At Mission Wealth, we believe focusing on low cost investments and employing efficient trading practices may help produce higher net of fee returns for our client’s investment portfolios.

At Mission Wealth, we believe focusing on low cost investments and employing efficient trading practices may help produce higher net of fee returns for our client’s investment portfolios.

In this video and article you can learn more about why managing costs is important and how you can use expense ratios to understand the potential fees associated with your portfolio.

Why do costs matter?

Your investment returns compound over time. This is also what occurs with any costs associated with those investments. This means you won't just lose the small fee, but also the growth that money could have had in the future.

Your investment returns compound over time. This is also what occurs with any costs associated with those investments. This means you won't just lose the small fee, but also the growth that money could have had in the future.

- All investments have associated costs.

- Money lost to costs compounds over time.

- Investments with higher costs tends to suffer when compared to lower-cost investments.

Watch the video and read more.

What are fund expense ratios?

Investment funds – such as mutual funds or exchange traded funds like ETFs – have an associated expense ratio. These are the annual fees that are deducted from a fund’s assets each year to pay for such things as fund expenses, management fees, administrative fees and operating costs. Expense ratios are quoted as an annual percentage.

As an example, if a fund has an expense ratio of 1% and you invest $100 into it, you should expect that $1 of that $100 will be used to pay for annual fees in the first year of investment. These fees impact the performance that you as an investor experience. Let’s say that same fund invests in a basket of stocks that end up being flat over the course of the first year. Because your returns are after, or net of – fees rather than being flat for that same time period, your investment in the fund would have lost 1% over the first year.

Minimizing expenses and other investment related costs is an important consideration when constructing and implementing an investment portfolio and may help to enhance investment portfolio returns.

Mission Wealth’s Focus on Minimizing Costs

As an example, we minimize expense ratios across our portfolios by utilizing very low cost investments, such as ETFs or institutional mutual fund share classes.

As an example, we minimize expense ratios across our portfolios by utilizing very low cost investments, such as ETFs or institutional mutual fund share classes.

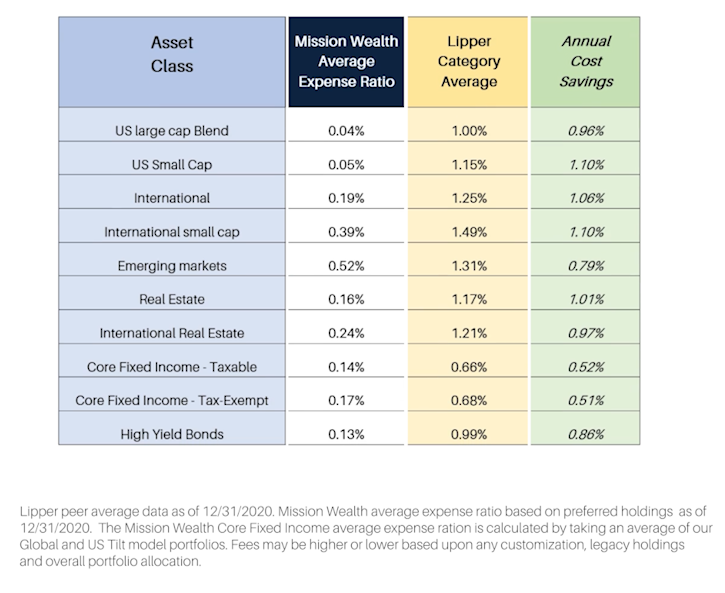

As this chart shows, The average expense ratio across all traditional asset classes we invest in is substantially lower than the respective peer average, as measured by the Lipper category average expense ratio.

In addition to minimizing expense ratios, we limit transaction costs by utilizing commission free ETFs, stocks and transaction cost free mutual funds where available and appropriate. In the instance that our preferred holdings do incur a transaction fee, we limit the transaction size and frequency to help minimize such fees.

We believe reducing costs, such as fund level expense ratios is critical in helping to enhance the returns for our clients. By focusing on low cost investments and efficient trading practices we believe we may produce higher net of fee returns for our client’s investment portfolios and in turn help us better achieve the long-term financial goals of our clients.

How Mission Wealth Can Help

You can watch more investment videos in our showcase. At Mission Wealth we work closely with you to identify your goals and build your roadmap, while helping you to consider your future options and optimize your financial security. To learn more, click here or reach out to our experienced team.

00401304 07/21

Lipper peer average data as of 12/31/2020. Mission Wealth average expense ratio based on preferred holdings as of 12/31/2020. The Mission Wealth Core Fixed Income average expense ration is calculated by taking an average of our Global and US Tilt model portfolios. Fees may be higher or lower based upon any customization, legacy holdings and overall portfolio allocation.