By Kieran Osborne, MBus, CFA®

Senior Portfolio Manager at Mission Wealth

SUMMARY: Mission Wealth took advantage of recent market movements to strategically reduce our municipal high yield bond allocation across our taxable accounts, in favor of corporate high yield bonds. The decision was driven by our outlook for a rising interest rate environment over the forthcoming years. With such a backdrop, we believe corporate high yield securities may outperform municipal high yield securities.

At its most recent meeting in mid-March, the Federal Open Market Committee (FOMC) raised the target range for the fed funds rate by 25bps – to between 75bps and 100bps – and signaled further rate rises are likely. The Fed’s “dot plot” forecasts indicate three rate increases in 2017 and another three in 2018. This is in-line with the current consensus market view of another one to two fed funds rate increases for the remainder of this year.

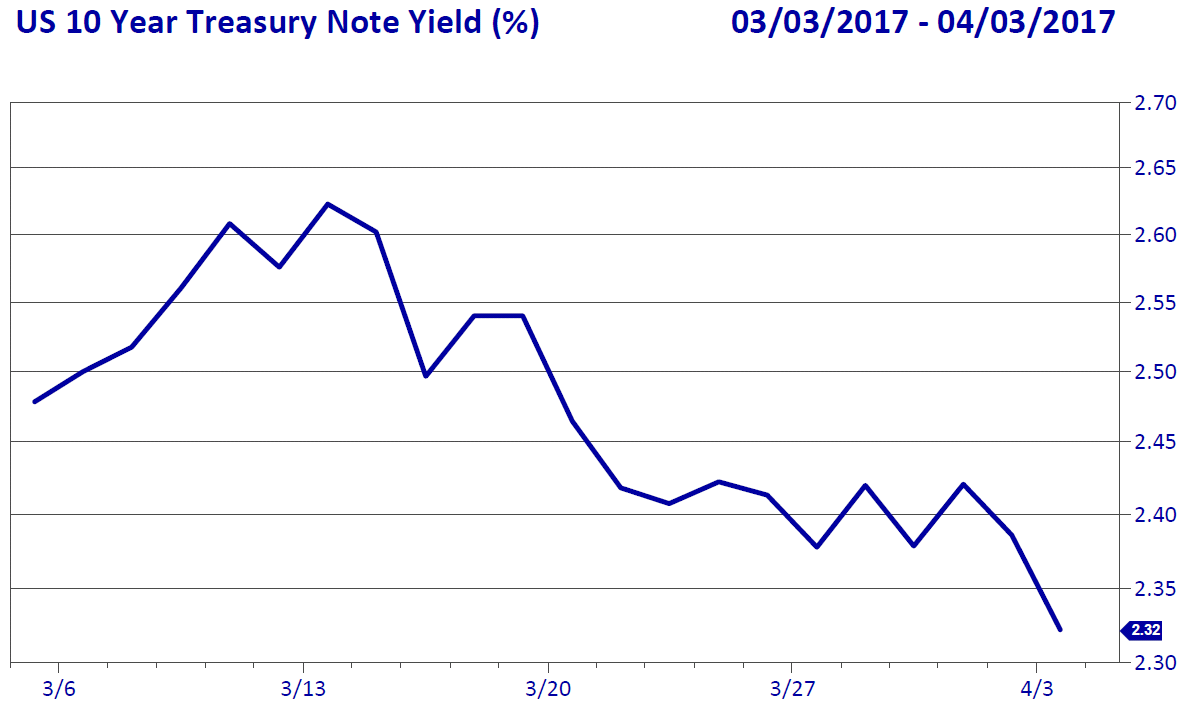

Despite this, the bond market actually rallied in response to the announcement. The benchmark 10-year Treasury yield initially dropped from 2.6% to 2.5%, as the Fed provided no indication that the speed of fed funds rate increases would quicken, while some market pundits focused on an overcompensating dovish tone in the Fed’s communication.

The bond rally was further compounded by the failure in Washington to repeal Obamacare. This failure led to short-term equity market weakness and strength in Treasuries, as concerns were raised that other items on the Trump agenda – namely tax reform – may also be stymied. As of writing, the 10-year Treasury was trading at 2.32%:

We believe this drop in yields may be short-lived. The core reason the Fed believes the time is ripe for raising interest rates is that the economy is strong enough to withstand a rising interest rate environment, and all the economic data we see confirms this positive economic momentum. As such, we consider rates will continue to grind higher over the coming 12 to 24 months.

Impact to Your Portfolio

Historical performance considered: We took advantage of the dip in the 10-year Treasury below 2.4% to strategically reduce our municipal high yield allocation in favor of corporate high yield bonds. We believe corporate high yield securities may offer a more compelling return profile with a backdrop of rising interest rates. Indeed, corporate high yield has historically been among the best performing fixed income asset classes in a rising interest rate environment. Conversely, municipal high yield may be among the most susceptible asset classes should interest rates rise. That’s because municipal high yield tends to have a much longer duration profile.

Duration of bonds a factor: There is an inverse relationship between interest rates and bond prices; as rates rise, bond prices typically fall, with longer duration securities generally experiencing larger declines in value. Municipal high yield funds typically have an average duration between seven years and eight years, whereas corporate high yield funds generally have much shorter duration profiles, typically in the three-year to four-year range. (In comparison, the broad bond market – as measured by the Barclays Aggregate Bond Market Index – has a duration just under six years.)

Favorable economic outlook taken into account: Additionally, we believe corporate high yield securities may benefit from the positive economic momentum that is a primary factor in allowing the Fed to increase rates. Under such an environment, corporate profitability and financials are likely to improve. As a result, corporate high yield securities may experience credit upgrades, which positively impact the price of those issues. In talking with our fixed income partners, the overarching indication is that the credit cycle still has a lot of runway left and many valuations remain compelling within the corporate high yield sector. As such, we consider the outlook to be much more favorable for corporate high yield bonds relative to municipal high yield.

Again, Mission Wealth has already made these changes to your portfolio on your behalf. No action is required on your part at this time. As always, if you have any questions regarding your portfolio or the markets, please don’t hesitate to contact your Client Advisor.

939400 4/17