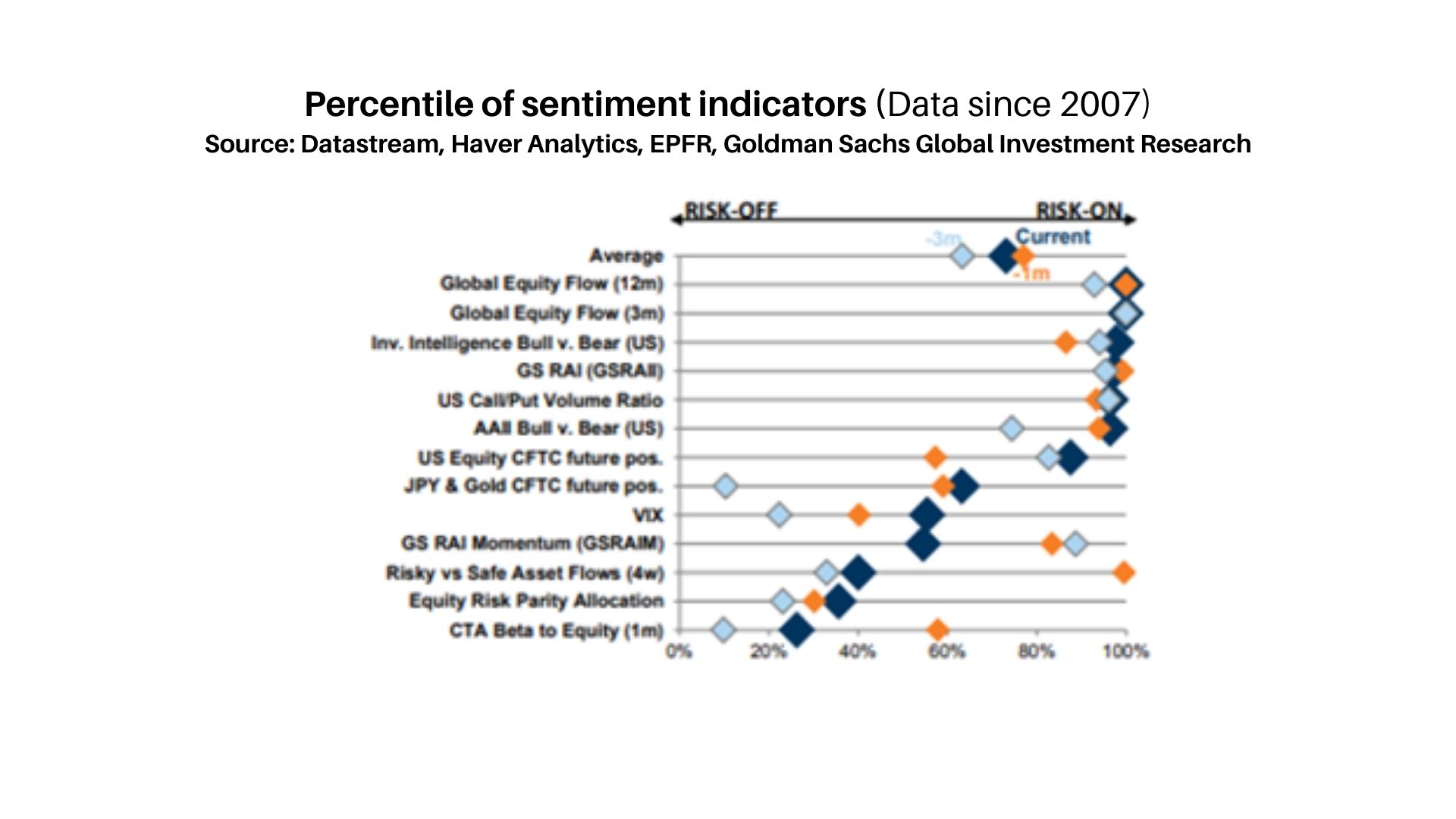

At the same time, Sentiment across major financial metrics is unsurprisingly tilting towards risk-on, though off levels one month ago.

At the same time, Sentiment across major financial metrics is unsurprisingly tilting towards risk-on, though off levels one month ago.

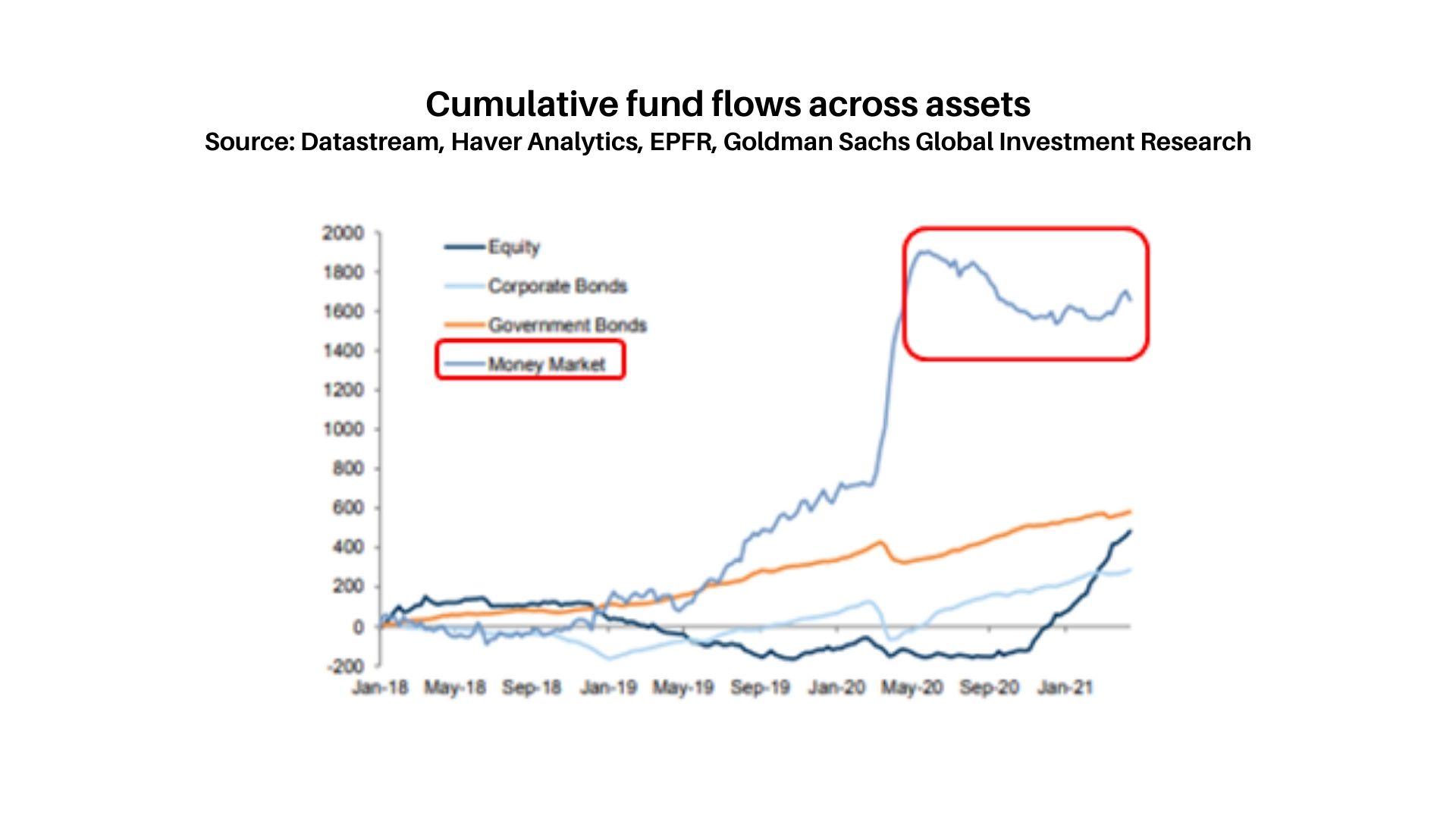

While equity fund flows have remained consistently positive since the back half of 2020, we have yet to see a major liquidation of money market funds, despite historically low interest rates. These still elevated money market fund holdings may help underpin ongoing stock market demand on the back of continued accommodative polices.

While equity fund flows have remained consistently positive since the back half of 2020, we have yet to see a major liquidation of money market funds, despite historically low interest rates. These still elevated money market fund holdings may help underpin ongoing stock market demand on the back of continued accommodative polices.

A lot of clients are asking: Can Value stocks continue to Outperform Growth stocks?

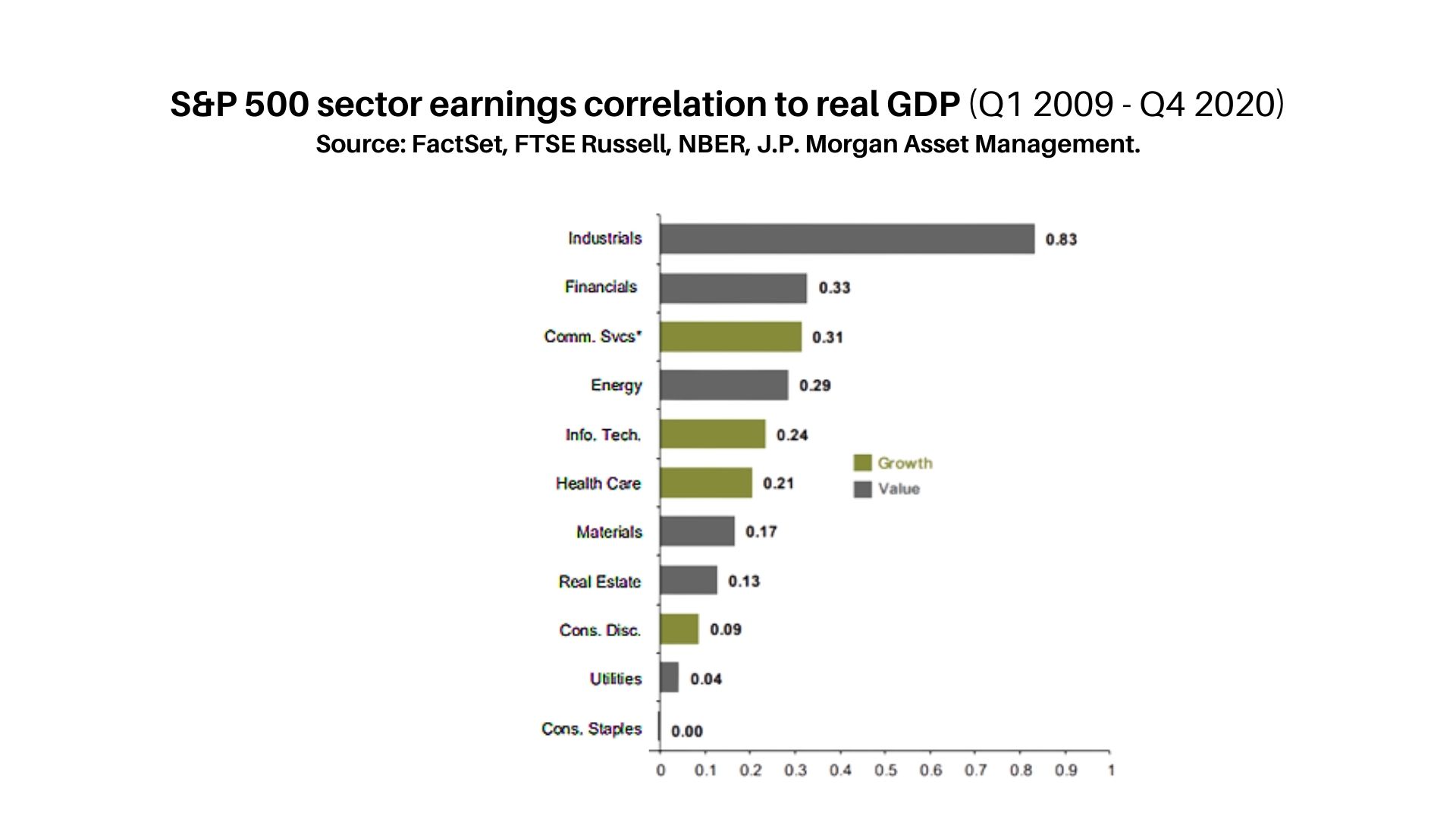

This is a really great chart that shows that Value stock earnings tend to be more highly correlated to economic growth than Growth stocks.

This is a really great chart that shows that Value stock earnings tend to be more highly correlated to economic growth than Growth stocks.

As such, the current strong economic backdrop may act as a tailwind for Value stocks and Value stocks may continue to outperform until we return to more normalized economic growth rates.

Lastly, despite the recent relative strength, Value stocks still appear cheap vs. Growth stocks across almost every valuation metric.

The Economy

Economy Continues to Perform Better than Anticipated

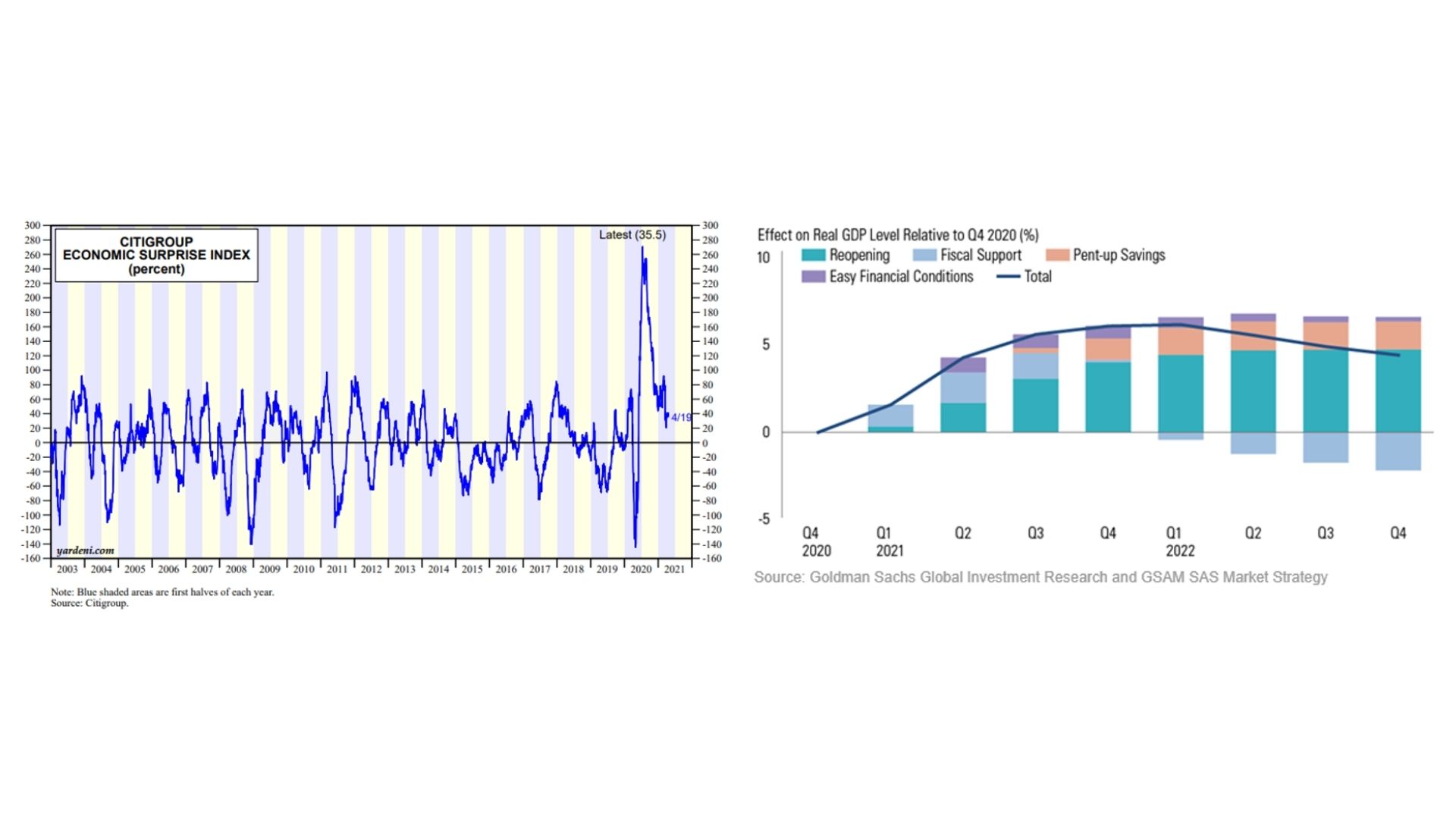

With a backdrop of massive central bank and Government stimulus, the economy continues to do better than anticipated and economic projections continue to be revised higher. As a case in point: under the recently passed stimulus plan, nearly $1.2 trillion dollars in economic stimulus will flow into the economy between now and the end of September – that represents about 5% of GDP!

With a backdrop of massive central bank and Government stimulus, the economy continues to do better than anticipated and economic projections continue to be revised higher. As a case in point: under the recently passed stimulus plan, nearly $1.2 trillion dollars in economic stimulus will flow into the economy between now and the end of September – that represents about 5% of GDP!

As such, we expect 2021 will have the best economic growth in decades, primarily driven by reopening, fiscal support, pent up savings and historically easy financial conditions.

COVID Update

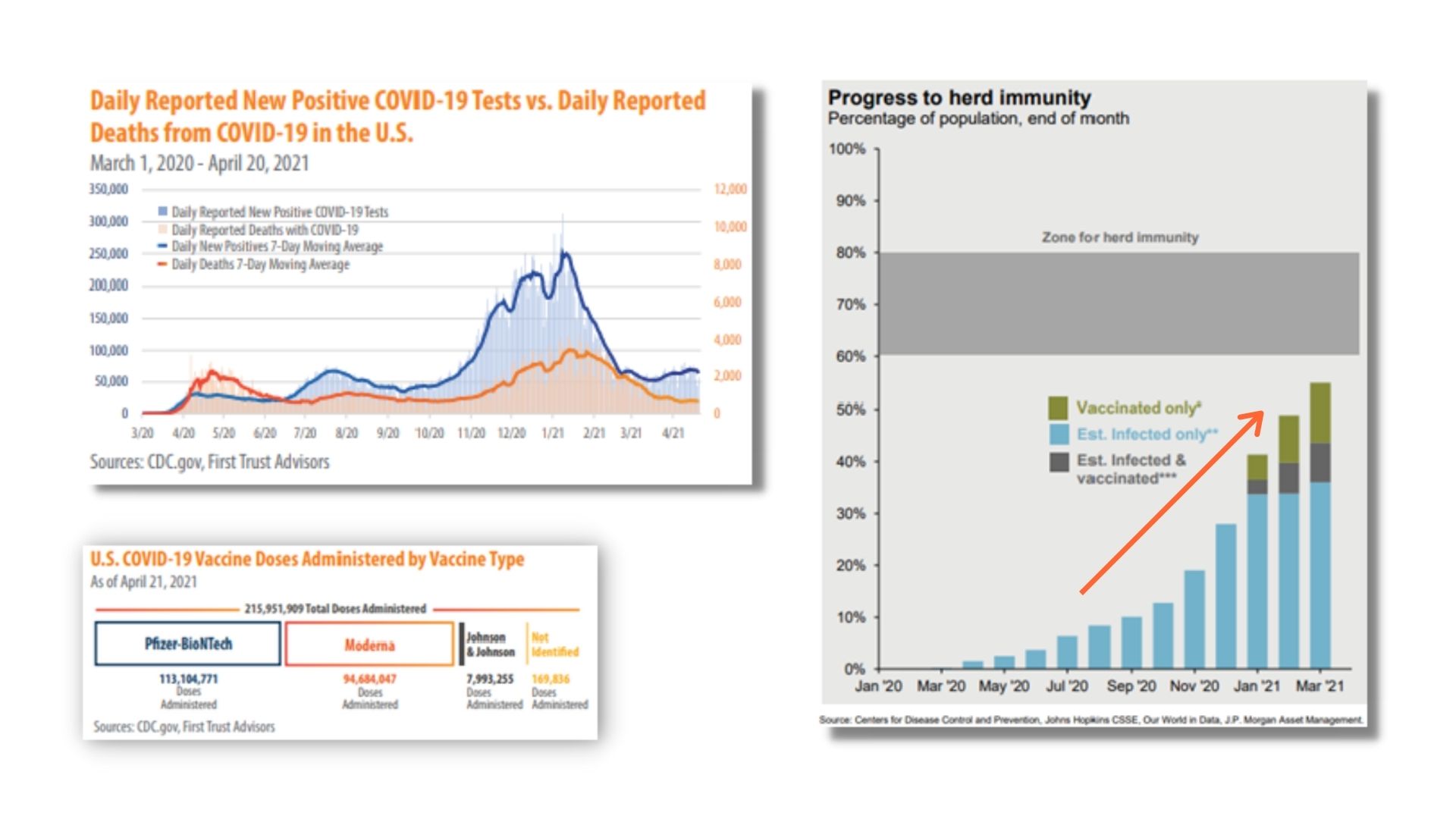

With this said, the economic recovery continues to be predicated on COVID developments and While there has been a slight uptick in cases recently, we are witnessing a firm downtrend in fatalities.

With this said, the economic recovery continues to be predicated on COVID developments and While there has been a slight uptick in cases recently, we are witnessing a firm downtrend in fatalities.

Importantly, Vaccine roll-out has been successful and the U.S. appears to be approaching the herd immunity zone. Some estimates anticipate that ~85% of the adult population will have immunity – either by vaccination or by already contracting the virus – by the end of June – this will allow economic growth to accelerate from summer through the back half of year and into 2022.

Economy Strong

We’re already seeing a lot of economic momentum:

We’re already seeing a lot of economic momentum:

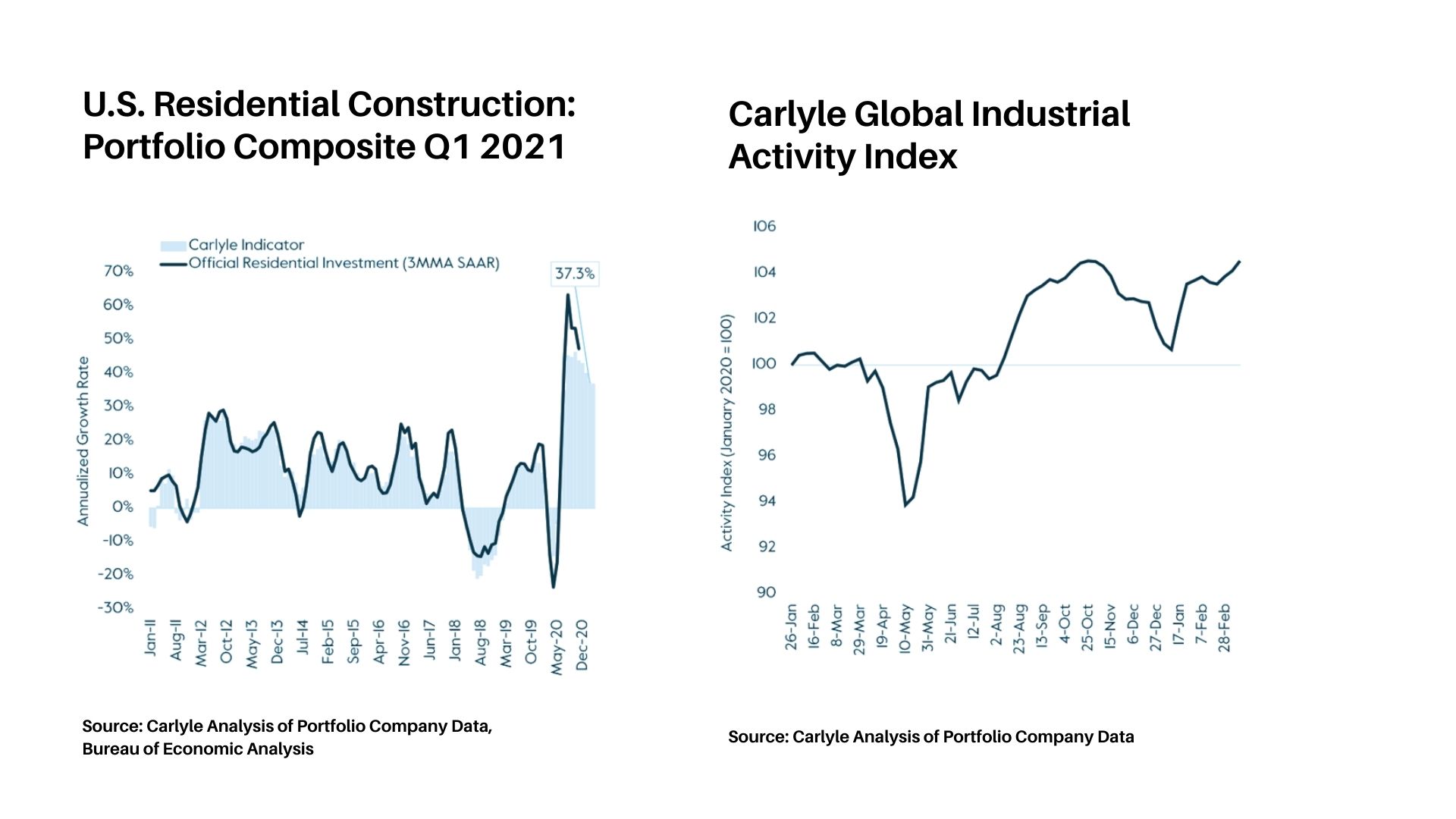

- Residential construction activity is very strong.

- Industrial rebound has gathered strength, with industrial orders and output surging across all major sectors of the economy.

- Vehicle sales are the strongest since 2017.

- Manufacturing is the strongest in 37 years.

- And thousands of jobs being added over recent months.

Consumer Strong

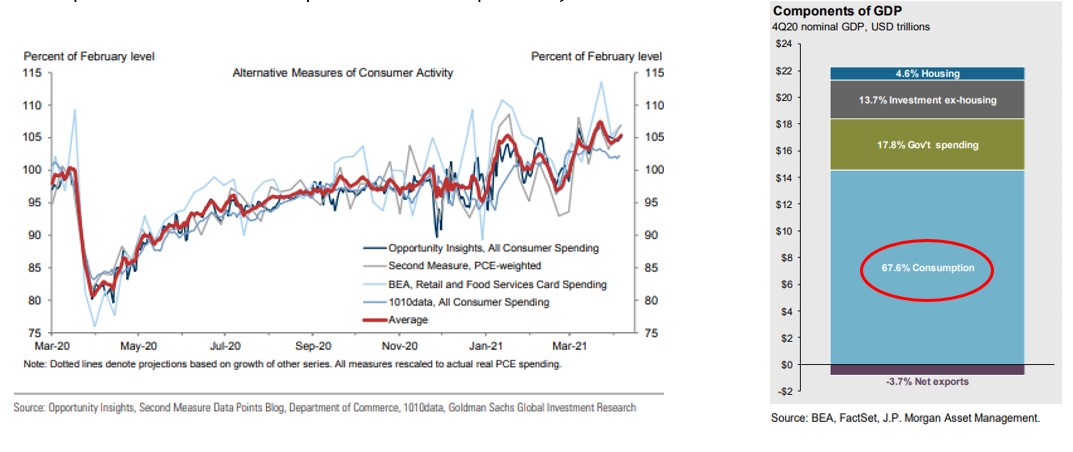

As the chart illustrates, Consumer spending has been trending positively and currently stands at over 105% of pre-virus levels. In particular, spending on areas most impacted by social distancing – like dining and transportation – has improved sharply. And this is important, as consumption makes up nearly 70% of U.S. GDP.

As the chart illustrates, Consumer spending has been trending positively and currently stands at over 105% of pre-virus levels. In particular, spending on areas most impacted by social distancing – like dining and transportation – has improved sharply. And this is important, as consumption makes up nearly 70% of U.S. GDP.

Hospitality Bouncing Back

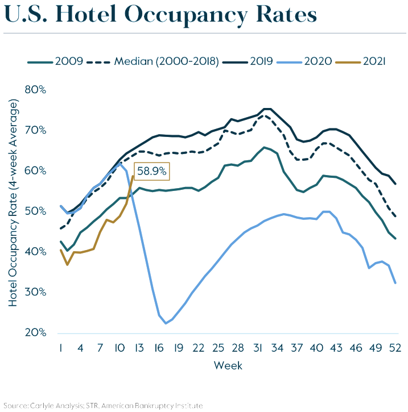

Speaking of industries most hard hit, we’re seeing a bounce back in the hospitality industry, with hotels experiencing strong weekend occupancies. In fact, Hotel occupancies are now at post-pandemic highs, as are U.S. airplane passenger volumes.

Speaking of industries most hard hit, we’re seeing a bounce back in the hospitality industry, with hotels experiencing strong weekend occupancies. In fact, Hotel occupancies are now at post-pandemic highs, as are U.S. airplane passenger volumes.

And it’s not just in the U.S., but a broad based global economic recovery, as evidenced by this chart tracking measures of manufacturing. In short, green is good and we’re seeing a lot of green and getting greener across the globe.

Federal Projections

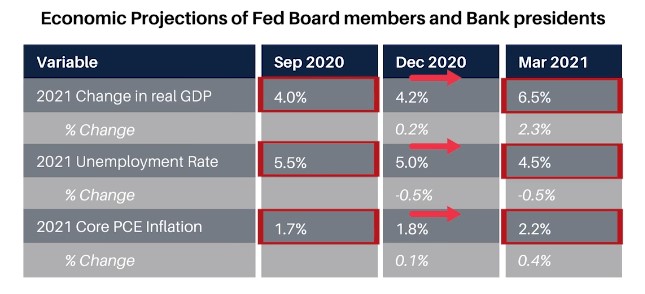

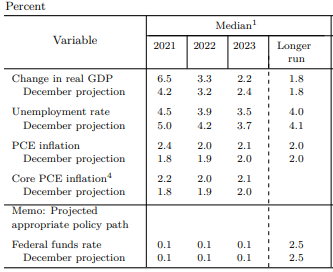

As mentioned earlier, economic projections continue to be revised higher, not the least of which are the Fed’s projections. You can see from this chart they increased expectations for economic growth in 2021 by a full 2.5 percentage points in the space of six months, bringing expectations for 2021 growth to 6.5% and we believe they are likely to revise these numbers higher again. Expectations for the labor market have also improved dramatically, with a much lower estimate for the unemployment rate than previously forecast.

As mentioned earlier, economic projections continue to be revised higher, not the least of which are the Fed’s projections. You can see from this chart they increased expectations for economic growth in 2021 by a full 2.5 percentage points in the space of six months, bringing expectations for 2021 growth to 6.5% and we believe they are likely to revise these numbers higher again. Expectations for the labor market have also improved dramatically, with a much lower estimate for the unemployment rate than previously forecast.

At the same time, the Fed did increase their expectations for inflation this year, but expect contained inflation over the medium to longer run.

At the same time, the Fed did increase their expectations for inflation this year, but expect contained inflation over the medium to longer run.- It’s important to remember that the Fed has communicated their inflation policy is symmetric around 2% - in other words they will allow it to be modestly higher without forcing them into tighter monetary policies to rein inflation in.

- And to that point, the Fed continues to be clear in communicating they will not raise interest rates before 2023.

Inflation

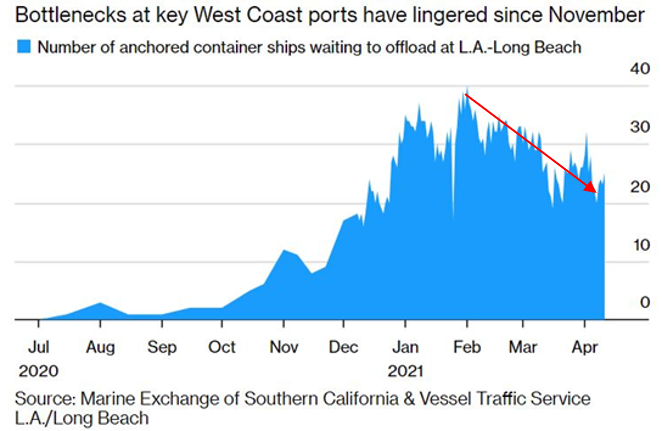

With respect to inflation, we do anticipate that over the Short term, higher commodities prices, trade bottlenecks and the strongest economic growth in decades are likely to push inflation higher.

With respect to inflation, we do anticipate that over the Short term, higher commodities prices, trade bottlenecks and the strongest economic growth in decades are likely to push inflation higher.

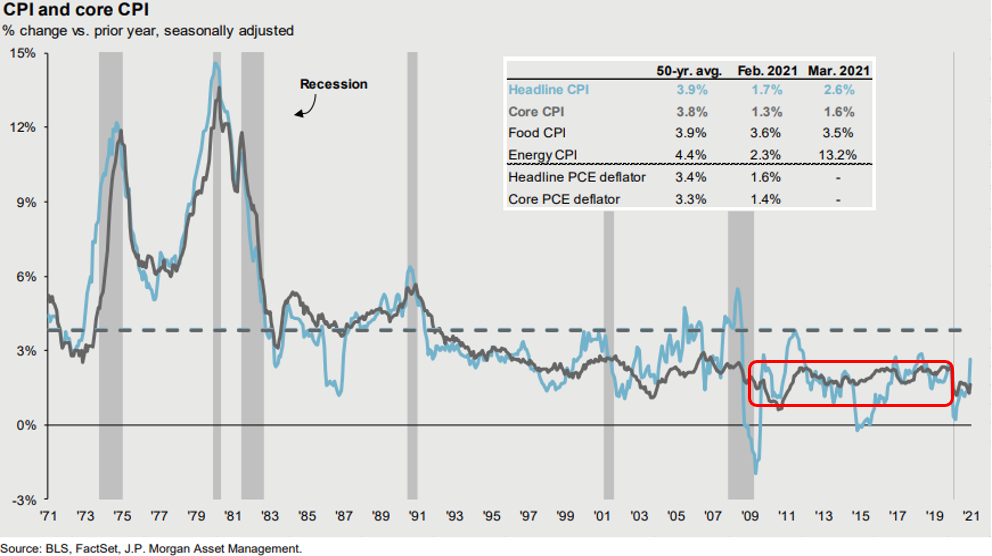

However, we believe this is more of a normalization in prices after a multi-month shock experienced last year rather than a longer term issue. We do believe Inflation is likely to peak in the coming months, but it may be transitory in nature.

Delays at ports appear to have peaked in February and are now subsiding and over the medium term, we believe structural issues are likely to contain inflation. Specifically, structural issues containing commodity prices, labor market slack and the recent substantial investment in technology across many sectors may help contain inflation over the medium term.

Interestingly, if history is a guide we shouldn’t necessarily expect massive easy policies to cause inflation: the last time we saw such accommodative policies was in response to the Great Financial Crisis of 2008. At the time there was a lot of concern about the potential for runaway inflation. Well, we didn’t get it. In fact the opposite occurred: The years that followed 2008 were arguably the most contained inflationary period ever. One point of note here though: the stimulus in reaction to the Great Financial Crisis did lead to financial asset price inflation in the form of stock market appreciation, but it did not lead to inflated goods and services in the real economy, as measured by the CPI. We expect a similar dynamic to play out once again.

Interestingly, if history is a guide we shouldn’t necessarily expect massive easy policies to cause inflation: the last time we saw such accommodative policies was in response to the Great Financial Crisis of 2008. At the time there was a lot of concern about the potential for runaway inflation. Well, we didn’t get it. In fact the opposite occurred: The years that followed 2008 were arguably the most contained inflationary period ever. One point of note here though: the stimulus in reaction to the Great Financial Crisis did lead to financial asset price inflation in the form of stock market appreciation, but it did not lead to inflated goods and services in the real economy, as measured by the CPI. We expect a similar dynamic to play out once again.

Despite recent strength, we believe structural issues may contain Commodity prices, driven by oil which still touches most goods and services directly or indirectly.

Despite recent strength, we believe structural issues may contain Commodity prices, driven by oil which still touches most goods and services directly or indirectly.

Consider the economics of the oil market. The U.S. is the largest oil producer in the world, making up 20% of global supply and U.S. refiners are driven by economics and extremely efficient: when prices dip below certain thresholds that make oil production uneconomic they are able to quickly shut down production. Conversely, anytime the price moves much north of the $55-$60 range they are able bring production online very quickly. This limits upside potential in the price of oil, as supply begins increasing over certain price points. The higher the price, the more supply comes to market providing a natural upper constraint.

Now consider the impact COVID has had on the economy. Even after the economy returns to “normal” there is likely to be an increased number of employees working remotely across all industries. More people working remotely will structurally reduce demand for commodities such as oil, while greater efficiencies in energy consumption are likely to contain prices moving forward.

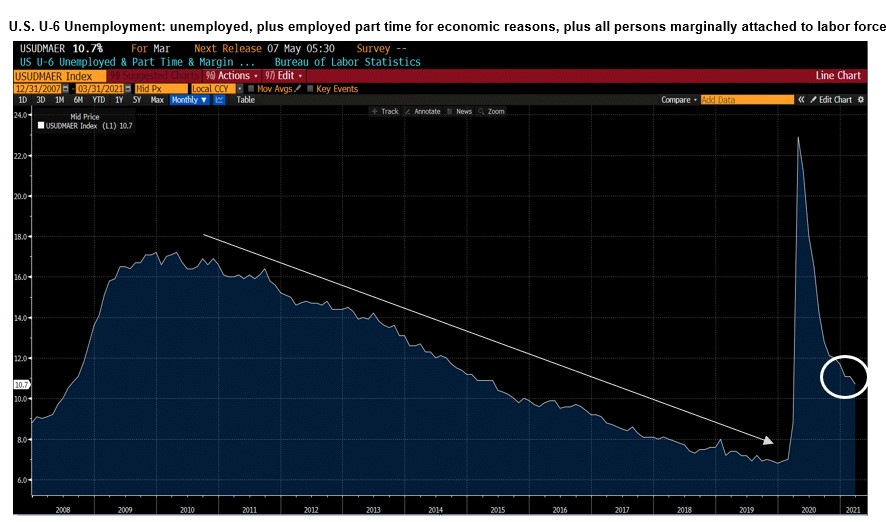

Labor Market Slack

Slack in the labor market was a key contributor to moderating inflation in the aftermath of 2008 and may keep prices in check again. This chart depicts a wider measure of underemployment, what’s called U-6 unemployment which is made up of unemployed people, plus those employed part time who would otherwise want to work full-time, plus all those people marginally attached to labor force –You can see it took a very long time for underemployment to reduce post-2008 and it is currently running at an elevated level of around 11%.

Slack in the labor market was a key contributor to moderating inflation in the aftermath of 2008 and may keep prices in check again. This chart depicts a wider measure of underemployment, what’s called U-6 unemployment which is made up of unemployed people, plus those employed part time who would otherwise want to work full-time, plus all those people marginally attached to labor force –You can see it took a very long time for underemployment to reduce post-2008 and it is currently running at an elevated level of around 11%.

When there is slack in the labor market, such as today, stimulus tends to increase output but not necessarily inflation – as businesses are able to hire and produce more goods, increasing supply to meet the increased demand.

It’s not until labor market slack is reduced that output is constrained since businesses can simply not hire more people to produce more goods or services, so prices tend to move higher as a function of constrained supply but increasing demand, which leads to upward pricing pressure. We simply aren’t there yet and are unlikely to be for some time yet.

We also believe recent substantial Technology investment will help moderate inflationary pressures. 2020 saw a particularly strong uptick in technology as businesses were faced with the realities of a socially distanced economy.

- Many businesses were forced to invest in technology to stay competitive, or to take advantage of unique opportunity sets

- This increase in technology spend is likely to lead to productivity enhancements and greater efficiencies across many industries, and in turn may act to moderate inflation

Again, our view is we are likely to experience increased inflation over the coming months but believe this is more of a normalization from last year’s multi-month price shock, and that any uptick in inflation will be transitory. Significant structural issues are likely to contain inflation over the medium term.

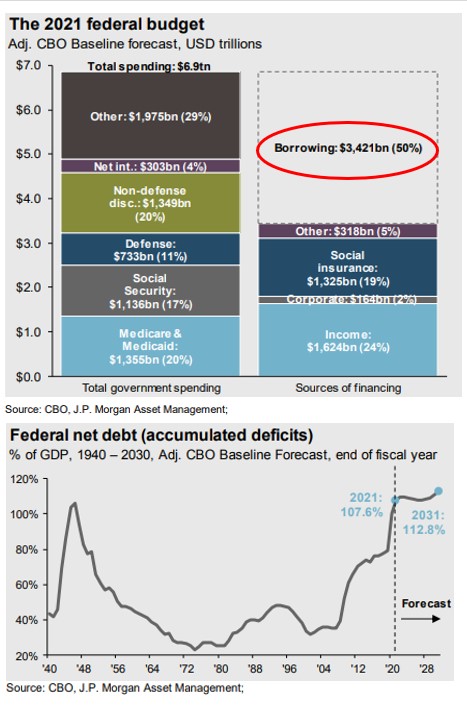

Fiscal Policy

Turning to fiscal policy, this chart depicts the 2021 Federal budget and incorporates this year’s recent $1.9 Trillion dollar stimulus package. Clearly, there is a substantial shortfall between government spending and sources of financing, with borrowing set to make up 50% of the budget this year.

Turning to fiscal policy, this chart depicts the 2021 Federal budget and incorporates this year’s recent $1.9 Trillion dollar stimulus package. Clearly, there is a substantial shortfall between government spending and sources of financing, with borrowing set to make up 50% of the budget this year.

On top of these assumptions, there is an infrastructure package to be negotiated as well as the recently proposed American Families plan, which may further increase the deficit.

As a result, Federal net debt is set to exceed 100% of GDP and stay elevated for the foreseeable future.

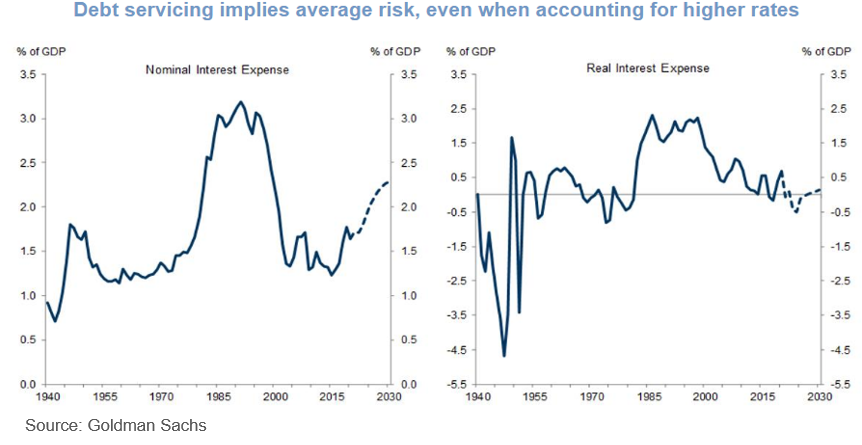

While absolute debt levels have grown to historic levels, the reality is the U.S. is in a relatively strong position to service that debt due to the low interest rate environment.

While absolute debt levels have grown to historic levels, the reality is the U.S. is in a relatively strong position to service that debt due to the low interest rate environment.

Even factoring in a backdrop of rising interest rates, we do not consider debt servicing costs pose a near-term risk.

Regardless, fiscal adjustments will eventually be required.

And speaking of fiscal adjustments, The Biden Administration plans to raise capital gains taxes and corporate taxes to help fund stimulus packages

While these proposals come as little surprise, we expect Congress will ultimately pass a scaled back version of Biden’s initial tax increase proposal given the razor thin margin in the Senate and potential pushback from centrists, particularly in light of the narrowed Democrat majority in the House.

The issue is likely to remain in flux for several months and we do not expect any tax increase to take effect until at least January, 2022.

The implication for stocks may be two-fold: 1) a reduction in bottom line earnings and 2) selling pressure ahead of increased tax rates taking effect, though likely short-lived if history is a guide.

Outlook

Stocks

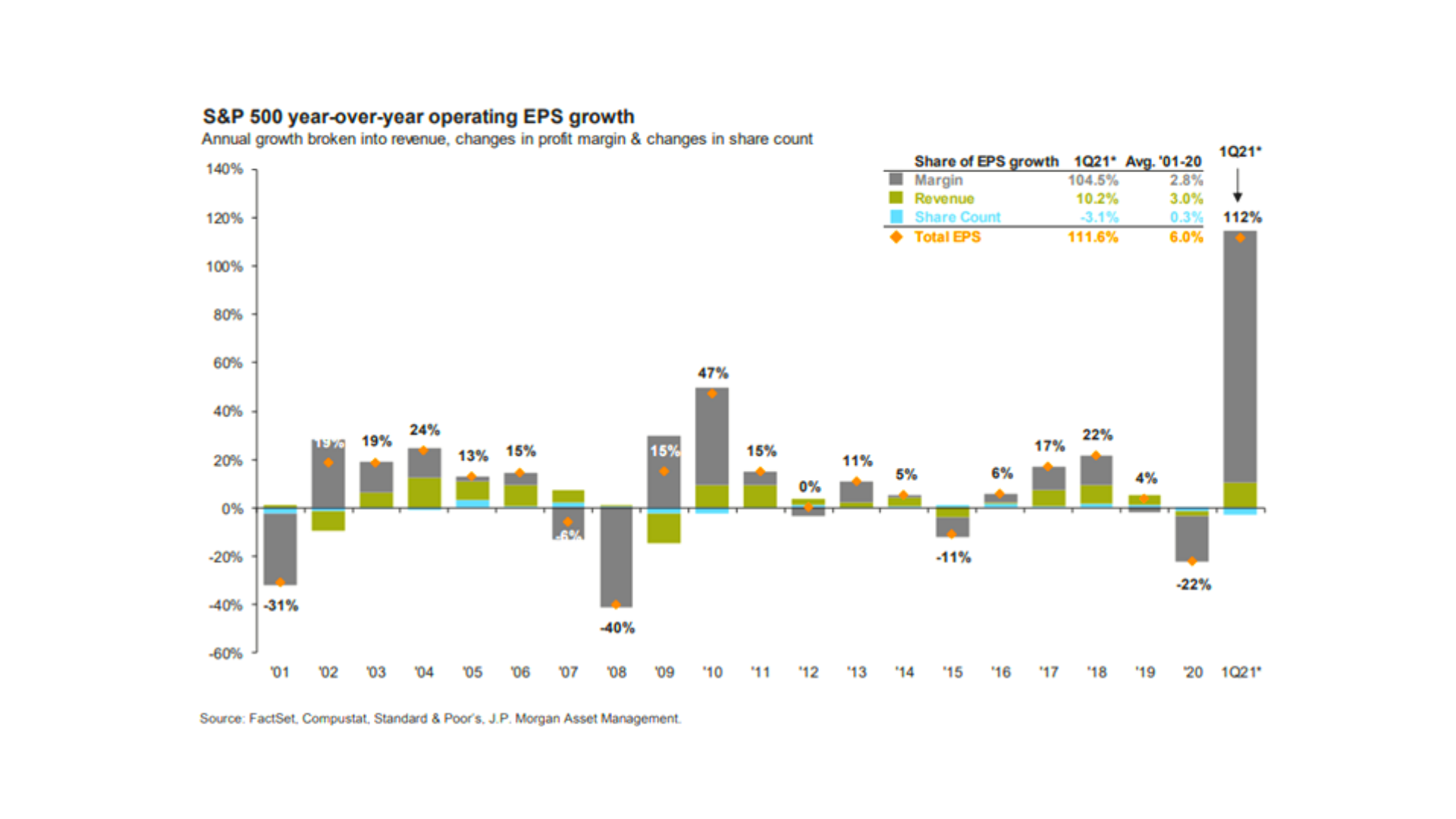

We believe the macro backdrop remains supportive of the stock market, with the strongest economic growth in decades helping drive earnings growth higher. Indeed, the market expects earnings to surge +40% in 2021and the current earnings season is another strong one, with 80% of S&P 500 companies exceeding consensus earnings expectations for the first quarter of 2021.

We believe the macro backdrop remains supportive of the stock market, with the strongest economic growth in decades helping drive earnings growth higher. Indeed, the market expects earnings to surge +40% in 2021and the current earnings season is another strong one, with 80% of S&P 500 companies exceeding consensus earnings expectations for the first quarter of 2021.

Taxes May Cause Uncertainty

While possible tax increases may cause some uncertainty, particularly with the potential for higher corporate tax rates to reduce bottom line earnings, though we do note that much of these expectations have already been factored into current stock market prices.

Also, the potential for capital gains tax increases may lead to some selling pressure ahead of any tax increase taking effect, in past instances selling pressure has been very short lived.

Don't Fight the Fed

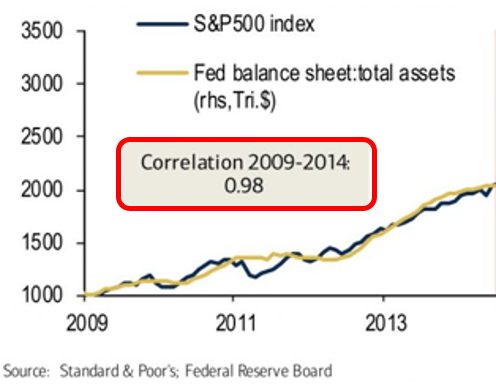

One overarching theme moving forward may be the influence of Fed policy. Investors may do well to heed the old adage “don’t fight the Fed” - Don’t underestimate the influence of easy monetary policy on stocks. The last time the Fed was this accommodative was in response to the Great Financial Crisis.

One overarching theme moving forward may be the influence of Fed policy. Investors may do well to heed the old adage “don’t fight the Fed” - Don’t underestimate the influence of easy monetary policy on stocks. The last time the Fed was this accommodative was in response to the Great Financial Crisis.

While the Fed’s policies then didn’t result in broad based CPI inflation, it did lead to financial asset inflation in the form of stock price appreciation. The Fed’s easy policies acted as a powerful tailwind for the stock market and as evidenced by this chart, in the years that followed the great financial crisis, the correlation between the S&P 500 and the Fed’s balance sheet was nearly 1.

Bonds

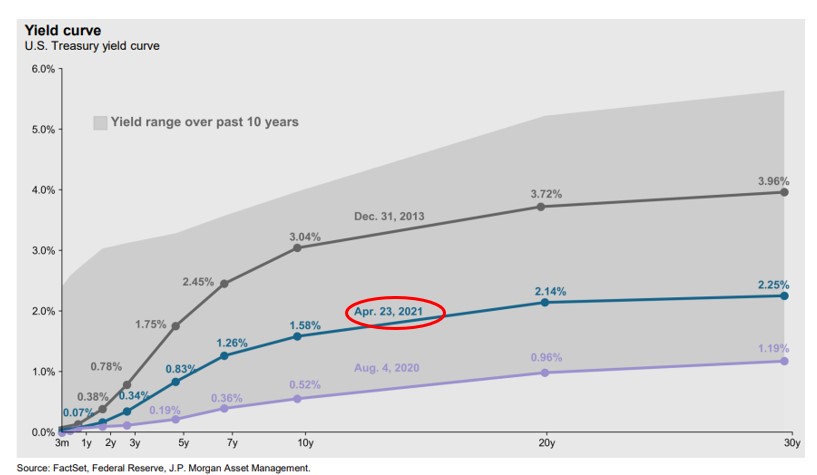

Turning to bonds, interest rates are likely to be anchored at front end of the curve via Fed policies, however despite an already significant move higher in yields year-to-date, there is still room for rates to move higher at the back end of the curve. This is highlighted in this yield curve chart, with the grey area depicting the yield range over the past 10 years. You’ll notice the current curve is towards the lower end of the spectrum.

Turning to bonds, interest rates are likely to be anchored at front end of the curve via Fed policies, however despite an already significant move higher in yields year-to-date, there is still room for rates to move higher at the back end of the curve. This is highlighted in this yield curve chart, with the grey area depicting the yield range over the past 10 years. You’ll notice the current curve is towards the lower end of the spectrum.

As a result, we continue to favor shorter duration than the broad bond market, while maintaining dedicated satellite fixed income allocations.

Longer maturity core fixed income may be particularly impacted by rising rates, whereas credit may benefit from ongoing accommodative policies. To this end, we have maintained dedicated allocations to actively managed bond funds and fixed income asset classes we consider may perform relatively well in a rising interest rate environment.

Longer maturity core fixed income may be particularly impacted by rising rates, whereas credit may benefit from ongoing accommodative policies. To this end, we have maintained dedicated allocations to actively managed bond funds and fixed income asset classes we consider may perform relatively well in a rising interest rate environment.

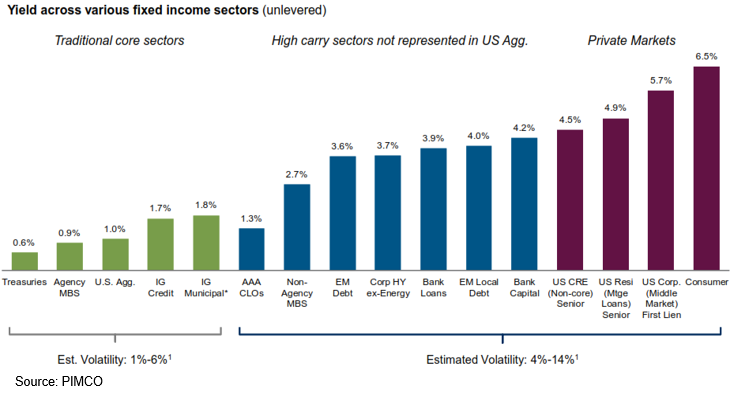

In addition, we believe unique opportunities may exist in less liquid areas of the bond market, which may offer equity-like return potential with lower volatility.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

For more information, please visit missionwealth.com or contact your advisor.

00401315 04/21