The Importance of Investment Discipline

When you've reviewed your goals and have a strategy to achieve them, it is important that you are able to exercise the discipline required to stick to the strategy you've put in place. Investing can be emotional, but don't be tempted to deviate from your plan. Watch the video below to learn about the importance of investment discipline.

Investment discipline is not easy, but there are ways that you can embrace the disciplined investing mindset and continue to make the best long-term decisions for your financial goals. Whether you're a business owner, retiree, professional, or an independent woman, you can make changes that can remove emotions from your investment decision-making process.

Successful investment management requires Investment discipline, which involves focusing on long-term fundamentals, maintaining full investment, and following a systematic approach to rebalancing. It removes emotions from the investment decision-making process and may ultimately prove to better achieve the long-term financial goals of our clients. We believe it is a critical component of portfolio management and vital to the success of any financial plan.

It is equally important to maintain discipline when times are good and when times are bad. By focusing on long-term fundamentals and taking emotions out of the investment decision-making process, investors can better navigate through market volatility or unpredictable market conditions with confidence that their long-term financial plans are secure.

Watch the video below, or click here.

What makes a disciplined investor?

Investment discipline means you have a strategy to meet your goals, minimize risk, and minimize costs. Don't be tempted to make emotional decisions.

2020 was a prime example of the benefits discipline can bring to an investment portfolio. In March and April of 2020 global stocks were trading significantly lower than the highs experienced earlier in the year. Many investors let emotions get the better of them, allowing the dire news headlines at the time to dictate their investment decisions, and unfortunately sold out at the exact wrong time. On the other hand, we maintained our discipline in the face of increased volatility. We didn’t react to the short-term market noise or get sidetracked by the news headlines. Rather, we focused on long-term fundamentals, followed our disciplined approach to rebalancing and were broadly adding to stock exposures at that time. This ultimately benefited our client’s portfolios in the form of enhanced returns, as the market eventually rallied back.

Although investing involves risk - interest rates change, market conditions shift, and asset classes become more or less valuable - we can use strategies like asset allocation and asset location, as well as portfolio rebalancing to match your risk tolerance and reach the financial goals you've set.

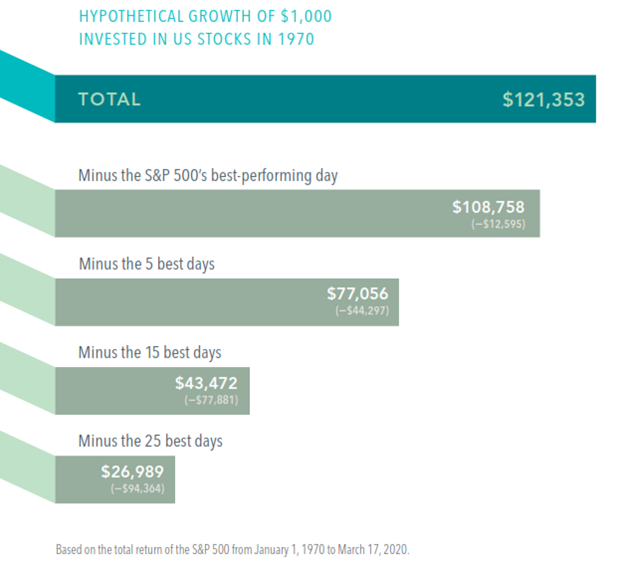

This chart highlights the importance of not allowing emotions to dictate investment decision making. It depicts the growth of $1000 invested in the S&P from 1970 to March of 2020. Fully invested, that $1000 would have grown to over $120,000. However, all too often investors sell out as volatility spikes and stocks sell-off. Some try to time markets by selling with the view to get back in at the market bottom. Timing markets is impossible. We believe selling when stocks have sold-off and volatility is peaking is precisely the wrong thing to do. This is because the best stock market days often immediately follow some of the worst days. That happened in 2008 and again in 2020 and invariably happens any time the market experiences a significant sell-off. Missing out on these very strong stock market days is detrimental to long-term returns. As the chart depicts, had you missed out on the five best days since 1970, your total return would have been reduced by over -36%! If you missed out on the 15 best days your total return would have been reduced by more than -64% and had you missed the 25 best stock market days your return would have been reduced by over -77%! These numbers are significant. Clearly, maintaining full investment over the long haul is key; trying to time markets or allowing emotions to dictate investment decision-making only degrades long-term investment performance and could potentially put your long-term financial plan at risk.

What makes a successful investment strategy?

Investment discipline accepts that the stock market has episodes of gains and losses. Remember to rebalance, don't chase winners or time the market, and steadily increase your contributions.

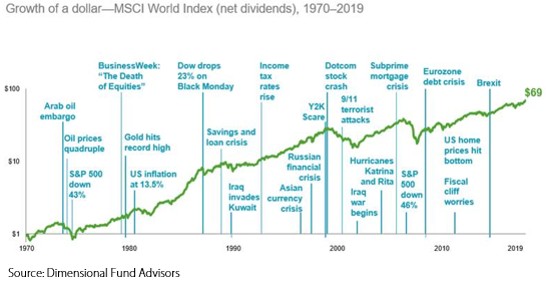

It’s important to remember that stock market investing typically involves episodes of gains, losses, and volatility within an overall upward trend. Good times don’t last forever, but neither do bad times. Periodic bouts of market volatility should be expected over time; they shouldn’t come as a surprise. Being prepared for these episodes and maintaining investment discipline may add to long-term total investment returns. More often than not, the best time to invest in stocks is when it feels most uncomfortable to do so.

Ultimately, by focusing on long-term fundamentals and not allowing short-term noise or emotions to dictate investment decision-making, we believe we can more effectively and consistently achieve the long-term financial goals of our clients.

Learn more about investing with Mission Wealth, or contact your client advisor.

00387517 12/20