Doing the Math on “Big” Money Allocations

By Brad Stark, MS, CFP®, AAMS®, CMFC℠

Founder and Chief Compliance Officer

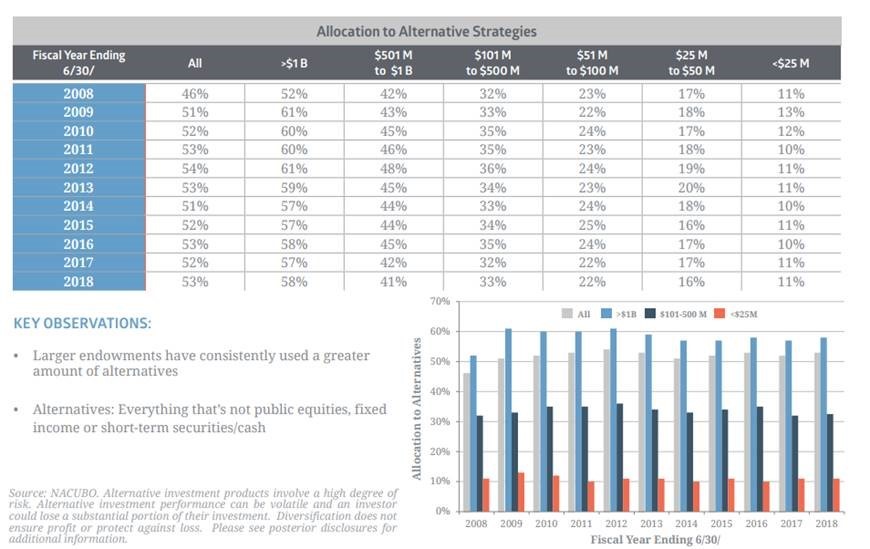

Endowments typically have significant allocations to “alternative strategies” which can play a role in diversification and long term portfolio growth.

Where appropriate, we too like to utilize alternative strategies for clients, usually in the rage of 10% to 15% of a portfolio. Today we are primarily focused on direct debt and real estate as well as low correlation equity trading techniques in some situations.

Alternative investments are usually less liquid investments but still invest in stocks, bonds and real estate as the underlying strategies. They can be desirable because of their ability to provide returns that are not directly correlated to financial market movements.

When we look at the overall “risk” allocations of endowments, they typically end up being around 70% true equity risk (alternatives, real estate, stocks, bonds, hedge, etc.). For most clients however, this risk allocation tends to be too high. Unlike endowments that technically have access to unlimited donations / funding for the next 100+ years, our clients do not have that luxury. Once work stops, there is no funding mechanism other than the current investments and liquidity to fund daily needs. For those reasons, we find that for most people, the sweet spot for the financial plan is generally in the 40-60% equity risk range.

If you'd like to learn more about this, you can read more here, or reach out to our experienced team.

00359401 02/20