Mission Wealth Commentary on Silicon Valley Bank

Mission Wealth SVB Exposure Immaterial

At the company level, Mission Wealth is unaffected – we do not conduct any direct business with SVB. In terms of investments, we have assessed the exposure to SVB to be immaterial across our portfolios. This is a function of our broadly diversified approach to portfolio construction, which helps us avoid concentrated stock positions and sidestep single stock catastrophes such as this. We are also not concerned about cash holdings of our clients. They are rock solid. We typically hold minimal cash balances, and all cash is held in money market funds, which are backed by liquid, very short-term, high quality fixed income securities. That is completely different to SVB’s deposits, where there was a severe mismatch in both duration and liquidity.

What Happened?

SVB helped finance many venture capital (VC) and private equity (PE) tech-oriented firms and had large inflows of deposits, particularly in 2021. SVB invested those deposits in long dated, long duration fixed income securities at a time when interest rates were at record lows. Subsequent upward interest rate pressure caused significant downward pricing pressure on those securities. As a result, SVB experienced large market-to-market losses on those holdings. Banks can categorize these as ‘hold to maturity assets’ if they don’t need to sell them. Problems arose when VC/PE firms wanted to withdraw their deposits and SVB was forced to liquidate the securities at losses. Once this issue became known, everyone wanted their money back, essentially causing a run on the bank and the appointment of the Federal Deposit Insurance Corporation (FDIC) as receiver. This was followed by the closure of New York-based Signature Bank, albeit for a completely different set of circumstances and related to its exposure to cryptocurrencies.

Not a Systemic Issue

We have been in close communication with all our investment partners and have received universal feedback that this is considered an isolated event. In many respects, this is not a credit event so much as poor treasury management isolated to SVB, which caused a severe mismatch in duration between deposits and the assets it invested those deposits into. SVB is not considered systemically important to the banking sector and no other banks have a similar mix of concentrated VC/PE tech-oriented deposits, large outflows, legacy held to maturity assets in a similar unrealized loss position, or with similar limited access to reserves and liquidity.

Depositors Fully Protected

This weekend’s developments helped provide substantial comfort. In a joint statement by the Treasury, Federal Reserve, and the FDIC, it was announced that all depositors at SVB will be fully protected and will have full access to their money beginning today (March 13th). In addition, the Fed will provide all necessary funding to depository institutions to help assure banks have the ability to meet the needs of all their depositors. These steps are critical in allowing all affected VC/PE firms to continue to make payroll and access capital for operations. It also signals more broadly that depositors’ savings are not at risk, helping to underscore confidence in the banking system. Elsewhere, First Republic Bank announced it secured additional financing from JPMorgan Chase & Co. which, in addition to the increased borrowing capacity from the Federal Reserve, boosts its available liquidity. Nonetheless, we are witnessing volatility across banking stocks, and particularly regional banks, as the situation continues to evolve.

Banking Industry Well Capitalized

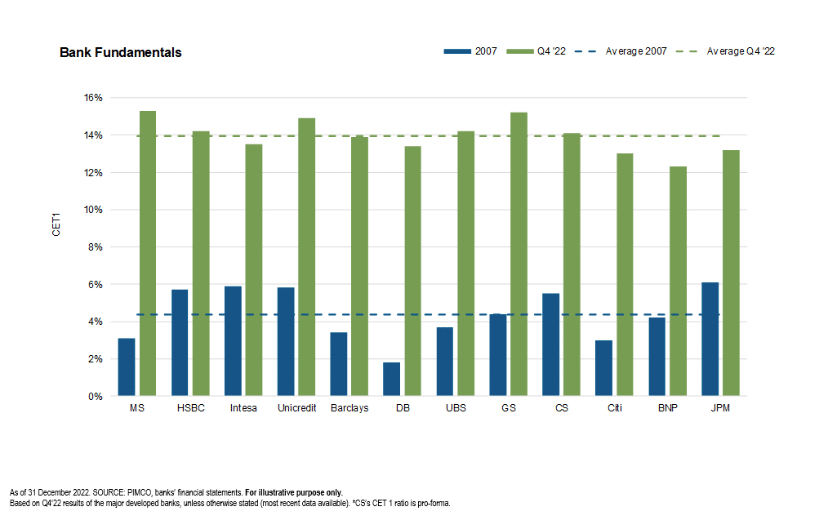

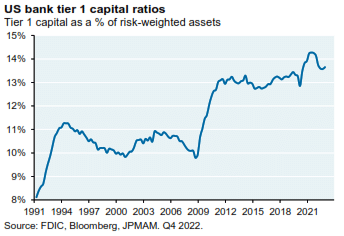

Ultimately, SVB found itself in a unique position with a very specific set of headwinds. Banks by and large are broadly operating with historically high levels of capital as a result of a more than decade worth of restructuring, de-risking, and de-leveraging post the Global Financial Crisis.

Tier 1 Capital refers to a bank’s equity capital and disclosed reserves. It is a related measure of capital adequacy and again, the higher it is the more well capitalized a bank is deemed to be. Tier 1 includes CET1 plus preferred stock and any qualifying minority interest that could be used to absorb losses.

The overarching theme here: the higher these measures are, the more well capitalized a bank is to help withstand any shocks. Broadly speaking, these measures are high and have generally increased over time, underscoring the health and resiliency of the financial industry.

However, we have entered a period where confidence has been shaken and any run on a bank by itself can cause issues, even for those well capitalized. Smaller regional banks have come under stock selling pressure. While the backstop by the Fed is what is needed to regain confidence, it is still early. In terms of market reaction, it is interesting to note that outside of financials, the markets are holding up relatively well, which is a divergence of what happened in 2008 when confidence was lost across the board.

We will continue to monitor the situation closely. It is very much early and shocks to the system are not unprecedented and occur periodically over time. If history is a guide, volatility is normal but ultimately the economy and the markets bounce back from these setbacks. We believe our broadly diversified portfolios are well positioned to weather this storm.

Copyright © 2023, Mission Wealth is a Registered Investment Advisor. All rights reserved.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00502306 03/23