Avoid Being An Average Investor: 7 Rules

By Brad Stark, MS, CFP®

Founder and Chief Compliance Officer

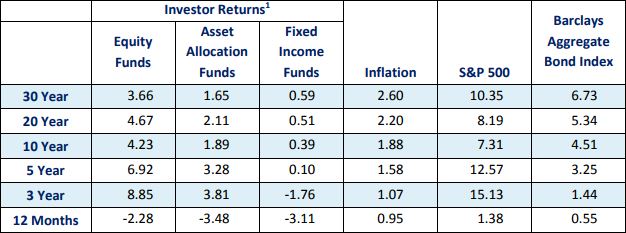

Time and time again, studies have shown that the average investor tends to earn less when compared to market benchmarks. For example, Dalbar’s annual Quantitative Analysis of Investor Behavior discusses how poorly investors perform over time relative to market benchmarks such as the S&P. The study found that in the covered time span of 1996 through 2015, “the 20-year annualized S&P return was 8.19% while the 20-year annualized return for the average equity mutual fund investor was only 4.67%, a gap of 3.52%.”

Careful analysis of this data shows that it is an investor’s behavior that is the primary cause of underperformance.

After reviewing thousands of financial statements, we have a good idea of where most people make mistakes and what behaviors can be adjusted to improve performance. The following are seven simple rules to observe if you wish to avoid the common pitfall of becoming an average investor.

- Don’t fall into the trap of chasing high-performing investments. People get enamored with the concept of what goes up must go up further. Unlike anything else we purchase in the world, investments are one of the few things that attract more money and attention as they becomes more expensive and become less attractive when they becomes cheaper. Realize that there may be a flaw in your investment-picking criteria when your first or second question revolves around past performance. Although performance is important when we are reviewing investments, it shouldn’t be the first thing you ask yourself.

- Understand how to analyze and discuss risk properly. Most people don’t understand risk until something bad occurs. It would behoove all investors to understand the terms “beta” and “standard deviation.” These are investment tools that can help outline the variance and risks you are hypothetically assuming.

- Investments take time. We tend to get impatient when it comes to investments and decide to make changes either due to greed or fear due to previous experiences. Learn to have patience and try to understand that if you invest in stocks, real estate or the like, you need to have a 5- to 10-year time horizon at the minimum.

- Don’t over concentrate your assets unless you are trying to hit a major financial home run (but with the knowledge that a strikeout is possible as well). Great wealth has been created and lost by making concentrated bets. As you make money, try to diversify into other asset classes to spread out the risks.

- Investments are not the same thing as money. Although they are quoted in dollar terms and redeemed for cash, investments are not cash. These two concepts are often confused. However, the difference is that one is used for short-term needs and the other should have a longer time horizon.

- Implement a portfolio that best matches your needs. This may be completely different from what may make you the most money. The key to investing is not always to make the most money but oftentimes to satisfy a goal. We recommend that you assume the least amount of risk necessary to accomplish your goals.

- Rebalance your portfolio on a regular basis (we recommend quarterly). Over time, not all of your investments will react the same, as some will go up in value and others down. While most people sell the investments that have done poorly and concentrate on the winners, they tend to do themselves a disservice as they violate some of the rules we have outlined above. The rebalancing process makes you sell high-performing investments and buy the low-performing ones.

Inspired Living™

Are you living your life in a way that brings you joy and meaning?

Join the Inspired Living™ movement to elevate your past, present and future. Let us introduce you to prominent thought-leaders, life coaches, and influencers who can work together with you to develop your customized life plan. We will give you curated resources, actionable advice and targeted strategies during your journey of self-discovery. Then we will align your multi-dimensional and multi-faceted life with your ultimate vision so that you can become the BestU™ in your life journey. Learn More

READ MORE: The Power of Long-Term Investing

1006430 1/18