Changes to the Child Care Tax Credit

By Brandon Baiamonte, MS, CPA, CFE, CFM, Director of Tax Strategy at Mission Wealth

Advance Child Tax Credit Payments

Advance Child Tax Credit Payments

Many families will start to receive advance child tax credit payments beginning July 15. The IRS will pay half the total credit amount in advance payments, and the other half will be claimed once you file your 2021 income tax return. You should receive equal payments from the IRS each month between July and December.

To qualify for advance child tax payments, you must have done the following:

- Filed a 2019 or 2020 tax return and claimed the child tax credit on the return.

- Your main home had to be within the United States for more than half the year.

- Have a qualifying child who is under age 18 at the end of 2021 and has a valid social security number.

- Had modified adjusted gross income below certain limits.

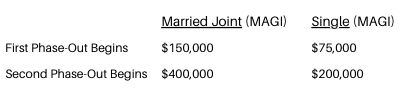

Income Phase-outs

Income Phase-outs

There are two income phase-outs for the child tax credit this year. Both are based on modified adjusted gross income (MAGI). For most people, this will be their adjusted gross income. The first phase-out reduces the tax credit to $2,000. The second phase-out reduces the remaining $2,000.

IRS Website

IRS Website

The IRS is offering the following website where you can get additional information about the advance child tax credit payments. This website also offers a tool where you can check to see if you are enrolled to receive payments, unenroll from the advance payments, or provide or update bank account information. You can also determine if you are eligible for the payments.

https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

Other Items to Consider

Other Items to Consider

If you believe your income will be too high in 2021 to receive the full child tax credit, then it might make sense to unenroll from the advance payments. Otherwise, you risk having to repay some or all of what you received when you file your 2021 tax return.

You may not receive any advance payments immediately if the IRS is still processing your tax return or if you filed an amended income tax return; however, you should begin to receive them once the IRS has processed the return and has determined your eligibility.

Your client advisor at Mission Wealth is available to help coordinate with your tax advisor and is a great resource to help plan for and implement this and other strategies.

Your client advisor at Mission Wealth is available to help coordinate with your tax advisor and is a great resource to help plan for and implement this and other strategies.

If you have questions our financial advisors can help you explore the most cost-effective tax management solutions to help cover a number of possibilities. We have no proprietary products to sell and no quotas to fill. We simply offer independent, objective advice that serves your best interests. Contact us below.

How Mission Wealth Can Help

At Mission Wealth, we help you explore the most cost-effective solutions to help cover a number of possibilities. We have no proprietary products to sell and no quotas to fill. We simply offer independent, objective advice that serves your best interests. We realize that taxes may be one of your largest ongoing expenses. We will bring tax reduction strategies to you and coordinate with your CPA on implementation. We also manage your investment portfolio in a tax-efficient manner.

DISCLOSURES: For informational and discussion purposes. These concepts should be discussed with your tax, financial and legal representatives prior to implementation.

OUR TAX REVIEWS ARE INTENDED TO COMPLEMENT YOUR ACCOUNTANT’S WORK. IT SHOULD NOT BE USED AS A SUBSTITUTE TO TAX PLANNING AND/OR TAX PROJECTIONS FROM YOUR TAX PROFESSIONAL.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISOR.

00412495 07/21