Bond Market Insights

Bond yields have been a dominant theme in 2022 as the Fed has raised rates more aggressively than many previously anticipated, largely a function of sticker inflation that is likely to stay elevated over the near-term. So far, the Fed has raised rates from the zero bound to the current 3.00% to 3.25% range, with additional rate hikes forecast for the balance of the year. We believe another 0.75% rate increase is likely at next week’s FOMC meeting, and market pricing currently infers the fed funds rate will end the year in the range of 4.25% to 4.50%.

With this backdrop of tighter monetary policy, bond yields have risen (bond prices have fallen) over the course of the year. We believe interest rates have reset to a higher trading band and we have become much more constructive on the outlook for bond returns, as we are now seeing some attractive risk-adjusted yield opportunities across the bond market.

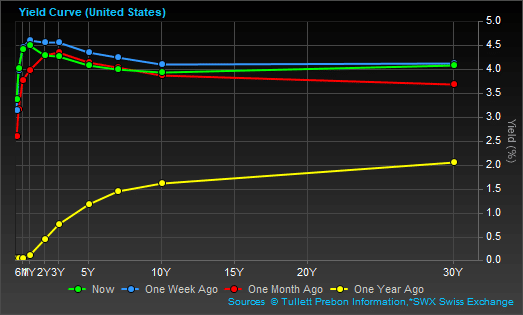

Of particular interest is the current shape of the yield curve, as measured by yields on Treasury securities. The yield curve has inverted, meaning that yields are higher for shorter dated maturities than longer dated maturities. Historically, inverted yield curves are the exception not the rule, and often precipitate an economic recession or slowdown. As of writing, the yield on a two-year Treasury bond was 4.3%. In comparison, the yield on a 10-year Treasury bond was 3.9%. In the current market, you are not getting paid to move out along the yield curve and take on the additional duration risk.

Ultimately, we believe the yield curve will re-normalize and again become upward sloping, though the timing is uncertain, particularly given the lack of clarity surrounding future Fed policy and uncertainties regarding the economy and inflation. Notwithstanding – and between now and an eventual re-normalization of the yield curve – we believe the current environment bodes well for relative risk-adjusted performance of Treasury bonds towards the front end of the curve where higher yields are currently on offer. As such, we are emphasizing this portion of the yield curve within our core fixed income allocations.

At the same time, and with the risk of a recession elevated, we anticipate credit issues may increase over the forthcoming period. We are focusing on higher quality, investment grade credits within our core fixed income allocations to provide protection against potential defaults or credit downgrade risks.

Despite the likelihood for ongoing near-term volatility given current uncertainties, yields within the bond market are more attractive today relative to levels seen throughout much of the last decade. As a result, we have become more constructive on the outlook for core fixed income returns and believe our bond allocations will generate increased income potential for our clients.

We continue to monitor developments closely and believe our portfolios are well-positioned to continue to meet the long-term goals of our clients. As always, should you have any questions please do not hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00481933 10/22