Market Update

With the second quarter of 2022 now in the books and summer upon us, we wanted to reflect on what has been a challenging first half of the year and our outlook for the second half of 2022 and beyond.

Uncertainty dominated the first half of the year. Concerns about inflation, the Fed raising rates, Russia’s invasion of Ukraine, and more recent concerns surrounding an economic slowdown all weighed on the market. These concerns were borne out in elevated levels of volatility and broad weakness across public stocks and bonds.

We have experienced similar market dislocations before and are well prepared to continue to navigate the current environment. It’s times like these that discipline may be rewarded. Dislocations may provide for enhanced opportunities and have historically offered attractive upside potential. We believe our portfolios are well-positioned and staying disciplined and focused on long-term fundamentals is key in achieving our clients' financial goals.

Divergence in Performance Provides Opportunities

Traditional Correlations Break Down

The start of 2022 saw traditional asset class relationships break down. Historically, stocks and bonds tend to be inversely correlated: when the stock market sells off, bonds tend to hold their value or rally. The opposite held true this year as investor concerns mounted around rising interest rates on the back of elevated inflation and Fed rate increases, leading to both stocks and bonds coming under pressure. Ahead of 2022, we had increasingly allocated to alternative income-oriented strategies we believed would fare well in a rising interest rate and still above-trend growth environment. We are pleased that our view was vindicated, with these strategies helping to shelter our clients' portfolios from the broad-based public market weakness.

Moving forward, we believe we may once again revert towards a traditional relationship between stocks and bonds, particularly given our outlook that bond yields may be range-bound over the near-term. As such, core fixed income may again provide a level of stability and a reliable income stream within client portfolios.

Inflation and Fed Policy

Inflation concerns dragged on sentiment during the first half of the year, with already elevated inflation being exacerbated by the war in Ukraine, which drove food and energy prices even higher. With this backdrop, Fed policy pivoted from an easy policy stance to a tighter one focused on reining in inflation. The Fed acknowledged elevated inflation was no longer transitory and became more aggressive with its interest rate hikes following the initial 0.25% increase in March. The Fed raised the fed funds rate by 0.50% in May and 0.75% in June and indicated a 0.50% or 0.75% increase is likely in July.

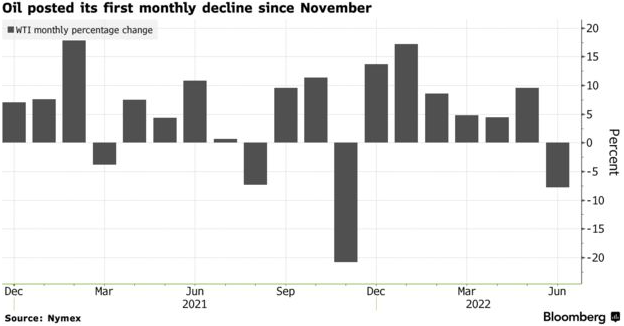

We believe peak inflation levels may have already been experienced, with hints of inflation abating on the back of recent softness in commodity prices, while forward-looking measures of inflation expectations have reduced towards long-term averages. As such, recent market commentary has revolved around the notion that the Fed may not be as aggressive in raising rates moving forward.

Policies Contribute to Volatility

Economic Growth

Tighter financial conditions, lingering input price and supply chain pressures, and the potential for a Fed policy mistake all drove concerns about a slowdown in economic growth. The market sell-off itself was also cited as a growth worry, given the potential resulting wealth effect. Global growth concerns were further compounded by widespread lockdowns in Shanghai related to China's continued strict adherence to a zero Covid policy (though these policies have subsequently been relaxed), while China also announced a number of offsetting accommodative policy support measures.

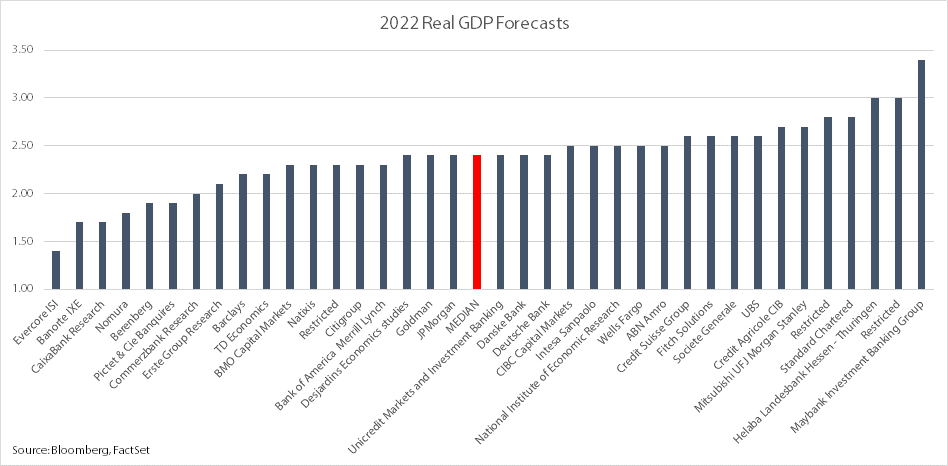

Despite growing concerns surrounding an economic slowdown, many underlying economic data points have held up. Manufacturing production is running at a 6.6% annualized rate through the first five months of the year; nonfarm payrolls are strong, and the unemployment rate has dropped from 3.9% to 3.6%. In April, both real consumer spending and real personal income were at record highs. Consumer balance sheets remain healthy and in speaking with industry partners, there is yet to be a material deterioration in business fundamentals. In analyzing the nearly 40 economic forecasts that were updated post the Fed’s June FOMC meeting, the median expectation for U.S. real GDP growth for 2022 is 2.40%, still above the long-term trend growth rate of ~2%.

Recession? Not Base Case...but Would be Mild

Outlook: Stocks

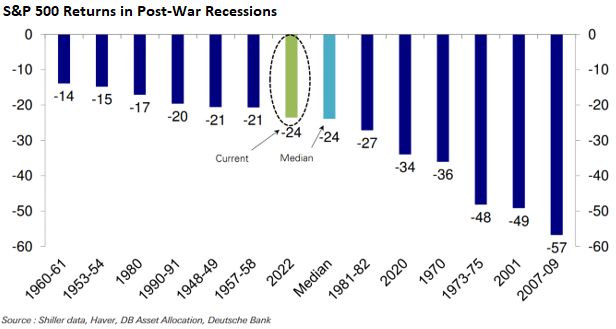

We are constructive on the outlook for stocks at current levels. While we continue to anticipate elevated levels of volatility as accommodative policies have been reversed, we nonetheless believe the market’s reaction has been overdone and doesn’t reflect underlying fundamentals. While recessionary risks have certainly become elevated, it is not our base case over the near term. However, the market has reacted as if a recession were imminent. In the instance a recession were to occur, it is likely to be a mild one. The current market sell-off is already in line with the median recession-driven selloffs of the post-war era. With this context, we believe downside risks from these levels may be contained.

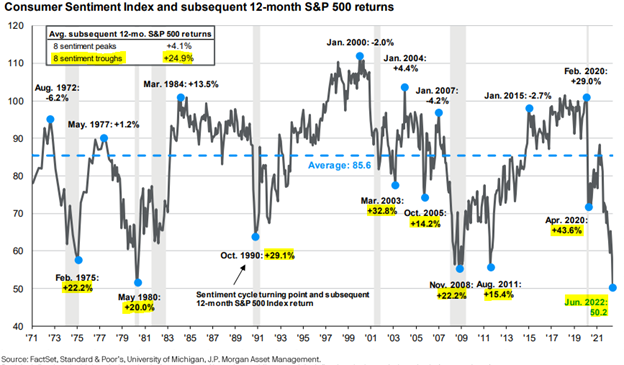

At the same time, many sentiment and positioning indicators suggest the potential for upside stock market returns. Consumer sentiment has been in the news recently after hitting a historic low. The following chart is interesting as it depicts the subsequent 12-month return for the S&P 500 following consumer sentiment troughs. After consumer sentiment bottoms out, the average 12-month return has been +24.9%. If history is a guide, there is clear upside potential from current levels.

Outlook: Bonds

After experiencing a historic move higher in yields, we believe the bulk of the pain has been felt for the bond market. As such, forward looking returns are likely to be primarily driven by current yields on bond portfolios. For reference, the yield to maturity on the broad bond market – as referenced by the Bloomberg U.S. Aggregate Bond Index – ended the second quarter at 3.8%. Select preferred bond holdings of ours are yielding much higher than that. Yields are the single most important factor in determining future returns for the bond market: historically, there has been a 94% correlation between the current yield and the subsequent five-year return. While we may not be out of the woods yet from a volatility standpoint (for reference, the 10-year Treasury has traded in a wide band recently, moving from below 2.8% to nearly 3.5% and as of writing back down to 2.8%, all in the space of a month), we believe today’s current yields across our bond allocations offer more attractive return potential relative to just six months ago.

We continue to favor income-oriented strategies that may do well in an elevated inflationary and rising interest rate environment. These strategies have performed well this year and may continue to do so given the economic backdrop. The current market dislocation may also offer upside potential for select strategies able to take advantage of unique opportunity sets. We have also been proactive in the current environment with respect to tax loss harvesting across taxable accounts, where appropriate, to enhance the after-tax returns for our clients.

Overall, we continue to focus on long-term fundamentals and believe our client portfolios are well positioned to continue to meet the financial goals of our clients.

Should you have any questions, please don’t hesitate to contact your Client Advisor.

We wish you a safe and enjoyable Fourth of July.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00455903 07/22