Mission Wealth’s Market Update for 11/1/23

This Market Update is provided by Mission Wealth’s Chief Investment Officer, Kieran Osborne.

In today’s rapidly evolving financial landscape, we want to keep you informed about the latest developments and how they may impact your investments. Here’s a summary of our key insights:

- We are positioning our client portfolios with a backdrop of higher interest rates in mind, and believe our portfolios are well positioned to navigate the forthcoming environment.

- The Fed held interest rates steady at its November 1st FOMC meeting, aligning with market expectations. The Fed emphasized its focus on managing inflation and indicated a commitment to maintaining a restrictive policy until it sees sustained progress toward its 2% inflation target.

- The economy has demonstrated resiliency, driven by a robust labor market and ongoing consumer spending. Inflation is likely to remain above the Fed’s target of 2% over the near-term.

- We believe we have already entered a structural shift with respect to monetary policy, where the years ahead will be marked by tighter policies relative to the years post-2008 through 2021.

- The Fed is unlikely to cut interest rates anytime soon, and we anticipate the Fed’s future economic projections will reiterate a higher for longer interest rate environment.

Fed Maintains Interest Rates

The Fed decided to keep rates steady at its November 1st FOMC meeting, maintaining the target for the fed funds rate at 5.25%-5.5%. This was largely anticipated by the market, which had assigned a near certain probability of a rate pause ahead of the meeting. The accompanying statement highlighted the strong pace of economic growth in the third quarter, a moderation – but still strong – jobs growth and tight labor market, and elevated inflation. The Fed anticipates tighter financial conditions are likely to weigh on economic activity and inflation moving forward. The statement also reiterated the Fed’s laser-focus on managing inflation, noting “the Committee remains highly attentive to inflation risks.”

At the subsequent press conference, Fed Chair Powell was careful not to be drawn on future interest rate policy decisions, noting the Fed will make decisions meeting-by-meeting, based on data dependence. At the same time, he indicated monetary policy is currently restrictive and the rise in long-term rates has done some of the Fed’s job for them. FOMC members are asking themselves whether they need to raise rates more, with the crux of the question focused on whether the stance of monetary policy is sufficient to bring inflation back down towards the long-term goal of 2%. Chair Powell also indicated that the Fed is likely to keep policy restrictive until they are confident in seeing inflation on a sustainable path towards 2%, and that some softening in the labor market will be needed to rein in inflation.

Resilient Economy

2023 has proven to be a year of resilience for the economy, a view echoed by Fed Chair Powell. Despite earlier concerns surrounding regional banks, economic data has consistently surpassed expectations, particularly since May. Both Q2 and Q3 GDP numbers were better than projected, driven by a robust labor market, which in turn has underpinned ongoing consumer spending.

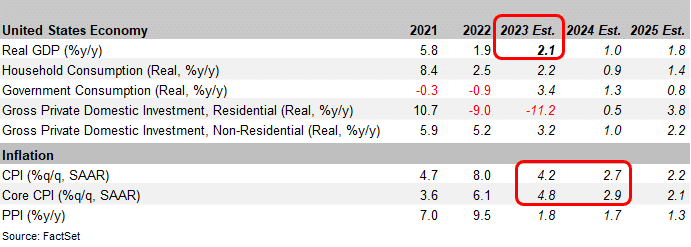

Current expectations for real GDP growth for 2023 are running at 2.1%. For perspective, estimates for 2023 economic growth were closer to zero at the beginning of the year and many were worried about an imminent recession at the time. Now, and with GDP growth exceeding expectations, the chances for a “soft landing” or “no landing” economic outcome have increased. Also notable is the expectation for inflation to stay elevated and above the Fed’s target of 2% for the foreseeable future. The market does not anticipate inflation will approach that level until at least 2025.

Tighter Monetary Policy Ahead

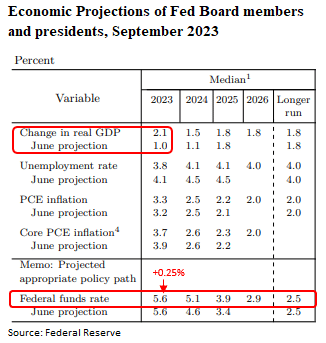

The resiliency of the economy and elevated inflation has a direct influence on Fed policy. We believe we have already entered a structural shift with respect to monetary policy, where the years ahead are likely to be marked by tighter policies: higher interest rates and quantitative tightening (shrinking of the Fed’s balance sheet), especially relative to the years post-2008 through 2021. Based on the Fed’s most recent economic projection materials (aka “dot plot” forecasts) from September’s FOMC meeting, the Fed has indicated one more 0.25% rate increase may be likely. However, as of writing, the market is currently assigning less than a 20% chance the Fed raises the fed funds rate in December.

Regardless of whether the Fed raises in December or not, a Fed pause is likely on the horizon. But that doesn’t mean the Fed is likely to pivot and cut interest rates anytime soon.

Rate Cuts not Imminent

Fed policy makers have been vocal in communicating that once the Fed pauses rate increases, rates are unlikely to come down in a hurry. For one, monetary policy can take up to 12 months to fully work its way through the economy. So, the most recent rate increase at the Fed’s FOMC meeting in late July won’t be fully felt until July of 2024. To this end, Fed Chair Powell has emphasized the need to take a data-dependent approach to monetary policy. Said another way, let’s wait and see. The Fed wants to see continued and sustained declines in inflation before considering cutting rates and would need to see a significant deterioration in economic fundamentals such that inflation rapidly moves towards 2% for the Fed to cut rates earlier than their current expectations.

The Fed will release its updated “dot plot” economic forecasts in December. Regardless of whether the Fed increases interest rates at its December meeting, we expect the updated “dot plot” will reiterate a higher for longer interest rate environment is likely. With this in mind, we are positioning our client portfolios with a backdrop of tighter interest rate policy and believe our portfolios are well positioned to navigate the forthcoming environment.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 3/2/26

March 2, 2026

Market Perspectives Q1 2026

February 25, 2026