The importance of having a long-term investment philosophy — combined with disciplined rebalancing — cannot be overstated.

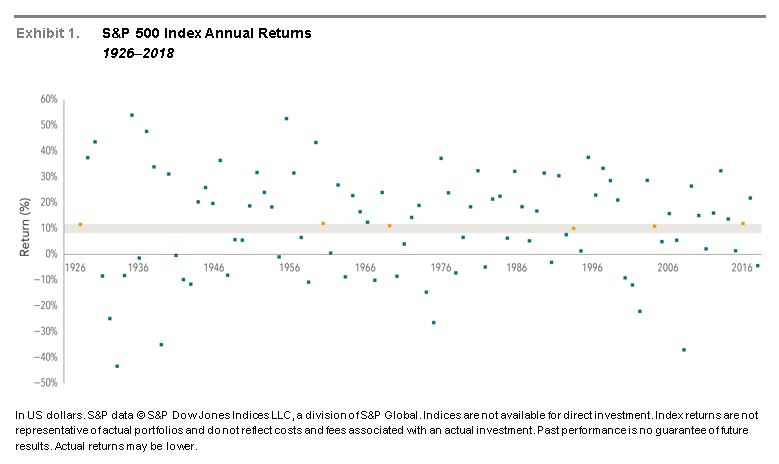

The US stock market has delivered an average annual return of around 10% since 19261. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting expectations, it’s helpful to see the range of outcomes experienced by investors historically. For example, how often have the stock market’s annual returns actually aligned with its long-term average? Exhibit 1 shows calendar year returns for the S&P 500 Index since 1926. The shaded band marks the historical average of 10%, plus or minus 2 percentage points. Despite the attractive long-term average annual return, the S&P 500 Index posted a return within 2% of this average in only six of the past 93 calendar years. In most years, the index’s return was outside of the range—often above or below by a wide margin—with no obvious pattern. For investors, the data highlight the importance of looking beyond average returns and being aware of the range of potential outcomes.

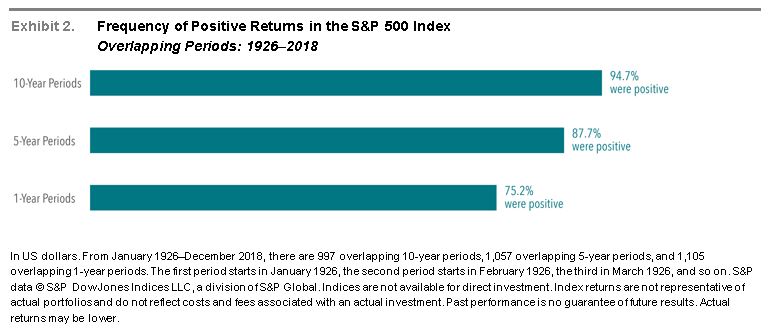

TUNING IN TO DIFFERENT FREQUENCIES Despite the year-to-year volatility, investors can potentially increase their chances of having a positive outcome by maintaining a long-term focus and not succumbing to short-term noise. Exhibit 2 documents the historical frequency of positive returns over rolling periods of one, five, and 10 years in the US market. The data show that, while positive performance is never assured, investors’ odds improve over longer time horizons.

CONCLUSION While some investors might find it easy to stay the course in years with above average returns, periods of disappointing results may test an investor’s faith in equity markets. Being aware of the range of potential outcomes can help investors remain disciplined, which in the long term can increase the odds of a successful investment experience. Indeed, the most positive market environments often follow challenging years. An asset allocation that aligns with personal risk tolerances and investment goals is invaluable in setting long-term targets. It also allows for disciplined rebalancing to add value during fluctuating market environments, forcing investors to “buy low” and “sell high.” Combined with a long-term focus and ignoring the short-term noise that too often affects investor sentiment, investors may be better prepared as stock prices change over time. 1. As measured by the S&P 500 Index from 1926–2018. Source: Dimensional Fund Advisors LP. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Diversification does not eliminate the risk of market loss. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

00345282 7/19