Market Update: First DeepSeek, Now Tariffs

2025 has already seen several headlines which have caused some market volatility to start the year. From Artificial Intelligence fears, compounded by stretched mega-cap valuation concerns, to a Fed on hold and, most recently, tariff announcements.

Please find our thoughts regarding these developments below:

- Recent headlines underscore the importance of a well-diversified portfolio and a disciplined approach to rebalancing.

- Headlines surrounding DeepSeek have caused an uptick in volatility, compounded by concerns over stretched mega-cap Tech firm valuations.

- The announcement of tariffs on Canada, China, and Mexico was broadly more hawkish than anticipated, though it is a very fluid situation.

- We believe these developments underscore the likelihood of a higher-for-longer interest rate environment and the potential for more moderate stock market returns, which we have been preparing for.

- We believe our portfolios continue to be well-designed to navigate the current period and deliver needed risk-adjusted returns for our clients.

First DeepSeek…

The big tech story for January was the revelation that DeepSeek, a Chinese large language model, evidently performs as well as the latest iteration of OpenAI and other top U.S. foundational models despite allegedly being trained at a fraction of the cost. The idea that the future of artificial intelligence (AI) could require less capex investment and be less resource intensive caused an increase in volatility for some high-profile AI-related tech companies, notably Nvidia.

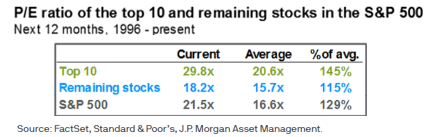

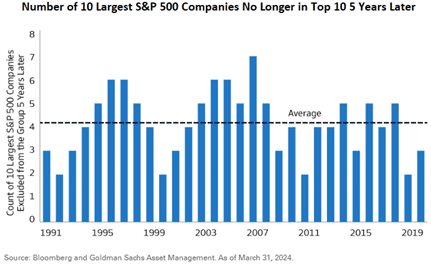

The uptick in volatility was arguably compounded by the increased concentration of the S&P 500 and concerns surrounding stretched mega-cap Tech firm valuations. The largest companies have stretched valuations relative to the rest of the market, and historically, those large firms don’t always stay amongst the largest forever. Historically, four of the largest 10 companies fall out of the top ten in the following five years.

All of this underscores the importance of well-diversified portfolios and avoiding being overly concentrated on large individual stock positions. We have a number of concentrated stock solutions available to our clients and prospective clients to help address these risks.

…Now Tariffs

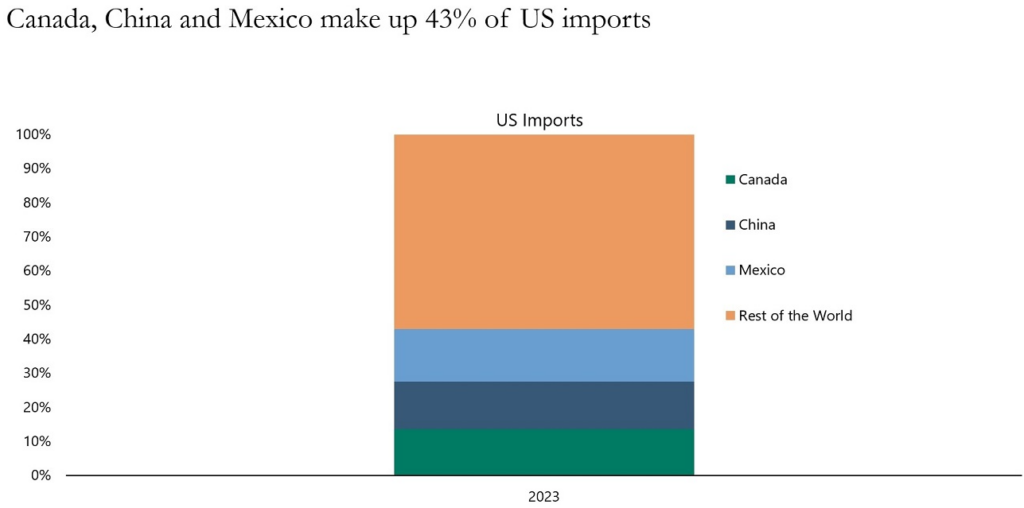

Over the weekend, President Trump issued executive orders to impose tariffs on Canada, Mexico, and China. An incremental 25% tariff on imported goods from Mexico and Canada was announced (energy imports from Canada will be subject to an incremental 10% tariff), while tariffs will be increased by 10% on imported goods from China. While tariffs were widely telegraphed, the announcement was broadly more hawkish than the market had anticipated. With that said, it is a highly fluid situation. The announced tariffs on Canada and Mexico appear relatively short-lived: following meetings with Mexican President Sheinbaum and Canadian Prime Minister Trudeau, President Trump agreed to pause tariffs for at least 30 days.

While the hope is tariffs are primarily used as a negotiation tactic, the risk is the tariffs get extended or, worse, raised in a tit-for-tat trade war should a country take retaliatory measures. Tariffs, by their very nature, are inflationary, as the cost increases associated with tariffs tend to get passed on to the end consumer. Indeed, given that these countries make up such a large percentage of U.S. imports, Goldman Sachs previously estimated that a sustained 25% tariff on Mexico and Canada could raise inflation by as much as 0.7%.

Investment Implications

These developments underscore the likelihood of a higher-for-longer interest rate environment and the potential for more moderate stock market returns, which Mission Wealth has been preparing for. Any increase in tariffs would cause the potential for inflation to stay elevated at a time when the Fed is struggling to get inflation back to its 2% target. As a result, the Fed – which recently announced a pause to its interest rate cutting cycle – may be increasingly hesitant to cut interest rates further.

Additionally, tariffs may act to moderate S&P company bottom line earnings via slowed revenue growth (to the extent the increased costs are passed onto consumers), lower margins (to the extent the company bears the increased costs), or a combination of the two. The last two years have demonstrated extraordinary stock market strength, which isn’t sustainable moving forward. We are not bearish on the long-term outlook for stocks, but we do anticipate stock market returns will normalize moving forward.

We continue to monitor developments closely. We believe our broadly diversified portfolios are well-positioned to navigate the current time period, provide resilience, and ultimately continue to support the long-term financial goals of our clients.

Should you have any questions, please don’t hesitate to contact our Mission Wealth team.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Is Private Equity the Missing Piece in Your Investment Strategy?

June 26, 2025

Market Update for 6/18/25

June 18, 2025