Mission Wealth Market Update 3/4/25

Market Update

It’s been a bumpy start to the year, with uncertainties surrounding tariffs currently dominating headlines. We’ve highlighted our thoughts below:

- 25% tariffs on Canadian and Mexican-made goods and an increase on Chinese tariffs to 20% are set to take effect today, Tuesday, March 4, 2025.

- We continue to monitor developments closely and believe our portfolios are well positioned to navigate the current uncertainty.

- Portfolio diversification is key to riding out any market fluctuations. While some high-profile mega cap stocks have come under recent pressure, other asset classes have fared much better, providing considerable downside protection.

- Economic fundamentals remain resilient, and we are focused on the long term, avoiding getting sidetracked by short-term noise. Time and again, discipline and a long-term focus have been rewarded.

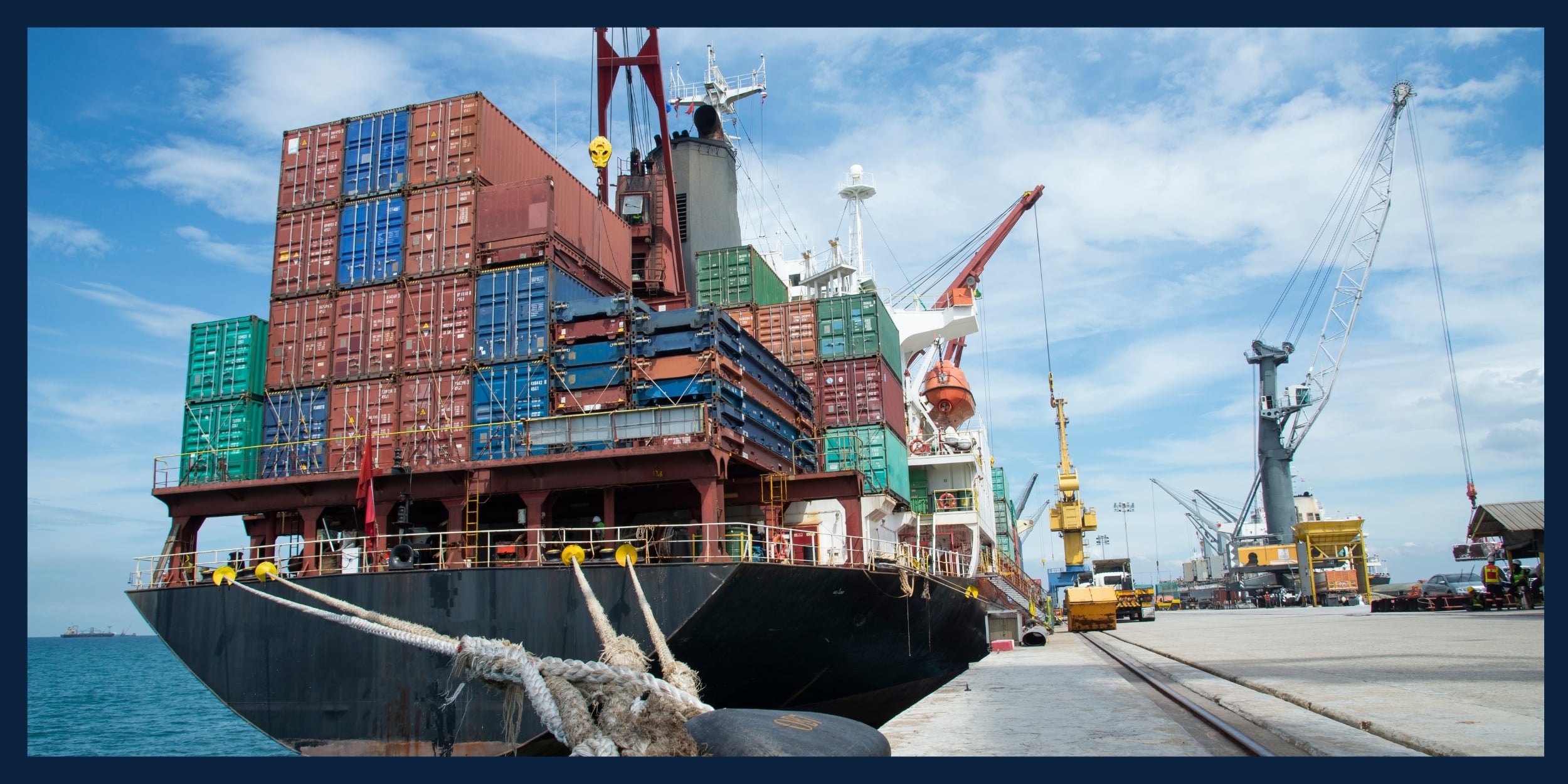

Tariff Tuesday

President Trump announced that the U.S. would proceed with 25% tariffs on Canadian and Mexican-made goods and doubled the China tariff rate to 20% on Tuesday, March 4, 2025. In response, China announced 15% tariffs on U.S. chicken, wheat, corn, and cotton, and 10% tariffs on sorghum, soybeans, pork, beef, seafood, fruits, vegetables, and dairy. Canada said it will proceed with plans to impose 25% tariffs on approximately $20 billion of U.S. goods, which may be followed by a second round of tariffs on CAD $125 billion in three weeks. Mexico’s President Sheinbaum said retaliatory tariffs on the U.S. are expected to come this Sunday.

It is a fluid situation, and we are still in early stages with more tariff developments to come. The hope is that tariffs remain primarily a negotiation tactic and may be dialed back. Nevertheless, these developments have caused a recent uptick in market volatility around fears of a more drawn-out, tit-for-tat trade war.

Look Through the Noise

We have seen concerning headlines and crises before. Investors should expect bumps along the road–volatility is par for the course for an investment in the stock market. That being said, discipline and a long-term focus have been rewarded time and time again. Over the years, there have been numerous concerning headlines, but the market has consistently produced positive returns over the long haul. We expect this time to be no different.

Economic Fundamentals Resilient

The market tends to overreact during the short run but is tied to underlying fundamentals over the long run. Economic fundamentals are still in place. While we have seen some moderation in economic data recently, the underlying economy appears resilient. We maintain close communications with all our investment partners, who invest in thousands of businesses throughout the economy. Despite the current headlines, the overarching feedback remains optimistic about future growth potential.

Underlying business fundamentals continue to be strong and robust. Revenue and profit growth remain broadly positive, and companies are experiencing record margins. Businesses are seeing increases in productivity due to investments in technology, particularly artificial intelligence (AI). Enhanced productivity is very important in extending the current economic expansion, and surveys of company management indicate an increase in capital expenditures in the months ahead.

Credit has increased with improved bank lending, and money supply is positive and accelerating. Bank balance sheets are in much better shape, and there are lower levels of structural leverage in the banking system. Household balance sheets are healthy, with many metrics near record levels. In turn, this has helped underpin robust consumer spending, which is the backbone of the U.S. economy, making up nearly 70% of the GDP.

In short, economic fundamentals remain resilient, and we do not see any major excesses in the economy. It’s those excesses that tend to perpetuate downside risks. As such, we remain positive about the long-term outlook for growth.

Diversification is Key

The importance of broadly diversified investment portfolios cannot be overstated. Having all your eggs in one basket may work over short periods of time, but it tends not to be sustainable over the long haul. While the performance of the U.S. stock market has been dominated by the “Magnificent 7” over recent years, that has recently changed. Year-to-date, Value stocks have significantly outperformed Growth stocks, and international stocks have significantly outperformed U.S. stocks. Moreover, other asset categories, such as bonds, real estate, private equity, and direct credit, have fared much better than the broad U.S. stock market.

This episode of uncertainty is a good example of why we believe in constructing portfolios that have different exposures to various elements of the market. Allocating to assets that can zig when others zag can provide considerable downside protection.

Stay Disciplined

Staying invested and disciplined is critical to the long-term success of an investment portfolio. With respect to rebalancing, our disciplined approach forces us to “buy low, sell high.” Through this lens, any ongoing volatility may be used to our advantage, providing a greater ability to add to high-quality assets on weakness, which may, in turn, enhance long-term performance.

We continue to monitor developments closely. Overall, we believe our portfolios are well positioned to navigate the current uncertainty and continue to meet our clients’ long-term goals. If you have questions about your portfolio management or want to learn more about Mission Wealth, please get in touch with us below.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026