By Kieran Osborne, MBus, CFA®

Partner, Chief Investment Officer

This is to Mission Wealth’s market perspectives for the fourth quarter of 2021. In this video series Kieran Osborne, Chief Investment Officer at Mission Wealth, will be presenting our outlook on the economy and financial markets. This presentation will cover three broad themes: an update on the market, our thoughts on the economy, and our outlook moving forward.

Each theme has it's own video so it's easy for you to watch or read your market updates. Click here for the full video showcase or click on each link to watch each section.

Key Themes

Stocks took a breather towards the end of the third quarter before rebounding early in the fourth quarter. A number of concerns came to the fore, particularly in September, amongst them the impact of the Delta variant, concerns around peak policy, peak growth and peak earnings, negative economic revisions, China concerns, inflation and interest rate increases. This gave way to more positive themes early in the fourth quarter, including easy financial conditions, still accommodative policies, strong corporate earnings, stock buybacks, retail investor inflows, and recent tax developments. All of which helped underpin recent stock market strength and culminated in the S&P 500 hitting a new all-time high.

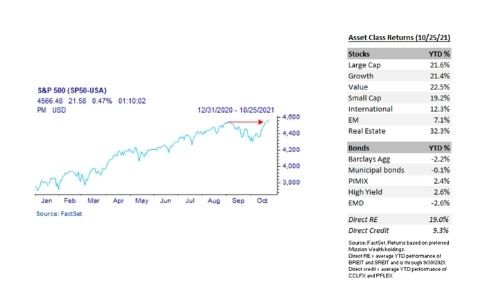

Year-to-date, all major equity asset classes are soundly positive, with real estate a particular standout after experiencing weakness in 2020. On the other hand, core fixed income has been challenged given the backdrop of rising interest rates. Though, our less liquid income oriented strategies have performed well.

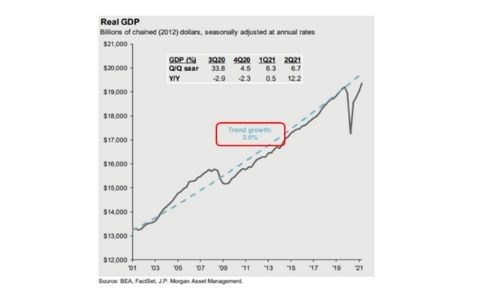

Turning to the economy, the Delta variant caused a larger spike in cases and lasted longer than many had anticipated and this resulted in downward revisions to economic projections. However, we do anticipate growth will reaccelerate and – despite revisions having been lowered – 2021 GDP growth is still expected to be well above the long-term trend growth rate of 2%; in fact if current forecasts come to pass, 2021 will represent the strongest GDP growth since 1984. We anticipate ongoing consumer strength and continued improvement in the labor market is set to underpin above-trend growth through 2023. Fiscal stimulus is likely to moderate moving forward and we expect the U.S. debt to GDP to plateau. Inflation may be elevated for longer than previously anticipated, though we do believe supply chain disruptions will resolve themselves and inflation may ultimately abate. Expectations are for the Fed to raise rates as early as 2022 and given the macro backdrop we believe risks are skewed to the upside for interest rates.

So with this backdrop, what is our outlook for asset classes? We are broadly constructive on the outlook for stocks, and believe still accommodative policies may help underpin ongoing appreciation, albeit at a moderated pace. However, we do anticipate volatility to increase as the Fed’s accommodative policies wear off, and we are well prepared. We hold a positive long-term outlook for the stock market and any increase in market fluctuations may provide us the opportunity to more effectively rebalance across our client accounts. Regarding bonds, we believe longer dated bonds – such as U.S. Treasuries with maturities of ten years or more – may be particularly susceptible to increases in yields and have positioned our fixed income with lower duration – or interest rate sensitivity – than the broad bond market. Given the macro-economic backdrop, we believe our direct investment strategies are well positioned to continue to generate attractive yield, low correlation to the stock market, and low levels of interest rate risk.

Mission Wealth Actions

We maintained our disciplined approach to portfolio rebalancing which forces us to “buy low, sell high.” For instance we were broadly adding to Real Estate exposures through the end of 2020 and early 2021 based on relative performance at the time. Real Estate has since outperformed most asset classes.

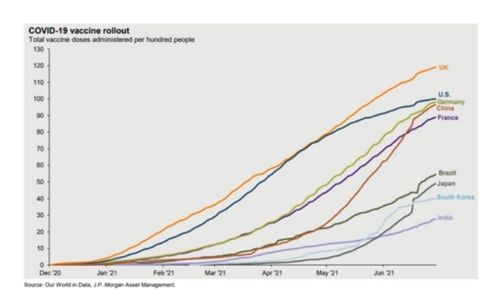

We continue to favor dedicated allocations to global equities. Despite recent strength, we believe the macro environment remains supportive and underpinned by continued vaccine rollout globally. Any near-term volatility may offer a rebalancing opportunity.

Our core fixed income allocations are positioned with less duration risk (interest rate sensitivity) than the broad bond market and we have actively avoided areas of fixed income most susceptible to interest rate changes, such as Treasuries with maturities of 10 years or more.

We believe unique opportunities currently exist in certain areas of the bond market which may offer relative return upside for our bond funds.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Market Update

Stocks took a breather towards the end of the third quarter before rebounding early in the fourth quarter. A number of concerns came to the fore in September, amongst them the impact of the Delta variant, concerns around peak policy, peak growth and peak earnings, negative economic revisions, China concerns, inflation and interest rate increases. This gave way to more positive themes early in the fourth quarter, including easy financial conditions, still accommodative policies, strong corporate earnings, stock buybacks, retail investor inflows, and recent tax developments. All of which helped underpin recent stock market strength and culminated in the S&P 500 hitting a new all-time high.

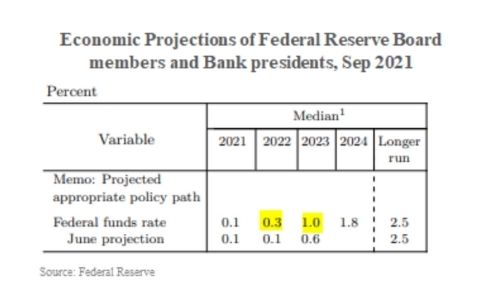

At the same time, core bonds have been challenged as yields have risen this year, with the benchmark U.S. 10 year Treasury climbed above 1.6%, after hitting a low of 1.17% earlier in August. This comes as the Fed indicated tapering is likely to start by the end of this year and their “dot plot” forecast that the first interest rate hike may be as soon as the end of 2022.

Year-to-date, all major equity asset classes are soundly positive, with real estate a particular standout after experiencing weakness in 2020. On the other hand, core fixed income has been challenged given the backdrop of rising interest rates. Though, our less liquid income oriented strategies have performed particularly well.

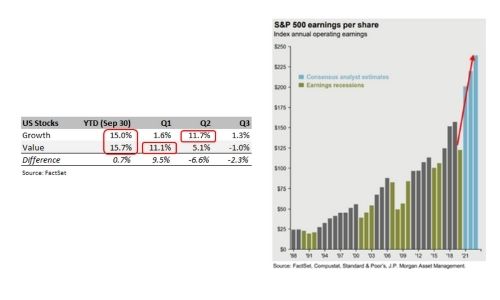

Interestingly, we have witnessed dispersion in returns across asset categories – which has led to rebalancing opportunities. For instance, while year-to-date performance for Growth and Value stocks is quite similar, quarterly performance differed dramatically, particularly in the first and second quarters. This divergence really underscores the importance of a disciplined approach to rebalancing; we were broadly trimming Value stocks towards the end of the first quarter on relative strength, and trimming Growth stocks towards the end of the second quarter.

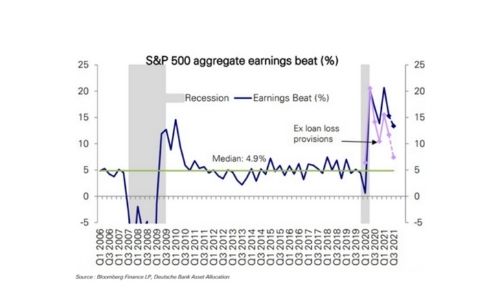

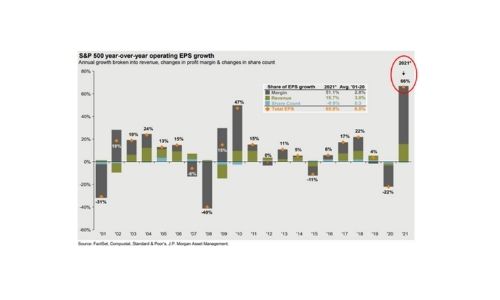

Corporate earnings have been very strong and have helped underpin stock market strength. S&P 500 earnings have significantly beaten analyst expectations and third quarter earnings season is tracking as another strong quarter.

Though, adjusting for loan-loss reserves associated with the banking industry, earnings beats do appear to be normalizing, though still above the long term average.

Importantly, companies are highlighting a very strong demand backdrop given the strength of consumer and corporate balance sheets.

With that being said, more persistent supply chain and input price pressures continue to be a common theme which may act as a moderating factor for profits margins.

Still, analyst expectations are for very strong S&P 500 earnings growth of 66% in 2021.

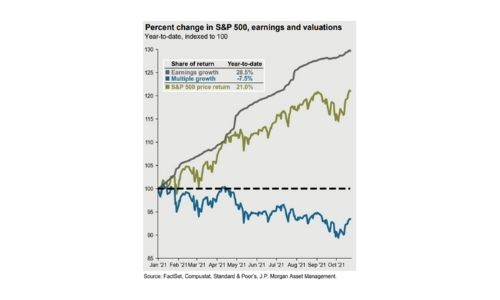

The substantial earnings growth may also help to alleviate some valuation concerns.

Despite a very strong start to the year for the stock market, stock price appreciation has not kept pace with the substantial earnings growth just mentioned.

We expect the divergence in stock price growth and earnings growth to widen, particularly as companies cycle very weak comparable months, while we also expect some moderation in stock market performance.

This may lead to a contraction in valuation multiples, such as the Price to earnings ratio, as the “E” in the formula grows faster than the “P.” In turn this may help alleviate some valuation concerns.

Chinese concerns have come to the fore recently on the back of regulatory crackdowns and property market worries with Chinese property developer Evergrande in the news for all the wrong reasons. Regarding Evergrande, our base case is any potential default or restructuring will be closely managed by Chinese regulators to limit contagion to both financial and property markets.

Turning to regulation, Chinese regulation is nothing new – indeed, the associated valuation discount assigned to EM stocks is in part driven by increased regulatory risks and China’s political situation allows for regulatory implementation to be far more rapid and swift than developed nations.

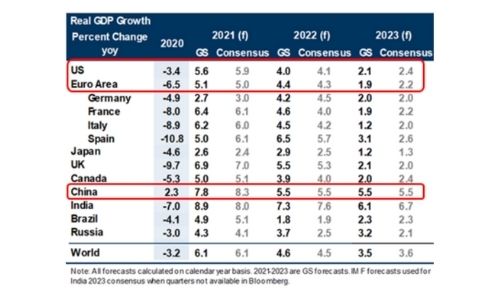

We expect longer-term earnings growth to be tied to broad-based economic growth, which we anticipate will be higher in China and much of the Emerging Market world relative to developed economies such as the U.S. and Europe.

Importantly, Valuations may stay at a discount over time, but if earnings growth outpaces other countries, the total return may be higher over the long haul.

The Economy

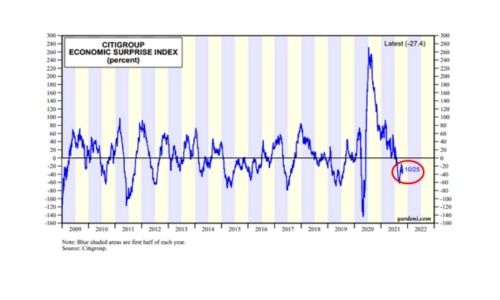

In turn, this weighed on the reopening momentum experienced earlier in the year as economic surprises moved from positive to negative which is clearly depicted in this chart – anything above the line is a positive surprise while anything below the line is a negative surprise.

As a result economic forecasts were revised downward. Specifically, GDP growth was revised lower to 5.7 percent for 2021, from 7 percent earlier in the year. That’s still extremely strong economic growth.

A bi-product of COVID is that Consumers have adapted, adjusted spending habits to the new environment.

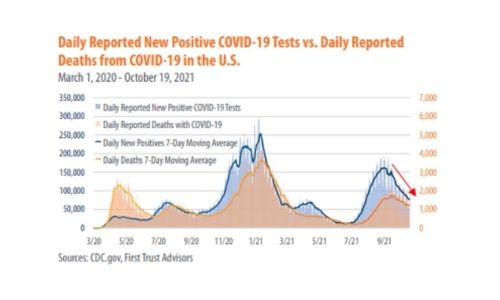

Children between five and eleven are also likely to get vaccinated in the coming months. While the rest of the world continues to catch up on vaccine roll-out.

As a result, we expect COVID’s impact to fade over time with any future uptick in cases having less of an economic impact.

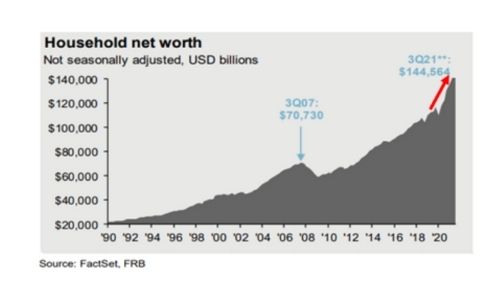

Household net worth has increased substantially, while disposable income has also increased as financing costs – primarily mortgage rates – are near historic lows.

As consumers refinance, they have more money in their pockets.

This is very important, given consumer spending makes up approximately 70% of GDP.

Consumers have retooled themselves and adapted to COVID environment: spending habits have increasingly shifted online but total spending is still very strong.

We believe this may help sustain the economic expansion.

While concerns have risen around stagflation (higher inflation and slower growth) our base case is the economy took a short-term pause due to Delta and inflationary pressures will ultimately abate.

We anticipate growth will reaccelerate after Delta caused a weak Q3 and despite lowered revisions, 2021 GDP growth still expected to be well above the longer term trend growth rate of 2%.

As Delta cases decline, travel and social gatherings increase, schools get back to in-person learning may help drive ongoing consumer strength and continued improvement in the labor market, which is set to underpin above-trend growth through 2023.

In fact, if 2021 expectations for 5.7% GDP growth come to pass it would represent the strongest annual growth rate since 1984. If 2022 comes in at 4.0% which is currently projected, it would be the strongest growth rate since 2000.

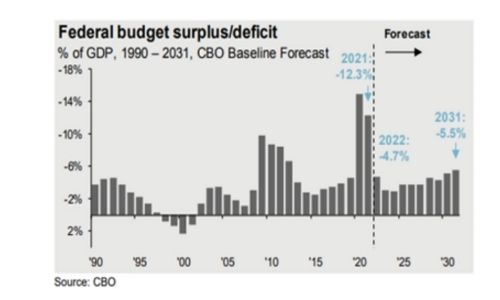

Turning to Fiscal policy and the U.S. government debt,

Despite historically large Fiscal policy packages, we anticipate fiscal tailwind to moderate moving forward.

As a result, we expect Government Debt as % GDP to plateau, driven by strong economic backdrop.

Importantly, it is not the absolute level of debt outstanding but the ability of the Government to service the debt that matters; the U.S. is in a relatively strong position to service its debt due to low interest rates.

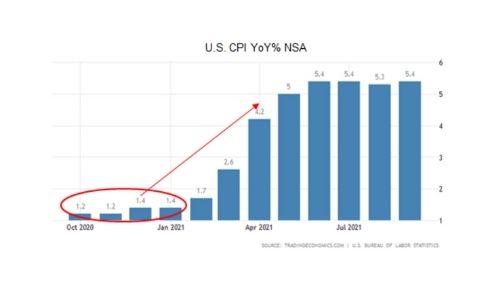

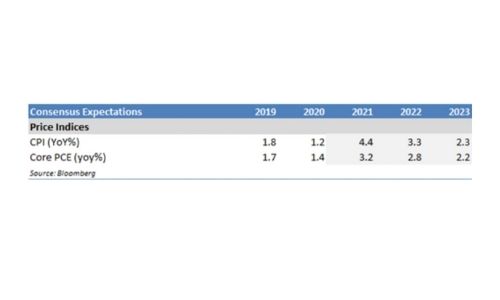

Inflation may be longer lasting than previously anticipated as supply chain issues continue to be resolved.

We believe we could have another elevated October print as we will be cycling a weak comparable month in 2020 – some of the headline numbers are a function of math: whenever you cycle very weak comparable months it’s easier to get elevated numbers – but inflation may be peaking and may decrease, particularly as we cycle stronger comparable months.

It’s interesting: we don’t anticipate inflation to migrate in a straight line back towards 2 percent and it may be bumpy. In fact, current supply chain issues may ultimately have the opposite effect once resolved.

Think about all the new cars that have been completely assembled save for a microchip to finish out the smart technology – right now is a terrible time to be a new car purchaser, but there may be a glut of new cars in the market once the microchip shortage is resolved – causing deflationary pressures.

Nowhere is the microchip shortage more evident than the used car market – take a look at the spectacular increase in used car values recently!

This trend is clearly not sustainable and we believe these values have the potential to quickly reverse themselves once a substantial increase in new cars come to market.

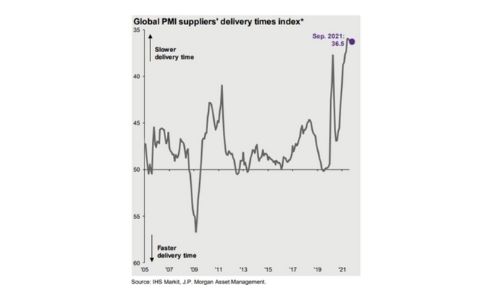

Supply chain issues are clearly influencing inflation and have yet to be worked through – as this chart depicts, a record number of businesses are currently finding it difficult to get inventories.

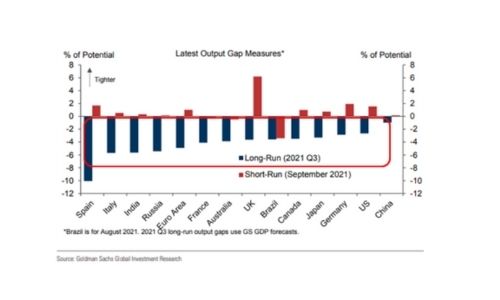

But we do think this may be a short-term dynamic: while short-term measures of output gaps are tighter due to manufacturing bottlenecks, measures of long-run output gaps imply substantial slack almost everywhere globally – and we Expect manufacturing bottlenecks to ease substantially next year as virus improvements reduce production disruptions.

Turning to the Fed, the Fed is on track to begin tapering in December and Fed Chair Powell indicated they expect to complete tapering by mid-2022.

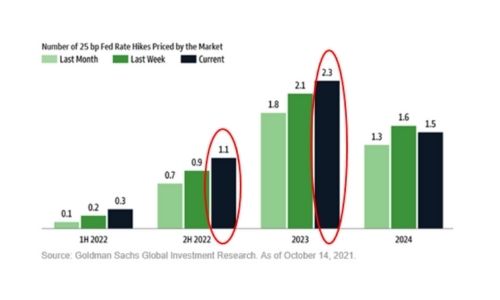

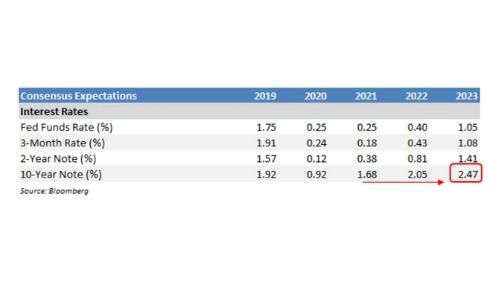

Regarding interest rate lift-off, the FOMC’s “dot plot” shows the median expectation is for one hike in 2022 and three hikes in 2023.

The market is currently pricing in at least one rate hike in 2021 and at least two hikes in 2023. Clearly, we believe there are more upward risks than downward risks for interest rates.

Concerns surrounding peak growth, profits and easy policies, which may weigh on markets.

Escalating tensions with China, which has been an underlying theme for some time.

Government shutdown and Debt ceiling concerns as we approach December.

Potential for tax reform to cause market volatility (though we consider any stock market weakness will likely be short-lived).

Outlook

We are broadly constructive on the outlook for stocks, and believe still accommodative policies may help underpin ongoing appreciation, albeit at a moderated pace.

With that said, we do anticipate increases in volatility as the Fed’s accommodative policies wear off.

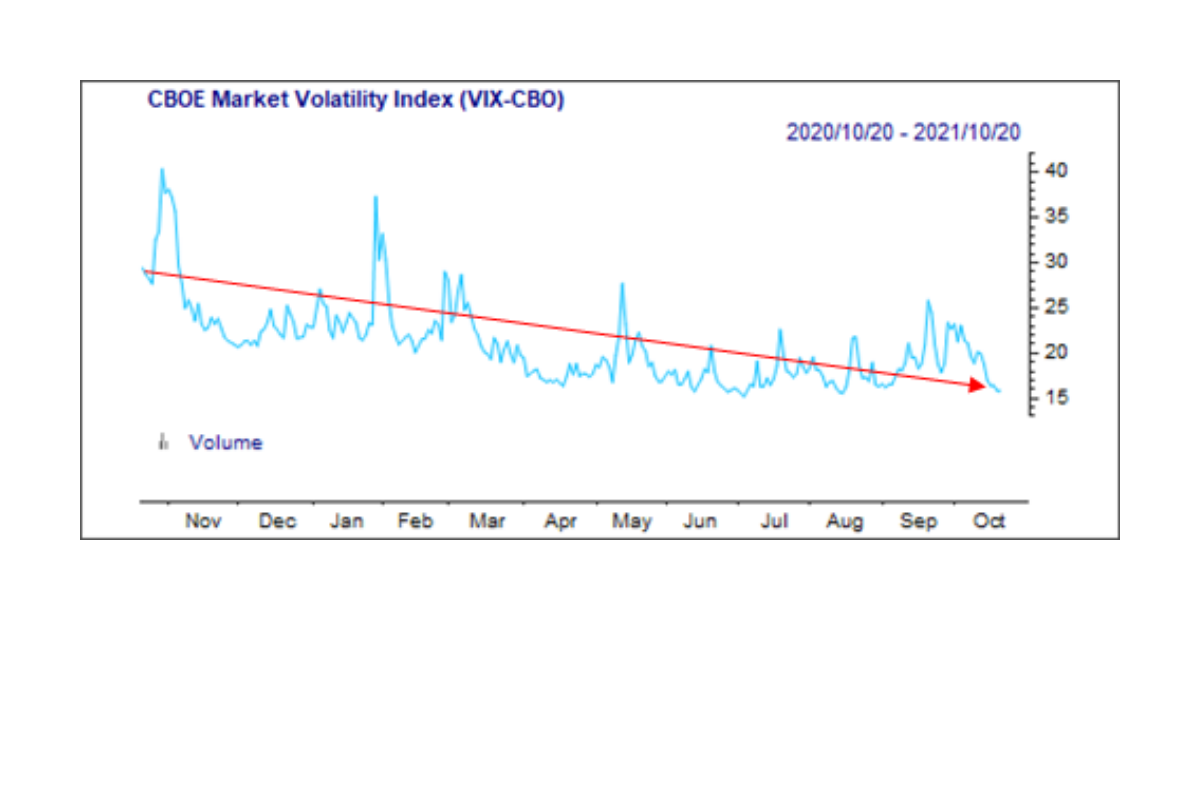

The widely followed “fear index,” the volatility index or VIX, has been on a downtrend. The gauge is now well below its lifetime average of approx. 19.5

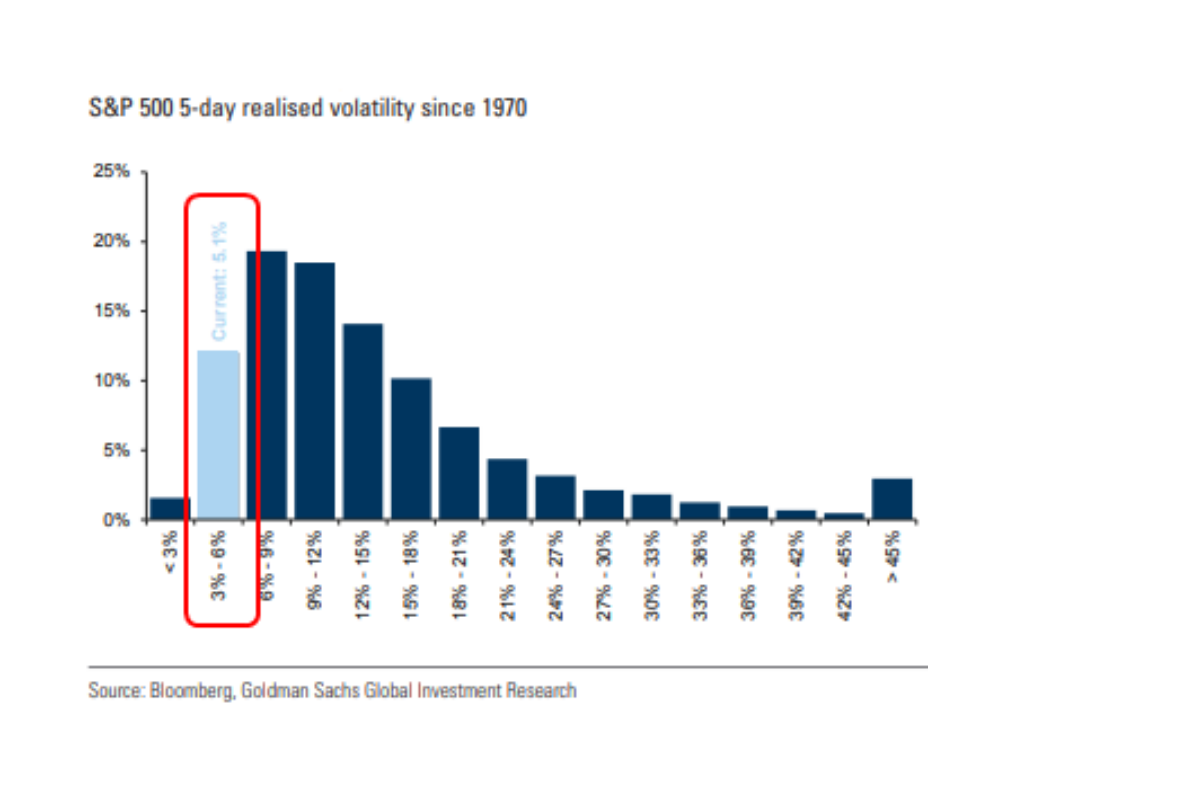

Recent five day realized volatility on the S&P 500 has been below its 10th percentile since 1970.

Recent Fed policies have arguably contained volatility since last year’s COVID driven March sell-off.

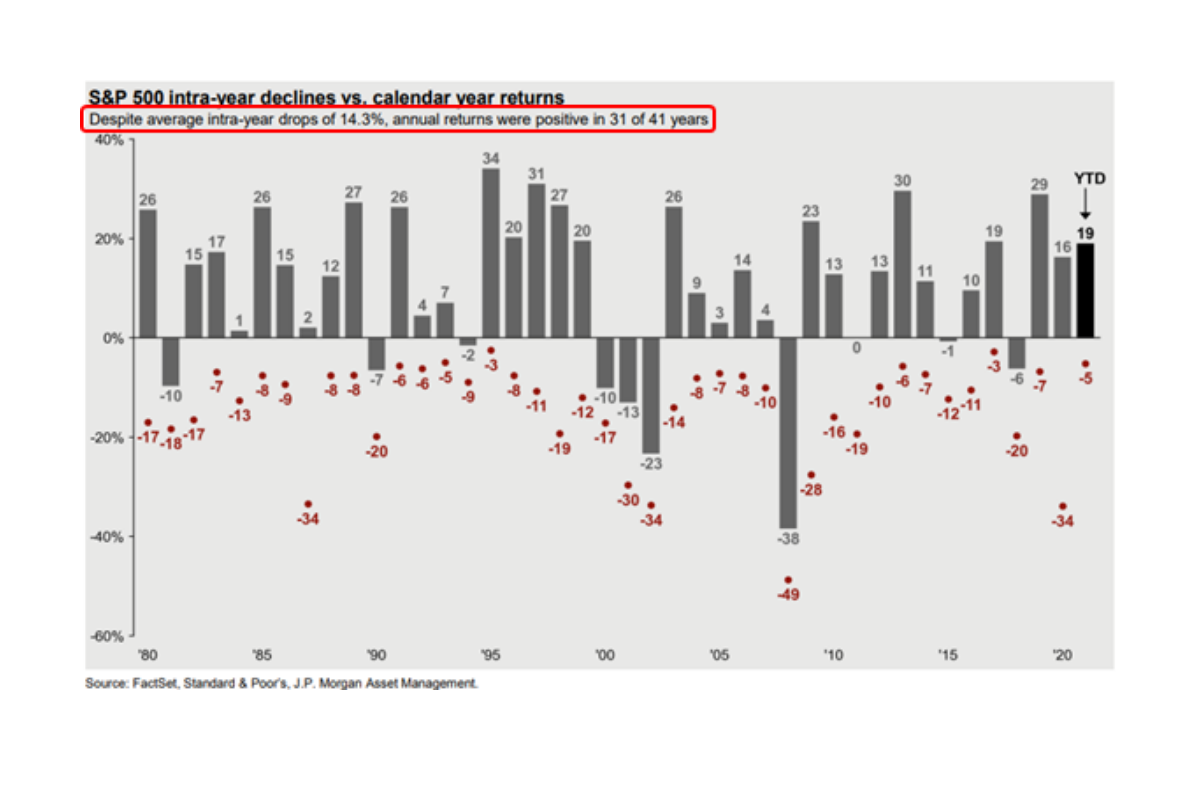

But it’s important to realize that volatility is par for the course for the stock market: in fact, the average intra-year decline for the S&P 500 since 1980 has been -14.3%. Stocks have also historically averaged multiple sell-offs of five percent or more in any given year; in contrast, so far in 2021 we’ve only had one.

Despite these intra-year sell-offs, stocks tend to post positive annual returns: in fact the S&P 500 has ended 31 of the last 41 years in positive territory.

It’s important to mention that we are well prepared for a potential rise in volatility. We actually view it as an opportunity. Any increase in market fluctuations may allow us to more effectively rebalance across our client accounts and ultimately add value through our dedicated approach to rebalancing.

As far as tax reform and the potential impact on the stock market, there is still a lot to be finalized, with proposals having been made to increase taxes on capital gains and dividends, estate taxes, and corporate tax rates.

With that being said, reports have emerged that the White House is considering abandoning plans to raise corporate and top individual tax rates.

Prediction markets now assign approximately an 80% probability there is no increase in the corporate tax rate (as of end Oct).

Recent focused has turned to a surtax on those earning $10 million dollars or more and a corporate minimum tax.

This has helped support equity markets as bottom line earnings and after-tax returns would be unaffected should tax increases not come to pass.

Regardless, should any tax hikes ultimately be passed, we would expect any short-term stock market weakness to be just that; in the past 13 instances of tax hikes there was only one year with a negative stock return and – contrary to conventional wisdom – stocks have actually performed better than their long-term average during periods of rising taxes – that’s because the market tends to discount the hikes in advance and businesses – and corporations – subsequently benefit from the associated stimulus.

Turning to the bond market, interest rates are likely to be anchored at the short end of the curve until Fed raises rates.

Given the Fed’s outlook and interest rate forecasts, there is clearly upward risks for rates, which is highlighted by consensus estimates for the 10 year yield.

We believe longer dated yields (10 years +) may be particularly susceptible to increases in anticipation of Fed hikes and are actively positioning our fixed income allocations with lower duration (interest rate sensitivity) than the broad bond market.

Unique opportunities may exist in less liquid areas of the bond market, which may offer equity-like return potential with lower volatility and the potential to benefit from a rising interest rate environment.

High level, we continue to favor stocks over bonds.

We hold a positive long-term outlook for the stock market and believe any increase in market fluctuations may offer an opportunity, allowing us to more effectively rebalance across our client accounts.

Given the macro-economic backdrop, we believe our direct investment strategies are well positioned to continue to generate attractive yield, low correlation to the stock market, and low levels of interest rate risk.

Overall, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients. For more information, please visit missionwealth.com or contact your advisor.

Disclaimers

The information in this presentation is subject to change without notification. Certain statements contained within are forward-looking statements, including, but not limited to, statements that are predictions of or indicate future events, trends, plans, or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Although the opinions expressed are based upon assumptions believed to be reliable, there is no guarantee they will come to pass. This information may change at any time due to market or other conditions.

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. Diversification cannot ensure a profit or protect against a loss.

Investments in commodities may be affected by the overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments. Commodities are volatile investments and should form only a small part of a diversified portfolio. The use of derivative instruments may add additional risk. An investment in commodities may not be suitable for all investors.

Diversification helps you spread risk throughout your portfolio, so investments that do poorly may be balanced by others that do relatively better. Neither diversification nor rebalancing can ensure a profit or protect against a loss.

Real estate may not be appropriate for all investors. Its value may fluctuate based on economic, regulatory, and environmental factors. Redemption may be at a price, which is more or less than the original price paid.

Do not act upon this information solely, and seek professional guidance before making investment decisions. This presentation is not intended to provide any specific investment advice. No investment strategy can ensure a profit.

Fixed income securities carry interest rate risk, inflation risk and credit and default risks. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Interest income generated by municipal bonds is generally expected to be free from federal income taxes and, if the bonds are held by an investor resident in the state of issuance, state and local income taxes. Such interest income may be subject to federal and/or state alternative minimum taxes. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for investors in all tax brackets. Short- and long-term capital gains and gains characterized as market discount recognized when bonds are sold or mature are generally taxable at both the state and federal level. Short- and long-term losses recognized when bonds are sold or mature may generally offset capital gains and/or ordinary income at both the state and federal level.

Fixed income yields are provided by Barclay’s Capital based on the following sources: US Treasury, Barclay’s Capital, FactSet, and JP Morgan Asset Management, and are represented by Brad Market, US Barclay's Capital Index, MBS, Fixed Rate MBS Index, Corporate, US Corporates, Municipals, Muni Bond Index, Emerging Debt, Emerging Markets Index, High Yield, Corporate High Yield Index. Treasury securities date for # of issues and market value based on US Treasury benchmarks from Barclay’s Capital. Yield and return information based on Bellwethers for Treasury securities.

Mission Wealth is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Mission Wealth and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Mission Wealth unless a client service agreement is in place. California Insurance License # 0D35068.

00426818 11/21