By Kieran Osborne, MBus, CFA®

By Kieran Osborne, MBus, CFA®

Partner, Chief Investment Officer

Welcome to Mission Wealth’s market perspectives for the third quarter of 2021. I’m Kieran Osborne, Chief Investment Officer at Mission Wealth and I’m excited to be presenting our outlook on the economy and financial markets.

This presentation will cover three broad themes: an update on the market, our thoughts on the economy, and our outlook moving forward. Each theme has it's own video so it's easy for you to watch or read your market updates.

Key Themes

Despite recent volatility tied to the Delta COVID variant, stocks continue to experience strength in 2021, primarily driven by continued economic reopening and positive economic revisions, earnings strength, and ongoing accommodative policies. Corporate stock buybacks have surged this year, and may help to underpin stock prices, while measures of risk appetite appear to have normalized, which we believe is a constructive sign. Bond prices have stabilized over recent months as inflation expectations – while still elevated – moderated after peaking in May.

We consider inflation is likely to abate after peaking this year as supply disruptions and wage pressures ease and productivity enhancements take effect. Given the strong economic backdrop, we expect the Fed may bring forward its first interest rate increase, potentially raising rates towards the end of 2022. Lastly, tax policy is likely to remain in flux for several months and any tax increases are unlikely to take effect until Jan of next year. We believe Congress may eventually pass a scaled back version of Biden’s initial proposals and any market volatility associated with tax policy is likely to be short-lived.

So with this backdrop, what is our outlook? Firstly, we believe the macro environment remains supportive of the stock market. Still elevated cash holdings may help underpin ongoing stock market demand on the back of continued accommodative polices, record earnings and growth. Potential tax increases may cause some uncertainty, but if history is a guide any market weakness may be short-lived. Longer dated bonds – such as Treasuries with maturities of 10 years or more – may be particularly susceptible to rising rates given the strength of the economy and in anticipation of Fed hikes, while other areas of the bond market may perform relatively well.

Mission Wealth Actions

First and most importantly, we maintained our disciplined approach to portfolio rebalancing and through the first months of 2021 were focused on reducing overweight exposures to Value stocks based on relative performance at the time. This has benefited our clients, as Value stock performance has since moderated.

We continue to favor dedicated allocations to global equities. Despite recent strength, we believe the macro environment remains supportive and underpinned by continued vaccine rollout globally. Any near-term volatility may offer a rebalancing opportunity.

Our core fixed income allocations are positioned with less duration risk – or interest rate sensitivity – than the broad bond market and we have actively avoided areas of fixed income most susceptible to interest rate changes, such as Treasuries with maturities of 10 years or more.

We believe unique opportunities currently exist in certain areas of the bond market which may offer relative return upside for our bond funds.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Market Update

Despite some volatility associated with inflation concerns earlier in the year and more recently regarding the Delta variant, stocks have experienced strong gains in 2021 with the S&P 500 hitting multiple highs.

Economic re-opening and positive economic revisions, earnings strength, and ongoing accommodative policies have all helped drive stocks higher.

On the other side of the ledger, bonds have stabilized over recent months after experiencing weakness through the beginning of the year, as inflation concerns moderated, driving bond yields lower which helped to underpin bond prices.

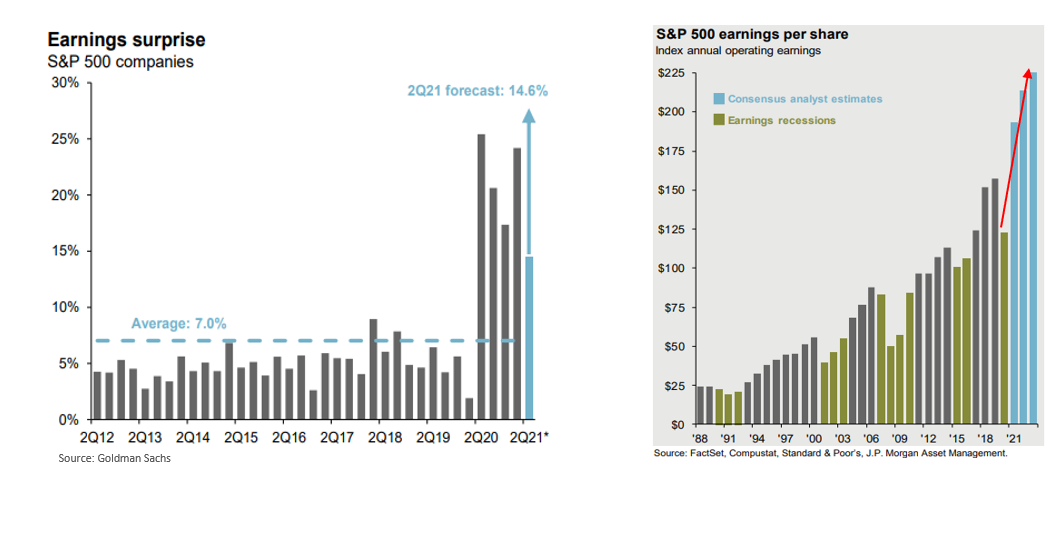

We consider strong earnings growth is likely to underpin the stock market. Indeed, current Analyst forecasts for second quarter S&P 500 earnings growth is around +65% from last year!

And earnings continue to surprise to the upside, leading to earnings expectations being revised higher. For instance, at the end of 2020, Analysts expected full year S&P 500 earnings for 2021 would be $167. They now expect earnings to be $191; that’s a 14.5% positive revision to their estimates! At the end of 2020 Analysts thought 2022 earnings per should would be $195; that’s subsequently been upgraded to $212!

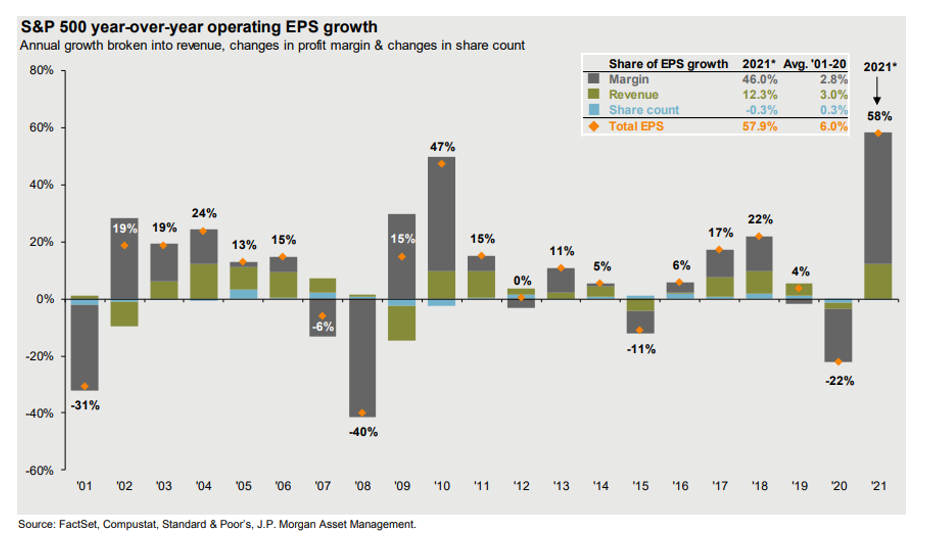

As this chart depicts, analysts forecast S&P 500 earnings growth of +58% in 2021. That is the strongest earnings growth in Decades.

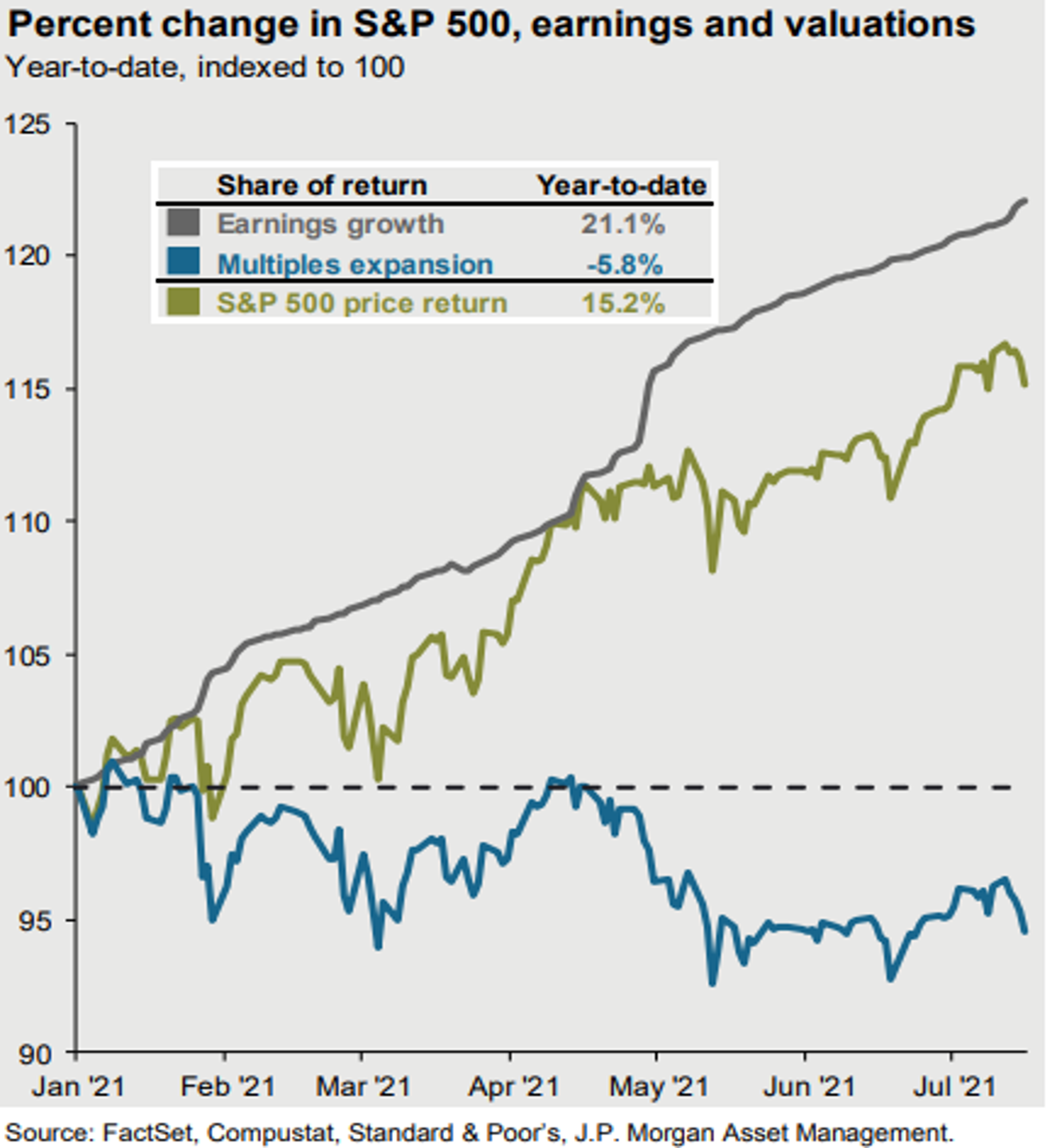

Interestingly, even given the strength of the stock market, stock prices have not kept pace with earnings growth. While we expect ongoing appreciation in the stock market, albeit moderated from the growth experienced so far this year, we do anticipate stock price growth will trail earnings growth moving forward.

One implication of this dynamic will be to reduce valuation metrics, such as the P/E ratio. As earnings, or the “E” in P/E grow faster than prices, or the “P,” in P/E, multiples will naturally come down over time, alleviating some valuation concerns.

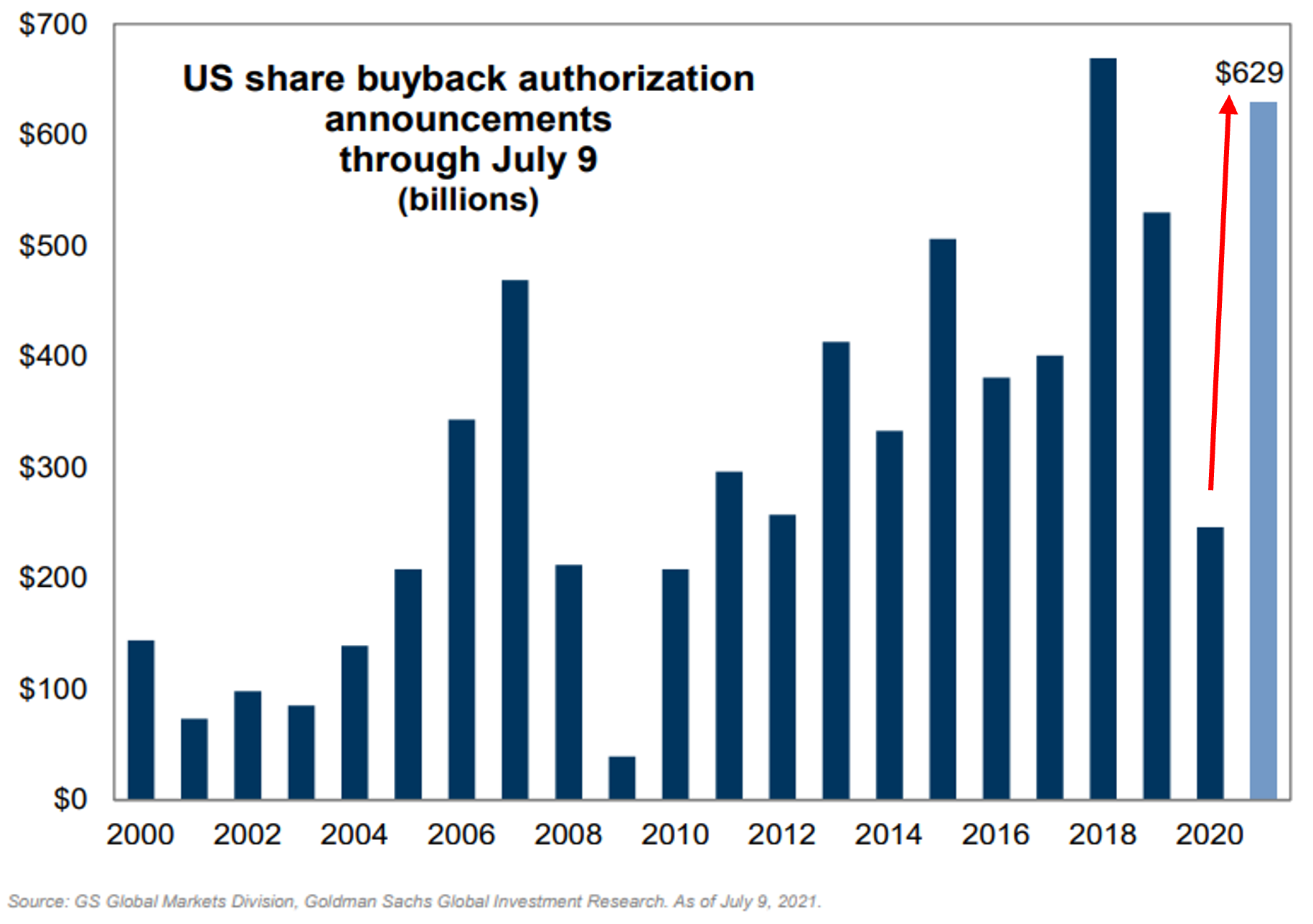

At the same time, announced corporate share buybacks are surging this year, led by several notable large-caps such as Apple, Google and Berkshire. As this chart depicts, share buybacks are on pace to set a record, with many big banks returning to the buyback market with the Fed’s approval in the second half of the year, which may help further underpin stock prices.

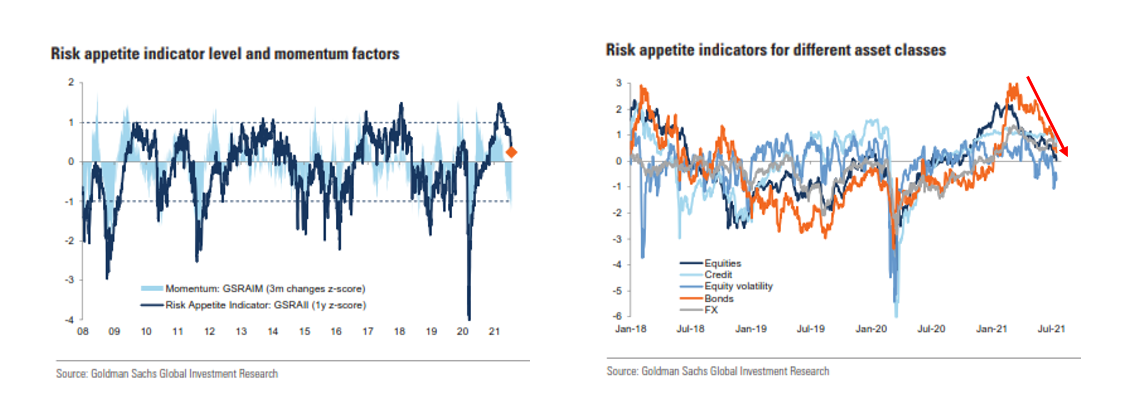

We’re also seeing some encouraging signs with Risk appetite normalizing from the elevated levels seen earlier in the year, which we believe is a constructive signal for the stock market, given the positive macro backdrop.

Importantly, risk appetite has decreased across all major asset classes.

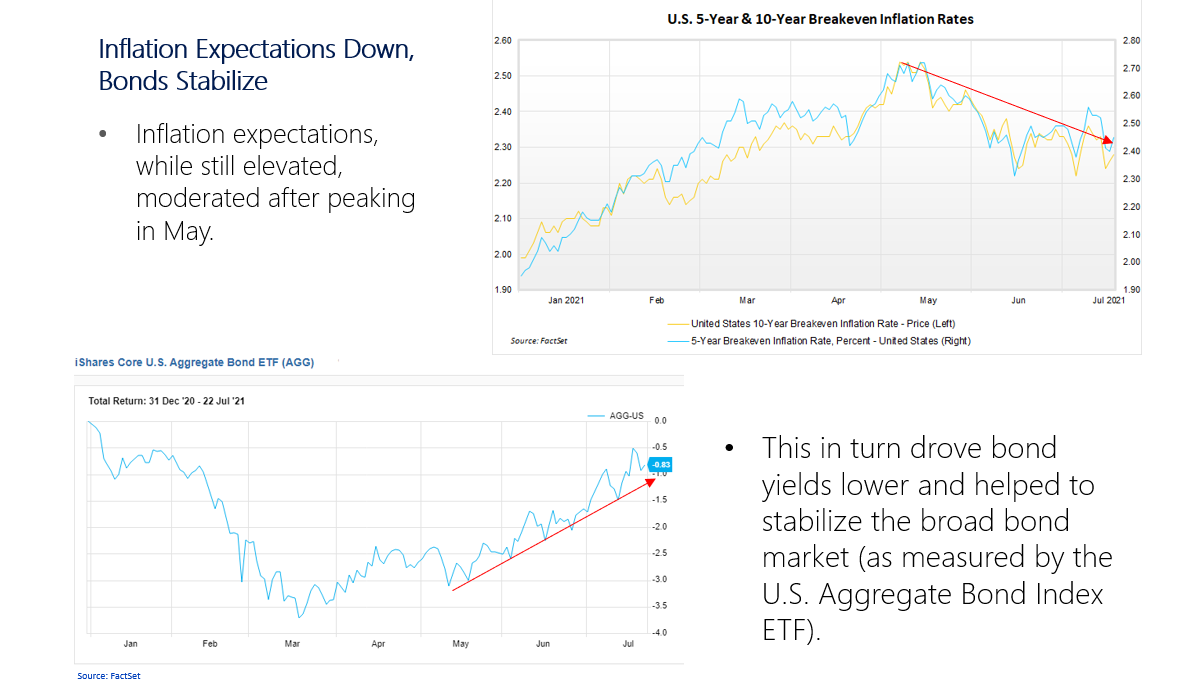

Turning to bonds, bond prices have stabilized over recent months. As this chart highlights, Inflation expectations, as measured by 5 year and 10 year breakeven inflation rates, and while still elevated, have moderated after peaking in May.

This in turn drove bond yields lower and helped to stabilize the broad bond market, as measured by the U.S. Aggregate Bond Index.

Next, we’ll take a look at the Economy.

The Economy

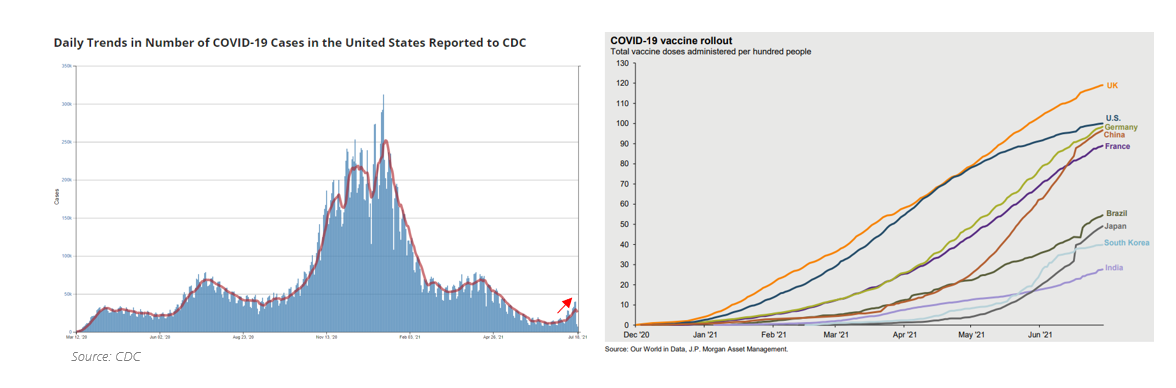

The economic recovery still remains closely tied to developments associated with COVID. Most recently, the Delta variant has caused an uptick in cases, though we have witnessed a strong preference by officials to push for increased vaccinations rather than new restrictions.

The good news is that vaccines appear to be very effective, with only a small percent of U.S. hospitalizations for those people who are fully vaccinated, and an even lower percentage of fatalities.

At the same time and as this chart indicates, the rest of the world continues to catch up on vaccine roll-out with many countries expanding the availability of vaccines.

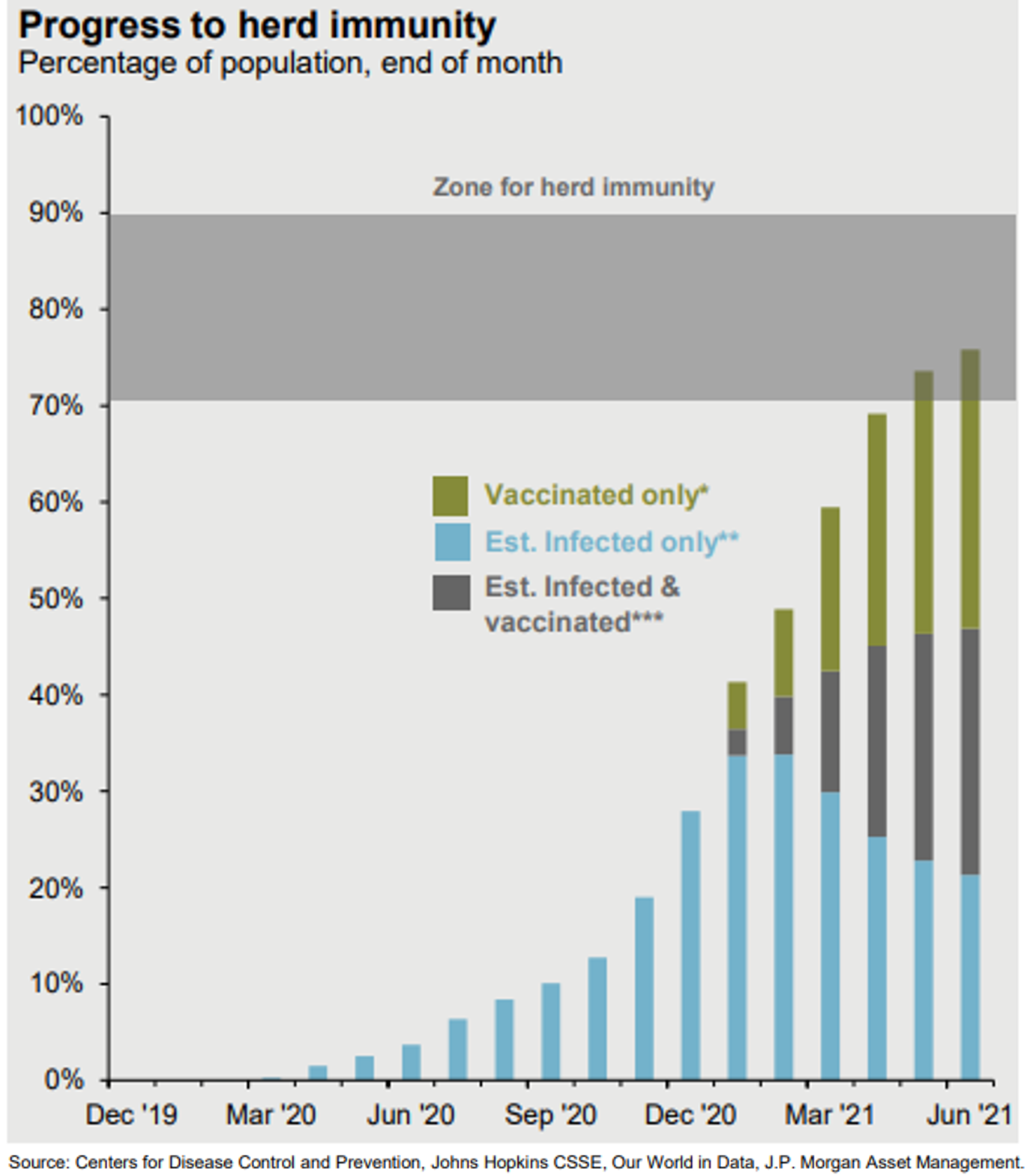

While vaccine roll-out has slowed somewhat recently in the U.S., data indicates we may be at lower end of herd immunity zone when combining vaccinated people and those that have already contracted the virus.

However, the reality is that variants such as Delta and others do exist and COVID may ultimately be endemic globally which means we should be prepared for periodic flare ups – particularly for countries with lower vaccination rates – and which may also cause concerns for growth and bumps in the global economic recovery.

With that said, we do expect more limited economic impacts than prior waves as vaccine rollout continues globally and lockdown measures continue to ease.

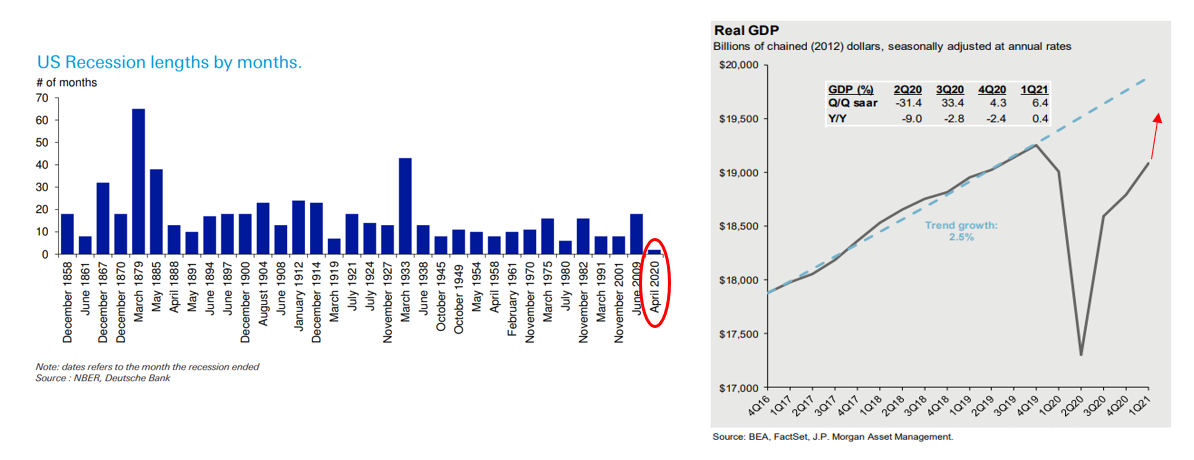

The COVID-led recession and recovery were certainly unusual by historic standards, with 2020 representing the shortest recession in history (and interestingly followed the longest in the Great financial crisis of 2008 since the Depression).

Recently released, Q2 2021 year over year GDP growth of 12.2% represents the strongest growth in decades, and the economy is now fully recovered to pre-COVID levels.

Moving forward, with a backdrop of ongoing central bank & Government stimulus, the economy is likely to produce strong growth in the second half of the year.

For instance, government stimulus representing about 5% of GDP is set to be injected into the economy by end of Sep and we expect additional stimulus in 2022 by way of infrastructure and social spending. In fact the first round of child tax credits were received on July 15, which may help underpin consumer spending, which makes up nearly 70% of GDP.

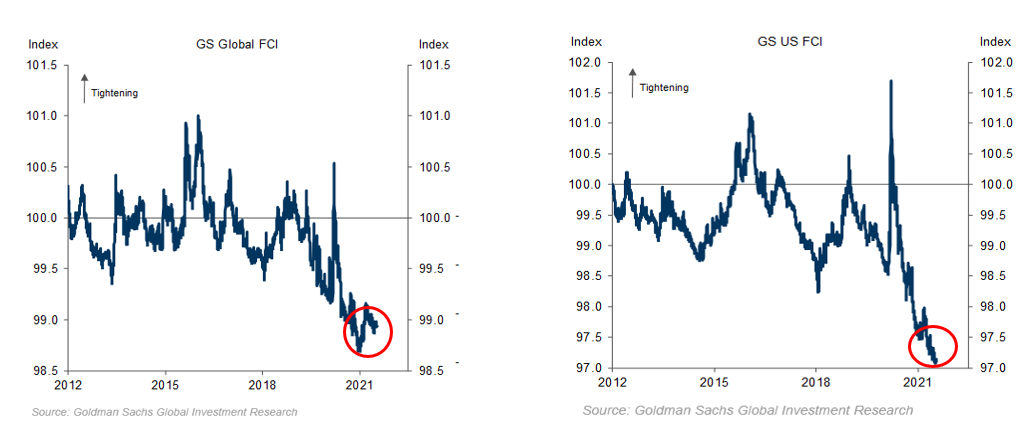

High savings and easy financial conditions likely to underpin consumer strength and many industries continue to reopen, while schools set to return to in-person learning, allowing more people to return to work.

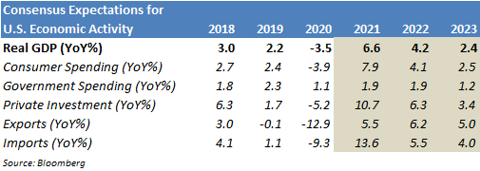

Ultimately, we expect 2021 will post the strongest annual growth since 1984; and if current analyst estimates are correct, 2022 is set to post the strongest annual growth since 1999.

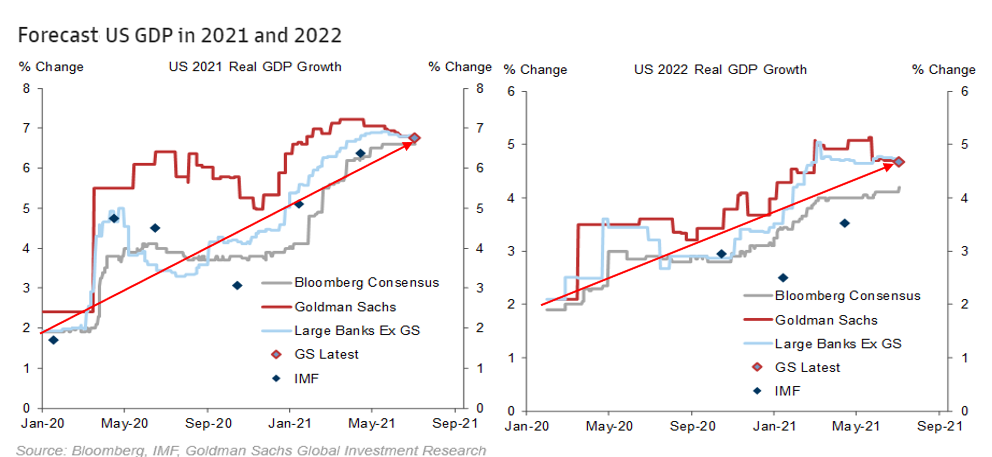

These charts detail analysts’ expectations for economic growth over time, with expectations for 2021 growth on the left and 2022 growth on the right. The strong economic backdrop has clearly led to positive revisions to economic growth projections throughout the year. Current real GDP growth is expected to be 6.6% in 2021 and 4.2% in 2022.

While measures of financial conditions remain very easy, driven by U.S. financial conditions in particular, as depicted in this chart. Easy financial conditions combined with excess savings from fiscal stimulus and a backdrop of outsized stimulus tailwinds may particularly help to underpin consumer spending, which is the single largest component of U.S. GDP.

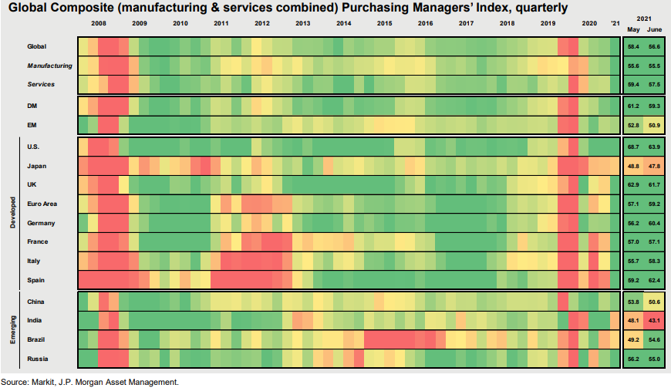

And it’s really a very strong and broad global recovery. We’re currently witnessing the strongest acceleration in global growth in at least 15 years. We expect that as vaccine roll-out continues globally, many countries – and particularly Emerging markets – to improve further.

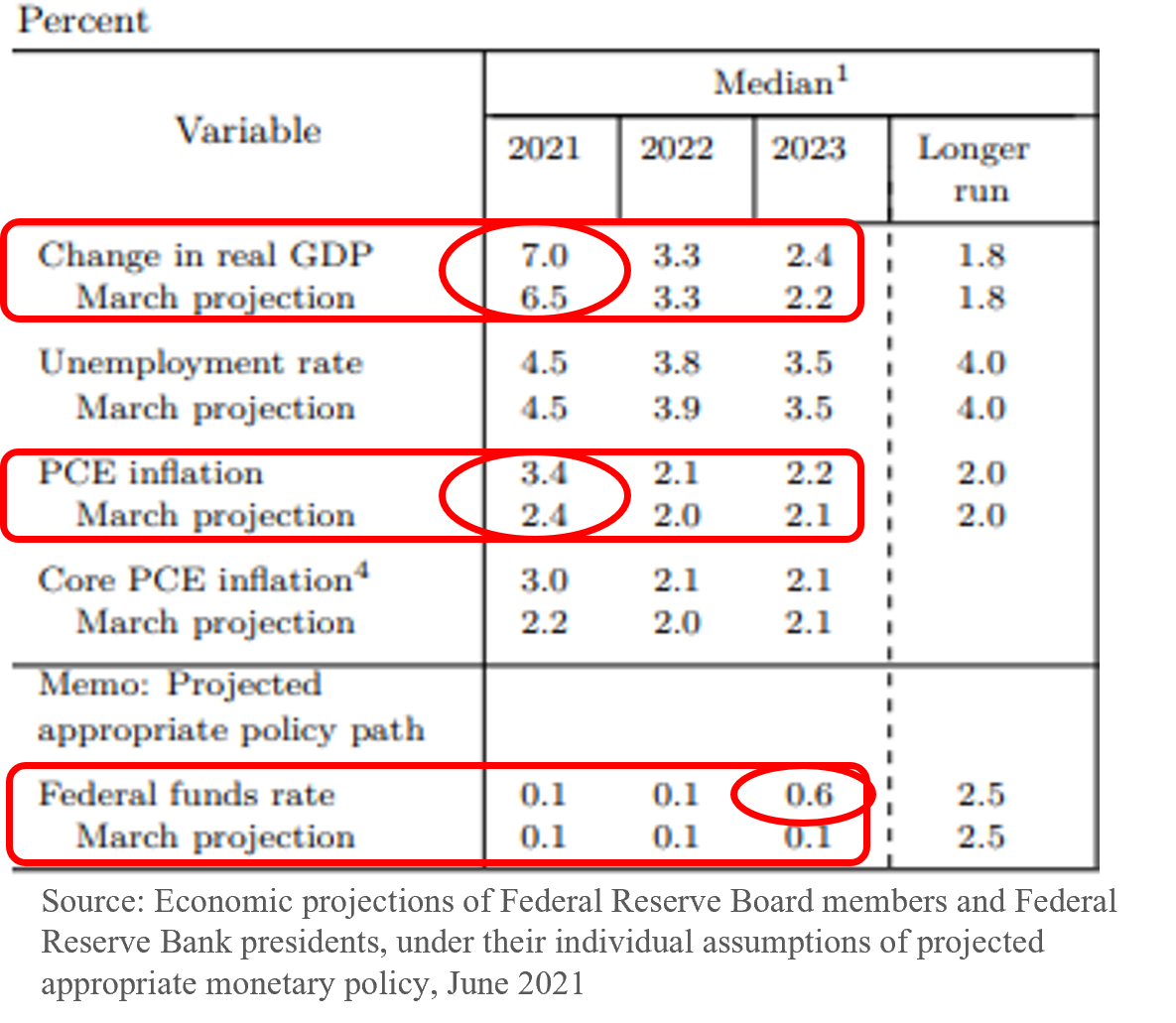

Turning to the Fed, the Fed recently revised its economic growth for 2021 higher from 6.5% previously projected in March to 7% currently and also boosted its forecasts for near-term inflation to run above 3% for 2021. Importantly, the Fed continues to communicate its view that inflation is transitory and that inflation pressures are likely to abate after this year and migrate back towards 2%.

As a result of the improved economic situation, the Fed now expects two fed funds rate increases by 2023. We expect the Fed may bring forward its first interest rate increase to the end of 2022 and may begin tapering its asset purchases end of this year or early ’22.

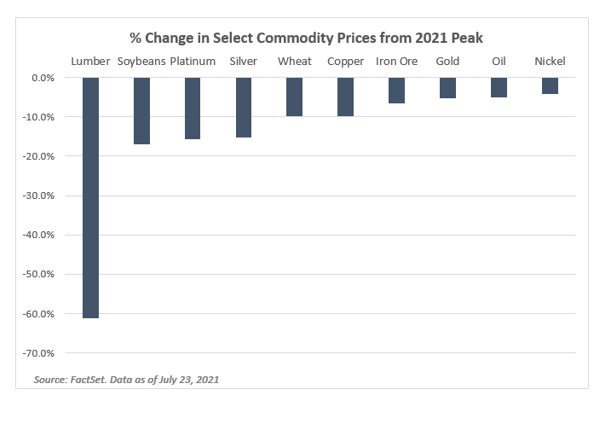

Inflation concerns have moderated somewhat due to Delta variant, and as this chart shows, many commodity prices – most notably lumber prices – have declined from the peaks experienced earlier in the year.

Still, many businesses continue to cite upward pressure from supply chain disruptions, higher raw-materials costs, and shipping constraints.

These issues, combined with strongest economic growth in decades, are likely to underpin higher inflation in 2021.

We do think this is partly a normalization in prices from a multi-month shock and inflation is likely to abate after peaking this year.

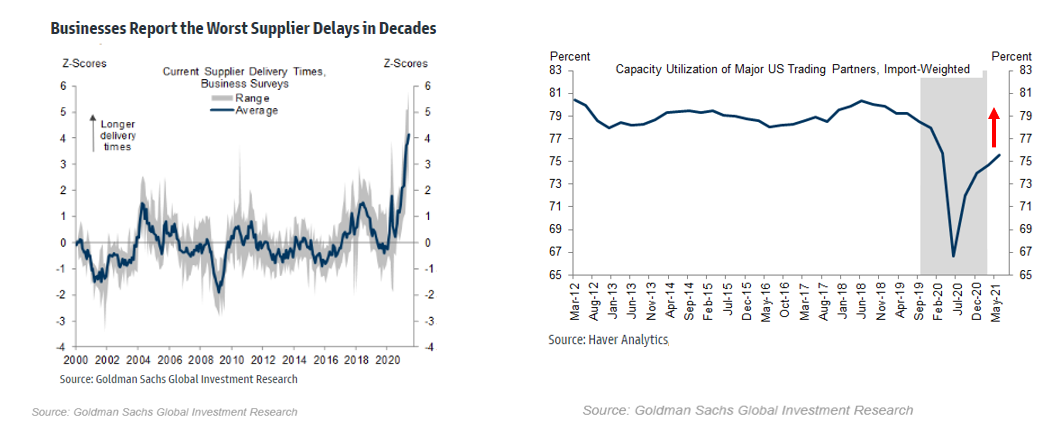

For one, supply disruptions may moderate moving forward. Constrained supply – driven by production cutbacks during the pandemic and problems in the global shipping industry – have caused supply disruptions, with many businesses reporting the worst supplier delays in decades.

At the same time, the massive increase in demand brought about by economic reopening and underpinned by accommodative policies has created a large Supply-demand imbalance and has resulted in large reductions in retail inventories.

We believe these pressures will moderate moving forward, as global capacity utilization has plenty of room to increase. Meaning, global production has plenty of room to ramp up.

There has been a lot of discussion surrounding labor market disruptions and wage pressures, which we believe may also ease in the coming months.

Current labor market issues are partly due to migration trends, with many people leaving the coasts and relocating to the Sunbelt. It’s a lot harder to hire in New York or San Francisco than it is in Phoenix. However, nationwide the data still indicates there is slack in the labor market. On top of which, the upcoming expiration of unemployment benefits may substantially increase labor supply.

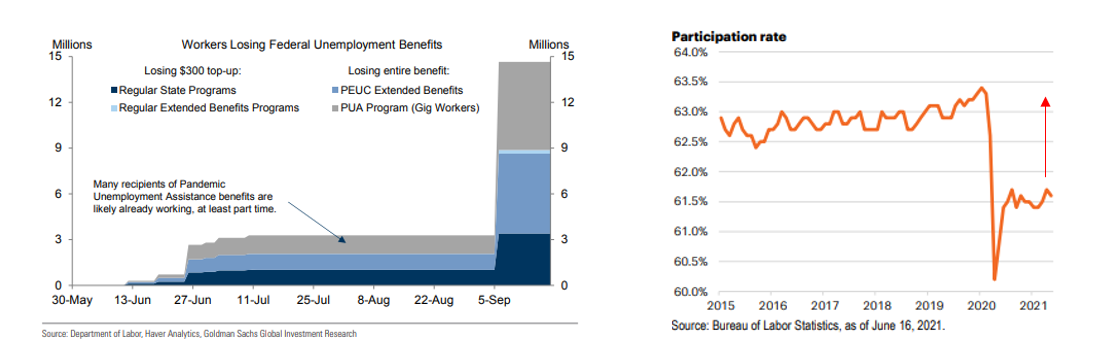

In Sep, approx. 8-9 million workers will lose benefits between the $300 weekly federal top-up and the Pandemic Emergency Unemployment Compensation. Most of these people may need to find jobs and this equates to over 5% of the current labor force.

This also coincides with schools returning to in-person learning, which may help increase the participation rate back towards pre-COVID levels. Many people had no choice but to stay at home and take care of their children while they were remote learning, and this may further increase the supply of labor.

One last point regarding inflation: we believe the recent surge in technology investment is likely to act to moderate inflation. We witnessed a particularly strong increase in tech investment last year when businesses were faced with a socially distanced economy.

Many businesses were forced to invest in technology to stay competitive, or to take advantage of unique opportunity sets.

This increase in technological investment is likely to lead to productivity enhancements and greater efficiencies across all industries within the economy, and in turn may act to moderate inflation.

Bottom Line: we will likely witness an uptick in inflation this year as prices normalize from last year’s shock, but believe it will moderate as supply disruptions abate, capacity utilization improves and the labor market normalizes. As such, we anticipate inflation is likely to revert towards the 2% level in 2022 and beyond.

Turning to fiscal policy and taxes, to help fund proposed stimulus packages, the Biden Administration has proposed to raise taxes on higher income earners by raising individual & capital gains rate and to increase corporate tax rates.

While negotiations are still ongoing, we expect Congress will ultimately pass a scaled back version of Biden’s initial tax increase proposal as there is unlikely to be enough support to pass it as originally proposed. The issue is likely to remain in flux for several months and in terms of timing, at this stage we believe any tax increases are unlikely to take effect until Jan of 2022.

Should tax increases come into effect, the implication for stocks may be two-fold: firstly, a reduction in bottom line earnings – though most analysts anticipate a fairly minimal impact, and secondly some selling pressure ahead of increased tax rate increases taking effect, though any weakness is likely short-lived if history is a guide, which I’ll speak to shortly.

While we consider the macroeconomic backdrop is supportive of ongoing economic growth, we do recognize there are a number of risks present that have the potential to cause market volatility. These include the potential for a rise in coronavirus cases associated with new variants, such as the Delta variant.

Escalating tensions with China, with recent cyber-attack accusations only heightening those tensions.

The potential for inflation pressures to stay higher for longer.

Concerns surrounding peak growth, profits and easy policies, and stretched valuations and margin pressure concerns.

There is the potential for a Fed policy mistake, such as raising rates too fast, too soon and thus derailing the economic recovery, though we don’t consider this a high probability as the Fed has consistently appeared to err towards an easy policy stance.

There is also the potential for any tax reform to cause market volatility, though we believe any related stock market weakness will likely be short-lived.

Next, we’ll take a look at our Outlook for financial markets.

Outlook

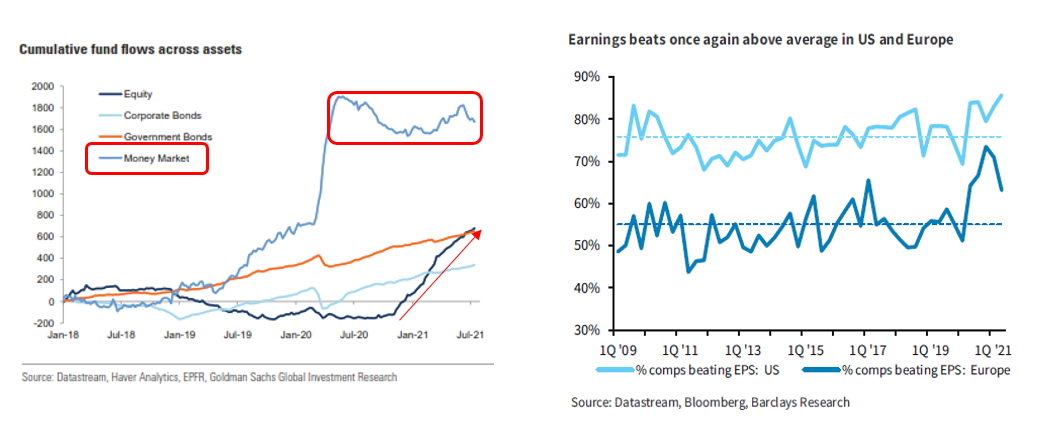

While equity fund flows have remained consistently positive since the back half of 2020, as shown by the dark blue line in this chart, we have yet to see a major liquidation of money market funds, despite near-zero rates of return on cash.

These still elevated cash holdings may help underpin ongoing stock market demand given the backdrop of continued accommodative polices, record earnings and growth.

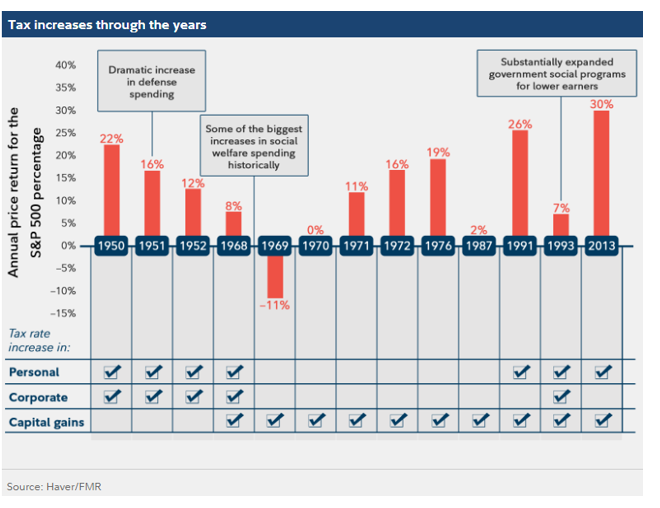

While the potential for higher taxes may cause uncertainty, historically – and counter to conventional wisdom – the S&P 500 has shown higher average returns during periods of increasing taxes.

In fact, as this chart shows, in the past 13 instances of tax hikes, there has only been one year with a negative stock market return.

That’s because markets tend to discount increased taxes in advance and the economy and businesses subsequently benefit from received stimulus.

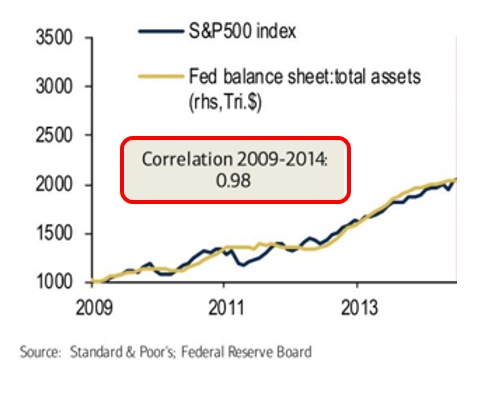

Monetary policy may continue to support the stock market. It may be good to heed the old adage don’t fight the Fed, as still accommodative central bank policies may continue to act as a positive tailwind for stock market returns, albeit potentially at a more moderate pace of growth than what we’ve witnessed year-to-date.

The Fed’s balance sheet is set to expand by another $1 Trillion by the end of 2022, which we believe may act as a catalyst for stock market returns similar to the dynamic that played out in the aftermath of the Great Financial Crisis of 2008. In the years that followed the Great Financial Crisis, the correlation between the Fed’s balance sheet and the S&P 500 was nearly one.

Globally, all central banks are expected to make purchases of nearly $3.5 Trillion in 2021, which follows $8.5 Trillion of purchases in 2020. In turn, this may help underpin global stocks.

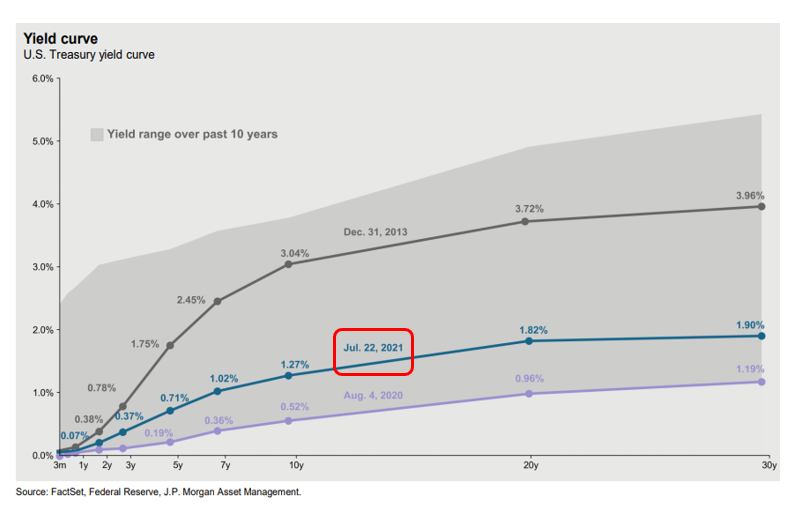

Turning to bonds, interest rates are likely to be anchored at the short end of the curve until Fed raises rates. However, we believe longer dated yields – such as the yields on Treasury bonds with maturities of 10 years or more - may be particularly susceptible to increases given the strength of the economy and in anticipation of Fed rate hikes.

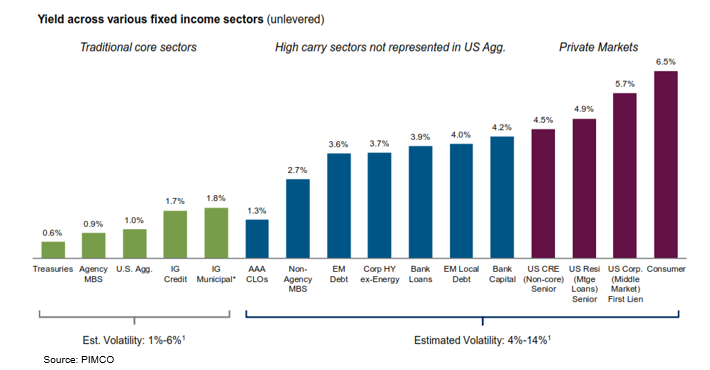

We continue to favor shorter duration and less interest rate sensitivity than the broad bond market, while maintaining dedicated satellite fixed income allocations, which may perform better under a rising interest rate environment.

Longer maturity core fixed income may be particularly impacted by rising rates, whereas credit may benefit from ongoing accommodative policies.

We also believe unique opportunities may exist in less liquid areas of the bond market, which may offer equity-like return potential with lower volatility.

Overall, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients. For more information, please visit missionwealth.com or contact your advisor.

Disclaimers

The information in this presentation is subject to change without notification. Certain statements contained within are forward-looking statements, including, but not limited to, statements that are predictions of or indicate future events, trends, plans, or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Although the opinions expressed are based upon assumptions believed to be reliable, there is no guarantee they will come to pass. This information may change at any time due to market or other conditions.

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. Diversification cannot ensure a profit or protect against a loss.

Investments in commodities may be affected by the overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments. Commodities are volatile investments and should form only a small part of a diversified portfolio. The use of derivative instruments may add additional risk. An investment in commodities may not be suitable for all investors.

Diversification helps you spread risk throughout your portfolio, so investments that do poorly may be balanced by others that do relatively better. Neither diversification nor rebalancing can ensure a profit or protect against a loss.

Real estate may not be appropriate for all investors. Its value may fluctuate based on economic, regulatory, and environmental factors. Redemption may be at a price, which is more or less than the original price paid.

Do not act upon this information solely, and seek professional guidance before making investment decisions. This presentation is not intended to provide any specific investment advice. No investment strategy can ensure a profit.

Fixed income securities carry interest rate risk, inflation risk and credit and default risks. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Interest income generated by municipal bonds is generally expected to be free from federal income taxes and, if the bonds are held by an investor resident in the state of issuance, state and local income taxes. Such interest income may be subject to federal and/or state alternative minimum taxes. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for investors in all tax brackets. Short- and long-term capital gains and gains characterized as market discount recognized when bonds are sold or mature are generally taxable at both the state and federal level. Short- and long-term losses recognized when bonds are sold or mature may generally offset capital gains and/or ordinary income at both the state and federal level.

Fixed income yields are provided by Barclay’s Capital based on the following sources: US Treasury, Barclay’s Capital, FactSet, and JP Morgan Asset Management, and are represented by Brad Market, US Barclay's Capital Index, MBS, Fixed Rate MBS Index, Corporate, US Corporates, Municipals, Muni Bond Index, Emerging Debt, Emerging Markets Index, High Yield, Corporate High Yield Index. Treasury securities date for # of issues and market value based on US Treasury benchmarks from Barclay’s Capital. Yield and return information based on Bellwethers for Treasury securities.

Mission Wealth is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Mission Wealth and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Mission Wealth unless a client service agreement is in place. California Insurance License # 0D35068.

00411906 07/21