What are the Worst Psychological Traps to Avoid During Market Uncertainty?

Salience Bias, Anchoring, and Action Bias

When markets turn negative, our emotions often do, too. Fear, stress, and uncertainty can push even seasoned investors to become market-timers, making irrational knee-jerk reactions, especially with this week’s attention-grabbing headlines.

At Mission Wealth, we help our clients stay calm and focused during turbulent markets by avoiding the most dangerous psychological traps and crafting resilient, diversified portfolios. Here are the top three psychological mistakes to avoid during this down market—and what to do instead.

Watch the Video Instead

First, let’s cover some of the investment behaviors that can build up and lead to making bad decisions. To hold yourself accountable, ask yourself if you are doing any of the following:

- Are you checking your investment performance too frequently, daily or weekly?

- When you check your accounts, do you focus on the dollar amount (not the percentage) that has changed in the day, month, or quarter?

- Do you often read headlines or articles about the total market, even if you are diversified and hold a fraction of your portfolio in that market?

- Are you considering selling or moving to cash to ‘stop the losses’?

If you answered ‘yes’ to any of these questions, the three topics below will be your best defense in digesting financial information during a declining market.

Trap #1: Salience Bias & The News Cycle

Salience bias is our tendency to focus on the most emotionally striking information, often what’s loudest in the news. News headlines are engineered to get clicks and eyeballs, not to make you a better investor.

Headlines like “Stocks Plunge!”, “Dow Has Worst Day Since 2020!” or “Billions Wiped Out from Markets!” are all designed to make you feel something, and your fight-or-flight senses tell you to take action.

With history as a guide, we can see that the period after the worst headlines tends to offer positive results in the marketplace. See a few examples from Time and Newsweek magazine covers during prior pullbacks, with the Dow’s subsequent performance below each cover.

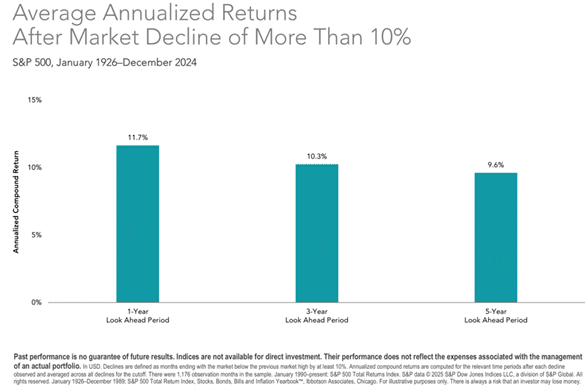

With almost 100 years of data, we can see this even more clearly: the average one-year return after a 10% market decline was +11.7% (data from 1926 to 2024).

Instead, remember these critical points to preserve your sanity when investing through a market pullback.

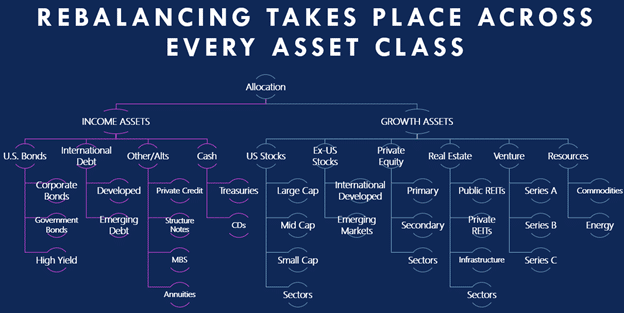

- Don’t judge your portfolio by the S&P 500 or the Dow alone. Most of our clients and most investors we talk to are more diversified than just one market. You likely own international stocks, real estate, bonds, cash, private equity, and private credit—not just U.S. stocks.

- If you only have U.S. stocks, chat with your advisor about the benefits of diversifying your portfolio into new markets. For concentrated stock positions, discuss whether protection is possible, such as buying Put Options to limit downside risk.

- Talk to your advisor to understand your actual exposure and how your portfolio has performed relative to the market, not in isolation.

- For example, if a diversified portfolio has returned -3% versus the S&P 500’s loss of -14%, the diversified portfolio has dodged a majority (nearly 80%) of the market correction!

- See a map of different asset classes and areas for investment below:

- If you are near an emotional breaking point and want to move to cash, talk with your advisor about shifting the portfolio to be more conservative before holding only cash. These are some of the best times to hold income-producing investments like public bonds, private credit, real estate, and infrastructure.

- If your portfolio can produce predictable income in the form of dividends and interest, you can let the stock portion of your portfolio recover since you’re not tapping into it for living expenses. Chat with your advisor to see if you can get enough predictable income from investments outside the stock market to meet your basic lifestyle expenses.

Trap #2: Anchoring Bias

The second trap to avoid is Anchoring Bias. Anchoring occurs when we latch onto an arbitrary number—like your portfolio’s highest value ever or the January 1st value—and use that as the baseline for all future judgments. Looking at short-term data will cause you to make short-term decisions.

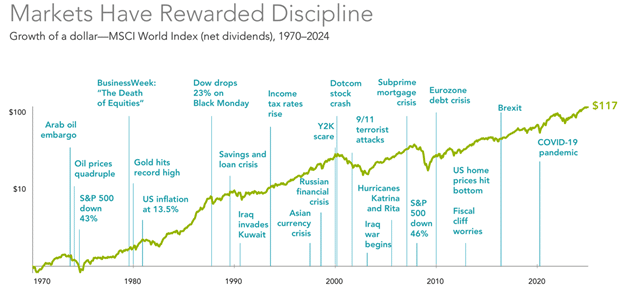

Beware of the “Worst Since” headlines, which are classic examples of anchoring. They subtly trick your brain into comparing today’s market to recent historical points. Here’s the problem: markets fluctuate. That’s not a bug; it’s a feature. Comparing everything to a recent high doesn’t help you make informed long-term decisions. Take the chart below, for example, which shows some of the worst headlines we’ve seen in the past 50 years.

[click_to_tweet tweet=”‘Looking at short-term data will cause you to make short-term decisions.’ Read Mission Wealth’s latest Market Update here. Via @missionwealth” quote=”Looking at short-term data will cause you to make short-term decisions.”]

Some of the worst anchors we see investors latch on to are:

- Recent Highs/Lows: Investors may feel compelled to buy at highs or sell at lows based on short-term price movements and often compare their portfolio to arbitrary short-term reference points like January 1st, the prior month’s end, or the preceding quarter’s end.

- Purchase Price: Many investors hold on to positions that have lost value in hopes of recovering, often convincing themselves that they will sell when the value bounces back. Not only does this miss a tax-loss harvesting opportunity, but the purchase price may also not factor in the income that that position has earned.

- Market Index Performance: Investors often compare their investment performance solely against one market index, even if they are invested in different types of markets.

- Volatility: Investors don’t have an anchor in mind for normal volatility. The S&P 500 has a standard range of movement between +43% to -23% (two standard deviations, 30 years of data). If you invest in the market, you need to know what a normal range of movement is. You can read more on the normal range of movement in our Q3 2024 Market Commentary.

Some better anchors for investors would be:

- Shift to a longer-term mindset: how are you doing over a 3+ year period?

- Do you compare your portfolio performance to a weighted benchmark for all markets you invest in?

- Is your portfolio producing the income you need regardless of market growth?

- Do you know what a normal range of movement is for your portfolio?

- In your financial plan, you can anchor to some safe limits. How much risk (in dollars) can you afford to take? What is your maximum spending capacity? What is your minimum rate of return needed to be financially secure? Talk with your advisor about these safe limits of your financial plan.

Trap #3: Action Bias

The last psychological trap to avoid is Action Bias. Simply put, we feel the need to act and can get in our own way with emotionally charged changes to our investments. We are hard-wired to take action and do something: it is our fight-or-flight response. On the other hand, patience can be perceived as inaction.

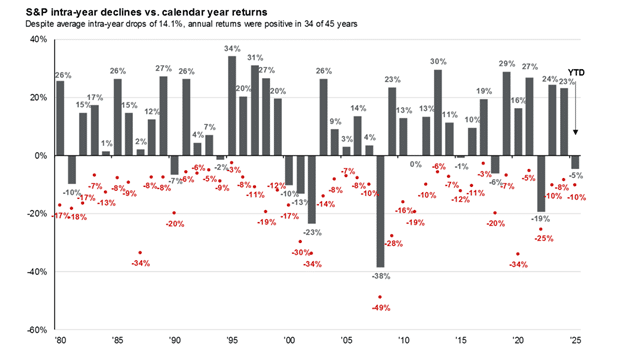

Realize that there is no shortage of reasons to be concerned. While the S&P 500 produces a positive result about 70% of the time, the average decline within each year (between the start of January and the end of December) has been 14% since 1980. Drawdowns are normal, even if their causes are unpredictable—there’s always something going on.

How Mission Wealth Can Help

At Mission Wealth, we have an arsenal of research at our fingertips to help you navigate market pullbacks. To name a few suggestions:

- We have third-party stress-testing software that can model how your portfolios may behave under different economic scenarios. This software can simulate drawdowns caused by tariffs, a tech/AI bubble, elevated inflation, or an S&P correction. We can then compare your portfolio to our recommended changes under these scenarios to quantify potential risk reduction.

- Advisors can discuss how Put Options may provide downside protection for concentrated positions in specific large companies. Our investments team has an in-house dedicated options trader.

- Potential alternative investment tweaks:

- Talk with an advisor about how bonds and private credit may fit into your portfolio for income-producing investments.

- To hedge potential tariff-induced inflation, talk with an advisor about how real estate and infrastructure investments may fit in the portfolio.

- Talk with an advisor about how private equity, venture capital, and international equity may fit into your overall allocation for growth outside the U.S. public stock market.

- For recent retirees, we can model a ‘Bad timing’ Scenario in your financial plan to show how a market downturn in early retirement may affect its success. Chat with your advisor about this option.

- Last, if you are very concerned about long-term growth, you can always discuss using a lower return assumption in your financial plan to be extra conservative. We can tell you what the safe minimum return you need to have a successful plan is.

Conclusion

The market will zig and zag for many known and unknown reasons. Planning for unexpected surprises is the name of the game. Building an effective defense against world headlines is not about predicting what will cause volatility; it’s about expecting volatility to arrive and building a resilient portfolio to mitigate the volatility when it comes.

We have a separate article on how we manage market volatility, and Mission Wealth is happy to discuss any concerns or questions you have. Contact us today for a complimentary portfolio and financial planning consultation.

A skilled sailor does not need to know what causes every wave in the ocean to know how to safely sail across the seas.

We hope you found these topics helpful as we enter the second quarter of 2025. For more detailed market commentary and to stay updated on the economy and tariffs, I welcome you to read our Chief Investment Officer’s market updates from our Insights Blog.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026