What is Tax-Loss Harvesting?

We've all heard the term tax-loss harvesting at some point but what does it mean to investors? Is there a silver lining to a down market? Click the video to watch, or read the text beneath it to learn more.

At Mission Wealth we proactively tax-loss harvest across our client’s taxable accounts where suitable and when opportunities present themselves. Tax-loss harvesting can provide significant tax savings and allows us to enhance the after-tax returns for our clients.

So what is tax-loss harvesting?

Tax-loss harvesting is a method applied to taxable accounts – such as an individual account or a Trust – whereby we sell an investment that is trading at a loss, and immediately use those proceeds to purchase a very similar investment position.

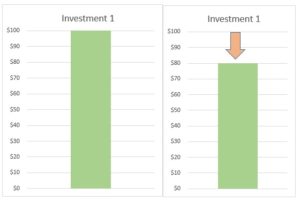

Let’s say we bought an investment, we’ll call it “Investment 1” for $100 per share a month ago. Let’s also assume the market sold off over the course of the month and that investment is now worth $80 per share.

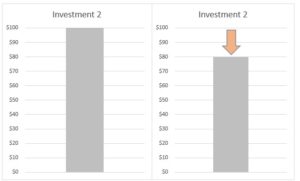

Now, there just so happens to be another investment, let’s call it “Investment 2” which we don’t currently own but is very similar to Investment 1, and it has also fallen in value from $100 to $80 per share.

Because the two investments have very similar profiles – maybe they are both small cap stock investments, as an example – we could Tax-Loss Harvest Investment 1 by selling it, realizing a $20 loss per share, and using the $80 proceeds to immediately buy Investment 2.

As a result of this transaction, we maintain our portfolio allocation – say to small cap stocks – so if the market rebounds we will fully participate. At the same time, we have switched from one investment to another and realized a loss of $20 per share. That loss may help enhance after tax returns.

Losses can be used in a variety of ways:

- Help offset gains that may have already been triggered elsewhere in the portfolio

- Help offset current income

- Provide more flexibility to trigger future gains within the portfolio – whether as a result of regular rebalancing, or to fund future withdrawals

- It may enable us to trim concentrated stock exposures that have large unrealized gains, helping offset those gains and allowing for a more diversified portfolio.

Let’s look at a concrete example.

In the example below, a $25,000 loss from Investment B can be applied to first offset $20,000 of gains that were triggered from a sale of Investment A.

Next, $3,000 of the loss can be used to offset ordinary income, while the remaining $2,000 of losses can be saved to help offset future gains or income. In this example, the total tax savings exceed $8,000.

At Mission Wealth, we proactively tax loss harvest across our client’s taxable accounts where suitable and when opportunities present themselves. Tax-loss harvesting can provide significant tax savings and benefits for our clients.

If you'd like to learn more about our investment services, check out our investments page.

00366839 05/20