Mission Wealth Market Update 12/18/24

Fed Cuts Rates by 0.25%, Revises Expectations for Future Rate Cuts

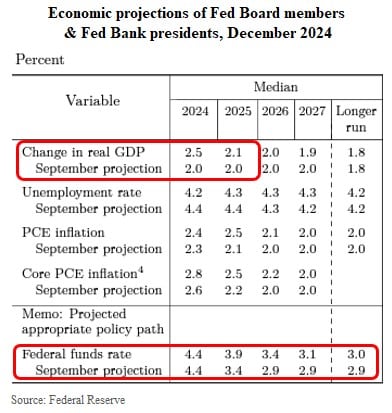

In a widely anticipated move, the Fed cut the fed funds rate by 0.25% at its December Federal Open Market Committee (FOMC) meeting, bringing the target range to 4.25% – 4.50%. The announcement was broadly expected, with the market assigning a near certainty a 0.25% cut would occur ahead of time. All eyes were on the Fed’s updated economic projection materials (aka the “dot plot” forecasts) for any adjustments regarding the likely future path for monetary policy. See the key points below:

- The Fed cut rates by 0.25% and revised its economic growth forecasts higher.

- The Fed reduced the number of expected future fed funds rate cuts and anticipates cutting rates by 0.50% cumulatively in 2025.

- We anticipate the Fed will be methodical and measured with its interest rate policy, and interest rates are likely to stay elevated, although with a downward bias.

- The macroeconomic backdrop underscores the importance of well-diversified portfolios and a disciplined approach to portfolio rebalancing.

The statement noted that the economy continues to expand at a solid pace, the labor market has generally eased though the unemployment rate remains low, and that inflation has made progress towards 2% but remains somewhat elevated. Notably, one voting member dissented (Cleveland Fed President Hammack), preferring to hold rates steady.

The Fed Expects Fewer Cuts in 2025

Given the ongoing strength of the economy, the Fed revised its expectation higher for 2024 growth to 2.5%, up from 2.0% in September. Likewise, the Fed increased its expectation for inflation this year and in the years ahead and expects the unemployment rate to remain relatively low moving forward.

With this backdrop, the Fed reduced the number of interest rate cuts it anticipates making in 2025 to two 0.25% cuts, or 0.50% of cumulative cuts, which is half the number of cuts the Fed previously anticipated in September (the Fed previously forecast 1.0% of cumulative cuts would be appropriate in 2025). At the subsequent press conference, Fed Chair Powell indicated the slower pace of rate cuts reflects expectations for higher inflation, though noted the Fed believes the trajectory for inflation remains broadly on track toward 2%.

Strong Economic Growth

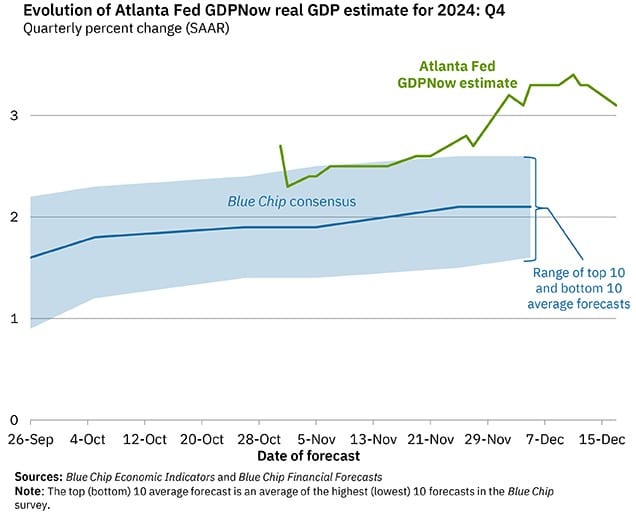

The economy is doing better than expected, and incoming data continues to point to above-trend GDP growth over the near term, buoyed by a strong and resilient consumer. The conversation is now shifting from a potential “soft landing” economic outcome to the possibility of a “no landing” outcome, with relatively robust economic growth continuing to persist. Indeed, the Atlanta Fed’s current estimate for 2024 Q4 GDP growth currently stands at +3.1%. This follows GDP growth of +2.8% in Q3 and +3.0% in Q2.

Measured Approach

Consensus expectations are for GDP growth to be in line with the long-term trend growth rate of 2% in both 2025 and 2026, and for inflation to stay elevated. The Fed’s own forecasts indicate the economy may produce marginally above-trend growth in 2025. With this backdrop, we believe the Fed will remain data-dependent and may be slower to cut rates moving forward (highlighted in the Fed’s dot plot forecasts). This notion was reiterated at the subsequent press conference, with Fed Chair Powell emphasizing the Fed may be more cautious in reducing rates amid economic strength. As a result, interest rates are likely to remain elevated, albeit with a downward bias. However, for context, we may be entering a more “normal” interest rate environment by historical standards.

While we remain constructive on long-term fundamentals, we anticipate the increased cost of capital associated with a potentially higher-for-longer interest rate environment may lead to some moderation in stock market returns relative to the strength witnessed over the last two years. We continue to monitor developments closely and believe our portfolios are well constructed for the forthcoming period. Should we experience any near-term volatility, it may offer us a rebalancing opportunity.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 3/2/26

March 2, 2026

Market Perspectives Q1 2026

February 25, 2026