How Clients Can Set Up Dual Factor Authentication at Fidelity

Financial institutions across the world are seeing an uptick in cybercrime, and Mission Wealth needs your help in protecting your personal technology devices and financial accounts. This article is intended to assist our clients with specific instructions for better protecting their investment accounts with Fidelity.

Setting Up Multi-Factor Authentication at Fidelity

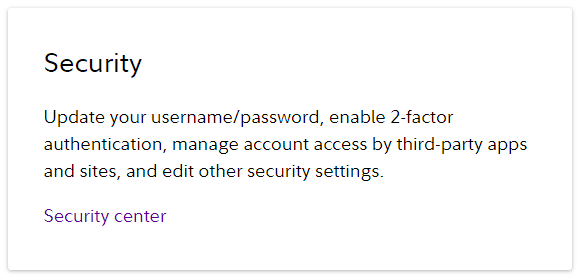

- Navigate to Your Profile Tab – Scroll down to the “Security Center“.

- Change Your Password – We recommend creating a long (15-20 characters) unique random password (i.e. something like this, but not this; 7O1^0y7gI9uusP5%RdP!).

- Review Trusted Devices – Do these look like yours? It is probably best to Remove All just to start cleanly. The next time you log in, it will ask if you want to “trust” the device you are using, and you can confirm that.

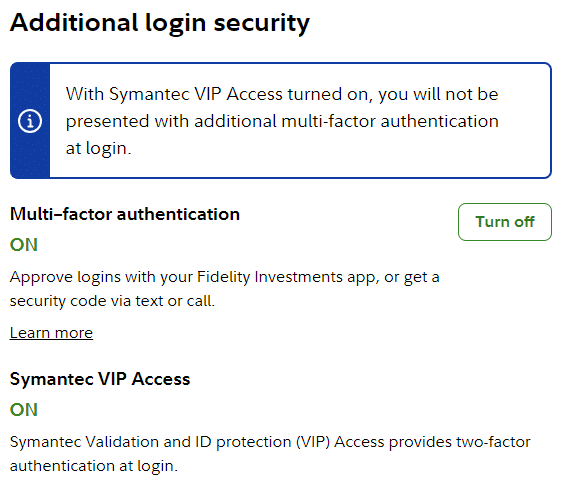

- Additional Login Security – Make sure “Multi-Factor” authentication is turned on. Here is a link on how to implement Symantec VIP.

- You will need to call Fidelity per the instructions above to activate the VIP credential for your login. If someone is able to get into your email account, log into your brokerage account, and you don’t have dual authentication, you can see the type of control they can have (assume the bad guys have your date of birth and social security number, both easy to purchase on the dark web). The same issues reside with your bank and other institutions as well. Lock those down as well using the techniques shared here!

- You will need to call Fidelity per the instructions above to activate the VIP credential for your login. If someone is able to get into your email account, log into your brokerage account, and you don’t have dual authentication, you can see the type of control they can have (assume the bad guys have your date of birth and social security number, both easy to purchase on the dark web). The same issues reside with your bank and other institutions as well. Lock those down as well using the techniques shared here!

- View the Security Checklist as well as other boxes to see if anything else pertains.

- Congrats, you just made yourself a very difficult target for cyber criminals!

We’re Committed To Your Security

Mission Wealth, along with our custodians Fidelity and Schwab, are committed to maintaining the integrity of our clients’ financial wellbeing. We understand that the digital aspect of financial security is increasingly critical. By staying informed and adopting robust cybersecurity practices, together we can navigate the complexities of the digital world, ensuring your wealth is not just managed wisely, but also protected robustly.

Other Resource Articles:

Navigating the 2024 Digital Terrain: Cybersecurity Tips to Protect Your Accounts

Cyber Scammers Continue to Target with Technology Advancements

How to Make Yourself a Difficult Target for Cyber Criminals

How to Reduce Your Cybersecurity Risk

As always, if you have any concerns about your financial security or need personalized advice, our team at Mission Wealth is here to help. Protecting your wealth is our top priority.

Contact us today for a free financial check-up or call (805) 882-2360.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

Mission Wealth Strengthens Leadership with 2026 Partner Class

January 14, 2026

Geopolitical Headlines, Market Resilience, and the Value of Long-Term Perspective

January 5, 2026