By Brian Sottak, CFA, CFP®, CAIA

Client Advisor

The global markets have experienced a tale of two worlds when comparing 2017 to 2018 in certain respects. Both 2017 and 2018 have shared the same positive fundamental commonalities that drive the markets such as: strong earnings, tax reform benefits, and the overall synchronized global growth. But while 2017 was largely categorized by low volatility and muted headlines, 2018 has seen an increase in volatility (still well below historical norms) and a meaningful increase in market-moving headlines that can often lead investors to make irrational decisions.

It is important to look beyond these headlines, tune out the noise, practice discipline, and take a long-term perspective.

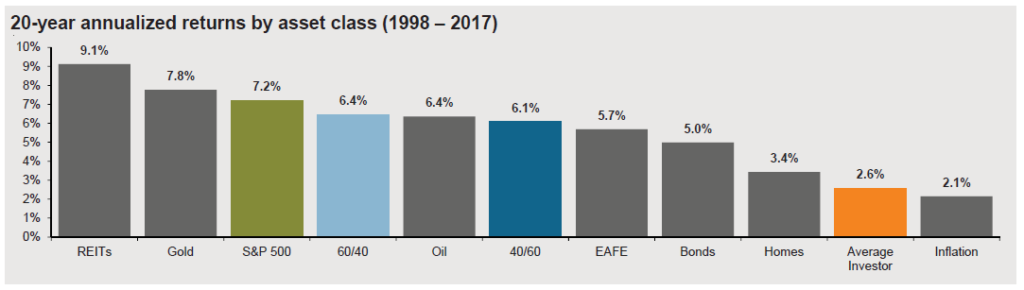

The chart below is based on a study that estimates that over the last 20 years the “average investor” has achieved only a 2.6% annualized return as compared to more than a 6.4% annualized return for an investor in a 60/40 stock/bond portfolio. This is largely because of poorly-timed (and often emotionally-driven) investment decisions. The stock market has ups and downs - it always has and it always will - but if you’re invested for the long-run, and exercise patience, your portfolio will continue to take business cycles in stride outperforming the “average investor”.

Source: J.P. Morgan Asset Management. Dalbar Inc.

Indices used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Bloomberg Barclays U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Gold: USD/troy oz., Inflation: CPI. 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high-quality U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/17 to match Dalbar’s most recent analysis. Guide to the Markets – U.S. Data are as of June 30, 2018.

At Mission Wealth we believe our client portfolios are well positioned to navigate the upcoming time period by following a strategic, long-term approach to investing, and building globally diversified portfolios that could benefit from continued global growth.

1066450 9/18