By Brian Sottak, CFA®, CAIA®

Research Analyst and Alternatives Specialist

Summary

Following the global financial crisis of 2008, we have witnessed U.S. stocks rally significantly. Historically low levels of volatility and very few market pullbacks have characterized this stock market rally, with volatility moving increasingly lower over recent time periods. Many investors trying to the “time” the market have been left behind, sitting in cash generating negative real returns, while stocks – and risk-on assets more broadly – continued to rally.

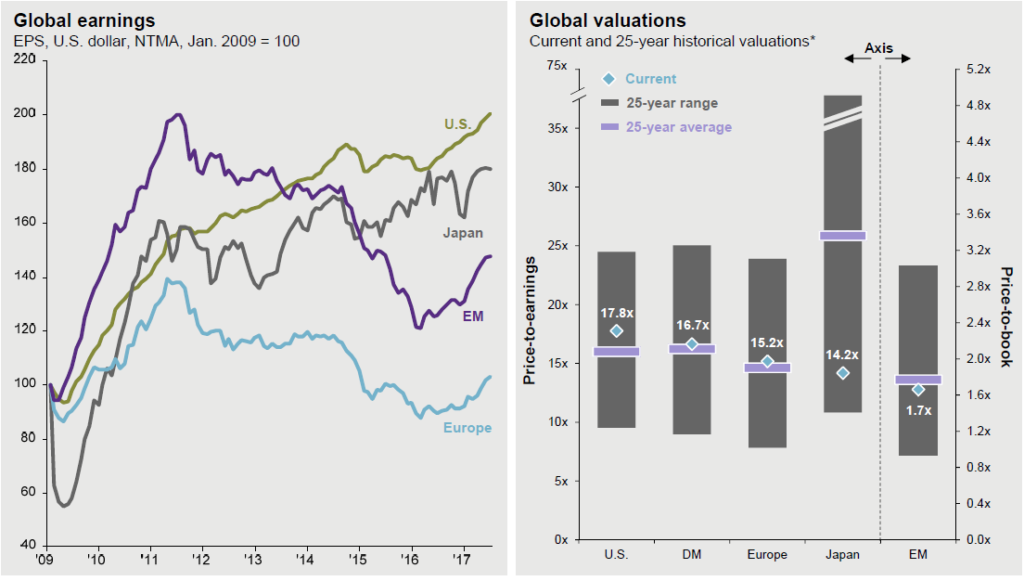

Now, U.S. stock valuations appear stretched and expectations for the remainder of 2017 and for 2018 are for modest growth, with the majority of Wall Street’s top strategists predicting that we end 2017 roughly at the same level we are at today for the S&P 500. At the same time, international and emerging market stocks appear undervalued to in-line with historic averages, and expectations are for improved growth abroad.

At Mission Wealth, we believe our client portfolios are well positioned to navigate the upcoming time period: we believe in globally diversified portfolios that are well exposed to accelerating international and emerging markets. We also maintain a dedicated allocation to less correlated alternative strategies, which may perform well should we see a reversion to more normal levels of volatility and/or a market pull-back. We are also especially cognizant of reducing cash drag on portfolio returns, closely monitoring the level of cash across client accounts to keep it to a minimum.

Looking Back

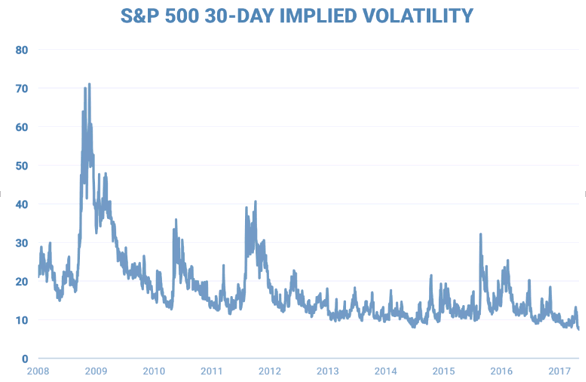

Over the past 8½ years, the S&P has seen an unprecedented bull market rally from the 666 low to north of 2,400 today. This amazing U.S. stock market run has largely been characterized by a low volatility environment, especially in recent years. The CBOE Volatility Index, better known as the “VIX” or the “Fear Index”, is the most widely followed barometer of expected U.S. stock market volatility. In a nutshell, it is a barometer of investor nervousness calculated using S&P 500 options. Over the past 8 years there has been a steady downward trend in the VIX index, indicating increased complacency for U.S. equity investors. In fact, the VIX is now hovering at all-time low levels:

Source: Bloomberg, Business Insider

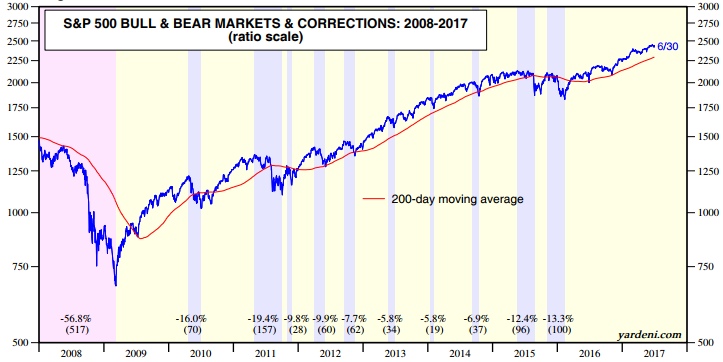

At the same time, the S&P 500 remains well above its 200-day moving average, and has gone more than six months without a one-day drop greater than 2%, the longest stretch in a decade. U.S. stocks are now in the second longest bull-run ever, which has lasted over 100 months, and is only surpassed by the 113-month span leading up to the dot-com bubble crash. U.S. stock market valuations appear stretched relative to historic averages. In addition, the S&P 500 has not had a correction in over 18 months, an unusually long period of relative calm compared to historic averages; over the last decade, the S&P 500 averaged roughly one 10% correction every year.

Source: Yardeni.com

Strong Q1 earnings and higher than expected growth in Financials and Technology have helped fuel the year-to-date S&P 500 rally. Stocks have shrugged off everything from monetary tightening, to oil’s slump, to drama at the White House, surging past consensus forecasts on surprisingly low levels of market volatility.

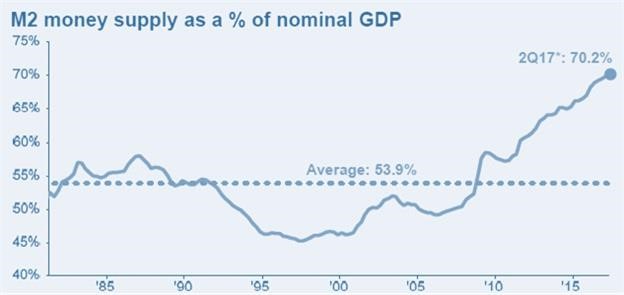

Despite the significant run-up in U.S. stocks, and risk-on assets more broadly, cash balances in the U.S. are at historically high levels and represent nearly $12.5 trillion. In spite of empirical evidence to the contrary, many investors have sat on the sidelines in cash since 2008 and at various points thereafter, trying to time an entry point into the market. Unfortunately, it is clear following such a strategy has left those investors behind.

Source: FactSet, JP Morgan Asset Management; BEA, Federal Reserve, St. Louis Fed

What’s more startling is that the build-up in cash occurred at a time when cash yields are also historically low, and well below the level of inflation, meaning that on a real basis (stripping out the effects of inflation), the return on cash is actually negative.

At Mission Wealth, we monitor and manage cash balances tightly, with the aim to hold as little cash as possible across client accounts, so as not to cause “cash drag” on portfolio returns. Each asset class we invest in has an expected return over a full market cycle that exceeds the yield on cash, and we construct portfolios with the primary objective of meeting the long-term financial goals of our clients. In short, we believe it is better to be fully invested in a portfolio following a long-term, strategic approach to investing that is built to meet our client’s goals, as opposed to trying to time the market.

Looking Forward

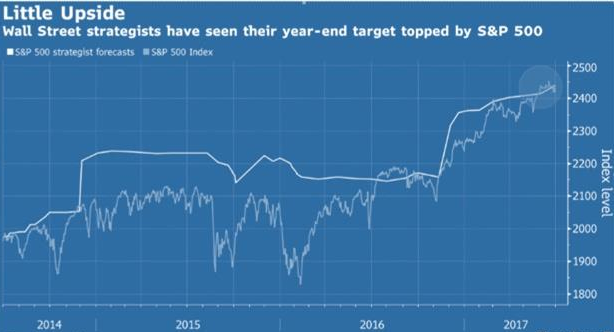

Wall Street analysts are predicting a roughly flat market over the next 6 months through year-end. Strategists across 20 Wall Street firms predict the S&P 500 will end the year at 2,439. The S&P is currently trading at 2,432 (as of July 5). This represents the least bullish forecast midway through the year since 1999 (per Bloomberg data).

Source: Bloomberg

Among others, strategists cited modest economic growth for the duration of 2017 and 2018, the prospects of accelerating inflation, higher policy rates, increased labor costs, stretched valuations, decelerating profit growth, and rising 10 year bond yields as factors that could weigh on the U.S. stock market.

In contrast, international and emerging market stocks appear more fairly valued to under-valued when compared to U.S. stocks. They are also experiencing an acceleration in earnings growth as the rate of expansion of the underlying economies are improving.

Source: FactSet, MSCI, Standard & Poor's, JP Morgan Asset Management

Impact to Your Portfolio

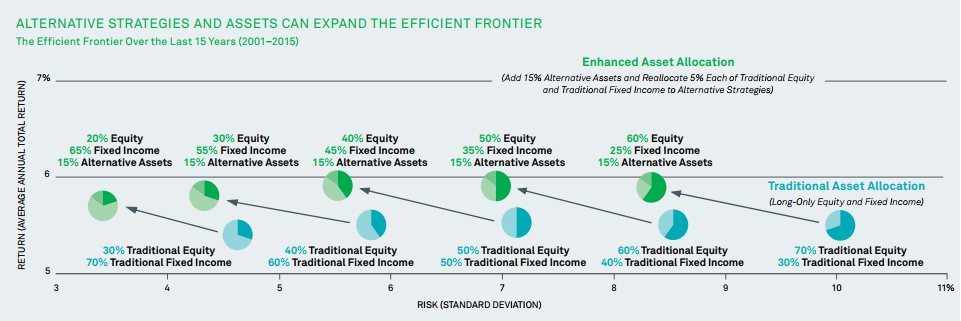

Whether Wall Street strategists are correct, or if we see the market continue to rally, or if we finally see a correction, now more than ever it is important to hold a diversified portfolio built for the long-term. Strategies that have lower levels of correlation to U.S. stocks, such as the alternative asset class, may provide strong diversification benefits and supplement portfolio performance with less correlated returns, potentially providing superior overall risk-adjusted returns.

Source: BlackRock; Informa Investment Solutions

At Mission Wealth, we believe our client portfolios are well positioned to navigate the upcoming time period. We believe in following a strategic, long-term approach to investing, building globally diversified portfolios that are well exposed to benefit from accelerating international and emerging markets. We also maintain a dedicated allocation to less correlated asset classes, such as alternative strategies, which may perform well should we see a reversion to more normal levels of volatility and/or a market pull-back. We are also especially cognizant of reducing cash drag on portfolio returns, closely monitoring the level of cash across client accounts to keep it to a minimum.

962015 7/17