Stocks Under Pressure

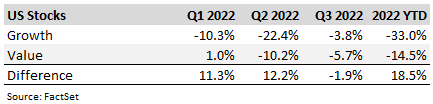

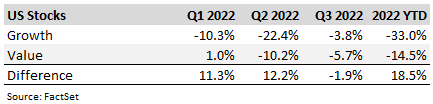

Stocks came under pressure in the third quarter of the year as tighter financial conditions – driven by more aggressive rate hiking policies – weighed on market sentiment. The S&P 500 fell -4.9% during the quarter. There was some divergence in performance, with Growth stocks (-3.8%) performing marginally better than Value stocks (-5.7%) and small cap stocks (-2.6%) performing better than the broad market. Notwithstanding, we have witnessed significant divergence in asset class performance to begin this year, with Value stocks outperforming Growth stocks by 18.5% through the end of Q3.

This divergence in relative performance has provided enhanced rebalancing opportunities across asset classes, offering an increased number of opportunities to “buy low, sell high,” which may ultimately add to performance over the long term.

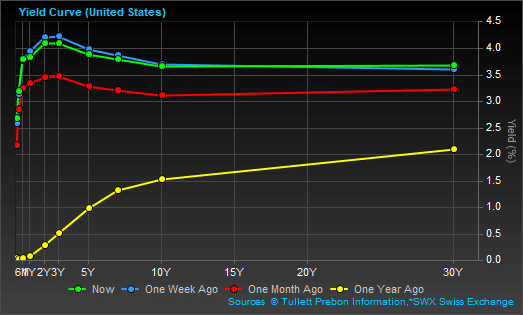

Bond Yields Rise, Yield Curve Inverts

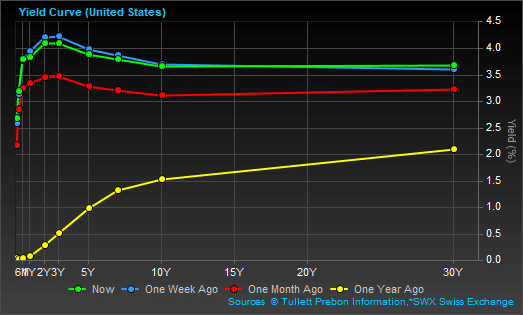

Bond yields rose through the third quarter on the back of tighter monetary policy, and bond prices consequently came under pressure. The yield curve – as measured by yields on Treasury securities – inverted, with shorter-dated bond maturities having a higher yield than longer-dated maturities. The 10-year U.S. Treasury yield moved higher, from 3.0% to end the third quarter at 3.8%. At the same time, the two-year Treasury yield rose nearly 1.3% and finished the quarter at 4.2%, bringing the widely followed two-year / 10-year yield differential into inversion.

With the Fed’s more aggressive monetary policy stance, we believe interest rates have reset to a higher trading band. With that being said, the Fed’s updated rates guidance has now been incorporated into market pricing and we are seeing some attractive yield opportunities. For instance, a portfolio of intermediate-term, high-quality investment grade corporate bonds is now yielding north of 5.5%, significantly higher than the yield seen on this portfolio recently.

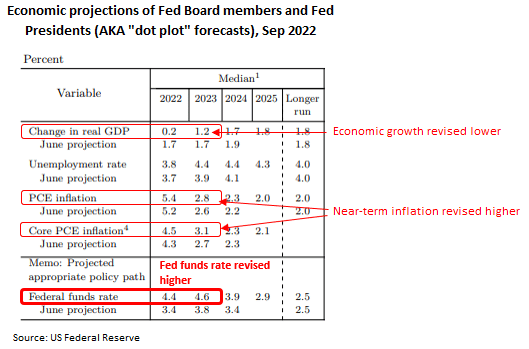

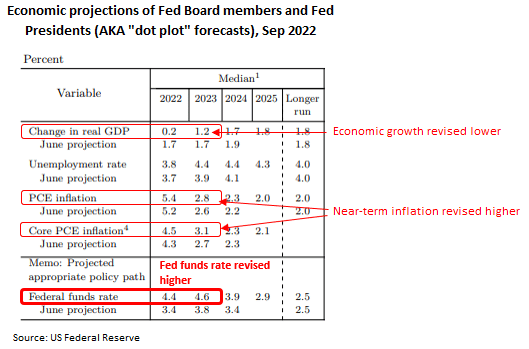

The dominant theme throughout the third quarter was a focus on more aggressive monetary policies, both domestically with the Fed and also across all major global central banks. Fed officials increasingly focused on the “raise rates higher and hold” messaging as the quarter progressed, and as it became apparent that near-term inflation is likely to stay higher than previously anticipated. This messaging culminated in the Fed raising the fed funds rate by 0.75% at its September Federal Open Market Committee (FOMC) meeting and raising its forecasts for future fed funds rate increases, inferring another 0.75% hike was likely in November followed by a 0.50% hike in December.

Fed Chair Powell has struck a hawkish tone, noting that combating inflation may require a sustained period of below-trend economic growth, again evidenced in the “dot plot” economic forecasts. The still very strong labor market also played into the tighter policy narrative, with Fed Chair Powell noting the labor market has thus far shown only modest evidence of cooling off.

Geopolitics, Seasonality and Earnings

Geopolitical tensions remained elevated as Russia continued to weaponize energy flows, annexed four Ukrainian regions and ratcheted up its nuclear warnings. At the same time, the rhetoric between the U.S. and China over Taiwan continued to escalate. Negative seasonality was also highlighted, with September historically a weaker month for the stock market, and company-sponsored buyback activity tends to be reduced ahead of quarter end and the start of Q3 earnings season. Speaking of earnings, Q2 earnings season results and guidance were broadly better than feared. While relatively stable demand was a broad theme across industries and sectors, there was some focus on elevated recession mentions as well as caution around margin pressures, while some high-profile companies announced plans to scale back hiring and, in some instances, announced layoffs.

Inflation Pressures Abating

The peak inflation narrative gained some traction during the quarter, particularly on the back of a 99-day stretch of declines for gasoline prices in the U.S. Inflation components of several regional manufacturing surveys softened further in September. Notably, lumber prices were off more than 70% from their peak and back to pre-COVID levels. As a result, forward-looking measures of inflation expectations declined further. With that being said, we continue to anticipate inflation will remain elevated and above the Fed’s long-term target of 2% over the near term, and that inflation will remain somewhat sticky but slowly decelerate towards the 2% level over time. With this backdrop, we have increased exposures to alternative income-generating asset classes we believe will do well in an elevated inflation and rising interest rate environment.

Recession Risks Elevated, but Likely Mild