Market Commentary for 3/17/25: Diversification at Work

Market Update

The start of this year is a prime example of how the benefits of well-constructed portfolios can shine during challenging times. Outside of U.S. stocks, all other major asset classes are positive year to date, including international stocks, the broad bond market, direct credit, real estate, emerging markets, private equity, and infrastructure. Within the U.S., large-cap Value has performed much better than large-cap Growth stocks. With an uptick in volatility, our broadly diversified portfolios have performed relatively well despite U.S. stocks coming under pressure.

We’ve outlined the key points here:

- We continue to monitor developments closely. Our broadly diversified portfolios have held up well year-to-date and offer the necessary diversification to help navigate ongoing volatility.

- Despite U.S. stocks coming under pressure, all other major asset classes are positive year-to-date, providing much-needed diversification benefits.

- Policy risks have spiked, and economic growth expectations have moderated. We don’t expect the impact of current policies and associated uncertainty to derail the economy.

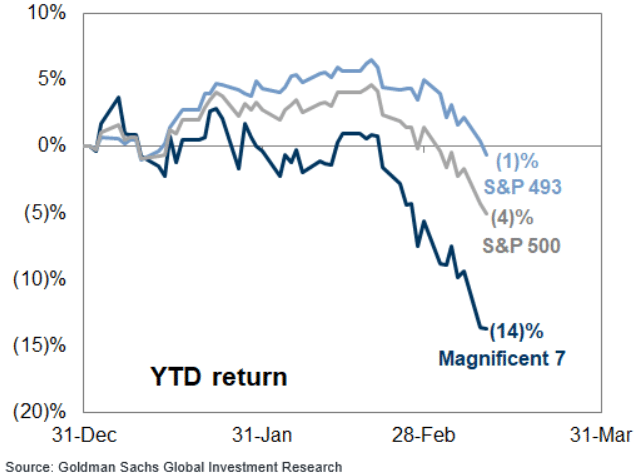

- The “Magnificent 7” have led the U.S. market lower, underperforming the broad S&P 500 year-to-date.

- The uptick in volatility has provided an increased opportunity to add value via rebalancing and to enhance after-tax returns through tax-loss harvesting.

The Importance of Diversification

At Mission Wealth, we manage broadly diversified investment portfolios with dedicated allocations to international and emerging market stocks, bonds, and alternatives. In contrast to U.S. stocks, all other major asset classes are positive year-to-date, providing much-needed diversification benefits. Through 3/14/2025, international stocks are up over +10%, emerging markets are up approximately +5%, and the broad bond market is up over +2%.

Within the U.S., value stocks have outperformed growth stocks year-to-date, with value stocks up over +1%. At Mission Wealth, we use growth and value stocks as a rebalancing tool: ahead of 2025, we were trimming growth stocks on relative strength at the time, in favor of value stocks. Now, with value stocks performing relatively well, we are trimming value stocks, where appropriate.

Elsewhere, alternative investments have broadly performed well year-to-date, with private equity, direct real estate, infrastructure, and direct credit all producing positive returns. Against this backdrop, our broadly diversified portfolios have held up relatively well despite the uptick in market volatility.

Uncertainty Leads to Moderated Near-Term Economic Expectations

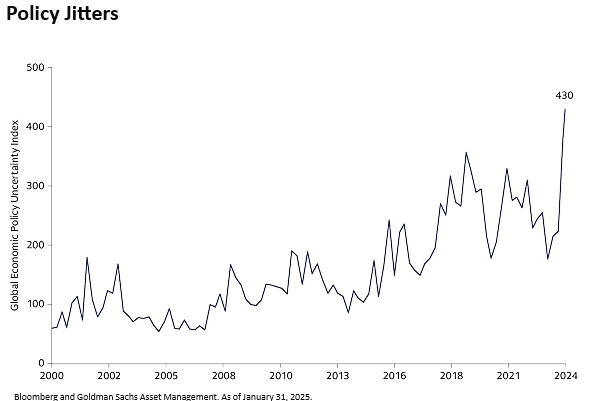

2025 markets have been dominated by geopolitical uncertainty, with policy risks spiking to record highs. Tariffs, in particular, have been front and center for investors. Expectations for near-term economic growth have reduced, while the outlook for inflation has increased. With this backdrop, the market has experienced an increase in volatility.

While we anticipate some moderation in near-term economic growth, we don’t expect the impact of current policies and associated uncertainty to derail the economy. Expectations are for lowered – but still positive – economic growth for 2025. Long-term fundamentals remain intact, with underlying economic resilience and no major excesses evident. While sentiment has soured recently, hard economic data remains relatively robust. Nevertheless, we should expect some softening in the economy over the short term. On the other hand, if the current uncertainty abates, we may experience an uptick in growth expectations.

“Magnificent 7” Drive U.S. Stocks Lower

Recent policy concerns, compounded by stretched valuations, have put downward pressure on U.S. stocks, particularly the “Magnificent 7” and Growth stocks. The “Magnificent 7” are arguably more susceptible to increases in tariffs and any escalation in global trade wars, given they generate a much higher percentage of top-line revenues from international sales vs. the rest of the S&P 500. Computer and electronic products are the largest import category from China to the U.S. The “Magnificent 7” have led the market lower and have significantly underperformed the broad S&P 500 year-to-date.

Year-to-Date Returns for 2025

If you have concentrated stocks in your portfolio, please consider diversifying that risk by using one of our concentrated stock solutions.

Discipline Rewarded During Volatile Times

We view the current period of uncertainty – and to the extent volatility continues – as an opportunity to add value with our disciplined approach to portfolio construction and rebalancing. Our disciplined approach to rebalancing forces us to “buy low, sell high.” Increased market volatility tends to lead to increased dispersion across asset classes – as has been witnessed so far this year. In these environments, a disciplined approach to rebalancing can prove beneficial, providing greater opportunities to add to high-quality assets cheaply.

Tax-Loss Harvesting: The Silver Lining of Volatility

While no one likes stock market declines, we have taken advantage of the current environment to enhance our clients’ after-tax returns through tax-loss harvesting. We have been tax-loss harvesting select U.S. stock positions across client accounts when suitable and where it makes sense.

We continue to monitor developments closely. Our portfolios offer the necessary diversification to help weather any ongoing market volatility, and our disciplined approach to rebalancing may offer us investment opportunities should volatility remain elevated.

If you are looking for an investment or wealth advisor to help you navigate market volatility, please contact us below for a free consultation.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026