By Kieran Osborne, MBus, CFA®

Chief Investment Officer

Welcome to Mission Wealth’s market perspectives.

I’m Kieran Osborne, a Partner and the Chief Investment Officer at Mission Wealth and I’m pleased to be presenting our outlook for financial markets and the economy today.

Firstly, I’d like to wish everyone good health – we hope you’re staying safe and well during these unprecedented times.

We’ve said in prior commentaries that 2020 will be remembered as the year of the virus and COVID continues to have a significant impact on financial markets, the economy and our outlook moving forward.

Market Update

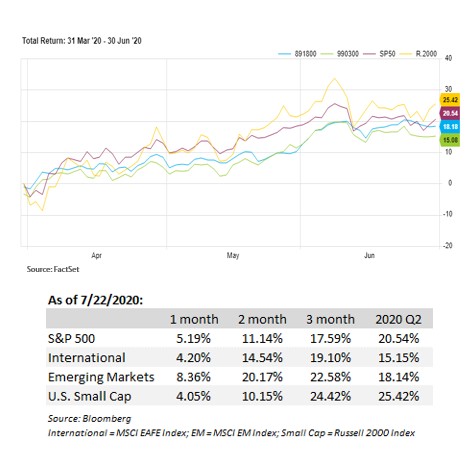

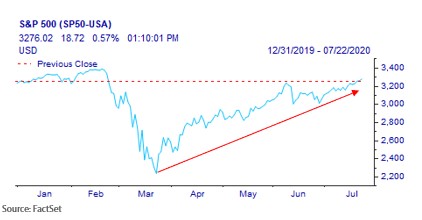

After concerns surrounding the coronavirus pandemic drove volatility and the fastest bear market in history in the first quarter, market sentiment improved dramatically in the second quarter of the year and stocks posted significant gains, with the S&P 500 experiencing its best quarterly gain since 1998. Small cap stocks particularly benefited from some of the stimulus measures enacted that were focused on smaller sized businesses. So what drove markets higher? Despite a worsening situation more recently, the trajectory of the virus has actually been better than some of the original dire forecasts. We also got massive unprecedented levels of monetary and fiscal stimulus, both here in the U.S. and globally. And that in turn may have helped to underpin better than previously anticipated economic data, while ongoing optimism regarding potential treatments and vaccines also helped propelled markets higher. Critically, investment discipline and maintaining full investment was key throughout the market dislocation: those who tried to time the market or sold and missed out on the market rally missed out on substantial returns.

Turning to the economy, we believe the U.S. economy already experienced the shortest, sharpest recession ever recorded. We anticipate GDP is likely to contract by around -5.0% this year, with particular weakness concentrated in the second quarter. The massive fiscal and monetary policy stimulus may help propel growth moving forward but much of the recovery will be dependent on the trajectory of the virus. However, unlike other periods of economic uncertainty, there is an end in sight in the form of a widely available vaccine, which should be available sometime next year. At that point the economy may get back to a sense of normality. We do expect accommodative policies for some time and a low interest rate environment as a result. The recent uptick in COVID cases has caused some states to pause or reverse the reopening process. COVID concerns combined with the uncertainties regarding the upcoming expiration of unemployment benefits may weigh on consumer spending. We may also experience an uptick in headline risk and volatility as we approach the November election, however legislative risks may actually be relatively limited regardless of the outcome of the election given neither party is expected to have a filibuster proof majority in the Senate. The result is likely to be ongoing political gridlock in Congress.

What is our outlook for asset prices?

We expect stock prices to moderate over the near-term while volatility may remain elevated as a result of ongoing uncertainties. With that being said, we do believe long-term returns for global equities remain compelling and may outperform Treasuries in particular, given the low interest rate environment and backdrop of ongoing accommodative policies. Within bonds, we continue to favor high quality corporate bonds over Treasuries and maintain dedicated satellite fixed income allocations. Investment grade corporate bonds and satellite fixed income continue to trade at relatively attractive valuation levels and the Fed has outright supported corporate bond prices. We also see some unique opportunities in less trafficked areas of the bond market which may offer upside return potential.

Overall, we believe our portfolios are well positioned for the forthcoming period.

What actions have we been taking?

Firstly, we followed our disciplined approach to portfolio construction and rebalancing throughout the market dislocation, and added broadly to stock exposures through March and April.

Now that stocks have rallied, we are again staying disciplined and are broadly trimming stock exposures on recent strength, having benefited from the recent stock price appreciation. We are favoring investments into investment grade corporate bonds, satellite fixed income and direct credit opportunities.

We took the opportunity to tax loss harvest where appropriate to enhance our clients after tax returns and have also reduced legacy concentrated stock exposures where it makes sense.

We continue to favor dedicated allocations to global equities. Despite the recent stock market strength, long-term return expectations remain attractive for stocks relative to Treasuries in particular.

We believe unique opportunities exist across the bond spectrum in select securities that continue to trade well below fair intrinsic value and may offer upside return potential for many of our bond funds.

Overall, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the long-term financial goals of our clients.

Stocks Rally

After concerns surrounding the coronavirus pandemic drove volatility and the fastest bear market in history, market sentiment improved significantly in the second quarter and the S&P 500 posted its strongest quarterly gain since 1998, rallying over +20%.

International and Emerging Markets also experienced significant strength, while small cap stocks particularly benefited from many of the stimulus measures enacted, returning more than +25% during the second quarter.

So What Drove Stocks Higher?

While worsening in some states recently, the trajectory of the virus has actually been better than some of the original dire forecasts.

Policy makers were also fast to enact massive levels of monetary and fiscal stimulus, both here in the U.S. and globally. Thus far, the size of the U.S. fiscal stimulus packages cumulatively is around $2.8 trillion with another $1 trillion or more on the way.

The Fed has also indicated it will use all the tools available to it to ensure the recovery is as strong as possible.

Those steps may have, in turn helped to underpin better than previously anticipated economic data, while states reopened earlier than many had previously anticipated. Some economists had been predicting the unemployment rate would exceed 20%. It’s currently almost half that at 11.1%.

Finally, ongoing optimism regarding potential treatments and vaccines also helped propelled markets higher, with many trials showing encouraging results.

Critically, Investment discipline was rewarded throughout the market dislocation. Volatile markets and dire headlines tempted some investors to abandon their long-term financial plans. However, we know that timing the market is impossible.

Rather, staying fully invested was key: the best trading days often occur after a market sell-off and missing out on these days has a significant negative impact on investment performance. 2020 has been no different.

In fact, as this chart depicts, had you missed out on the five best trading days of this year for the S&P, you would have missed out on 30% returns.

Many investors ask,"How do you reconcile record unemployment numbers and strong market performance? How can stocks be so strong in the face of poor economic data?"

The answer is found by understanding that market prices are forward-looking and based on future expectations for growth, while economic data is inherently backward-looking.

We believe the market priced in expectations for record unemployment and a recession before the data was released. After the market low experienced in March, real time economic and virus data improved, while massive global stimulus measures were announced, all drove increases in future growth expectations.

The reality is we are now at the beginning of a new economic growth phase and with it comes opportunities.

We believe the market may be looking through near-term economic weakness and towards the growth potential in 2021 and beyond on the back of unprecedented levels of fiscal and monetary policy support, which may help underpin growth and asset prices moving forward.

The Economy

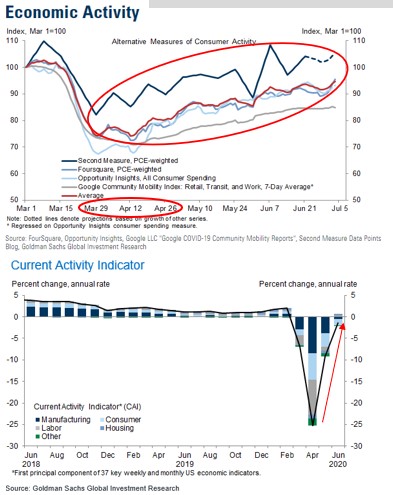

We expect the U.S. economy has already experienced the shortest, sharpest recession ever, with data indicating the economy likely bottomed out in April.

We expect the U.S. economy has already experienced the shortest, sharpest recession ever, with data indicating the economy likely bottomed out in April.

Overall, we expect 2020 U.S. GDP is likely to contract by approx. -5%, with particular weakness concentrated in the second quarter, before recovering in the latter half of the year.

Importantly, the recovery will be dependent on the trajectory of virus and reopening. We are currently experiencing this via some states pausing or rolling back reopening plans. The reality is the economic recovery will take time. However, unlike other periods of economic uncertainty there is an end in sight. What I mean by that is once a vaccine is widely available (which should happen sometime in 2021) the economy may return to a sense of normality.

Fiscal stimulus

Massive fiscal stimulus has helped market sentiment and we have been encouraged by the proactive approach policymakers took to speedily enact much needed economic stimulus programs to counteract the negative impacts of social distancing and economic lockdowns.

Europe just announced an additional €750 billion economic recovery fund, while U.S. fiscal packages cumulatively total around $2.8 trillion so far with another $1 trillion or more likely very soon. To put some context around the scale of current fiscal policy, the size of the emergency relief package at the height of the Great Financial Crisis in 2008 was less than $800 billion but thought enormous at the time.

As this chart shows, Global discretionary fiscal easing represents more than 7% of world GDP and the U.S. has been amongst the most proactive, with U.S. fiscal policy closer to 12% of U.S. GDP.

Simply put, the degree of current fiscal policy support globally is unprecedentedly large.

However, we do expect the longer term implications of such policies will be higher taxes or reduced federal spending, or a combination of the two.

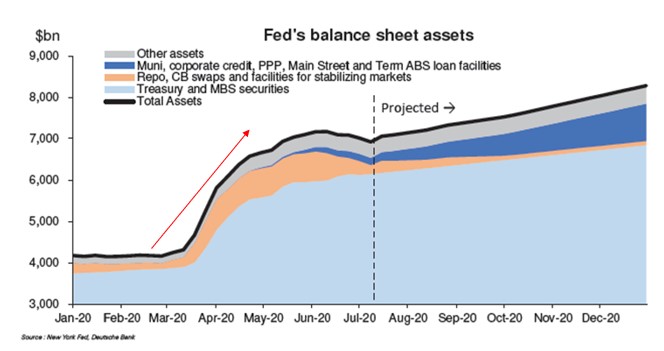

Global Central Banks

Global Central banks have also been very active in providing accommodative monetary policies, with 10 out of 10 major central banks pursuing easy policies, both by cutting interest rates and expanding balance sheets via quantitative easing programs aimed at buying up assets. Indeed, this chart depicts the large recent increase in the Fed’s balance sheet. The Fed has also clearly communicated its commitment to using all the tools at its disposal to ensure the recovery is as strong as possible.

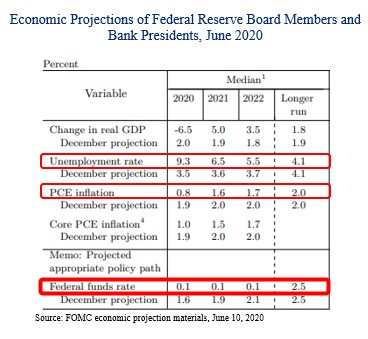

It’s very interesting to take a look at the Fed’s own economic projections, shown in this  chart, particularly with respect to the Fed’s dual mandate of contained inflation around 2%, and full employment.

chart, particularly with respect to the Fed’s dual mandate of contained inflation around 2%, and full employment.

Importantly, the Fed expects contained levels of inflation below their 2% target and the unemployment rate to remain above long-run equilibrium rate through 2022.

The implication is clear: accommodative policies will be with us for some time yet, and expect short term rates to stay lower for longer, which is borne out in the Fed’s own projection of no fed funds rate increases through 2022.

Virus Tracker

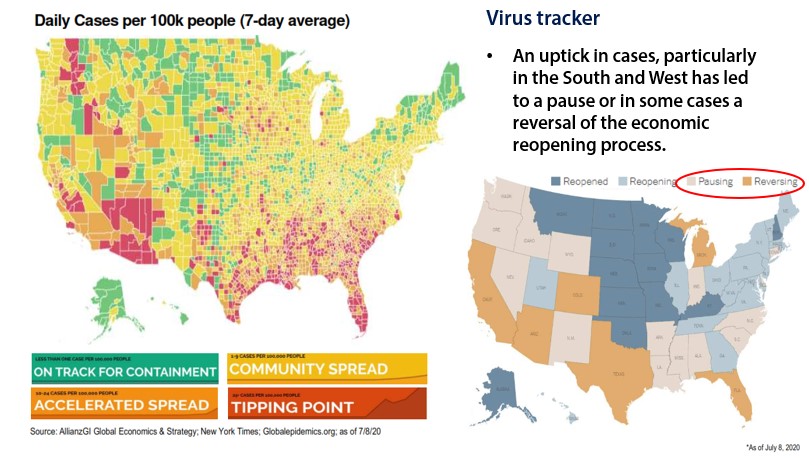

Despite the positive policy support, we have experienced a recent uptick in COVID cases, particularly in the South and West, as highlighted in this chart, which shows daily cases per 100,000 people. The short of this chart is red and orange depict higher case growth, while green is much better. This uptick in cases has led to a pause or in some cases a reversal of the economic reopening process, as shown in this chart.

Consumer Concerns

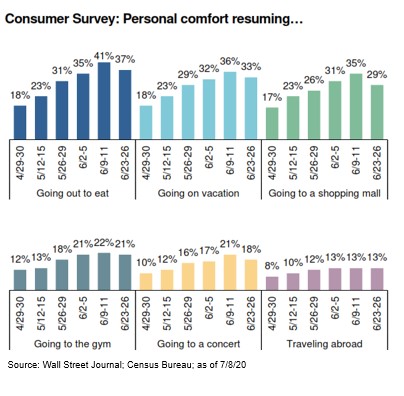

The recent uptick in cases is causing renewed consumer concerns. And this is important, because consumer spending drives about 70% of U.S. GDP.

For instance, some businesses that reopened are now forced to close again and lay off workers for a second time.

With the recent uptick in cases, consumers have gotten less comfortable spending, which is highlighted in this chart showing a recent decline in personal comfort for such things as going out to eat or going to a shopping mall.

On top of which, the $600/week in additional unemployment benefits are set to expire July 31st – if there is no replacement, consumer spending could be further negatively impacted.

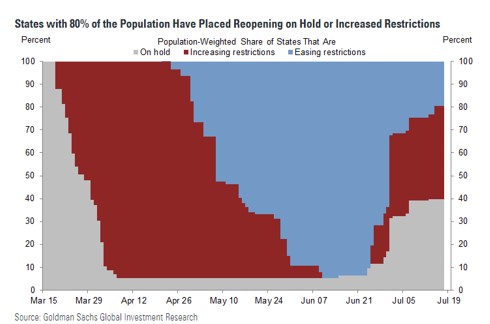

The implication of the recent uptick in cases and states rolling back or pausing reopening plans – which you can see clearly highlighted in this chart – is that we should expect a moderation in economic growth over the near-term. Indeed, real time economic data indicates a recent deceleration in activity across the U.S. and this may be exacerbated if additional fiscal stimulus is delayed. The economic reality is that this economic recovery will take some time and we may experience some setbacks along the way.

The November Presidential Election

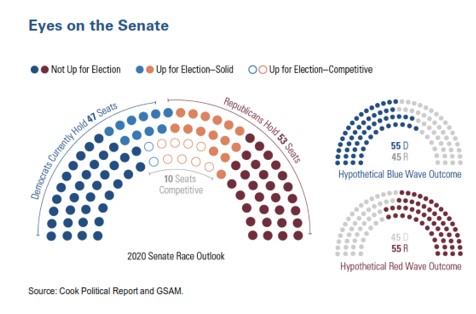

Turning to the election in November, Aside from Presidential election, which everyone is well aware of, Congress will also be closely watched. The House will almost certainly remain Democrat controlled, however the Senate may be keenly contested. As this chart shows, there are 10 competitive seats up for re-election.

It’s important to note however, that the Senate requires 60 seats to pass legislation along party lines.

Even in a hypothetical “Blue Wave” or “Red Wave” outcome, the controlling party would not have a filibuster proof majority of 60 seats.

As a result, legislative risks may be limited regardless of the outcome of the election, with ongoing political gridlock likely in Congress.

Outlook

Outlook For Asset Classes

Given the significant recent strength, we expect stock prices to moderate over the near-term, with possible downside risks and ongoing volatility due to:

- The recent uptick in COVID cases and resulting deceleration in economic growth.

- Uncertainty regarding extension of current stimulus package.

- Uncertainties leading into the November election.

- Renewed and increasing US-China tensions.

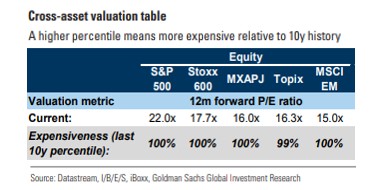

- Stretched valuations – which you can see in this chart.

- As well as some worrying retail investor momentum trends which have propelled large tech names in particular to ever more expensive levels.

Stocks

Stocks

Despite potential short-term volatility and moderation in returns, we believe long-term returns for Global equities remain compelling and may outperform Treasuries in particular, given the low interest rate environment and backdrop of accommodative policies, which should be supportive of risk-on assets.

Bonds

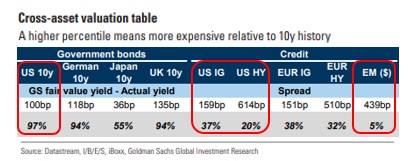

In terms of bonds, we continue to favor high quality corporate bonds over Treasuries and maintain dedicated satellite fixed income allocations.

- As you can see in this chart, Treasuries as measured by the US 10 year trade at relatively expensive levels, whereas investment grade corporate bonds, high yield and Emerging Market bonds offer relative value.

- With a backdrop of low interest rates and accommodative policies, Treasury returns may be challenged, whereas credit may benefit from spread compression and price appreciation.

- The Fed has also outright supported corporate bond prices, which has also benefited satellite fixed income asset classes.

- We also believe unique opportunities currently exist across less trafficked areas of the bond market, with select securities trading well below intrinsic value, which may offer upside return potential for our bond funds.

- Less liquid credit funds in particular may offer equity-like return potential with lower volatility in the current environment.

Overall, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the long-term financial goals of our clients.

Thank you for your time. We hope you stay safe and healthy.

Should you have any questions, please contact your Client Advisor.

00373060 7/20