Market Update for 3/22/23 – Fed Raises Rates 25bps

Fed Raises Rates 0.25%

The Fed raised rates 0.25% at today’s FOMC meeting, bringing the target range for the fed funds rate to 4.75% - 5.00%. This was broadly in-line with expectations (the market had priced an ~85% chance of a rate hike immediately ahead of the meeting). The Fed also reiterated a continuation of its quantitative tightening (QT) program via reducing its holdings of Treasuries and Agency securities. The vote was unanimous.

The accompanying statement noted “some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” This was softened from language used in the prior statement, which stated “ongoing” tightening would be appropriate. The statement also addressed the soundness and resilience of the banking system, though noted that tighter credit conditions are likely to weigh on economic growth, the labor market and inflation.

Stocks initially bounced after the announcement and statement release, but pared gains following Fed Chair Powell’s press conference, and ended the day lower with the S&P 500 down -1.65%. Bond yields moved lower (bond prices higher) through the course of the day, with the benchmark 10-year Treasury currently trading at 3.44% and down from where it started the day at 3.60%.

For perspective and as it pertains to the current banking uncertainty: the S&P 500 is currently marginally higher than where it traded immediately before the Silicon Valley Bank collapse. Stock weakness has largely been isolated to the banking sector, indicating the market believes this is not a systemically important event for the broad economy. This is in stark contrast to 2008, where we witnessed broad-based weakness.

Pushes Back Against Rate Cuts

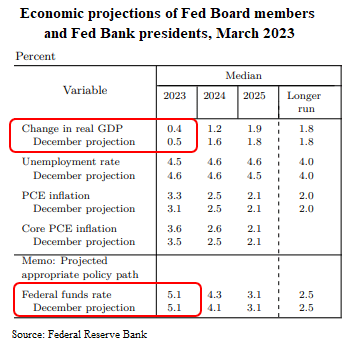

The Fed’s economic projection materials (aka “dot plot” forecasts) indicate a marginal reduction in economic growth expectations for 2023, relative to the prior projections made in December. The Fed slightly increased its inflation expectations and slightly reduced its expectation for the unemployment rate. The year-end fed funds rate projection was unchanged at 5.1%, indicating one more 0.25% rate hike this year, and no rate cuts are expected until at least 2024. A point Fed Chair Powell reiterated at the subsequent press conference.

Moderation in Future Hikes

By raising rates 0.25%, the Fed signaled they don’t believe current issues facing the banking sector will lead to a significant economic impact, and not significant enough to bring about a material reduction in inflation. This view is borne out in their updated economic projections.

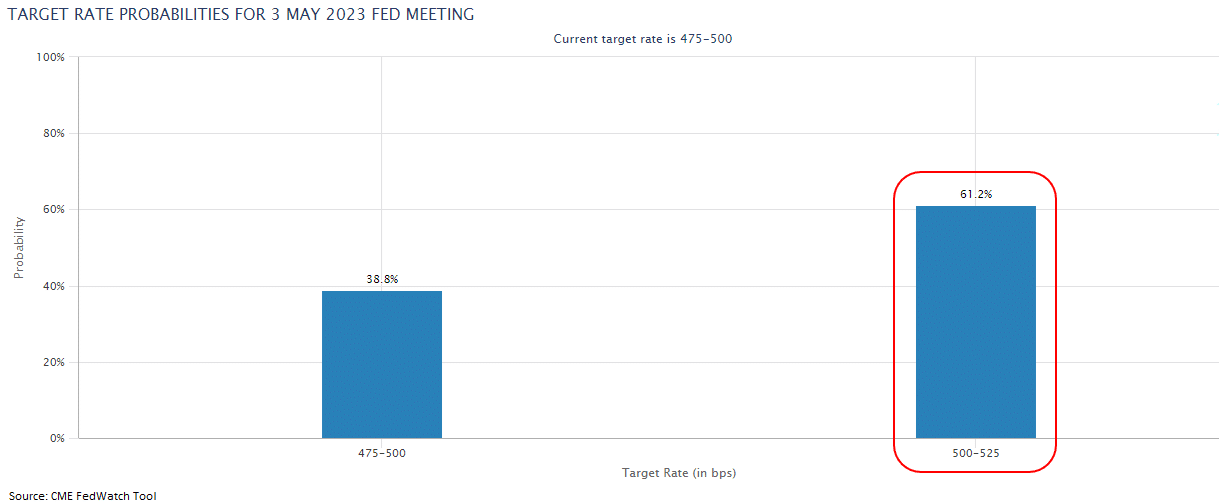

With that being said – and while the immediate issues facing the banking sector appear to be easing – lending standards remain tight (particularly for regional banks), which may weigh on business investment, spending and economic growth. As such, the outlook for Fed policy and further rate hikes has moderated. As recently as three weeks ago the market was discussing the possibility of a 0.50% hike at today’s meeting and pricing in 1.0% or more of total additional rate increases. Now, market pricing and the Fed are indicating only one more rate hike, with the market pricing an approximately 60% chance of another 0.25% rate increase at the FOMC’s meeting in May.

Based on current information, we don’t anticipate the Fed will cut rates over the near-term. The Fed has clearly communicated its focus on reining in inflation, so we would have to see a significant deterioration in economic fundamentals for inflation to move lower and for the Fed to even consider cutting rates.

We continue to monitor developments closely and believe our portfolios are well positioned to navigate the current market environment and ultimately achieve the long-term financial goals of our clients.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Recent Insights Articles

Market Update 3/2/26

Market Perspectives Q1 2026

How Mission Wealth Is Redefining Scale in Wealth Management

Mission Wealth Financial and Wealth Management

At Mission Wealth, our dedicated financial advisors provide the guidance you need to help with life's financial complexities. Our in-house team of financial professionals with specializations in investments, taxes, estate plans, trusts, charitable planning and asset protection will partner with you and your other trusted advisors to address your unique needs and complexity.

Please visit our website at missionwealth.com or call us at (805) 882-2360 to speak with a wealth management professional.

00503718 03/23