Powell Strikes Hawkish Tone

At his widely anticipated Jackson Hole speech, Fed Chair Powell reiterated the Fed’s focus on reining in inflation, and to bring it back towards the Fed’s 2% target. In pursuing this goal, he indicated a tighter monetary policy stance may be required for some time and is likely to require a sustained period of below-trend economic growth and some softening of the labor market. On the economy, he commented that it is already slowing from the historically high growth rates of 2021, though the “economy continues to show strong underlying momentum.” While recent measures of inflation have shown improvement, Powell nonetheless stated that progress “falls far short of what the Committee will need to see before we are confident that inflation is moving down.” He also indicated that it will become appropriate to slow the pace of tightening “at some point,” as he had previously mentioned in his July FOMC press conference.

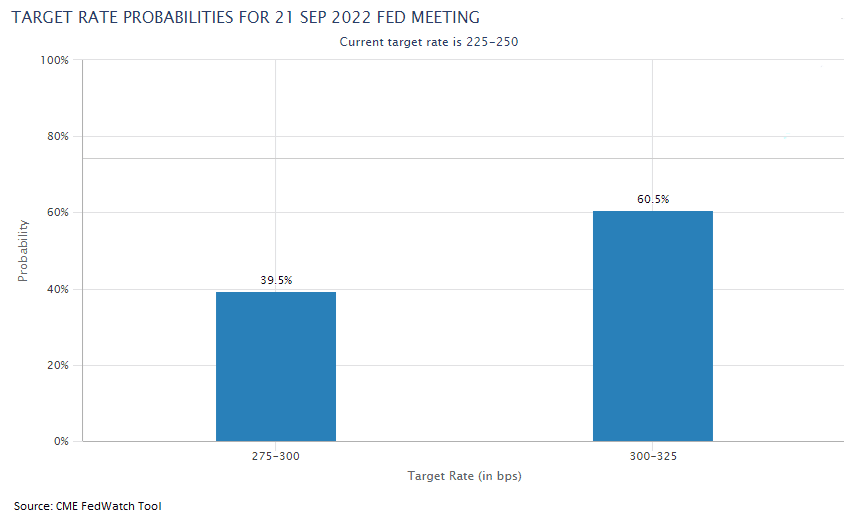

Regarding the upcoming September FOMC meeting, Powell indicated another 0.75% increase in the Fed Funds rate could be appropriate. Current market pricing infers a 60% chance the Fed raises rates another 0.75% in September and a 40% chance they raise rates by 0.50%:

Softer Inflation Data

On the topic of inflation, a softer than expected PCE price index print coincided with Powell’s speech. The headline PCE price index declined -0.1% in July (vs. consensus expectations for a rise of +0.1%) and was up +6.3% over the same period last year, down from +6.8% in June. Elsewhere on the inflation front, forward looking inflation expectations fell, with data from the University of Michigan survey showing a 4.8% year-ahead estimate, the lowest in eight months.

While inflation may now be trending in the right direction, we anticipate it will stay elevated for some time before migrating towards the Fed’s target of 2%.

Market Reaction

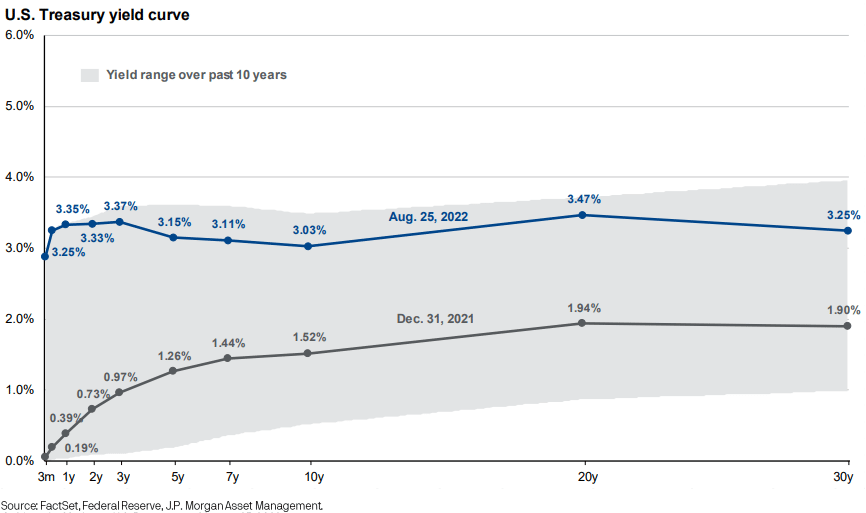

We believe intermediate and longer dated bond yields have largely moved ahead of the Fed raising interest rates. As such, we believe the bulk of the pain is now behind us for the bond market and yields are likely to be range bound around the 3% level. The implication is that current bond yields are likely to be the primary driver of forward-looking bond returns (albeit we anticipate ongoing volatility over the near-term). We continue to favor allocations to alternative income-oriented strategies that may do well in a heightened inflationary environment and with a backdrop of rising interest rates. Many of these strategies have performed very well this year despite the challenges facing broad public markets.

As always, should you have any questions, please do not hesitate to contact your client advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00462649 08/22