By Rick D. Gonzalez, MBA, CFP®, CIMA®, AWMA®

Client Advisor

In the world of investing, it seems as though the choices that are available to us are infinite. One can choose to invest in everything from pharmaceutical companies to restaurant chains to retailers and so on.

Even with such a wide variety of options, these days more and more people are beginning to invest in companies that benefit society at large. For example, in recent years we have seen the financial service industry experience a rapid growth in asset managers that offer Socially Responsible Investing (SRI) and Environmental, Social, and Governance (ESG) investing. This new trend has left many investors with much confusion when trying to understand the different categories, acronyms, and the viability of these investment options. In addition, there is uncertainty with respect to performance of SRI and ESG companies.

To fully understand SRI, ESG and their investment performance, it is helpful to look at the historical context and establish how these two approaches differ.

SRI

SRI has been around for a very long time. Beginning in the 1800s, it was first established by religious groups as an investment discipline that considers Environmental, Social, and Corporate Governance to generate long-term returns with a positive societal impact.

Historically, SRI investing has used negative screening criteria to exclude companies involved with alcohol, tobacco, weaponry, nuclear energy, gambling, fossil fuels and various additional categories. This approach was more passive in nature in terms of eliminating companies with undesired products and services frequently referred to as “sin stocks.”

ESG

Environmental, Social, and Governance (ESG) investing is a direct extension of SRI. Some examples of ESG characteristics include:

- Environmental: Climate change/carbon, clean technology, pollution/toxins, sustainable natural resources, water use and conservation

- Social: Workplace safety, labor relations, community development, human rights, avoidance of tobacco or other harmful products

- Corporate Governance: Executive compensation, board diversity, anti-corruption policies, board independence and corporate political contributions

ESG is more of a proactive approach in terms of investing in companies who are good global citizens. These companies put significant focus on how they treat their employees, suppliers and customers within their business practices.

How are companies selected into ESG?

After identifying key risks and trends, and an evaluation of risk management and exposure, companies are given an ESG score. Asset managers use those companies with the highest scores to create an investment portfolio.

What are the benefits of ESG?

ESG factors can be used to gauge the sustainability of a company and to provide better forecasts of the company’s risk and soundness. For example, an electric car company with poor labor practices and battery disposal is unsustainable. This company would initially be considered to be part of a socially responsible industry (no fossil fuels). However, with these poor practices and disposal methods it does not measure up from an ESG perspective.

Companies have always been subject to regulatory constraint, and this scrutiny will most certainly continue to increase. Because of this, many companies are moving toward ESG as guidelines for their own operations and structure. Companies who are not in the environmentally responsible category may wish - or be forced - to move into an ESG strategy to keep pace with other companies who are benefiting from such a structure.

Performance of SRI and ESG Companies

SRI and ESG isn’t just a strategy to make one feel better about one's investment choices. A study published by the Harvard Business Review found that socially responsible companies show higher profitability and stock performance than their counterparts. Deutsche Bank also performed an analysis dating back to the 1970s and found that approximately 90% of studies show that ESG investing provided better returns than passive investing.

It stands to reason that companies who focus on ESG have increased profitability and reduced risk. It also sets the table for companies to exist in perpetuity. If a product or service is not sustainable within an ESG business practice, then that product or service will not be pursued.

Socially Responsible Investing and Millennials

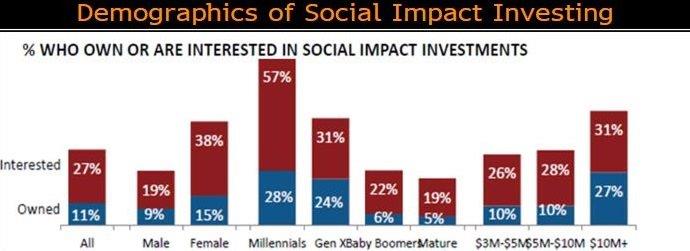

While SRI and ESG investing has gained momentum over the past 20 years, for the millennial investor it is of critical importance. According to a study conducted by Deloitte, millennials may control up to $24 trillion in assets by 2020 – a result of a massive intergeneration transfer of wealth. Millennials have a large appetite for SRI and ESG investing. A Bloomberg report suggests that over 80% of millennials are interested in these types of investment strategies, with no end in sight.

Source: Bloomberg

SRI and ESG investing may or may not provide outperformance with respect to the broader global equity markets. However, it can better match investors with their core values and beliefs, and can be a predictor for those businesses whose practices are efficient and sustainable. If you would like to know more about SRI and ESG investing, speak to your financial professional about incorporating these strategies into your investment portfolio.

At Mission Wealth, through our sophisticated research software, we can scour the universe of investments and not only exclude those that you are opposed to, but we can reward companies that are doing good by including them in your portfolio. Our Social Values Portfolio is comprised of the top ESG-rated companies in their respective industries.

Inspired Living™

Are you living your life in a way that brings you joy and meaning?

Join the Inspired Living™ movement to elevate your past, present and future. Let us introduce you to prominent thought-leaders, life coaches, and influencers who can work together with you to develop your customized life plan. We will give you curated resources, actionable advice and targeted strategies during your journey of self-discovery. Then we will align your multi-dimensional and multi-faceted life with your ultimate vision so that you can become the BestU™ in your life journey. Learn More

READ MORE: Avoid Being an Average Investor: 7 Rules

READ MORE: The Power of Long-Term Investing

1007490 1/18