Mission Wealth Economic Update 7/22/2022

Overview

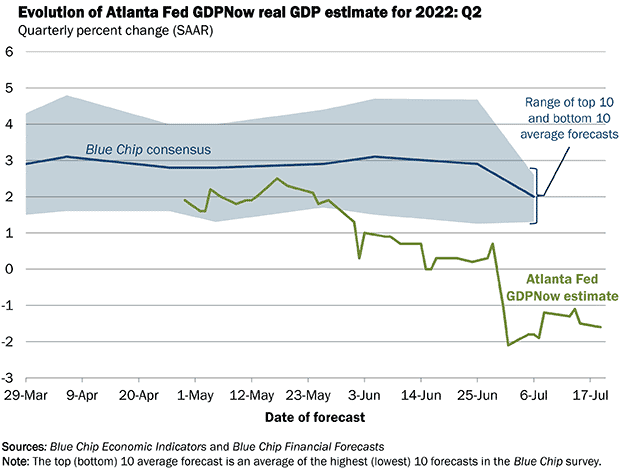

- The risk of a recession has weighed on markets recently, and there is a chance we experience two consecutive quarters of negative real GDP growth. In such an instance, the National Bureau of Economic Research (NBER) may find it hard to deem the current decline a recession when many other economic measures the NBER takes into account are pointing to expansion, not contraction.

- If deemed a recession, it would be a strange one, with exceedingly strong nominal growth, a very strong labor market and most economic data pointing up, not down.

- While a near-term recession is not our base case, if one comes to pass we anticipate it would be relatively mild. The economy has not built up significant excesses and certainly does not exhibit anywhere near the level of excesses witnessed ahead of 2008.

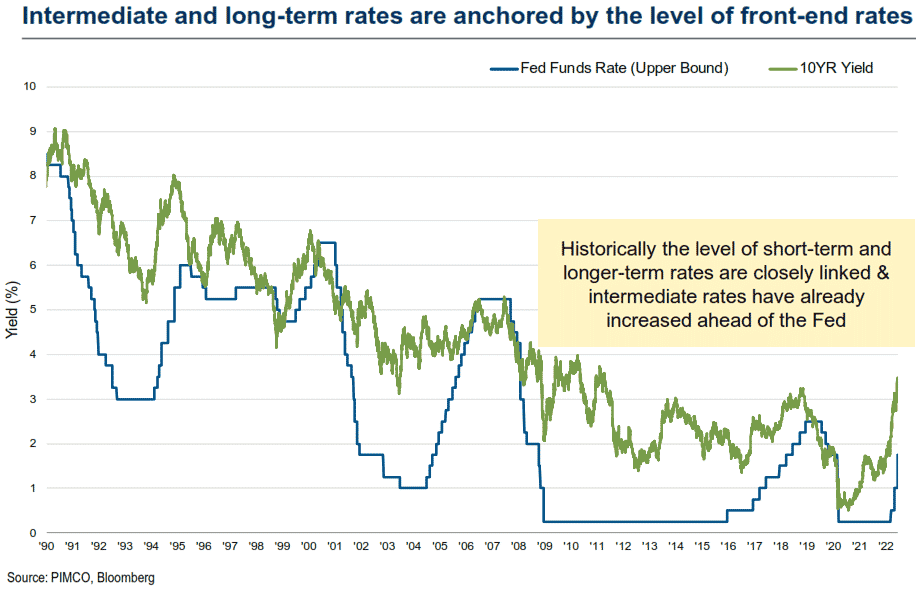

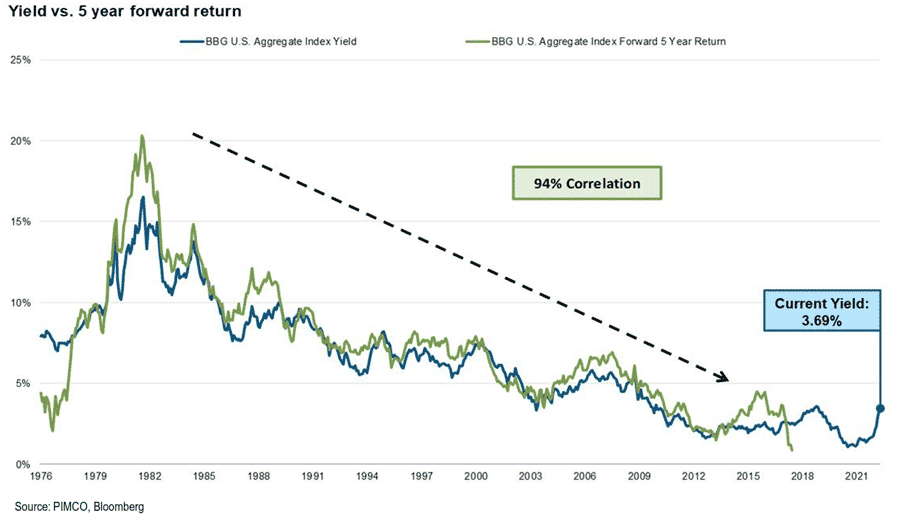

- We are constructive on the outlook for stocks from current levels and believe bond yields are likely to be range bound, with the current yield being the primary determinant of future bond returns.

- We continue to monitor developments closely and believe our portfolios are well positioned to navigate the current and forthcoming environment and will continue to meet the long-term goals of our clients.

Economic Update - Recession Risks Elevated

Many Measures of the Economy Still Positive

If deemed a recession, it would be a very strange one. For one, the labor market is exceedingly strong, with the unemployment rate dropping from 3.9% to 3.6% this year and nonfarm payrolls continuing to climb in June, exceeding expectations. The pace of job growth has been robust all year, which is not consistent with how most people think of a recession. To this end, the National Bureau of Economic Research (NBER) – which is responsible for officially identifying economic expansions and recessions – emphasize several economy-wide measures of economic activity in making its assessment. Most of these inputs are showing continued economic growth, not decline.

These measures include:

- Real personal income, which hit an all-time high in May.

- Employment data: nonfarm payrolls jobs continued to climb in June, exceeding expectations and the unemployment rate has dropped to 3.6%.

- Real personal consumption expenditures, which experienced a decline in May after hitting an all-time high in April, though is still up 2.1% over the prior 12-months.

- Retail sales, which have increased 8.1% in the last 12 months through May.

- Industrial production, which hit an all-time high in May.

Additionally, NBER considers both gross domestic product (GDP) and gross domestic income (GDI) as key inputs in determining economic cycles. GDI increased +2.5% in the first quarter to reach an all-time high and was up 11.9% over the prior 12 months. Nominal GDP (that is unadjusted for inflation) continues to grow at a fast pace: over the last four quarters, nominal U.S. GDP growth averaged 12.2% and will likely be close to 10% for the balance of this year.

Regardless, the NBER won’t make a call overnight; the organization takes months to make an official determination. If officially deemed a recession, it would be a very weird one – at least by historic standards. One with exceedingly strong nominal growth, and most economic metrics pointing up, not down. Of course, if Q2 real GDP comes in-line with consensus expectations for a positive print there is unlikely to be any debate regarding an official economic contraction.

...But Economic Growth Appears to be Slowing

Next Recession Likely to be Mild

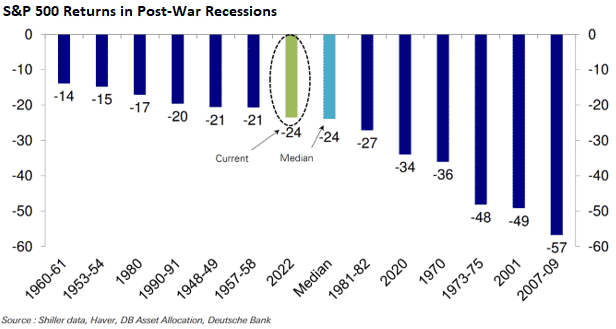

While our base case is that a recession won’t occur over the near term, if one does occur we think it would be a mild one, particularly in comparison to the two prior instances (the Global Financial Crisis of 2008 and the COVID-led recession of 2020). Both of which can be considered “once in a lifetime” events. Notwithstanding, these experiences remain fresh in the minds of many investors and may have factored into the recent market sell-off: the very hint of a recession leads some to flashbacks of the depths of the GFC. However, the reality is we currently don’t have anywhere near the level of excesses built up in the economy as we did back then, and it’s those excesses that tend to drive the worst recessionary periods. In contrast to 2008, consumers and corporations are in a much healthier situation.

Constructive on the Outlook for Stocks and Bonds

We continue to monitor macroeconomic data and developments closely. We believe our portfolios are well positioned to navigate the current and future environment, providing consistent income and growth potential to ultimately achieve our client’s financial goals.

As always, should you have any questions, please don’t hesitate to contact your client advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00458286 07/22