We've heard of asset allocation, but how about asset location? Learn about how asset location fits into an investment strategy. Click the video to watch, or read the text beneath it to learn more.

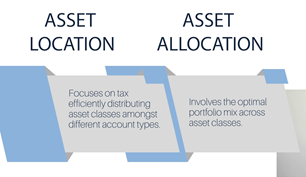

In this video, we’ll cover the benefits of Asset Location. While asset allocation involves the optimal portfolio mix across asset classes, asset location focuses on how to most tax efficiently distribute those asset classes amongst different account types.

Click here to watch our 6-minute video that explains asset allocation.

Since different account types have different tax considerations, by incorporating asset location can help maximize after-tax returns for our clients.

Certain client-specific requirements such as short-term cash needs may dictate to an extent what assets to hold and in what accounts, however generally speaking we are able to invest more tax efficiently by incorporating asset location into consideration.

So, how does asset location work?

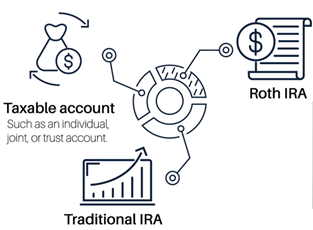

Let’s say you have three investment  accounts within your broad investment portfolio: the first is a taxable account - such as an individual, joint, or trust account. The second is a Roth IRA, and the third account is a Traditional IRA.

accounts within your broad investment portfolio: the first is a taxable account - such as an individual, joint, or trust account. The second is a Roth IRA, and the third account is a Traditional IRA.

-

- Taxable account- such as an individual, joint, or trust account

- Roth IRA

- Traditional IRA

Within the scope of this broad portfolio – which might have an overall target allocation of, say 60% stocks and 40% bonds – we can incorporate asset location:

Within the scope of this broad portfolio – which might have an overall target allocation of, say 60% stocks and 40% bonds – we can incorporate asset location:

- Optimizing which assets to hold in each account to minimize taxes paid and maximize after-tax

Let’s consider the different Tax Considerations of each account and the implications for investing.

A Taxable account – for example: individual, joint, or trust account

- Pays taxes on ordinary income

- To minimize tax implications:

- Tilt fixed income towards tax-free municipal bonds

- Position towards higher growth assets that do not generate taxable income or generate qualified dividend income

- Taxable accounts also offer an opportunity to tax loss harvest – Watch our 4-minute video that explains tax loss harvesting.

A Roth IRA

- Contributions to a Roth IRA come from after tax money

- Taxes have already been paid and no further tax is needed.

- Allocate to high growth assets to maximize the growth potential

- Future retirement withdrawals are not subject to taxes.

- Income generated is tax-free; can tilt towards high growth assets that may generate higher levels of ordinary income.

Whereas a Roth IRA is funded from after tax money, a Traditional IRA:

- Funded from pre-tax money.

- Deferred tax accounts; you pay taxes on future distributions at your future marginal income tax rate.

- Any income generated is tax-free.

- Tilt towards high ordinary income generating assets, such as high yield bonds or other high income alternatives.

When faced with a decision to locate growth assets (such as stocks), across the different account types, it’s typically better to prioritize allocating high growth assets in a 1) Roth, since that minimizes expected future taxes, then to a 2) taxable account, since any future distributions on a taxable account are likely to be taxed at Long Term capital gains rates, and lastly to a 3) traditional IRA since future distributions will be taxed at your future marginal tax rate and thus incur the largest tax burden.

Studies show that incorporating tax-efficient investing – like asset location – into an investment portfolio can add 0.41% of additional performance benefit annually.*

Again, specific client circumstances may dictate asset location to a degree, but generally speaking, by incorporating asset location and tax considerations may ultimately help maximize after tax returns.

How Mission Wealth Can Help

If you are looking for guidance on investment decisions, read more about our services or contact us to be connected with an advisor.

Source: 0.41% Tax Trading Overlay calculation is an average derived from the “Tax-Efficient Investing: Solutions for Maximizing After-Tax Returns” white paper by Vanguard (Donaldson and Kinniry 07). These benefits are hypothetical and not guaranteed. Each investor situation is unique.

00378005 09/20