Market Update

2022 has so far been marked by a decided uptick in volatility. Concerns surrounding inflation, rising interest rates on the back of Fed policy, Russia’s invasion of Ukraine and more recently, increased concerns about an economic slowdown, have all led to investor uncertainties. Further complicating matters and confounding some has been a recent dynamic of good news is bad; bad news is good, whereby the market reacts positively to the release of weaker economic data and reacts negatively to stronger economic data. The prevailing view being that weaker economic data may lead to the Fed slowing the speed of its rate hiking cycle. While it has been a challenging start to the year for public stocks and bonds, select income-oriented strategies have performed well. Moreover, our outlook for stocks and bonds has become much more constructive. On a forward-looking basis, we believe current levels may present an attractive entry point.

Overview

- The start of the year has been marked by a decided uptick in market volatility; however, we believe current levels may present an attractive entry point for investors.

- Market disruptions have led to enhanced portfolio opportunities in the form of rebalancing and tax loss harvesting.

- We believe the current market sell-off isn’t reflective of underlying fundamentals and concerns about a near-term recession are overdone. However, there is a risk overhang with persistent inflation.

- Our long-term outlook remains favorable for stocks, and we believe current levels offer upside potential.

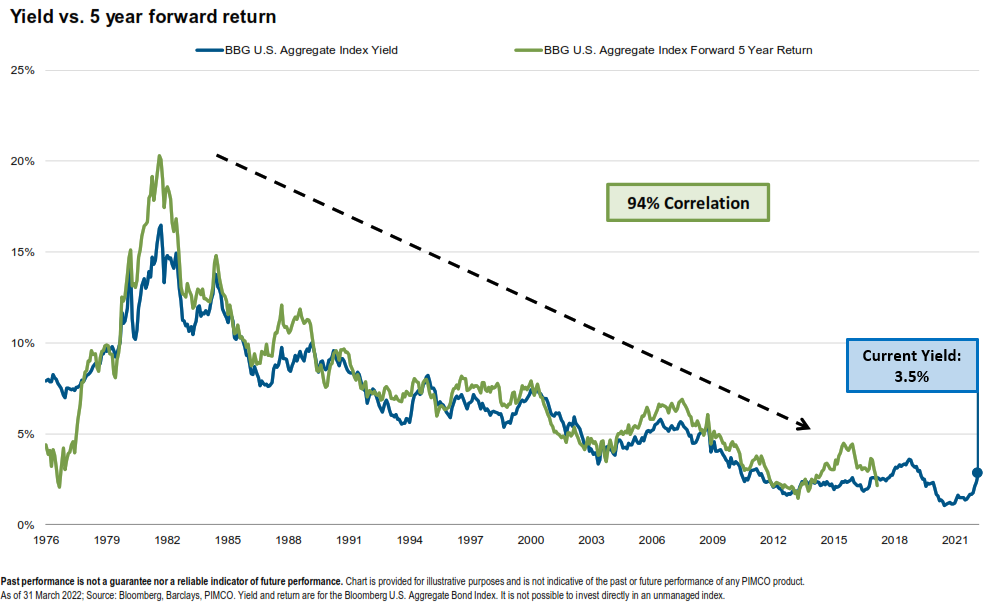

- We believe bond returns will primarily be driven by current yields, while select income-oriented strategies may perform well under the current macroeconomic environment.

- We believe our portfolios are well positioned to navigate the forthcoming period and will continue to meet the long-term goals of our clients providing exposure to long term growth and current income.

Volatility: A Consequence of Reduced Accommodation

Enhanced Opportunities

Uncertainty Overdone

Notwithstanding our view that an increase in volatility was a natural byproduct of the Fed and the Treasury taking away historically large accommodative policies, the extent of this year’s market movement doesn’t appear consistent with the underlying economic fundamentals. Only 1932 (Great Depression), 1940 (World War II), and 1970 (the Vietnam War and a recession) had worse starts to the year for the stock market. We certainly don’t anticipate a significant recession (though risks exist) – let alone a depression – in the foreseeable future, while Russia’s invasion of Ukraine – which unfortunately appears likely to be a prolonged conflict – is unlikely to spiral into a wider war outside of the region.

Regarding the economy, we believe concerns about a near-term recession are overdone: consumers remain very healthy and continue to be supported by a strong labor market. Corporate and consumer balance sheets remain robust. The consensus forecast for 2022 real GDP growth is currently +2.8% (vs. long term trend growth of ~2%) and +2.1% for 2023. Importantly, of all 66 estimates for 2022 growth and of all 61 estimates for 2023 growth included in FactSet coverage, not one forecaster expects a recession in either 2022 or 2023.

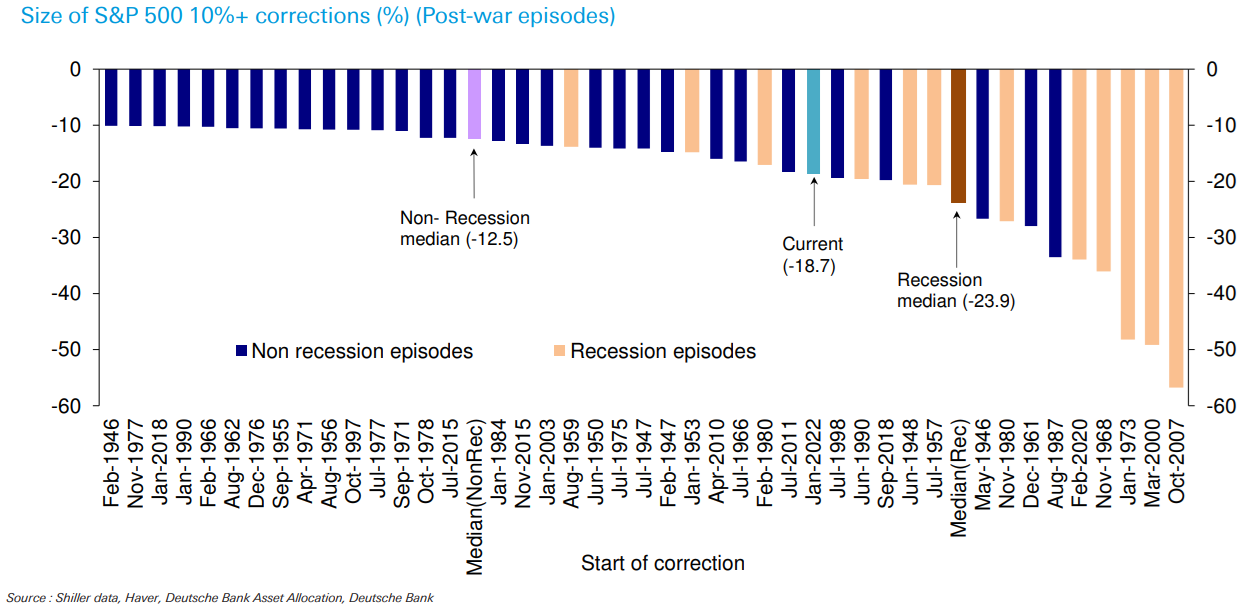

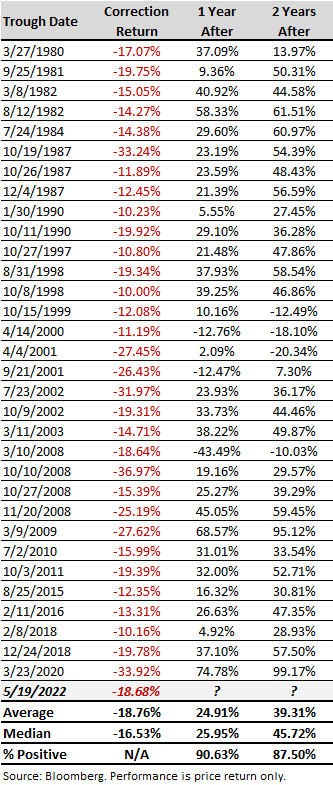

Through the market bottom in May, the S&P 500 was down -18.7%. For context, the median non-recession driven market sell-off in the post WWII era has been -12.5%. The median recession-driven market correction over the same timeframe has been -23.9%. While economic forecasts for real GDP growth have been revised lower, our base case is for above trend economic growth through this year and into 2023, yet the market has reacted as if a recession is imminent.

Positive Upside Potential for Stocks

Bonds: Pain Behind Us

Speaking of yield, we continue to favor allocations to select income-oriented strategies such as floating rate securities, real estate, and direct credit, all of which we believe will perform well with a backdrop of elevated (but falling) inflation, above-trend economic growth and rising interest rates.

Overall, we believe our portfolios are well positioned to continue to meet the long-term financial goals of our clients.

For additional information, please don’t hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00452817 06/22