United States Debt: How High Can It Go Before It’s No Longer Sustainable

Founder Brad Stark provides an editorial piece on the US debt-to-GDP ratio and the future economic indicators we should look for.

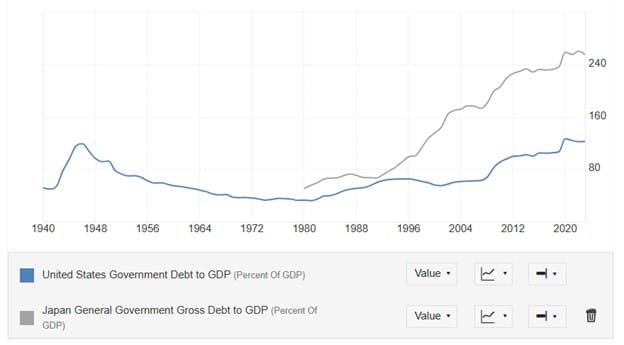

When I entered the wealth management industry in 1992, the US debt-to-GDP ratio was 62%. By 2008, the US debt-to-GDP ratio had increased to 68%, then ballooned to 100% in 2012. We now stand in the 120% range as total outstanding government debt. The debt held by the public as a percentage of GDP is running around 100%; intra-governmental holdings (Medicare trust, Social Security trust, etc.) make up the balance. Interestingly, because the Federal Reserve (Fed) is considered independent of the federal government, the debt held on the Fed’s balance sheet is considered part of the debt held by the public.

Top Countries by Government Debt (Percent of GDP)

Source: International Monetary Fund (Pulled November 2024)

As of this article, the Fed holds about $4.3 trillion in Treasuries, or about 15.5% of the debt held by the public. All things considered, net of intragovernmental accounts and the Fed, debt-to-GDP is around 85%. For the past 32 years, the increase in US debt has been an ongoing client and public concern about “how high can this go before it is no longer sustainable?”.

So far, the answer has been higher than we are now.

However, there are some comparisons and perspectives to consider when discussing this topic.

Using Japan’s GDP as an Example

Japan has been the canary in the coal mine as it pertains to debt levels vs. the country’s economic output when Japan crested the dreaded 100% of GDP “threshold test” in 1996. Japan currently stands well into the mid-200% range (something long ago believed to be unsustainable). To be clear, I am not advocating for higher debt levels or believe it is financially wise to go down this path. Just by simple mathematics, what tends to happen over time is that economic growth slows by the overhang of debt and upward pressure on taxation, which further erodes the ability for sustainable economic growth.

US Government Debt-to-GDP Ratio vs Japan

Source: Trading Economics (Pulled November 2024)

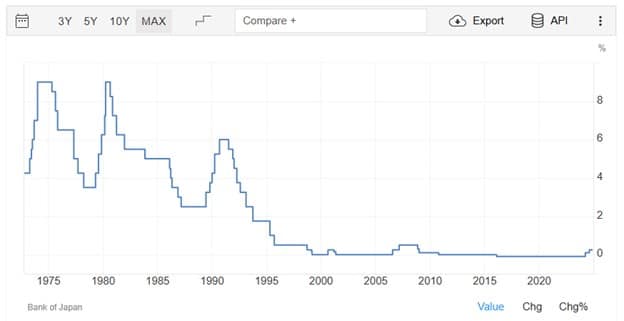

One “fix” to this problem is maintaining low interest rates, which is the playbook for the Bank of Japan. Interestingly enough, starting around 1996, Japan went to a near 0% interest rate environment and has been that way ever since. Another path is to “grow” your way out of the deficit, but you must also curtail government spending (which can be an economic tightrope). Then the next question becomes, how can you grow out of the deficit without really low interest rates and inflation as a byproduct? Another thought pattern is that you embrace inflation and make your debt “cheaper,” but then you ruin your currency, which hurts economic sustainability. There is no “easy” answer.

Japan’s Interest Rate Over Last 50 Years

Source: Trading Economics (Pulled November 2024)

Could The US Maintain Low Interest Rates?

Regarding low interest rates, the United States can’t realistically live in a 0% interest rate climate for a host of reasons. We did experience 0% interest rates starting in 2008 as a response to the global financial crisis. We arguably kept rates too low for too long (not only in the US but also in the Eurozone and many other countries). In times of economic distress, the Fed is the lender of “last resort,” a lesson from the Great Depression as one of the last-ditch efforts to stave off deflation and a downward economic spiral that is difficult to stop. Hence, central banks worldwide have learned that lesson, and we have seen many central banks become more aggressive in propping up economies that start to slide (many arguments for and against this approach).

When it comes to “economic levers” to utilize, the Fed must have an interest rate environment for which the Fed has the ability to reduce rates. This is one reason the Fed has wanted to increase the fed funds rate post-COVID (to provide “dry powder” to deploy if need be). Another lever is to print money and increase government spending. All of these actions are “inflationary,” which is initially fine because the objective is to stop the potential for deflation (which in turn causes loan defaults, which causes further economic slowdowns, which causes strains on the banking system, which results in less lending, which further causes price/value declines, which furthers economic slowdown, which follows with additional value declines, which leads to bank defaults, which, which, which….you get it, not a good cycle to start).

As we have experienced in hindsight, the world kept interest rates too low, governments spent too much money for too long, and inflation has been the byproduct. Usually, one would slow government spending, and the Fed would increase rates to create a “soft landing,” which has occurred so far. But by the time the Fed deployed these measures, the “plane ballooned” too much on the approach, and the Fed had to get aggressive (at least with interest rates).

How Long Can This Debt Go?

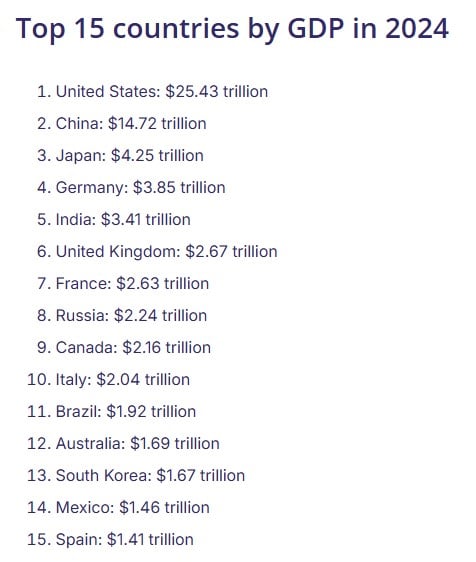

Now, to the original question: how long and how far can this level of US debt go? The US is in an interesting position and has long been the “safest,” best economy, and country to bet on financially. The US currency has been the world’s most secure, but that notion has also been questioned. With that said, I will ask a counter question, “which country and which currency is a better bet?”

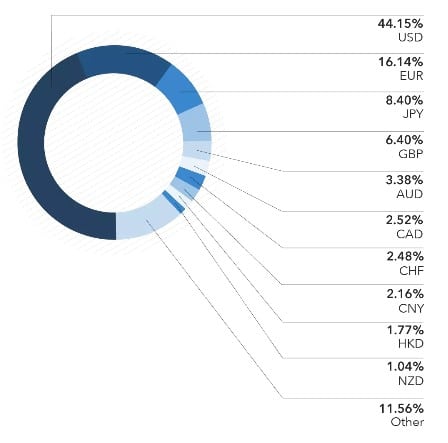

One can’t turn to the Eurozone with the same arguments as the Eurozone has debt issues. When you look at the top 10 currencies traded globally, the US dollar is the most active, which makes sense given that the US has the largest global GDP. With China as the second largest economy, why is the Chinese currency the eighth highest traded and estimated to make up only 1.23% of the global reserves? This is where the US has historically had a foothold when it has come to “trust” with our economy, banking, laws, and financial system. By the way, the Swiss franc makes up 0.18% of the global currency reserves and cannot handle the volume necessary to support international trade transactions (and neither can cryptocurrency, at least for now).

Source: Safeguard Global (Pulled November 2024)

Liquidity is a Large Factor

Aside from the safety aspect (having a government that has never defaulted on its debt), liquidity is a huge reason the US dollar is the global reserve currency. The US has the deepest, most liquid market in the world. In comparison, Europe’s markets are nowhere near as deep and are too fragmented: if you want to buy a US government bond, you buy a Treasury. To buy a European Union (EU) government bond, you must decide whether to buy a German, French, Italian, Austrian, Belgian, Spanish, etc. Each EU country has its own market and spreads to account for. Now consider transacting millions – or billions – worth of securities; it’s so much easier to buy government bonds in the US because of the massive depth and breadth.

Top 10 Most Traded Currencies (Global)

Source: IG Top 10 Most Traded Currencies (Pulled November 2024)

China will not allow the free flow of capital – both in and out of the country. The financial markets are still in their relative infancy and not well developed or deep. The renminbi also does not float freely but rather is pegged to the US dollar (further reinforcing the US dollar’s reserve currency status). Until the Chinese government allows free capital flows and a free-floating currency, the renminbi can never be considered a global reserve currency. These currency concepts counter China’s tightly managed approach to economic policy. You’d need a complete change and overhaul of the Chinese government to take steps to achieve the free flow of capital.

The Future of US Debt

For several decades, the US dollar’s status as the global reserve currency has periodically been questioned, but nothing has truly challenged it. The Euro was designed to do so and has been the most successful, though it remains a distant second. Outside of the Euro, the “perception” of safety and the ability to handle financial deal flow has been dominated by the USD, EUR, Yen, and British Pound.

Until there is a better-perceived “safe” alternative to the US for people trusting their capital to a country, the US can get away with higher debt levels. However, this is not a great path for future generations, and the US deficit will have consequences for which we as a nation have to get serious about and, at the very least, slow it down.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

A Few of Our Favorite Mission Wealth Client Stories From 2025

December 30, 2025

Reflect on the 2025 Market and What Investors Should Expect in 2026

December 16, 2025