Market Update

With the recent rise in volatility, we wanted to provide our thoughts on the market and the economy.

- Importantly, we have seen similar market volatility and will see market volatility again. Our portfolios are built to withstand and navigate times like this.

- The dominant theme underpinning markets appears to have reached an inflection point, with concerns rising about the health of the economy.

- More data is needed, and while we don’t anticipate a near-term recession, the economy may be slowing its rate of growth.

- Sell-offs happen, but not overreacting and staying focused on the long term is critical.

When Bad News Becomes Bad News

The overarching market theme appears that we reached an inflection point from “bad economic news is good,” which indicated a greater chance the Fed will cut rates, and in turn helped underpin markets… to now “bad economic news is bad,” which has caused a rise in recessionary fears and concerns the Fed is behind the curve. Throw in a surprise interest rate hike by the Bank of Japan (which raised rates to the highest level in 15 years) and the resulting unwinding of the Yen carry trade (which is selling/borrowing Yen at near-zero interest rates in favor of higher-yielding currencies/assets), plus stretched equity valuations, which arguably exacerbated the move lower. Sentiment was also not helped by rising Middle East tensions and political uncertainty.

The uptick in market volatility came after the market rallied last Wednesday following the July Federal Open Market Committee (FOMC) meeting, where Fed Chair Powell all but said the Fed would cut rates in September. Sentiment then turned decidedly negative, primarily on the back of last week’s softer-than-anticipated July employment report (nonfarm payrolls rose 114k vs. consensus expectations of 175k, and the unemployment rate rose to 4.3%), as well as a softer Institute for Supply Management (ISM) manufacturing print.

However, we also know the market tends to overreact, both to the upside and the downside, and this may be another example. It is still too early to say whether we’ve reached the bottom – and additional volatility may be likely – however, the data we’ve seen thus far doesn’t dramatically change the economic narrative or indicate an imminent recession. Indeed, today’s ISM services data came in above expectations and high-frequency data indicate a still-strong consumer. With that said, more data is needed, and while we don’t anticipate a near-term recession, the economy may be slowing its growth rate.

Sell-Offs Happen…

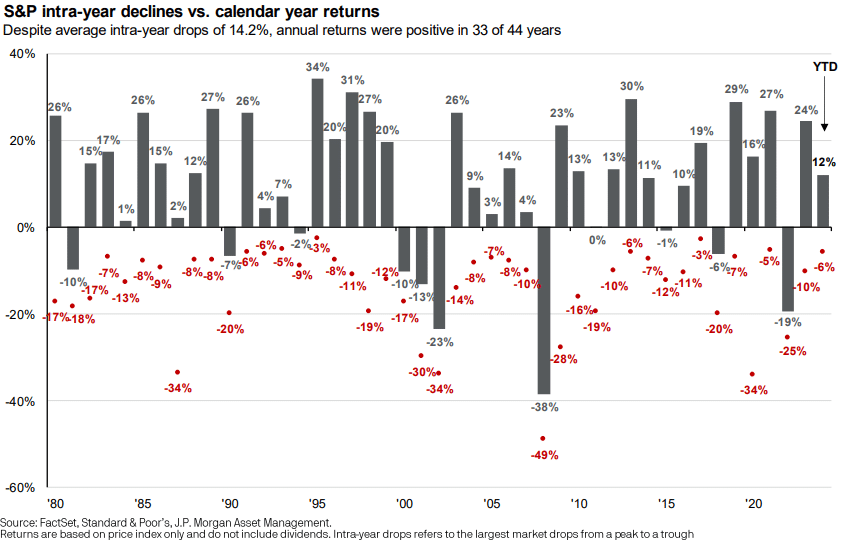

While sell offs are never welcome, they are par for the course for investments in the stock market and act as a natural release valve. Today’s rise in volatility may have caught some off guard, as the volatility comes after an extended period of relative calm.

To put today’s stock market into perspective, as of close today (8/5/24), the S&P is -8.5% from its all-time high. This compares to the average long-term intra-year decline of -14.2%.

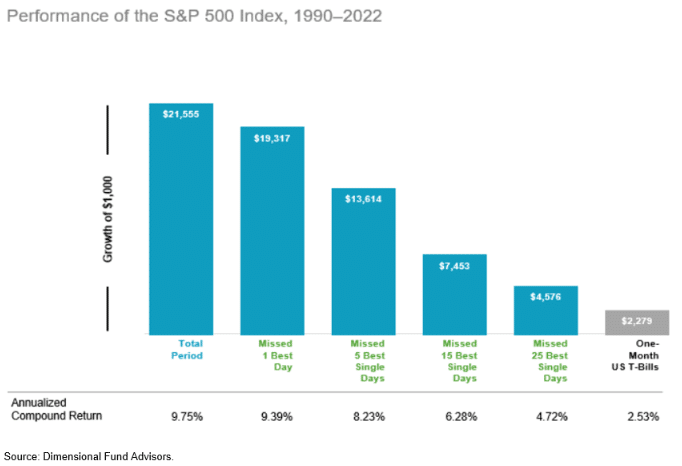

…But Reacting Can Hurt Performance

Importantly, and despite these intra-year declines, annual returns for the S&P have been positive in 75% of years. Indeed, and despite the recent weakness, the S&P 500 is still soundly positive this year. Moreover, the best stock market performance days typically occur after periods of increased market volatility. Not reacting to current conditions and staying focused on the long-term can be rewarded. Conversely, reacting and missing out on just a handful of those best days can harm long-term portfolio performance.

Benefits of Diversified Portfolios

We believe our portfolio construction can help during times of stock market duress. We take a broadly diversified approach to our stock market exposure and have not overallocated to high-profile growth names that are now under pressure. Rather, we are agnostic to allocations to Growth vs. Value and view both styles as enhanced rebalancing tools during times such as this. For instance, value stocks have significantly outperformed growth stocks over the last month. Leading into the current time period, we had been favoring value stocks over growth stocks, based on relative performance at the time.

Maintaining allocations to core fixed income has provided diversification benefits. Our high-quality fixed income has broadly rallied in the face of an uptick in stock market volatility as interest rates have decreased and supported bond prices. Likewise, our allocations to alternative asset classes (broadly private equity, real assets, and direct credit) have helped buffer much of the downward moves in the stock market. Where suitable, we have favored trimming some stock market exposure on recent strength in favor of private equity, which we anticipate will provide enhanced risk-adjusted returns over the long haul.

We continue to monitor the market closely and believe our portfolios are well positioned to navigate the current timeframe and continue to meet our clients’ long-term objectives.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 10/29/25: Fed Delivers Rate Cut as Economy Shows Resilience

October 29, 2025

Market Update 9/17/25: Fed Resumes Rate Cutting Cycle — What Does This Mean for Markets and Investment Portfolios?

September 17, 2025