This article/video is part of a series that applies psychology to financial planning so we can all make wealthier decisions. As a multi-billion-dollar investment and planning firm, Mission Wealth can give you collective wisdom and real-life examples from thousands of multimillionaires. You can read 2024’s Investor Commentary here.

Joey Khoury is a Partner, one of Mission Wealth’s Senior Wealth Advisors, and an adjunct professor at UCSB who has studied behavioral finance at Cornell and Harvard. Every quarter, Joey and Mission Wealth publish 1-3 psychological topics that are relevant and current to the world around us.

This quarter, we’re covering the psychological traps of Optimism Bias and Confirmation Bias across three core areas: Investments, Estate Management, and Financial Planning. We’ll share practical planning tips below to ensure you know how to navigate these traps.

Watch the Full 6-minute Video Instead

INVESTMENTS

The biggest psychological traps that we currently face for our investments are confirmation bias and optimism bias.

Key Point #1: Optimism Bias

Don’t let two years of positive market performance cause you to lose sight of normal volatility and how often markets are negative.

Optimism bias is the tendency to expect positive outcomes and avoid thinking of negative ones. When markets are extremely positive, this causes us to put the blinders on regarding normal market pullbacks.

Reality-Check Facts:

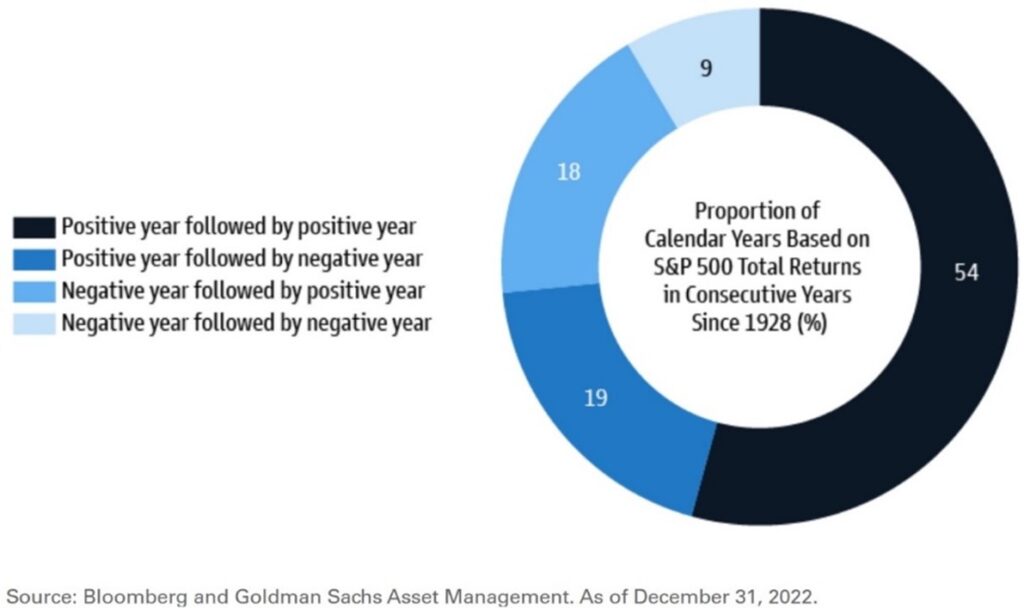

- Nearly 100 years of data show us that a positive year is followed by a negative year about 19% of the time.

- While markets are positive 73% of the time overall, a normal range of movement in any given year for the S&P 500 is about positive 45% to negative 25% (2 standard deviations, data going back 30 years).

- It is normal for the market to average a 10% pullback about once per year, a 15% pullback once in 3 years, and a 20% pullback once in six years (averages).

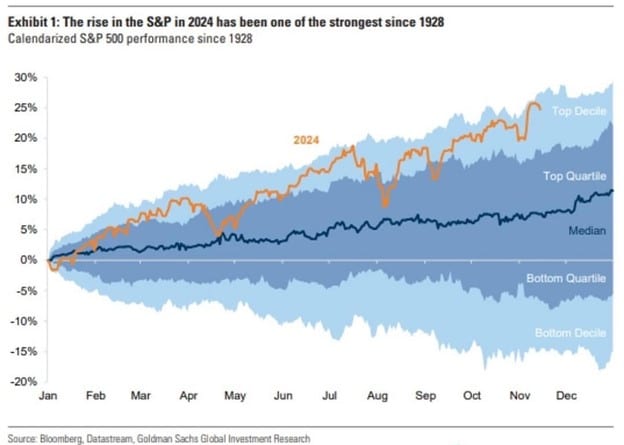

- We are currently in the top decile of performance for 2024

- While the outlook for 2025 remains positive, caution is advised to avoid getting swept up in irrational exuberance. Experienced investors know that cycles of expansions and contractions are perfectly normal.

- Planning Tip #1: The best time to buy an umbrella is when the sun is brightly shining, not when it has already started to rain. Similarly, the best time to discuss what to do during market pullbacks (rain) is when markets are very healthy (sunshine) like they are currently. Positive times can give you the clear-headedness to discuss future market contractions if you overcome the natural urge not to think about it.

Key Point #2: Confirmation Bias

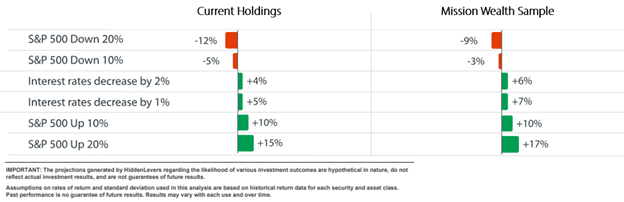

A rising tide lifts all boats. Many investors have participated in the soaring market since the pandemic. This can create a positive feedback loop: investors believe they are great at investing because they have earned positive returns (called Confirmation Bias). What many investors don’t see is how overexposed they might be to a market correction.

- Planning Tip #1: Our investment analysis can tell you how connected you are to the S&P 500 and how far down your specific positions are correlated to a general market downturn. We can give you a drawdown analysis to exemplify how much your portfolio would drop if the S&P 500 fell by 20% and recommend potential changes that may help reduce this correlation risk.

- Planning Tip #2: Talk with your advisor to assess your drawdown risk and whether now is the right time to take some risk off the table.

- Planning Tip #3: Avoid attributing positive returns to confirmation bias; a ship’s captain does not take credit if the ocean gives them smooth waters.

FINANCIAL PLANNING

Key Point #1: Optimism Bias

With two incredible years of market performance behind us, we see many financial plans that are now healthy but once were not—and some families are banking on these recent gains to make critical decisions such as when to retire.

Talk to your advisor about how you may further diversify to reduce your portfolio drawdown risk; especially if the financial plan does not have a large buffer for maximum loss.

- Planning tip #1: as part of our financial planning process, we can tell you the total amount of money your financial plan can afford to safely lose in one number. With this number in mind, whether it’s ten thousand or ten million, you can compare it to the size of the maximum drawdown risk of your current portfolio (or to the size of concentrated positions). Having a risk factor below your total financial capacity for risk will help safeguard your financial independence and retirement.

- Planning Tip #2: We can also run a ‘bad timing’ scenario to show you if your retirement would be jeopardized if you faced a hypothetical severe market correction.

ESTATE PLANNING

Key Point #1: Optimism Bias

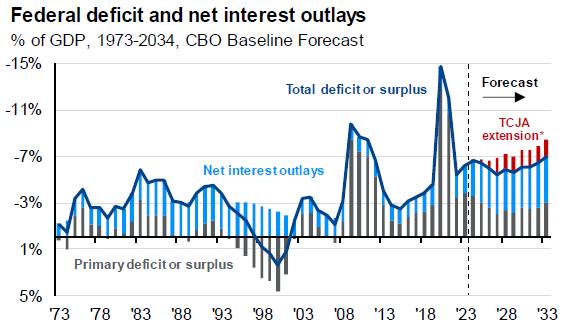

With the Tax Cuts and Jobs Act (TCJA) likely being extended, the ‘push’ to assess or revise estate documents is alleviated. However, frequent reviews of the estate plan are still necessary, and families with taxable estates should still plan to meet with their financial, tax, and estate advisors regardless of the expected tax law extension.

Nobody wants to think about what happens when they’ve passed on- it’s just not a pleasant thought nor pleasant conversation (Optimism Bias acts as a defense mechanism to thinking about this subject matter).

However, it is necessary to best care for your family so that they are not left in a sea of financial confusion should something happen to you. Having an up-to-date estate plan can not only help you avoid potential costs like estate tax or probate fees, but it can also give the people you love the most a chance to process the change.

Should the TCJA be extended, the Congressional Budget Office (CBO) expects the federal deficit to increase by about $3.3 trillion (CBO Publication Source, May 2024)

Source: JPM Guide to the Markets, 9/30/24

This deficit will have to be rectified in the future, which could lead to changes in estate/tax law.

- Planning Tip#1: Our financial planning process can give you a rough estimate of your future estate size and potential estate tax liability. Our estate planning process, led by our in-house attorney, Andrew Kulha, can help review and assess your estate structure for potential issues or recommended changes.

- Planning Tip#2: Chat with your advisor now about reviewing your estate documents if this is an area you’d like to refresh. If you plan to update your estate documents, don’t delay because of this legislative change! Your strategies may or may not change, but having a regular review of your estate documents should not.

Conclusion

We hope you found these topics helpful as we enter the new year. We welcome you to read or watch our Chief Investment Officer’s market updates from our Insights Blog for more detailed market commentary.

To submit a request for future topics, please don’t hesitate to email Joey directly at jkhoury@missionwealth.com.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

What Is the Emerging Role of Artificial Intelligence (AI) in Shaping Financial Advice and Portfolio Management?

November 11, 2025

What Are the Benefits of Partnering with a Specialized Wealth Management Firm Amid Growing Competition from Large Banks?

November 6, 2025