Market Update

The first quarter of 2022 was marked by a distinct uptick in volatility. Concerns about inflation, rising interest rates, Fed policy, and geopolitical tensions on the back of Russia's invasion of Ukraine dominated headlines and contributed to investor uncertainties. All of which led to the first quarterly decline in the S&P 500 since the depths of the pandemic in Q1 2020. Ahead of 2022 we had anticipated a rise in volatility as we transition towards a market less influenced by accommodative policies. While the significant ramp up in geopolitical tensions came as a surprise, we were nevertheless well prepared for an increase in volatility. While the broad market came under pressure during the first quarter, there was some disparity across sectors and asset classes, which benefited our diversified approach and disciplined rebalancing. We continue to focus on long-term fundamentals and believe our globally diversified portfolios are well-positioned to navigate the current environment and will continue to meet the financial goals of our clients.

Stocks Lower, Divergence Across Sectors

Fed Tightening Drives Yields Higher, Less Liquid Strategies Perform Well

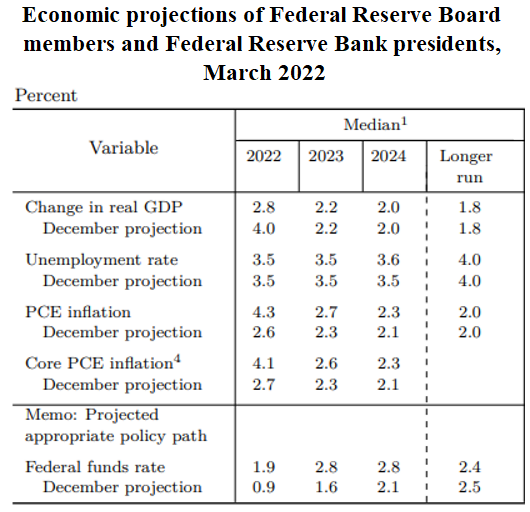

With a backdrop of elevated inflationary pressures that the Fed no longer considers to be transitory, expectations were raised for more aggressive Fed interest rate increases. The Fed indicated via its "dot plot" economic forecasts that a total of seven 25bps interest rate increases would be likely in 2022, with the first increase occurring in March.

As a result, bond yields moved higher throughout the first quarter, with the benchmark 10-year Treasury yield climbing from 1.51% to end the quarter at 2.32%. Core bonds consequentially came under pressure, with the broad bond market (as measured by the Bloomberg Aggregate Index) declining -5.93%. Credit fared marginally better, with both investment grade corporate bonds and high yield bonds holding up slightly better than the broad market.

On the other hand, we were pleased with the performance of our less liquid income-oriented strategies throughout the first quarter. Our broad baskets of direct credit and direct real estate investments posted positive returns, helping to stabilize investment portfolios. We believe our direct investments may provide a good hedge against ongoing inflationary pressures and rising interest rates. We also increased our exposure to floating rate securities during the quarter. Floating rate securities held up particularly well to start the year and may stand to benefit from a rising interest rate environment.

Ukraine Conflict: Market Impact Mirrors History

Our thoughts go out to all those affected by this devastating conflict. The humanitarian toll is heartbreaking to watch and beyond comprehension. We are actively supporting charitable organizations helping with the refugee crisis and hope a resolution will be found to end this conflict soon.

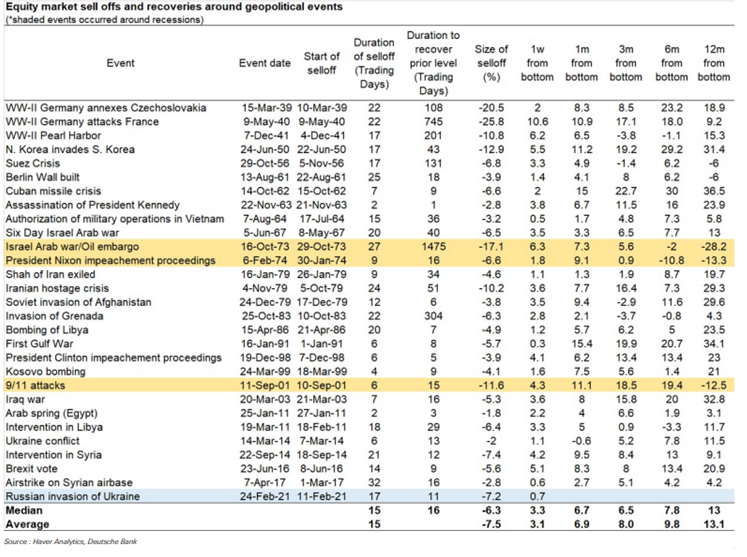

In terms of the market impact of the conflict, it has largely followed similar trends to those experienced with past geopolitical events. The S&P 500 is now back above the level when the U.S. initially warned of an imminent Russian invasion, which marked the start of the escalations and geopolitical-induced market sell-off. Historically and on average, it takes three weeks to hit a bottom and three weeks to fully recover those levels. This event took around three weeks to hit a bottom, while the subsequent recovery was a few days faster than historic norms, taking a little over two weeks to fully recover. At the end of the first quarter the S&P 500 was 8.73% above its low point earlier in the month (with six more trading days before reaching a month from bottom).

Outlook

We continue to monitor developments closely. Despite the recent uptick in uncertainties, consumer balance sheets remain historically strong, with massive excess savings. Consumer spending has shown resilience and has been underpinned by a very strong labor market. We are focused on these underlying fundamentals and remain constructive for the long-term outlook for stocks. We anticipate yields may move higher from current levels and have positioned our fixed income allocations accordingly. Floating rate securities may do particularly well in a rising interest rate environment. We favor allocations to less liquid income-oriented strategies such as direct credit and direct real estate, both of which may offer attractive upside return potential with a backdrop of elevated inflation and rising interest rates. Ultimately, we believe our portfolios are well-positioned to continue to meet the long-term financial goals of our clients.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00445597 4/22