By Brad Stark, MS, CFP®

Founder and Chief Compliance Officer

Over the years we have worked closely with hundreds of clients to help them create financial plans that address their needs. In doing so, we have developed many budgets that meet clients’ short- and long-term retirement goals. What we have found over time is that there are very few people that already have (or follow) a retirement budget.

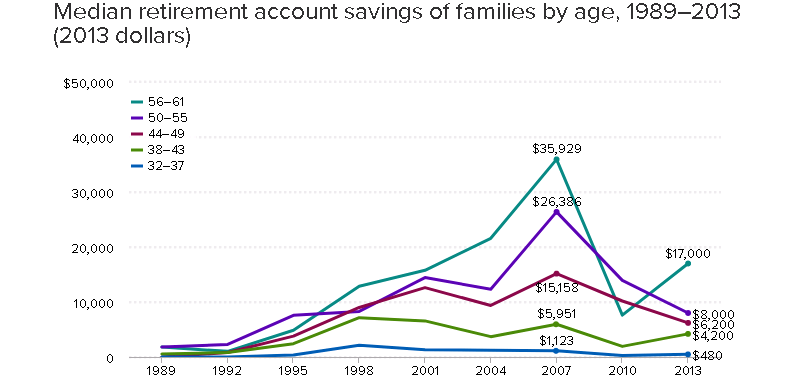

Our findings reflect nationwide trends that should be a huge concern for Americans thinking about retirement. According to the Economic Policy Institute, nearly half of families have no retirement account savings at all. Even older workers who can see retirement on the horizon aren't prepared for it. The median savings for families whose wage earners are between 50 and 55 years old is only $8,000. For those who are between 56 and 61, it's $17,000.

Source: Economic Policy Institute

It’s never too late or too early to begin saving for your Golden Years, and with a budget you can easily track your progress. Here are a few items to consider when budgeting that may help your overall situation:

- Track what is going in and out. When it comes to planning for the future, it really should be a priority to know what is truly coming in and what is going out. According to Janet Ames, of blue isle bookkeeping, “it’s amazing how small transactions here and there can add up to surprisingly large amounts of money. We find that clients who have never strictly tracked expenses are sometimes shocked by the ‘little’ things in life that become substantial numbers over a calendar year.” You can easily track your expenses by using free tools (such as Mint.com, which helps you create budgets and track your spending directly through their app). If you prefer to create and manage your budget manually, you can download Mint.com’s simple budget template here.

- Pay yourself first. There is an old saying when it comes to saving: Make sure you pay yourself first. So the first thing you should consider is saving at least 10% of whatever you make for your future. If you can save more, that is great, but 10% is a good starting point. If you run out of money during the month, that will be your first indicator that cutbacks are necessary elsewhere.

- Protect your cash flow. It is imperative that you carve off enough money to “protect” your cash flow. Whether you are purchasing life, health, disability or long-term care insurance, it will depend on your particular situation and needs. But making sure that you prioritize covering your “obligations” is a good practice for your protection as well as providing for your family's security. In general, you should have 5 to 10 times of your annual income in life coverage with 60%-70% of your income covered by disability insurance. The newer generation HSA medical plans can offer substantial savings if your overall health is good. Remember, if your largest income-producing asset is you, think about your current assets, debt obligations and what would happen if death or prolonged disability were to occur.

- Devise a tax planning strategy. “We often find that the two largest expenses for our clients are their mortgage and tax payments,” according to Ames. Being proactive in tax planning strategies for both the short and the long term can translate into substantial savings over time. Look to structure investment tax efficiently as well as maximize retirement plans. The tax code is extremely complicated and everyone’s situation is different, so we recommend you discuss strategies particular to you with your CPA.

- Determine your level of retirement readiness. At the end of the day, you are trying to create a portfolio that at retirement will provide the necessary cash flow and growth opportunities to fund your expenses. At our firm, we have come up with the 90/70/30 formula to help determine an individual’s level of retirement readiness. When 90% of your expenses can be covered with known income sources and it takes 70% or less of your investment assets to produce that result while leaving at least 30% to be allocated for growth to combat inflation, you are likely on a good path toward retirement.

Building a retirement strategy sooner rather than later is a taxing objective that many struggle with but with some discipline and proper planning, it can be achievable and can help to alleviate financial stress.

At Mission Wealth, we will help you categorize your spending and make recommendations, if applicable, in order to ensure your spending is aligned with your goals. This will also help you understand how much you can safely spend without jeopardizing your long-term financial security.

READ MORE: Retirement Strategy Tool is Geared for Success

1004925 1/18