Fed Accelerates Tapering, Signals Rate Hikes

As was widely expected, the Fed announced an accelerated tapering of its asset purchase program, reducing asset purchases by $30 billion per month from the previously announced $15 billion per month. The Fed’s “dot plot” economic projections also indicated FOMC members believe more fed fund rate increases will be warranted next year, with the median estimate forecasting three rate increases in 2022 and another three in 2023. We believe risks are firmly to the upside for interest rates and expect a faster transition towards a more “normal” market environment less influenced by Fed policies. We are well prepared for such an outcome and have positioned our portfolios accordingly.

Market Update

Stocks finished strongly on Wednesday on the back of the Fed’s announcement, with the S&P 500 +1.6% and ending the day near all-time highs. Headlines were dominated by the Fed’s decision to accelerate tapering and increase the outlook for rate increases in the years ahead. The Fed said it would begin reducing asset purchases by $30 billion per month, up from previously announced $15 billion. This was broadly in-line with consensus expectations.

Fed Projections

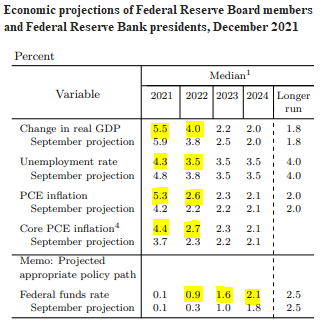

The dot plot shows FOMC members believe more fed fund rate increases will be warranted next year, with the median estimate being three rate increases in 2022 followed by another three in 2023. They also anticipate slightly lower growth this year relative to the prior September projection, though still well above long-term trend growth, noting ongoing COVID developments and the potential impact of the omicron variant. On the other hand, they expect slightly higher growth in 2022 and a stronger labor market. Likely the primary issue tilting the Fed in favor of an increasingly hawkish stance is the expectation for higher inflation than previously anticipated and for inflation to stay elevated into next year, albeit declining from 2021.

Implications

Bonds: We expect risks are firmly to the upside for interest rates. As such, we have positioned our fixed income allocations with less duration (or interest rate sensitivity) than the broad bond market and have avoided areas of the bond market we believe are most susceptible to interest rate increases, such as Treasuries with maturities of 10 years or more. We also believe our less liquid income strategies may fare particularly well with a backdrop of rising interest rates and above-trend economic growth.

Stocks: We anticipate a faster transition towards a more “normal” market environment less influenced by Fed policies. This may result in increased volatility; recent easy Fed policies have arguably contained volatility, but once those policies are taken away we may return to more normal levels of volatility. We are well-prepared: we hold a positive long-term view on equities and any increase in market fluctuations may allow us to more effectively rebalance across our client accounts, and help enhance returns over the long haul.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00432051 12/21