Fed Pauses Rates Again

At the Fed’s last Federal Open Market Committee (FOMC) meeting of the year, the Fed decided to maintain the target for the fed funds rate at 5.25-5.50%. This decision was largely in line with market expectations ahead of the release, which assigned a near certainty the Fed would pause interest rate increases at its December meeting. Fed Powell indicated the last rate hike is likely now behind us, and the market is now setting its eyes on the likely first rate cut, which per the Fed’s estimates should occur sometime next year.

Investment Implications

- We believe our portfolios continue to be well positioned to navigate the changing macroeconomic environment.

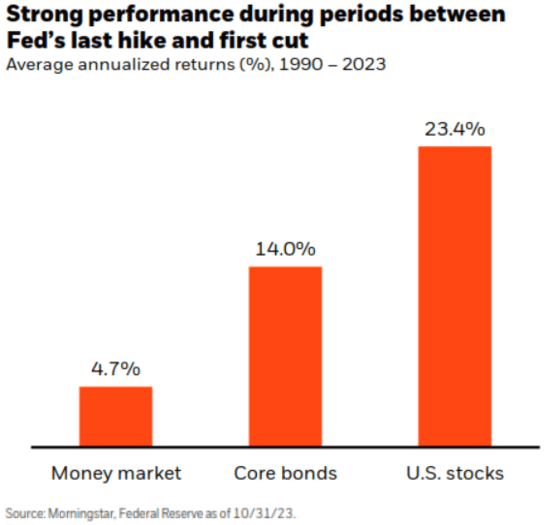

- Historically, the time period between the last Fed interest rate hike and the first interest rate cut has been positive for both stock and bond returns.

- Longer term, we believe we have entered a structural shift towards tighter monetary policy relative to the years post-2008. This shift may act to moderate stock market returns over the long haul.

Stronger Growth in 2023, Interest Rates to Decline in 2024

The Fed’s accompanying statement noted that recent data indicates economic activity may have slowed from the strength experienced in the third quarter of 2023. Job gains have also moderated from earlier in the year, though the labor market remains strong. The statement also noted that inflation has subsided but remains elevated and above the Fed’s long-term target of 2%.

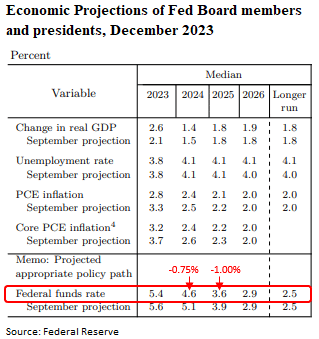

All eyes were on the Fed’s economic projection materials, aka the “dot plot” forecast. The Fed increased its outlook for economic growth this year, and marginally revised lower its economic growth outlook for 2024 to +1.4%, down from the previous estimate of +1.5%. At the subsequent press conference, Fed Chair Powell indicated that, as it stands, the Fed’s base case is for no more interest rate increases, although emphasized any future decision will remain data dependent. The “dot plot” showed the Fed believes interest rates will drop in 2024. The Fed’s current expectations for the fed funds rate at the end of 2024 are between 4.50% and 4.75%, or -0.75% below the current range of 5.25%-5.50%, representing three 25 basis point interest rate cuts. Thereafter, the Fed anticipates another 1.00% of interest rate cuts will be appropriate in 2025.

The Fed indicated inflation is set to moderate further, revising its estimate for 2023 inflation -0.5% lower for both PCE Inflation and Core PCE Inflation. Forecasts for inflation in 2024 and 2025 are marginally below the Fed’s prior estimates in September and expected to trend lower over time. The labor market is likely to remain relatively robust, with the Fed incrementally increasing unemployment rate expectations for 2024, bringing the unemployment rate in line with the Fed’s long-term goal of 4.1%.

Economy Resilient, But Set to Slowdown

Despite many headwinds thrown its way – regional banking concerns, higher interest rates, sticky inflation, tighter credit conditions, geopolitics, debt ceiling concerns – the economy consistently exceeded growth forecasts throughout 2023. Consumer spending, underpinned by a robust labor market, helped propel the economy forward and avoid an economic slowdown. As a result, the chances of a “soft” or “no landing” economic outcome have increased. With that being said, we are seeing softening in labor market fundamentals, while tighter credit conditions may weigh on economic growth moving forward, a view that was reiterated in the Fed’s December FOMC statement. In reality, it can take up to 12 months for the full effect of monetary policy to work its way through the economy. The last Fed interest rate increase was at the end of July 2023, so the full effect of the Fed’s tightening policy is likely not to be felt until at least July 2024. As a result, expect slowing growth next year, as predicted in the Fed’s economic forecasts above.

Don’t Expect Imminent Rate Cuts

With that backdrop, the Fed will likely cut interest rates, but is unlikely to do so before the majority of prior interest rate increases work through the economy. Moreover, while inflation is moving in the right direction, it remains well above the Fed’s 2% target and still has some way to go. The Fed has emphasized its laser-focus on bringing inflation back towards its long-term goal, so may be hesitant to cut rates before it sees ongoing and meaningful inflationary trends towards its target. This view has been supported by Fed rhetoric, which has consistently indicated that once the Fed is done hiking, interest rates are unlikely to come down in a hurry. Current market-implied estimates for the first Fed interest rate cut are for approximately May of next year, though we wouldn’t be surprised if that date gets pushed back over time. Of course, should we see a significant deterioration in economic fundamentals slipping towards a recession, the Fed may cut interest rates sooner or further than what the Fed’s current forecasts indicate.

Fed Pause May Help Stocks & Bonds

Historically, this has been a good period for both stock and bond investments. The period between the last Fed rate hike (end of July 2023) and the first Fed rate cut (TBD) has historically been supportive of stock and bond returns.

Structural Shift to Tighter Policy

Long-term, we believe we have already entered a structural shift with respect to monetary policy. Even if the Fed brings interest rates back towards it’s longer run equilibrium rate of 2.5% (we don’t anticipate that happens over the near term, nor do the Fed’s economic forecasts), the fed funds rate will still represent tighter monetary policy relative to the years post-2008 through the end of 2021. Furthermore, by way of quantitative tightening (QT), the Fed is committed to shrinking its balance sheet. This dynamic alone represents tighter monetary policy, so even under a “Fed rate pause” environment, to the extent QT remains in effect, the Fed is, by implication, erring towards tighter monetary policy.

Asset Class Implications

As a result, we believe the tailwind of easy monetary policies that helped propel stocks higher in the post-2008 years has been removed. We’re not bearish on the outlook for stocks, we just think expectations need to be reset for annualized stock market returns more aligned with historic averages of mid- to high-single digits.

We believe the outlook for bonds has improved. Bond yields are much more attractive today relative to the yields available just 12-24 months ago. Many of our preferred core bond holdings are yielding mid- to high-single digits, and the current yield on a bond portfolio tends to be the largest determining factor for future bond returns.

Given the economic outlook, alternative investments may play an important role in investment portfolios, providing upside return potential and lower correlations to the broad stock market. Ultimately, we believe our portfolios are well positioned to navigate changes in monetary policy and the macroeconomic environment, and continue to meet the long-term financial goals of our clients.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Is Private Equity the Missing Piece in Your Investment Strategy?

June 26, 2025

Market Update for 6/18/25

June 18, 2025