Now that the election has passed, Americans are looking for guidance as to what they should be doing, or not doing, before the end of 2020 and beyond. In many cases, the “correct” answer may not be known today, but at least a conversation with your advisor would be reassuring. Read on to learn a summary of the main provisions of the Biden administration's tax plan and how to plan ahead for these potential changes.

Scope of Plan

The problem now is that we don’t know the political standing in Washington, as this will hinge on the results of the Georgia runoffs to be held in January 2021. If just one Republican senator gets elected, Republicans will retain control of the Senate, with the House and White House controlled by Democrats. With such a scenario of split control, the full Biden tax plan will not go through and will require deep compromise to pass any new legislation. If the Democrats win in Georgia and take control of the Senate, there will still be infighting within factions of the Democratic Party and thus achieving significant new legislation will require compromise.

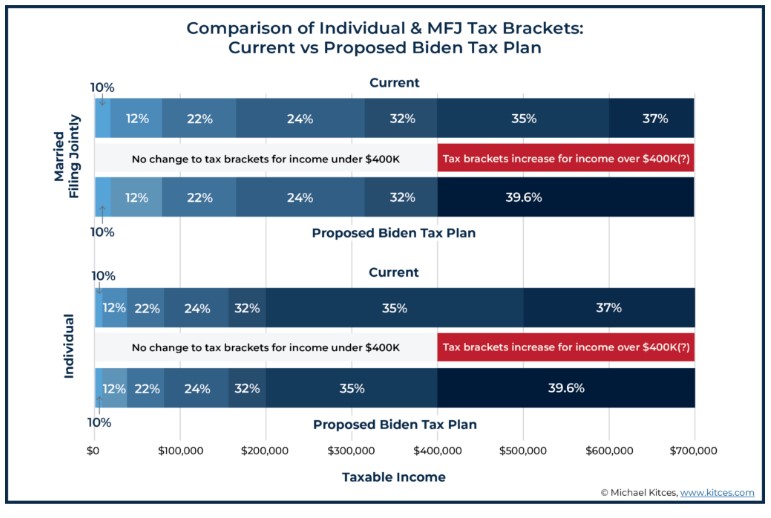

Marginal Tax Brackets

Taxpayers with incomes under $400,000 will keep the current tax brackets. Taxpayers with incomes of $400,000 and over will be subject to the marginal tax brackets in effect when President Trump took office (i.e. the top bracket of 37% will be increased to 39.6%). In addition, the 35% bracket will be going away. What has not yet been made clear is whether the $400,000 threshold applies to Single Filers or Joint Filers. The details of how new tax brackets would apply remain to be seen.

Qualified Business Income (QBI) Deduction

Qualified Business Income (QBI) Deduction

Under current tax law, pass-through businesses (partnerships, LLCs, S-corporations, and sole proprietors) are permitted to take a deduction of 20% of their net profits (subject to certain thresholds and limits). On average, this deduction results in an 8% net reduction in taxes. The Biden Plan proposes to eliminate this deduction for taxpayers earning over $400,000. This would be a big hit for businesses – worse than an increase in marginal tax brackets.

Itemized Deductions

The Biden Plan proposes to place a cap on itemized deductions of 28%. In other words, if a taxpayer is in the 28% marginal bracket or below, there would be no limit on itemized deductions. If marginal bracket was above 28%, there would be a cap (former Pease Limitation). This would have no effect on taxpayers that claim the standard deduction.

Retirement Accounts

The Biden Plan proposes to replace the deduction for pre-tax contributions to retirement accounts with a tax credit equal to 26% of the amount of contribution. This would lower the tax burden for taxpayers in low tax brackets to contribute to tax-deferred retirement accounts, while increasing it for taxpayers in brackets over the proposed rate.

Capital Gains

For taxpayers earning more than $1,000,000, capital gains would be taxed at ordinary income tax rates. Based on current rates, a high-earning taxpayer would pay capital gain taxes at 20% in 2020; in 2021 the tax rate would be 39.6%.

Corporate Income Tax Rates

Increases the income tax rate from 21% to 28%.

Elimination of Step-Up Basis

An additional tax proposal calling for the elimination of the step-up in basis of capital assets inherited upon death is being considered. The Biden proposal does not call for any sort of exemption in the elimination of the step-up basis at death. It’s hard to imagine that such a change would take place; a more likely outcome is that there may be a limited step-up in basis for non-spouse beneficiaries.

Estate Tax Exemption

The Biden Plan would seek to repeal the estate and gift tax exemption made by the Tax Cuts and Jobs Act, returning the exemption amount to approximately $5.85M per person (what the original $5M exemption would have been by 2021). Whether the changes would occur effective to the date of enactment, prospectively for 2022 in future years, or even retroactively to the beginning of 2021, is unclear.

Increase in SS Taxes

The Biden Plan imposes a 12.4% OASDI payroll tax on income earned above $400,000, evenly split between employers and employees.

Planning Opportunities

Planners are left with a major dilemma: act now and make potential changes that could be costly or unwanted if substantial changes to the tax code are not implemented in 2021, or wait and risk the chance that such changes may be implemented, potentially increasing costs. A few strategies that are worth consideration include:

- Accelerate Income - Taxpayers earning slightly above $400,000 may actually have the most to lose with potential bracket changes, but also the most adverse impact if they accelerate significant amounts of income but no changes occur. Taxpayers earning significantly above $400,000 receive less potential benefit for accelerating income. But if you are already in the 37% marginal bracket, there’s limited downside to accelerating income, even if tax brackets are not changed (and still some benefit if the Biden tax plan is implemented).

- Accelerate Capital Gains – For taxpayers earnings above $400,000, consider taking some chips off the table and realizing capital gains in 2020 (taxed at 20%) vs. waiting until 2021 (taxed at 39.6%). This could serve as a form of “tax insurance” to hedge against the risk of potentially dramatic increases in long-term capital gains rates next year.

- Gift Appreciated Assets Using Lifetime Exemption – Holding appreciated assets until death would rapidly switch from a very desirable tax strategy to an especially undesirable one, because taxing all appreciated investments at death, all at once, would be even more likely to push capital gains into the new higher capital gains rate. In addition, the current high estate tax exemption may be potentially lost. For taxpayers with a net worth what will almost certainly subject their estate to an estate tax liability upon their passing, there is a strong impetus to act now, to ensure they do not lose out on maximizing the current exemption amount.

- Spousal Lifetime Access Trusts (SLATs) – The use of SLATs by married couples can allow an individual to utilize their full gift/estate tax exemption while retaining some access to the funds via their spouse. It’s not a perfect solution, however, as death of the spouse or divorce can substantially complicate matters.

- Take Itemized Deductions in 2020 – Most high income taxpayers who already itemize deductions will benefit more by claiming their deductions in 2020 at current rates, due to the potential of the Biden-proposed cap of 28% on the value of itemized deductions. Also consider bunching itemized charitable deductions in 2020 (e.g. Donor Advised Fund).

- Roth IRA vs. Traditional IRA – Lower income taxpayers will benefit more from the retirement contribution tax credit by contributing to a Traditional IRA. Higher income taxpayers may benefit more from contributing to a Roth IRA (if under income phase-out range).

- Roth Conversions – This would be a great way for high income taxpayers to accelerate income in 2020. This would be a logical place to pull income from.

- Business Owners – Accelerate income in 2020 by accelerating certain billing, such that more income is collected and received in 2020. Those same businesses can delay paying certain expenses until the beginning of 2021, in order to increase taxable income in 2020 and decrease taxable income in 2021.

How We Can Help

At Mission Wealth we can help you analyze your real estate portfolio, including the income yield and rate of return you are receiving. If you plan to purchase a new home, we can help evaluate your real estate holdings and act as a sounding board to help you make smart decisions. We’ll also review your insurance coverage to make sure you’re properly covered. We can coordinate with your existing real estate professionals or introduce you to others.

We can also help you determine alternatives and tax consequences related to those alternatives, if applicable. In addition, we can help you categorize your spending and make real estate recommendations in order to ensure your spending is aligned with your goals. This will also help you understand how much you can safely spend without jeopardizing your long-term financial security.

00390057 12/20