Mission Wealth Economic Update 7/27/22

Fed Raises Rates 75 Basis Points:

As was largely anticipated, the Fed raised rates by 75 basis points today, bringing the target range for the fed funds rate to 2.25% - 2.50%. This brings the fed funds rate in line with what the Fed considers to be the long-term neutral rate. Fed officials anticipate increasing rates further, with the statement indicating the Fed “anticipates that ongoing increases in the target range will be appropriate.” The market broadly expects the Fed to raise rates to the 3.5% range.

The Fed noted recent indicators of spending and production have softened; however, the labor market remains robust with strong job gains and the unemployment rate remaining low.

Fed officials reiterated their commitment to reining in inflation, stating “The Committee is strongly committed to returning inflation to its 2 percent objective.”

Federal Reserve Chairman Jerome Powell suggested a 0.75% rate increase may be considered in September, but upcoming economic data would need to be considered. The Fed also alluded to potential adjustments to policy should economic conditions soften and/or developments sour: the Fed will “be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

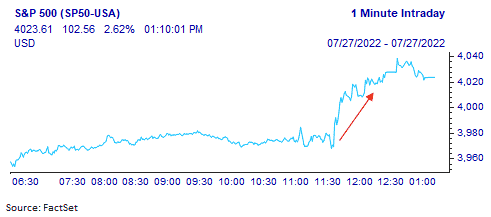

U.S. stocks were up ahead of the announcement and rallied further this afternoon, as investors were optimistic after Chairman Powell’s press conference remarks that the Fed would continue to seek price stability and that Powell did not believe the U.S. is in a recession. Powell may have taken away some of the uncertainty around future rate increases by indicating the best guide for where the fed funds rate may top out was June’s Summary of Economic Projections (SEP). The median projection then was 3.25-3.50%. He also added that while not in a recession, there is some evidence we may be seeing the economic slowdown we need. The S&P 500 closed up +2.6% today.

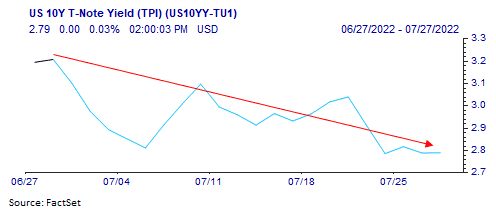

Overall, the announcement was largely in line with expectations and Powell’s remarks at the subsequent press conference reinforces our outlook that interest rates are likely to trade in range-bound territory moving forward. The current yield on bond portfolios is likely to be the primary determining factor for future bond returns. The current yield to maturity on the broad bond market, as measured by the exchange-traded fund BND, is currently 3.7% and many of our bond funds offer much more attractive yield profiles today vs. the beginning of the year.

As always, should you have any questions, please don’t hesitate to contact your client advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00459322 07/22