Market Insights

With the backdrop of tighter monetary policies, we believe interest rates have reset to a higher trading band and we have become more constructive on the outlook for bond returns, as we are now seeing some attractive risk-adjusted yield opportunities across the bond market. Please see our recent commentary here.

As was widely expected, the Fed raised rates 0.75% at today’s FOMC meeting, bringing the target for the fed funds rate to 3.75-4.00%. Today’s meeting did not have accompanying projection materials, aka “dot plot” forecasts, though the statement noted the labor market remains robust, economic indicators point to modest growth, and inflation remains elevated. To this end, the Fed anticipates additional rate hikes will be required to bring inflation back down towards its 2% long-term target. In addition to rate hikes, the Fed will continue to reduce its balance sheet over time by reducing its holdings of Treasury and agency mortgage-backed securities.

At the subsequent press conference, Fed Chair Powell struck a hawkish tone, indicated the ultimate level of interest rates could be higher than previously anticipated, and that it is too premature to start talking about pausing rate hikes altogether.

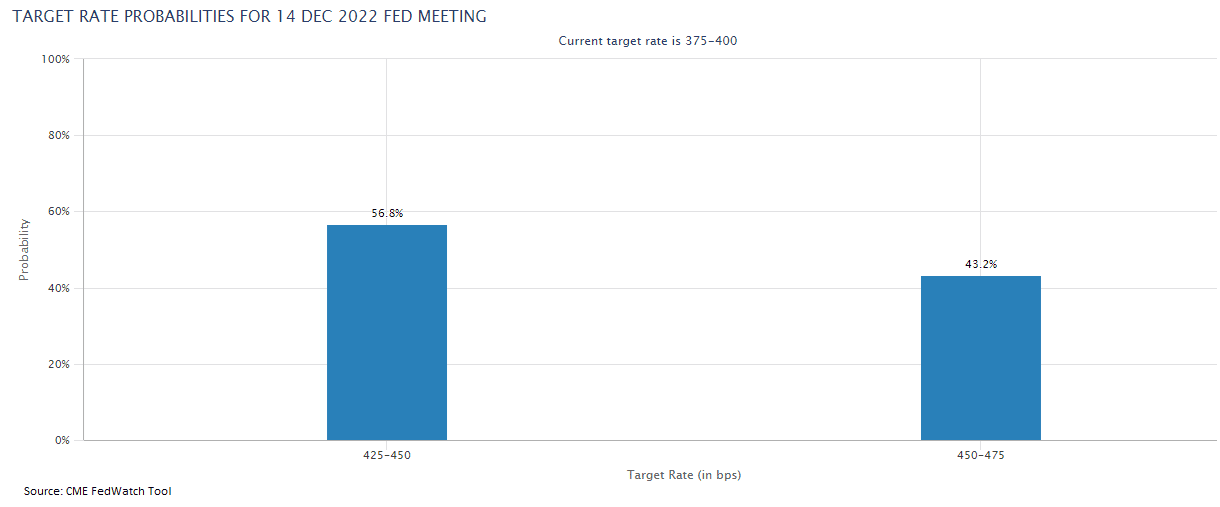

The market is now pricing in a nearly 60% probability the Fed raises rates 0.50% at its December meeting and just over a 40% chance it raises by another 0.75%.

Elsewhere, October ADP payroll data came in hotter than expected, adding to the notion the Fed may err on the side of tighter policies for the foreseeable future.

Stocks sold off throughout Powell’s press conference, with the S&P ending the day down -2.5%. Bond yields bounced, with the benchmark US 10-Year Treasury yield currently trading at 4.10%. The yield curve remains inverted, with the US 2-Year Treasury yield currently priced at 4.60%.

We continue to monitor developments closely and believe our portfolios are well-positioned to navigate the current environment. As always, should you have any questions please do not hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00482646 11/22