By Brian Sottak, CFA®, CAIA®

RESEARCH ANALYST AND ALTERNATIVES SPECIALIST

Given where we are in this current business cycle, now 8 ½ years into a monumental bull-market run, investors are left asking themselves “how much longer can this rally continue?” Some investors pulled out of the equity markets many years ago and have missed out on years of double digit returns, other investors have unsuccessfully been trying to time the markets in recent years, while long-term investors have enjoyed the gains and will continue to ride out future business cycles employing a diversified long-term approach to investing.

Market Timing

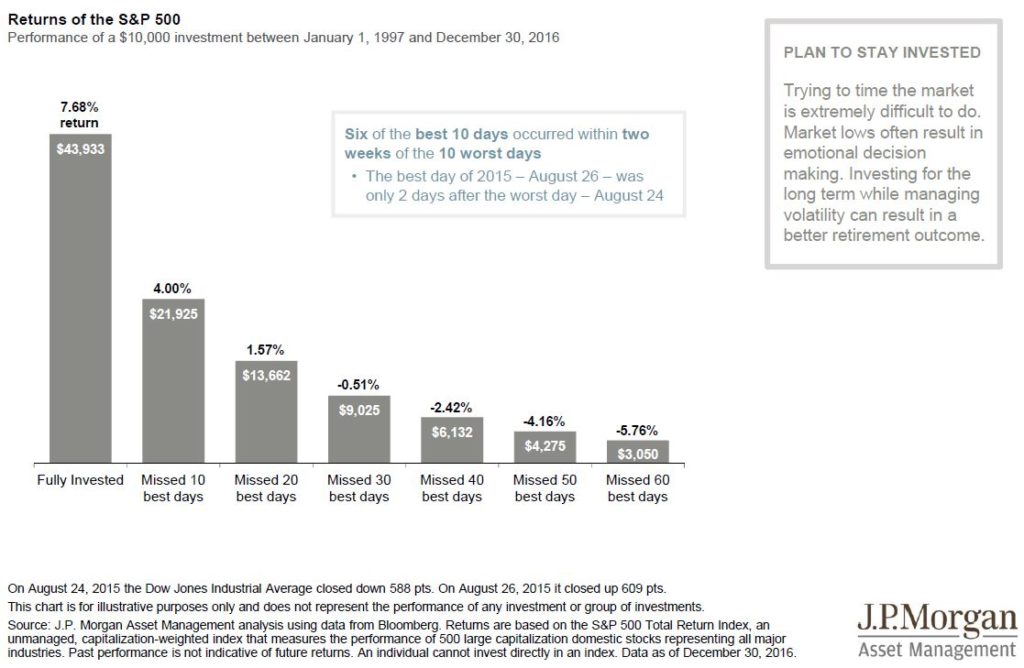

It can be tempting to try to time the market, aiming to get out before the next market downturn, but history suggests it is much more beneficial for investors to fight that urge and remain invested over the long run. Sometimes investors think they can outsmart the market, other times fear and greed push them to make emotional, rather than rational, decisions. By missing out on some of the market’s best days (not being invested in the market), investors can lose out on crucial opportunities to grow their portfolio. Over the period spanning from 1997 to 2016, missing the 30 best days in the market would yield a negative return if you had been invested in the S&P 500. Six of the ten best days for the market during that period were within two weeks of the ten worst days. Both the good days and the bad days in the market tend to follow each other very closely. Since 1928 the S&P 500 has lost 20% or more in six years (1930, 1931, 1937, 1974, 2002, 2008), excluding the Great Depression years, in the following year of each 20% drop, the market rallied back 25%+.

Diversified Portfolio

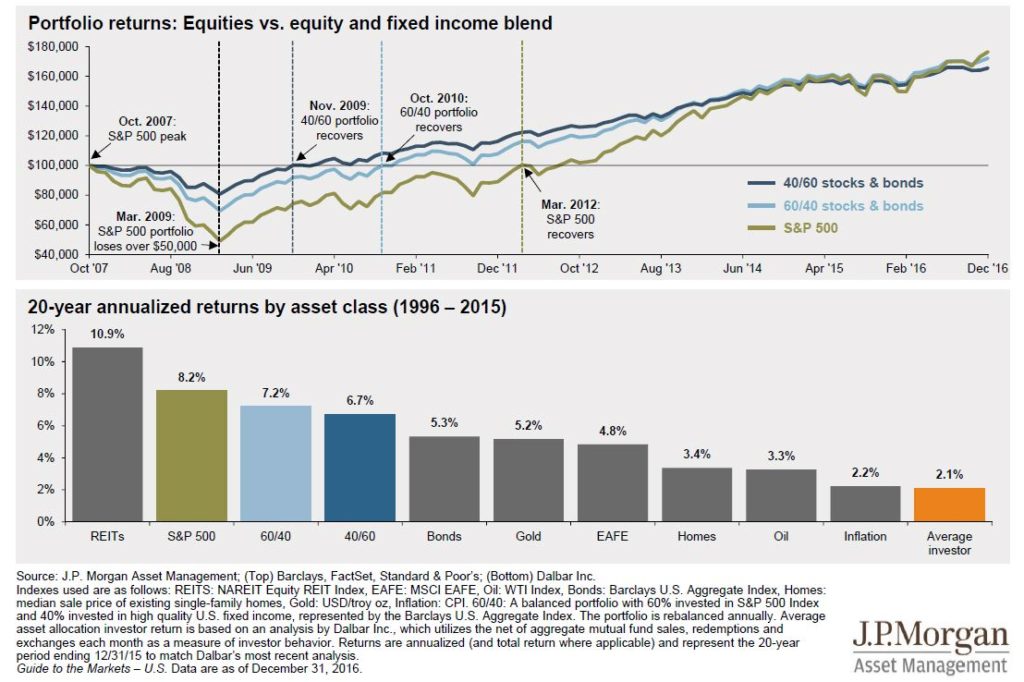

Some investors lament the fact that a diversified portfolio has failed to keep up with the S&P 500 in the raging bull market that we have experienced since 2009. However, this is only half of the story. As the first chart below shows, a blended portfolio that included equities and fixed income securities realized much smaller losses during the financial crisis, enabling these blended diversified portfolios to recover much more quickly than a portfolio of equities alone. While one-year equity returns have varied significantly since 1950 (+47% to -39%), a portfolio made up of a blend of equities and fixed income securities has not suffered a negative return over any five-year rolling period in the past 66 years.

The second chart below is based on a study that estimates that over the last 20 years, the average investor has achieved only a 2.1% annualized return as compared to more than 7% for an investor in a 60/40 stock/bond portfolio, largely because of badly timed (and often emotionally driven) investment decisions.

Systematic Re-balancing

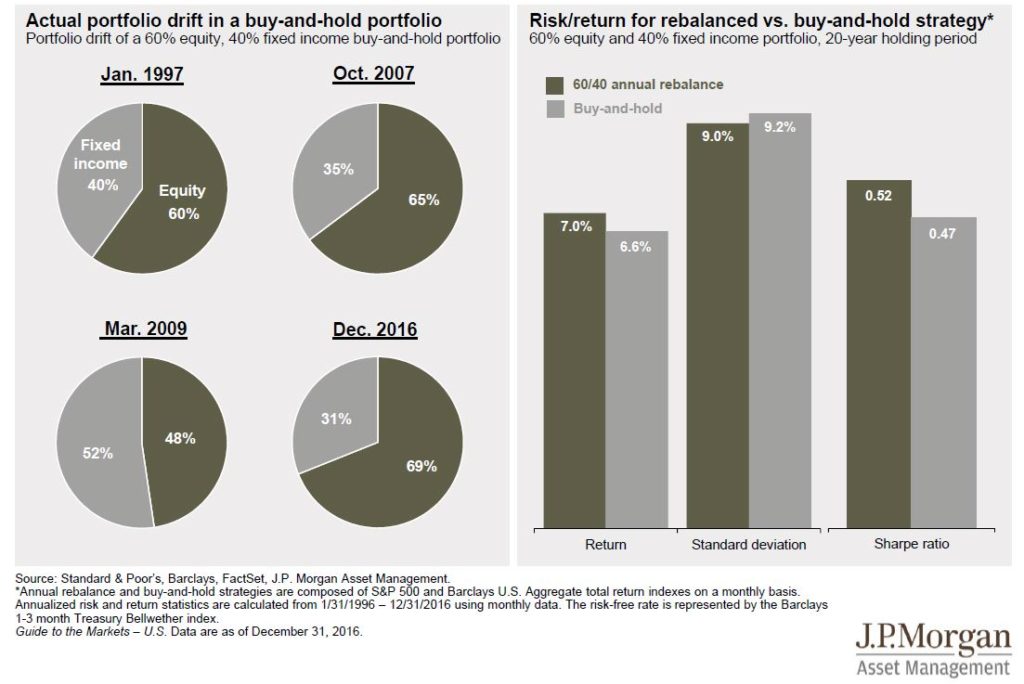

In addition to maintaining a diversified portfolio over the long run, a portfolio that is strategically rebalanced to target weights will help dampen volatility over business cycles. A buy-and-hold strategy that does not rebalance on a regular basis often leads to the best performing asset class dominating the portfolio, often shortly before the next market downturn when diversification and balance are most important. Systematic rebalancing helps investors remain in control, and has historically generated higher returns and less risk when compared to a buy-and-hold strategy.

Conclusion

While market pull-backs cannot be predicted, over the long-term, they can be expected. In fact, markets suffered double digit declines in 21 of the last 37 years, but despite the regular pull-backs, roughly 75% of those years ended with positive return. Investors need a plan for riding out volatile periods instead of reacting emotionally. The best thing you can do as an investor is to lengthen your time horizon. There has never been a 20-year period where you purchased and held the S&P 500 where you would have lost money. That includes the Great Depression, it includes the Great Recession, and that includes inflation.

At Mission Wealth, we employ a long-term diversified approach to investment management. We believe that staying invested in the market across business cycles, and using a systematic approach of regular rebalancing, are of the utmost importance. Staying true to our objective, “Your goals. Our mission,” your Advisor and the entire team at Mission Wealth work diligently to navigate the markets to help you achieve your life goals.

Inspired Living™

Are you living your life in a way that brings you joy and meaning?

Join the Inspired Living™ movement to elevate your past, present and future. Let us introduce you to prominent thought-leaders, life coaches, and influencers who can work together with you to develop your customized life plan. We will give you curated resources, actionable advice and targeted strategies during your journey of self-discovery. Then we will align your multi-dimensional and multi-faceted life with your ultimate vision so that you can become the BestU™ in your life journey. Learn More

Footnote:*Data sourced from JP Morgan Asset Management 2017 Market Insights.986479 10/17