By Kieran Osborne, MBus, CFA®

By Kieran Osborne, MBus, CFA®

Chief Investment Officer

Welcome to Mission Wealth’s market perspectives for the first quarter of 2021. I’m Kieran Osborne Chief Investment Officer at Mission Wealth and I’m pleased to be presenting our outlook on financial markets and the economy to you today.

2020 was an unforgettable year – largely for all the wrong reasons. COVID-19 impacted every facet of our daily lives and is likely to have a lasting impact on our global economy. Many parts of the economy effectively hit a brick wall earlier in the year, as social distancing policies ground activity to a halt for many businesses.

This presentation will cover three broad themes. Each section comes with it's own video.

- An update on markets,

- Our views on the economy,

- Our outlook moving forward.

Key Themes

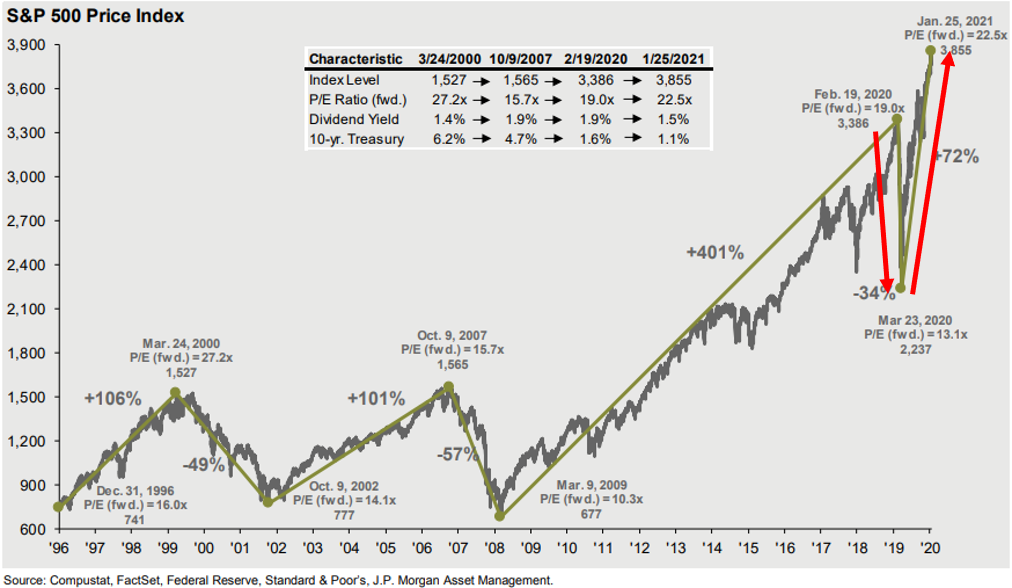

Stocks experienced the fastest bear market in history as the economic impact of the coronavirus and related social distancing policies took hold in March 2020. This was followed by trillions of dollars in government aid and unprecedented monetary support, which helped propel markets higher. There was also a lot of dispersion in performance across equities, with growth stocks outperforming value stocks, particularly in the first half of the year. U.S. stocks outperformed international markets, while many sectors struggled, notably energy, public REITs, and financials, to name just a few.

Risk appetite now appears elevated, though we believe the macro backdrop does remains supportive. Lastly, we would caution on being overly concentrated in large and mega-cap growth stocks, as the advantage afforded to tech-oriented businesses by a socially distanced economy potentially abates.

Turning to the economy, while we believe significant near-term uncertainties remain, we do anticipate we are at the beginning of a new economic expansion. We believe unprecedented levels of policy support have helped underpin economic resilience and provides a strong base from which to grow the economy moving forward. We anticipate more coronavirus relief and infrastructure stimulus from Washington, and while fiscal adjustments will eventually be required to address the burgeoning debt load, we don’t consider meaningful tax or regulatory reform is likely over the near-term. While the outlook and risks continue to be tied to coronavirus developments, economic projections continue to be revised higher. In fact, we anticipate 2021 global growth will be the highest in over a decade.

So with this backdrop, what is our outlook? We believe medium term returns for global equities remain supported by the economic environment and ongoing accommodative policies. With that said, volatility may remain elevated, but any short-term sell-off may offer a rebalancing opportunity to add to stock exposures. Turning to bonds, we favor shorter duration over longer duration and corporate bonds and agencies over Treasuries, while maintaining dedicated satellite fixed income allocations. We believe less liquid credit funds in particular may offer attractive return potential moving forward.

Mission Wealth Actions

I think it’s useful to reflect on some of the actions we have been taking.

- During such an unprecedented time, we maintained our disciplined approach to portfolio construction and rebalancing, adding broadly to stock exposures through March and April.

- We took the opportunity to tax loss harvest where appropriate to enhance after tax returns and have also reduced legacy concentrated stock exposures where it makes sense, with a particular focus on large and mega-cap tech and growth stocks.

- We continue to favor dedicated allocations to global equities. Despite recent strength, we believe long-term return expectations remain relatively attractive. Any near-term volatility may offer a rebalancing opportunity to add to stock exposures.

- We have favored allocations to high quality corporate bonds and Agency securities over Treasuries, and believe unique opportunities exist in certain areas of the bond market which may offer relative return upside for our bond funds.

- Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Watch our short educational videos to learn about investment concepts.

Market Update

After concerns surrounding the coronavirus pandemic drove volatility and the fastest bear market in history, market sentiment improved significantly on the back of unprecedented government and monetary policy support, resulting in a historically fast stock market recovery.

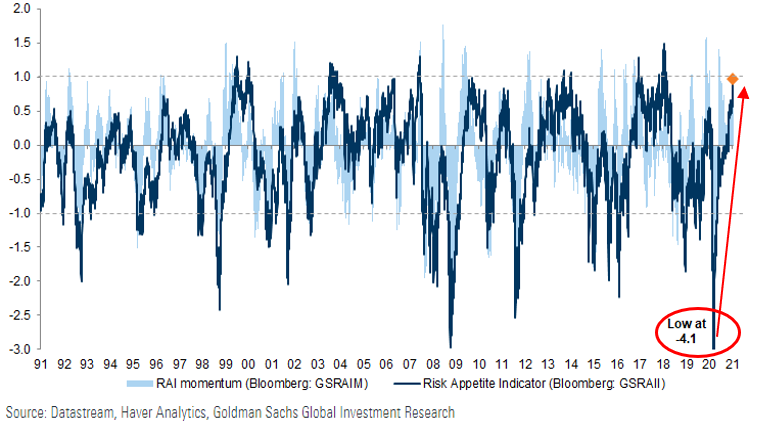

Given the recent stock market strength, measures of risk appetite have now become elevated. In fact, after hitting an all-time low in the first quarter of 2020, the Risk Appetite Indicator – which aggregates a wide range of market level data and positioning – is now approaching one of its highest levels.

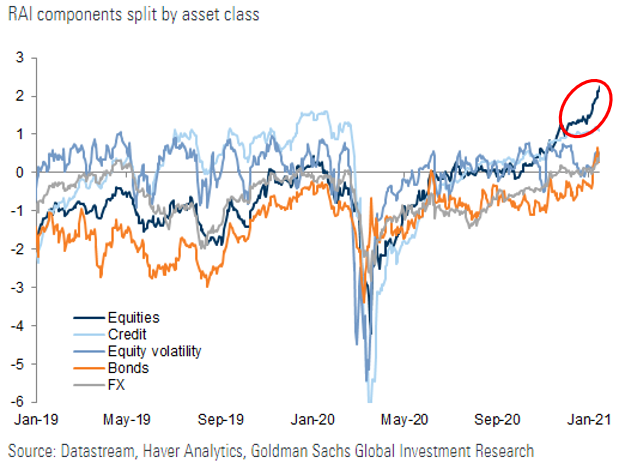

Delving into the composition of the risk appetite indicator, we can clearly see that Equities in particular have driven the uptick as the reflation trade has recently accelerated.

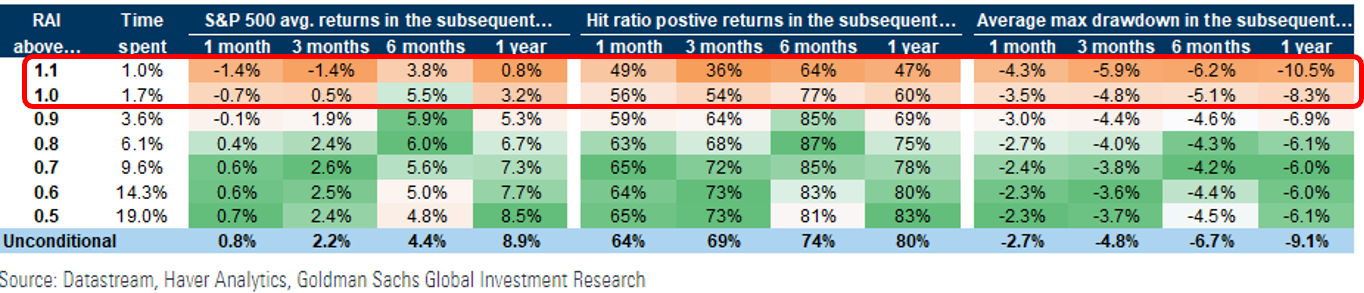

While an elevated risk appetite indicator does increase downside risks, it is actually a better predictor of a bounce back in markets off lows as opposed to forecasting a sell-off from highs. In fact, historically risk appetite can stay high for extended periods with a supportive macro backdrop – which we believe is currently the case.

Nevertheless, as this chart depicts, larger equity draw-downs and a moderation in returns tend to occur following higher risk appetite levels. We believe the implication is to expect ongoing volatility over the near-term with potential for short-term market pull backs. However we believe such sell-offs may offer rebalancing opportunities.

It’s also important to remember that stock market volatility should be expected.

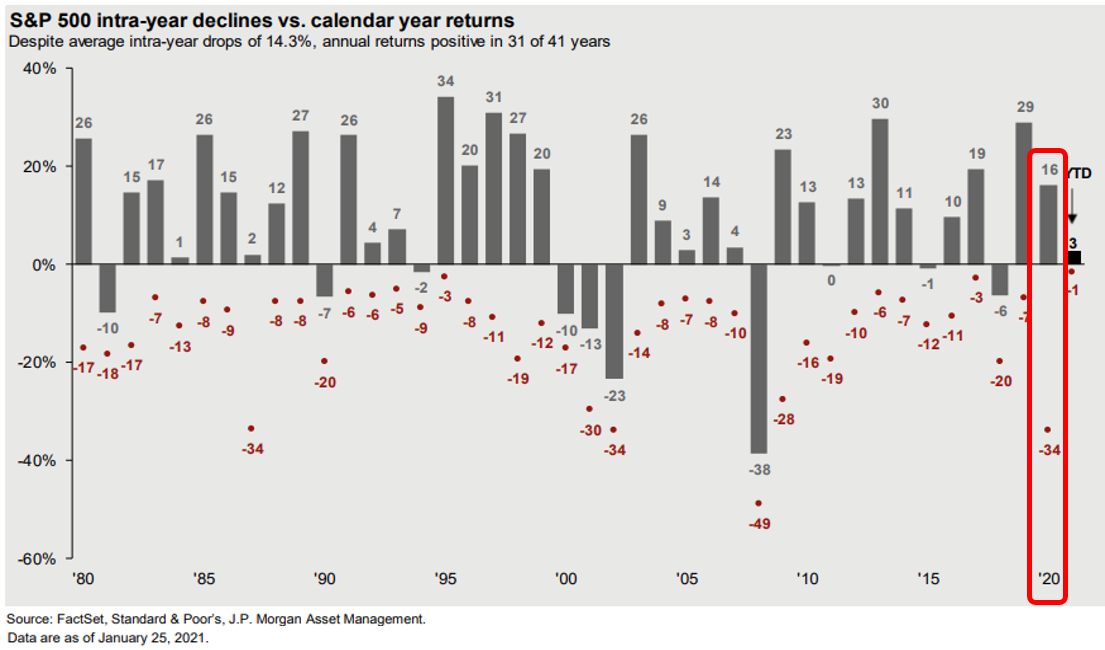

As this chart highlights, the average intra-year decline for the S&P 500 is -14.3%, yet the market has historically finished positive 75% of those years. These intra-year declines really underscores the importance of maintaining investment discipline in the face of market uncertainties, not overreacting to dire headlines but rather rebalancing systematically and sticking to a long-term financial plan and diversified asset allocation. 2020 was a prime example. After experiencing the fastest bear market in history, in March and April of 2020 we were broadly adding to stock exposures and tax-loss harvesting across many client accounts, which in turn helped overall portfolio performance as the stock market rallied through the remainder of the year.

highlights, the average intra-year decline for the S&P 500 is -14.3%, yet the market has historically finished positive 75% of those years. These intra-year declines really underscores the importance of maintaining investment discipline in the face of market uncertainties, not overreacting to dire headlines but rather rebalancing systematically and sticking to a long-term financial plan and diversified asset allocation. 2020 was a prime example. After experiencing the fastest bear market in history, in March and April of 2020 we were broadly adding to stock exposures and tax-loss harvesting across many client accounts, which in turn helped overall portfolio performance as the stock market rallied through the remainder of the year.

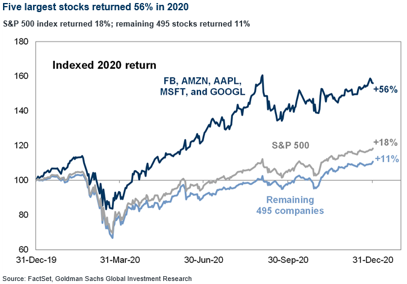

We would caution on being overly concentrated in large and mega-cap growth stocks in particular. Many large tech and growth oriented businesses posted outsized returns in 2020 as the trend towards online retail accelerated and businesses across the nation were forced to invest in technology to remain competitive. However, as vaccine roll-out is underway and the advantage afforded to tech-oriented businesses by a socially distanced economy abates, we may see a normalization in returns.

particular. Many large tech and growth oriented businesses posted outsized returns in 2020 as the trend towards online retail accelerated and businesses across the nation were forced to invest in technology to remain competitive. However, as vaccine roll-out is underway and the advantage afforded to tech-oriented businesses by a socially distanced economy abates, we may see a normalization in returns.

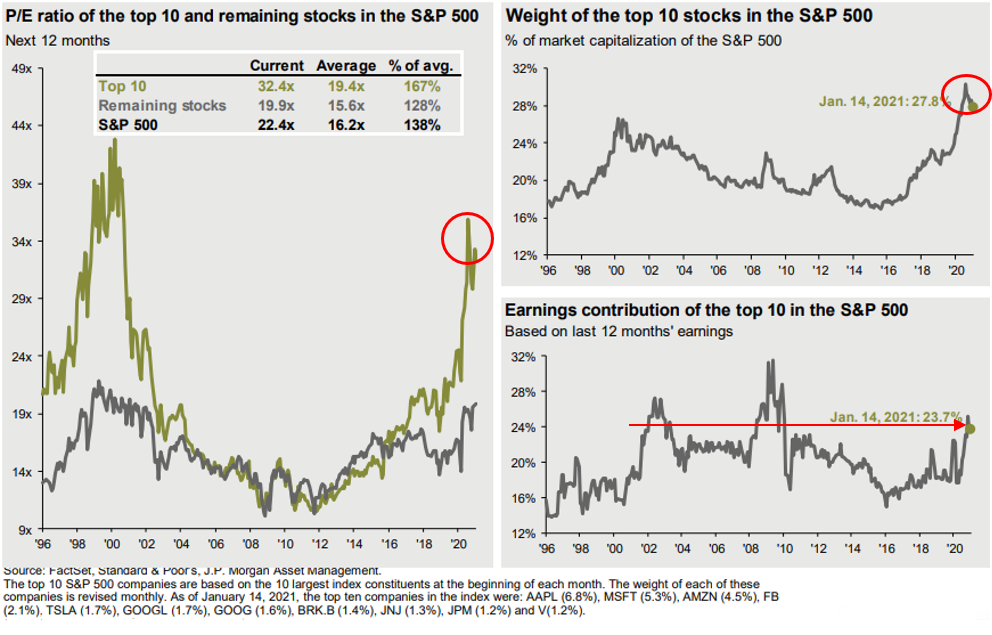

Moreover,  we are seeing some stretched metrics. For one, the weight of top 10 stocks – made up of Apple, Microsoft, Amazon, Facebook, Tesla, Google, Berkshire, J&J, JPMorgan and Visa – currently exceeds even the dot.com level. …While relative earnings contributions to the broader market is well below that of prior highs …and valuation multiples are at levels not seen since the dot.com bubble.

we are seeing some stretched metrics. For one, the weight of top 10 stocks – made up of Apple, Microsoft, Amazon, Facebook, Tesla, Google, Berkshire, J&J, JPMorgan and Visa – currently exceeds even the dot.com level. …While relative earnings contributions to the broader market is well below that of prior highs …and valuation multiples are at levels not seen since the dot.com bubble.

For these reasons, we have been actively reducing legacy concentrated stock exposures where it makes sense, with a particular focus on large and mega-cap tech and growth stocks.

The Economy

While near-term uncertainties remain, we anticipate we are at the beginning of a new economic expansion.

While near-term uncertainties remain, we anticipate we are at the beginning of a new economic expansion.

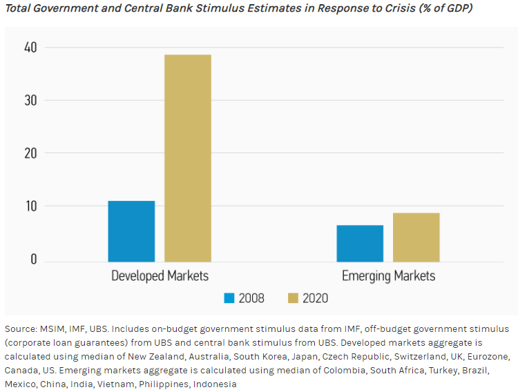

We believe unprecedented levels of policy support have helped underpin economic resilience and provides for a strong base from which to grow the economy. As this chart depicts, the current combined government and central bank stimulus dwarfs the size of the stimulus seen in 2008 and we believe such massive monetary and fiscal stimulus is likely to provide a tailwind for the economy and risk-on assets, such as stocks, over the near-term.

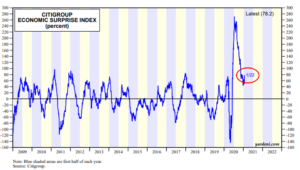

Since bottoming out in March 2020, the economy has been remarkably resilient and despite expectations for a near-term slowdown as a function of the recent spike in coronavirus cases – the economy continues to exceed expectations, as evidenced by a still elevated economic surprise index. Indeed, we continue to see economic forecasts revised higher.

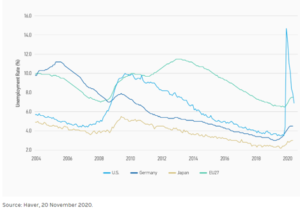

You might recall that many economists were forecasting the unemployment rate to be north of 20%. It’s currently 6.7% and forecast to fall further in 2021.

You might recall that many economists were forecasting the unemployment rate to be north of 20%. It’s currently 6.7% and forecast to fall further in 2021.

For perspective, global unemployment rates – while spiking significantly – have fallen quickly and are now well below 2009 highs and expected to fall further in 2021.

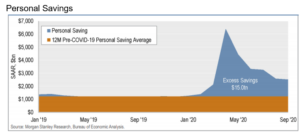

At the same time, $15 trillion of excess savings has been built across low and high income households since COVID-19 began.

Both metrics are very positive indicators for the consumer and may help underpin economic growth moving forward, since consumer spending makes up approximately 70% of GDP.

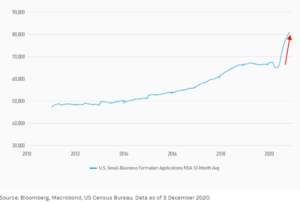

We’ve also seen a huge surge in new business formations which may help propel the economy higher and unemployment lower.

We said this at the onset of the crisis and this uptick really underscores it:

Don’t underestimate the ingenuity of individuals to adapt!

Humans are resilient and this spike in new businesses is a reflection of the ability to adapt and take advantage of unique opportunities brought about by the current environment.

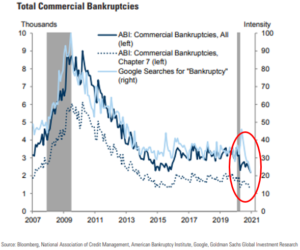

At the same time total commercial bankruptcies have declined further in December and remain well below pre-virus levels, indicating stimulus programs such as the PPP and the Main Street Lending program helped many businesses stay afloat and in a position to grow once the economy returns to normal.

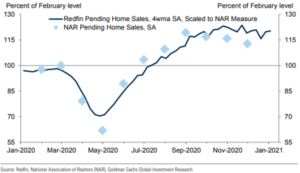

While the broader economy is expected to contract in 2020, the housing market is a particular bright spot and anticipated to contribute positively to 2020 GDP as pending home sales remain well above pre-virus levels through December. Low mortgage rates, demographic tailwinds, pent up demand and constrained supply all supportive of prices.

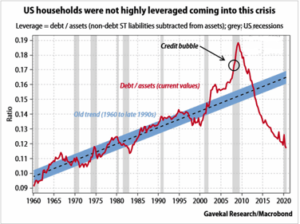

While household leverage was at its lowest level in  decades leading into crisis, which we believe has helped alleviate systemic issues, such as that experienced in the 2008 financial crisis.

decades leading into crisis, which we believe has helped alleviate systemic issues, such as that experienced in the 2008 financial crisis.

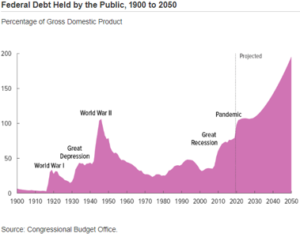

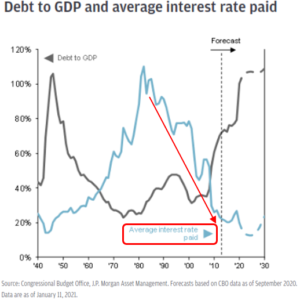

As a result of the increased fiscal stimulus, we have witnessed an increase in the absolute level of Federal debt outstanding. As can be clearly seen in this chart, Debt/GDP has grown and is expected to rise further, with another COVID relief package currently being negotiated and additional infrastructure spending likely to follow.

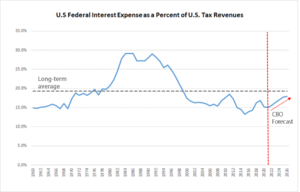

And that’s really the most important metric: The ability to service outstanding debt. The U.S. government’s debt service ratio – as measured by the annual interest expense on debt as a percent of annual tax revenues – remains below the long-term average, albeit forecast to migrate higher over the coming years.

Again, we do anticipate fiscal adjustments will eventually be required in the coming years, particularly if interest rates migrate higher.

Speaking of which, while the risks surrounding increased taxes and potential regulatory reform are elevated under a unified White House and Congress.

We don’t believe Meaningful changes are likely – at least over the near-term – as many politicians may be hesitant to risk derailing the nascent economic recovery given the lingering economic headwinds from the coronavirus pandemic.

What’s more, Democrats control the Senate with a razor thin margin and we anticipate potential pushback from centrists, particularly in light of the narrowed majority in the House.

As such, we expect that any potential and substantial tax reform is more likely to occur towards the end of Biden’s term rather than the beginning.

Coronavirus

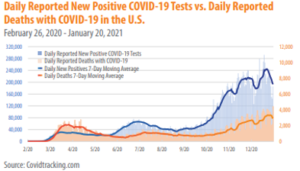

Turning to recent coronavirus developments, the U.S. has experienced a significant uptick in new cases and COVID-related deaths, though trends appear to be improving more recently.

Turning to recent coronavirus developments, the U.S. has experienced a significant uptick in new cases and COVID-related deaths, though trends appear to be improving more recently.

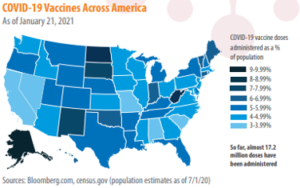

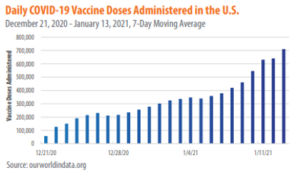

Vaccine roll-out has begun and prediction markets assign a 98% probability that enough vaccines will be distributed to inoculate 100 mill people in the U.S. by the end of May, and a 97% probability that enough vaccines will be distributed to inoculate 200 mill people by the end of Sep. Both probabilities have improved over recent weeks.

Fed Forecasts

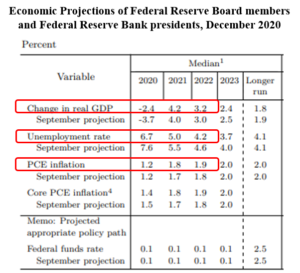

As mentioned earlier, economic forecasts continue to be revised positively, the Fed included. As this chart depicts, the Fed is projecting 2020 GDP to contract by -2.4%, which is substantially improved from their -3.7% estimate in September and their -6.5% estimate in June. Economic growth projections for 2021 and 2022 have likewise been revised higher.

As mentioned earlier, economic forecasts continue to be revised positively, the Fed included. As this chart depicts, the Fed is projecting 2020 GDP to contract by -2.4%, which is substantially improved from their -3.7% estimate in September and their -6.5% estimate in June. Economic growth projections for 2021 and 2022 have likewise been revised higher.

The Fed also expects the unemployment rate to decline in 2021, from 6.7% to 5.0% before dropping again to 4.2% by the end of 2022.

The Fed is certainly not alone in revising growth forecasts higher: the IMF recently increased its 2021 global growth projection to 5.5% from 5.2% amid expectations of a vaccine-powered strengthening of activity and additional policy support.

Indeed, Global GDP growth is expected to be the highest in over a decade.

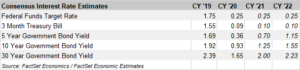

The Fed’s policies are likely to have a substantial impact on bond yields. The Fed is likely to maintain an easy monetary policy stance until unemployment and inflation approach long-term targets.

Amongst others, the Fed has clearly communicated they will maintain low interest rates for the foreseeable future.

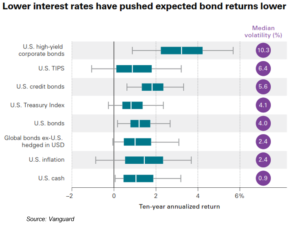

With a backdrop of accommodative monetary policies the market’s yield curve expectations are for rising rates at the back end of the curve, such as the 10 year or 30 year yield, while rates are expected to stay relatively steady at the short end of the curve, such as the 3 month yield. As a result, we believe longer duration core fixed income returns may be challenged in particular.

While there are a lot of positive dynamics impacting the economy, there are certainly also a number of uncertainties. Amongst them:

- The recent uptick in COVID cases and any issues with vaccine roll-out or uptake

- Uncertainty regarding size and timing of additional fiscal stimulus, particularly should bipartisan support be sought.

- Valuation concerns particularly for many mega-cap tech and growth stocks.

- Regulatory uncertainty (taxes, tech oversight, financial regulation, rollback of deregulation)

- And lastly the Potential for Chinese trade negotiations to intensify given Chinese trade appears a top priority for both sides of the aisle.

Outlook

Stocks

Stocks

Our medium term outlook for stocks is positive. While we do anticipate ongoing elevated levels of stock market volatility given the continued uncertainties, we believe any near-term volatility may offer a rebalancing opportunity to add to stock exposures.

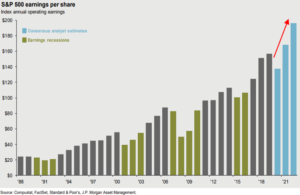

While aggregate earnings for the stock market are down from 2019 levels, earnings have generally come in ahead of expectations, with top and bottom line numbers consistently beating consensus estimates on the back of resilience in the broader economy. With that said, and as this chart depicts, we believe the market is looking through the near-term weakness towards a re-acceleration in growth the in latter half of 2021 and beyond.

While aggregate earnings for the stock market are down from 2019 levels, earnings have generally come in ahead of expectations, with top and bottom line numbers consistently beating consensus estimates on the back of resilience in the broader economy. With that said, and as this chart depicts, we believe the market is looking through the near-term weakness towards a re-acceleration in growth the in latter half of 2021 and beyond.

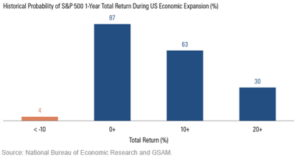

We believe medium term returns for global equities remain supported by the economic backdrop and ongoing and unprecedented levels of accommodative policies. Historically, similar time periods of accelerating economic growth have been a positive fort the stock market, with stocks posting positive one-year returns 87% of the time during past economic expansions.

backdrop and ongoing and unprecedented levels of accommodative policies. Historically, similar time periods of accelerating economic growth have been a positive fort the stock market, with stocks posting positive one-year returns 87% of the time during past economic expansions.

What’s more, we believe the influence that expansionary monetary policies can have on the stock market shouldn’t be overlooked. The Fed hasn’t been this accommodative since the great financial crisis of 2008. Coming out of that crisis the Fed expanded its balance sheet dramatically via quantitative easing programs - buying Treasuries and mortgage backed securities. This provided a natural tailwind for markets. In fact, as this chart illustrates, the correlation between the S&P 500 and the Fed’s balance sheet coming out of 2008 was nearly 1.

Similar quantitative easing policies and balance sheet expansion are being employed today and the Fed has clearly communicated it will continue to pursue expansionary monetary policy for the foreseeable future. We believe this may act as a natural tailwind for risk-on assets, such as stocks once again.

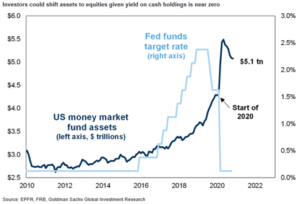

Another factor that could naturally benefit stock price appreciation is the recent uptick in savings and historically high cash balances. While cash balances are historically high, cash yields are historically low.

This underscores the importance of maintaining full investment – unlike other time periods when cash yielded something, today cash yields zero. It’s not producing any income or return, so the opportunity cost of sitting on the sidelines is a lot higher. And this may help underpin flows into and strength in stocks over the near-term.

In investment management, investment forecasts should accommodate the environmental uncertainty where possible. Stay focused on the long-term, and don't let short-term noise, volatile money markets, or buyers and sellers influence you away from your goals.

Turning to bonds, we favor shorter duration and corporate bonds and agencies over Treasuries, while maintaining dedicated satellite fixed income allocations.

Treasuries, while maintaining dedicated satellite fixed income allocations.

With a backdrop of low interest rates, especially at the short-end of the curve and accommodative policies potentially pushing longer dated yields higher, longer duration Treasuries in particular may be challenged, whereas credit may benefit from lower duration risks and spread compression.

We also believe unique opportunities currently exist across less liquid areas of the bond market, which may offer equity-like return potential with lower volatility in the current environment.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Thank you for your time today. Should you have any questions, please don’t hesitate to contact your Client Advisor.

00393298 2/21