Mission Wealth Market Update 6/17/22

Fed Acts Against Stubborn Inflation

While downward market gyrations are unpleasant, we have been here before and successfully navigated them with patience and diligence. We believe in underlying fundamentals and take a long-term view. During times of market dislocation, discipline is usually rewarded; we believe the current environment offers enhanced opportunities for portfolio rebalancing and tax planning, which may add to the long-term returns for our clients.

While supply chain issues are still an overhang from the pandemic, the massive infusion of cash and accommodative monetary policies of the past several years has led to heightened inflation. Russia’s invasion of Ukraine has added to upward pressure on energy prices, with elevated inflation lasting much longer than many had anticipated. The risks of a recession (which normally lowers inflation by its nature) has heightened on the back of recent developments. There is some controversy as it pertains to timing and the direction of the underlying economy. We have been in constant contact with multiple investment partners who have unique insights into all sectors of the economy. Feedback has been consistent with our base case: there has yet to be a deterioration in underlying business fundamentals and corporate balance sheets remain healthy. Though that is subject to change. Corporate earnings as whole (SP500 via FactSet) have reported positive year over year growth, but the velocity is slowing. The IMF estimates world GDP to come in around +3.6%, for 2022, a slow down from 2021 which was 6.1%. Strong corporate balance sheets are driving an uptick in share buyback activity, which may provide support for stocks moving forward. With this said, the situation is fluid and the Fed is actively trying to slow down the economy to depress price movements.

Fed Raises Rates

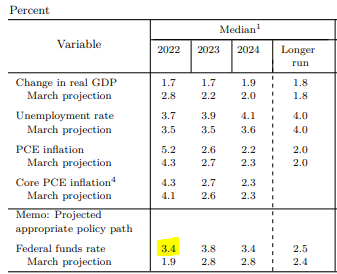

At this week’s FOMC meeting, the Fed announced a 0.75% increase to the fed funds rate, bringing the target range to 1.5% - 1.75%. The Fed believes additional increases will be appropriate in bringing inflation back towards its 2% objective. The move was broadly in-line with market expectations and followed a hotter than expected headline May CPI report.

The Fed’s “dot plot” economic projections now indicate the fed funds rate will be in the 3.25% - 3.5% target range by end of the year, up a full 3.25% from where we began the year at 0% - 0.25% and implying another 1.75% of increases this year. Fed Chair Powell also indicated another 0.75% hike may be likely at the July meeting as they attempt to front load hikes (there are four remaining Fed meetings: Jul, Sep, Nov and Dec).

The decision came on the back of upward revisions to the Fed’s forecast for headline inflation (core inflation revisions were marginally higher), driven by continued supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. During his press conference, Fed Chair Powell also referenced a recent uptick in forward-looking inflation expectations, which he indicated was key in underpinning the decision to raise rates by 0.75%.

Also notable was a reduction in the Fed’s outlook for economic growth to be marginally below trend this year. However, this adjustment in real GDP was largely driven by inflation revisions; adjusting for increases in inflation, the Fed’s expectation for nominal GDP for 2022 is north of 7%.

Speaking of the economy, the Fed statement noted overall economic activity appears to have picked up after edging down in Q1. The labor market remains strong, with job robust job gains over recent months, and the unemployment rate has remained low. Chair Powell reiterated this view at the press conference, underscoring the relative health of the economy, supported by robust consumer and business fundamentals. Clearly, the Fed is more concerned with taming inflation given the economic backdrop.

Market Reaction

The initial stock market reaction following the announcement Wednesday was broadly positive; however, market sentiment quickly soured on Thursday with concerns rising about the ability of the Fed to tighten and achieve a soft landing, particularly with a backdrop of global central bank tightening after the Swiss National Bank and the Bank of England followed suit in raising rates and expectations for an ECB rate hike later this year. Stock markets finished marginally higher on Friday, but still down on the week.

Bond yields fell (bond prices appreciated) following the Fed’s announcement, with the benchmark 10-year Treasury yield finishing the week at 3.23% after trading as high as 3.48% ahead of the decision. We anticipate bond yields to be range bound moving forward and the primary determinant of future returns for high quality (core fixed income) bonds to be the current yield on a bond portfolio, with many of our preferred bond holdings offering much more attractive yields today relative to the start of the year.

Outlook & Portfolio Positioning

To be sure, the risks of a recession have heightened on the back of recent developments; however, we do not believe a recession will occur over the near-term. We do not believe the extent of this year’s stock market decline is reflective of the underlying economic fundamentals, though we did anticipate an uptick in volatility as historically massive accommodative policies were taken away. But the volatility has been to the down side where normally it would be mixed. We are reminded that corrections happen. They used to occur all the time and we factor those into our financial plans. Current dynamics may be indicative of the market coming to grips with a new regime shift away from easy monetary policies towards higher interest rates (a more normal environment of decades past) and consequently higher cost of capital. In such an environment, the outsized returns on stocks witnessed over the prior decade ending 2021 may be more difficult to achieve. As a result, we do expect a moderation in stock market returns moving forward, but are constructive on the outlook from current levels.

We have actively been positioning client portfolios towards asset classes we believe will perform relatively well in an elevated inflation and rising interest rate environment. The current market dislocation may offer unique opportunities for less liquid investment strategies that may be able to take advantage of market dislocations to source outsized return opportunities. We have also been taking the opportunity to tax loss harvest across taxable accounts where appropriate, to enhance the after-tax returns for our clients.

We are staying disciplined in light of current market dynamics. We aren’t letting the short-term noise and news headlines affect our investment decision-making or judgement. Discipline may be rewarded in the current environment, which we believe offers enhanced portfolio rebalancing opportunities that may ultimately add to the long-term returns for our clients.

As always, should you have any questions, please don’t hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00454737 06/22